By Stephen Jen (via Itau Global Connections).

Bottom line

Now that the Bank of Japan will be led by a team of super-doves, the mechanism through which a more aggressive BOJ could influence the yen is through capital flows. We have used the analogy of a two-stage rocket to describe how USDJPY could be propelled. The first stage is foreign leveraged funds shorting the yen, acting on the rhetoric from the Abe Administration.

This stage is coming to an end, to be followed by the second stage: Japanese investors selling yen. Specifically, what Japanese investors do in the coming months will be critical to the sustainability of the depreciation of the yen. In this note, we examine the capacity of Japanese private investors adopting greater risk tolerance in their investment behavior by allocating more assets overseas and/or increasing their exposure to Japanese equities.

In sum, we believe there is significant potential for Japan’s retail sector to raise its exposure to risk assets, which include Japanese equities as well as foreign assets. Japanese households (HH) hold about 56% of their liquid assets in the form of cash, 5.8% in Japanese equities (direct holdings), and 0.8% in foreign assets. These figures are rather odd, both compared to their history and to the US. In 2007, for example, Japanese HH’s holdings of cash were 49.2% of their total liquid wealth, and their exposure to equities was 12.4%. The corresponding figures for the US currently are 16% and 43%, respectively. The point here is that Japanese HHs seem to have an overly risk-averse portfolio, suggesting ample capacity for them to take on more risk. Total HH liquid financial wealth is about 319% of Japan’s GDP (about USD 16.5 trillion). Every 1% shift in their portfolio would correspond to a USD 165 billion in flows. Japan’s private sector as a whole holds USD 56.6 trillion worth of liquid financial assets. Every 1% shift in the portfolio would be worth USD 566 billion. You get the idea. For the Abe Administration, it is critical that it is able, through a more proactive BOJ, to persuade Japanese HHs to alter their portfolios to push the Nikkei higher and the yen lower. A shift in Japanese investors’ collective portfolio would have very significant market consequences.

Japanese HH balance sheets

massive but risk-averse.

In the weeks ahead, there will be significant actions taken by the Abe Administration and the BOJ to sustain the USDJPY and Nikkei trends, we expect. An important consideration we have in thinking about both the strategy of the Abe Administration and the likely future trajectory of USDJPY is what the Japanese HHs do with their money.

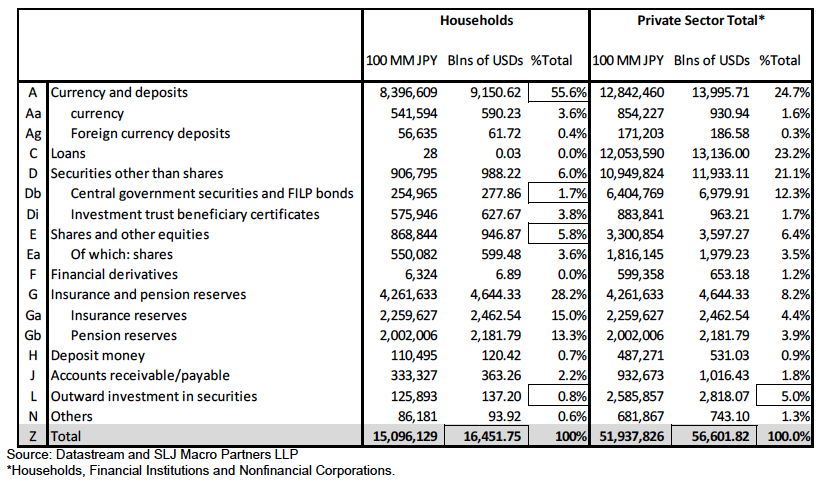

The table above summarizes the composition of the financial wealth (property holdings are not included) of Japanese HHs and of the private sector as a whole. The BOJ’s Flow of Funds data (FoF) cover five main categories of the private sector:

(1) financial institutions;

(2) non-financial corporations;

(3) households;

(4) private non-profit institutions;

and (5) overseas institutions.

The FoF data shows that, as of 3Q12, Japanese HHs had around USD 16.45 trillion worth of liquid financial assets – equivalent to around 319% of Japan’s GDP. Of the six categories, Japanese HHs hold the largest net asset position. (banks have the biggest asset position, but that is matched by liabilities.) Thus, this sector – unburdened by concerns about asset-liability mismatch – is most important for the purpose of thinking about the scope of capital outflows. (The Japanese government may be heavily indebted, but the HHs are in great shape.) Here are some other observations.

– Japanese HHs have a cash-rich portfolio. Japanese HHs hold 55.6% of their liquid financial wealth in cash (Row A of the table). This is extraordinary, when compared to their cash holdings of 49.2% in 2007 and the current US HH’s cash holdings of around 16%. On a base of USD 16.45 trillion, the difference between 49.2% and 55.6% is significant (around USD 1.05 trillion). Japanese HHs hold too much cash, it seems.

– Japanese HHs have very few direct holdings of equities. Japanese HH’s direct holdings of equities account for only 5.8% of their total financial portfolio (Row E of the table). This compares with 12.4% in Japan in 2007 and 43% for the US now. It seems that Japanese HHs hold too little domestic equities.

– Japanese HHs have very low foreign-currency holdings. Despite the familiar subject of “Ms. Watanabe’s” foreign investment portfolio, foreign equities account for only 0.8% of the total financial wealth of Japanese HHs (Row L in the table). This figure also seems low. For the private sector as a whole, the figure is 5.0%, which suggests Japan is still very inward-oriented when it comes to financial investments, even though the absolute size of Japan’s private-sector foreign asset holdings (USD 2.8 trillion) is large.

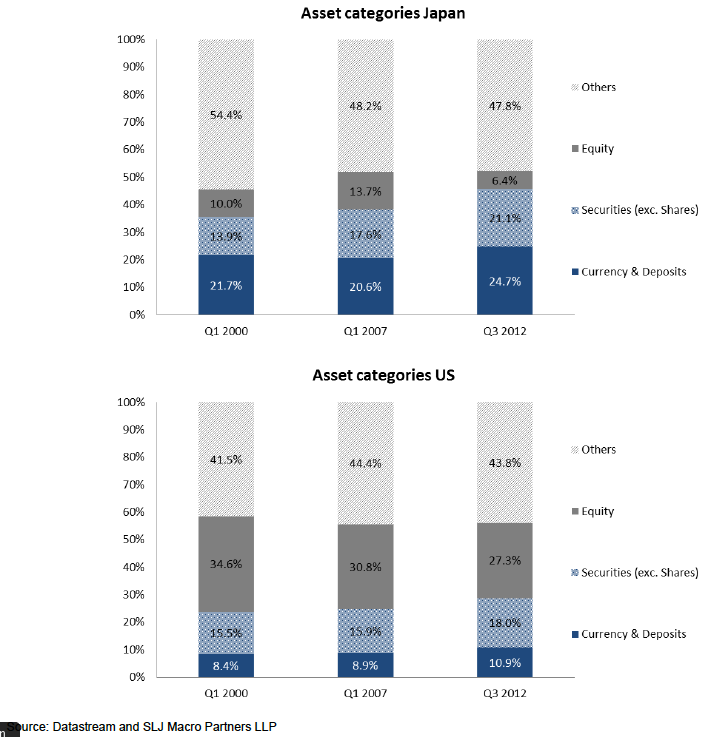

Japanese private-sector balance sheet: massive but risk-averse. We extend the above analysis to the private sector as a whole (i.e., considering the six categories mentioned above in the aggregate), and compare the balance sheets of the private sector investors in Japan and the US (which for the US include households, financial institutions, and non-financial corporations). The charts below summarize our calculations.

We make these observations, most of which rhyme with the findings above for the households sector.

– Japan’s private sector’s cash holdings are at a high watermark in the past decade. We show snapshots for 2000, 2007, and 2012 to illustrate how the compositions of the private sector balance sheets in Japan and the US have evolved. What we find is that, not only is Japan’s private-sector cash holdings high relative to the US (24.7% versus 10.9%), but it is also high compared to 2000 (21.7%) and 2007 (20.6%). Thus, not only are the HHs holding more cash now than at any time in the last decade, with the exception of 4Q11, the Japanese corporates also are hoarding a lot of cash.

– Japan’s private-sector equity exposure is at a low watermark in the past decade. At the same time, Japan’s private sector has a much lower exposure to equities than at any other time in the last decade (6.4% now, versus 10.0% in 2000 and 13.7% in 2007). A similar decline in exposure to equities is witnessed in the US, but the decline there is not nearly as sharp as the one seen in Japan.

The Abe Administration needs to persuade the Japanese private sector to alter its portfolio. High cash holdings and low exposure to equities are signs that the Japanese HHs and the private sector as a whole have been risk-averse. The historical trends discussed above suggest that Japanese investors have become steadily more risk averse over the past decade, and certainly since the Great Recession. The JPY overvaluation that the Abe Administration has been complaining about is due in part to the investment behavior of the Japanese investors themselves. This means that, for the yen to fully “normalize”, it is insufficient that foreign hedge funds, which have shown their fickleness this week, push USDJPY higher through speculative positions. Since USDJPY is positively correlated with the Nikkei, we should expect to see a virtuous circle between the two asset prices. Rather, there needs to be a genuine reorientation in the collective portfolio of the Japanese HHs and the private sector as whole.

History suggests that this is doable.

The top chart above shows that, between 2000 and 2007, as global equities rose, Japan’s cash holdings fell while their equity exposure rose. Since 2008, global equities have recovered. Yet, strangely, the Japanese private sector portfolio has remained risk-averse. The extraordinary risk-aversion of Japanese investors is the fundamental problem with the yen – what the Abe Administration, in our view, needs to correct.

To encourage Japanese investors to alter their ways, the fiscal year-end (March 31, 2013) is important, because large institutional funds in Japan make their decisions for the year, or for the first half-year, around that time. To persuade them to consider reducing their hedge ratios and/or raise their exposure to the Nikkei, the Abe Administration will need to ensure that the Nikkei remains buoyant and a general expectation for further yen depreciation. Mr. Kuroda is a good choice as the next BOJ governor, in light of these considerations. He was, during 1999-2003, the Vice Minister for International Affairs at the Ministry of Finance, in charge of the largest currency intervention operations the world had seen, up to that time. He should, therefore, be sensitive to the factors and the psychology that will be important for the yen.

Bottom line. The collective portfolios of the Japanese HHs and private sector as a whole are huge. Japanese HHs have a balance sheet of USD 16.45 trillion, and the private sector holds USD 56.6 trillion worth of financial assets. These are massive numbers. Every 1% reallocation into either the Japanese equities or foreign assets would be USD 165 billion for the HHs and USD 566 billion for the private sector as a whole. This relative size of Japanese investors to foreign investors marks the key difference between Japan and Switzerland. In the case of Switzerland, non-Swiss safe-haven flows into CHF assets have been the key driver for EURCHF. But the fate of USDJPY will be dictated by Japanese investors, not foreign hedge funds.

——

Stephen Jen is the managing partner at SLJ Macro Partners.

Prior to establishing SLJ Macro Partners in April 2011, Stephen was a Managing Director at BlueGold Capital (since May 2009), working as the key risk-taker in currencies and as its macro strategist. Before BlueGold, Stephen was a Managing Director at Morgan Stanley and, from October 1996 to April 2009, held various roles, including the Global Head of Currency Research and the Chief Global Foreign Exchange and Emerging Markets Strategist. Prior to Morgan Stanley, Stephen spent four years as an economist with the International Monetary Fund (IMF) in Washington, D.C., covering economies in Eastern Europe and Asia. In addition, Stephen was actively involved in the design of the IMF’s framework for providing debt relief to highly indebted countries. Stephen holds a PhD in Economics from the Massachusetts Institute of Technology, with concentrations in International Economics and Monetary Economics. He also earned a BSc in Electrical Engineering (summa cum laude) from the University of California at Irvine. Stephen was born in Taipei, Taiwan, and now lives in London with his wife and two children.

Tags: Bank of Japan,Quantitative Easing,wages

1 comment

Sharon Knapik

2013-04-27 at 11:38 (UTC 2) Link to this comment

ThreeCheeseFondue: I for one, have most certainly gotten back into the market. Was in cash for the crash and started adding after the March 2009 lows. It’s been a once in a lifetime opportunity.