Tag Archive: Precious Metals

Hidden Forces of Economics

We have noticed a proliferation of pundits, newsletter hawkers, and even mainstream market analysts focusing on one aspect of the bitcoin market. Big money, institutional money, public markets money, is soon to flood into bitcoin. Or so they say.

Read More »

Read More »

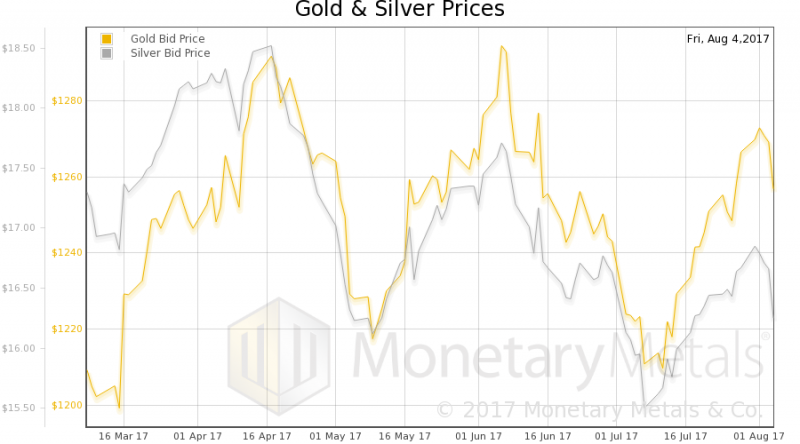

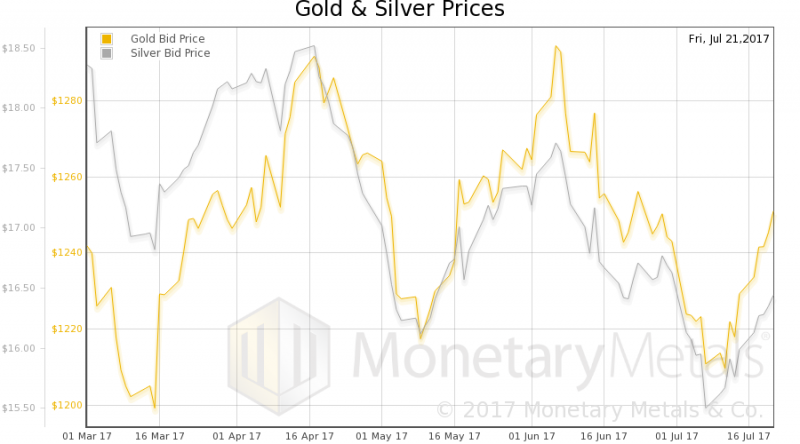

Precious Metals Supply-Demand Report

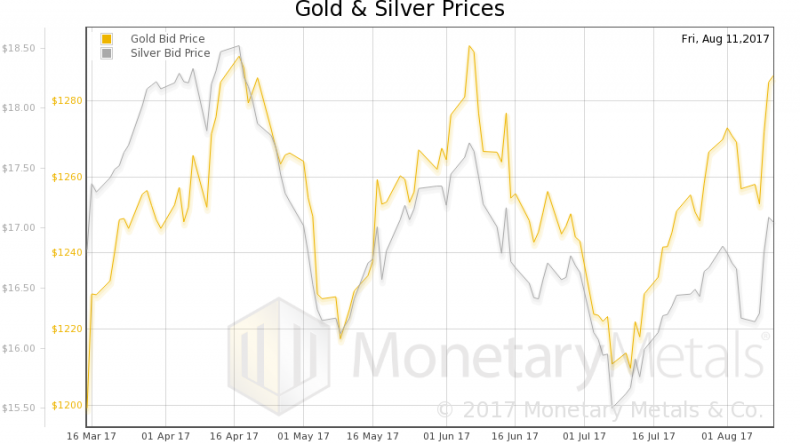

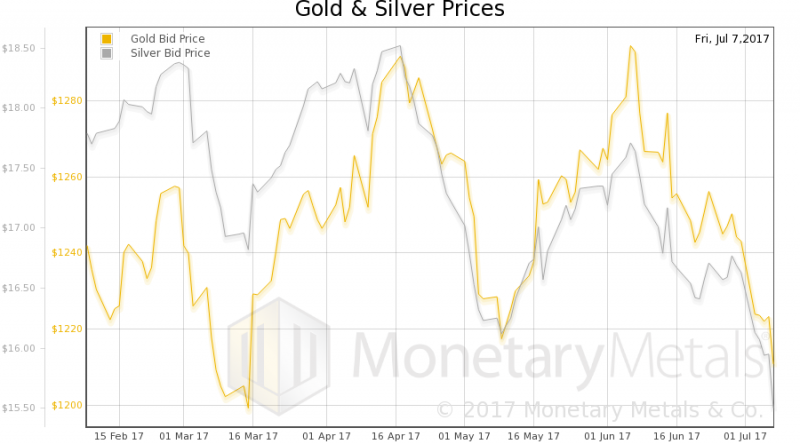

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Talking Global Macro Investing With A 25-Year Market Veteran

If you were rich, successful, and intelligent - which often, not always, go hand in hand together - where would you live?The last time I was in the Rockies, I remember thinking to myself. You know what, if it weren't for the fact it's so damn far from the beach I could actually live here. It's really quite lovely.

Read More »

Read More »

Bad Ideas About Money and Bitcoin

How We Got Used to Fiat Money

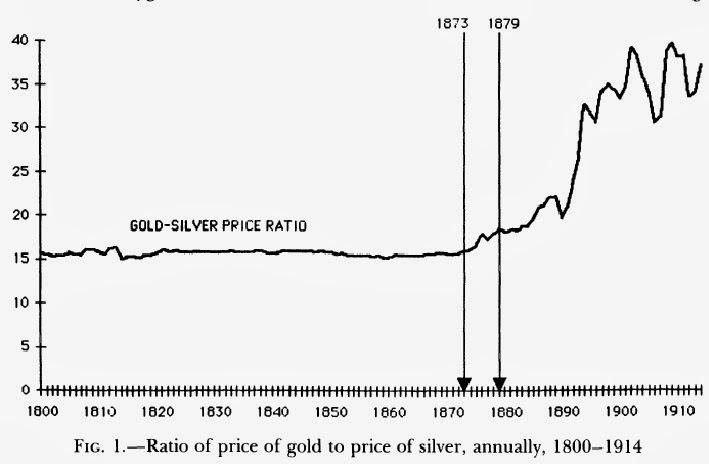

Most false or irrational ideas about money are not new. For example, take the idea that government can just fix the price of one monetary asset against another. Some people think that we can have a gold standard by such a decree today. This idea goes back at least as far as the Coinage Act of 1792, when the government fixed 371.25 grains of silver to the same value as 24.75 grains of gold, or a ratio of 15 to 1.

Read More »

Read More »

Precious Metals Supply and Demand Report

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Buy Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”

Don't let "traditional biases" stop you from diversifying into gold - Dalio on Linkedin. “Risks are now rising and do not appear appropriately priced in” warns founder of world's largest hedge fund. Geo-political risk from North Korea & "risk of hellacious war". Risk that U.S. debt ceiling not raised; technical US default. Safe haven gold likely to benefit by more than dollar, treasuries.

Read More »

Read More »

Bitcoin Has No Yield, but Gold Does – Precious Metals Supply and Demand Report

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

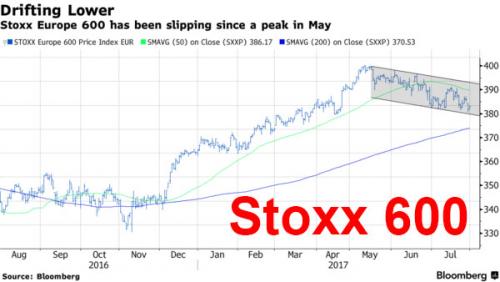

Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday's sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained 1.2 percent to 1.1320 per euro...

Read More »

Read More »

Bitcoin Forked – Precious Metals Supply and Demand Report

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Bitcoin, Gold and Silver

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Global Stocks Rise On “Growth Optimism”, Ignore Political Turmoil; Dollar, Oil Creep Higher

S&P futures rose 0.1% on the last trading day of the month, trailing European and Asian markets boosted by China’s July Mfg. PMI, which despite declining from from 51.7 to 51.4, and missing expecations of 51.5, saw the construction index rise to its highest level since December 13, sending Chinese iron ore futures surging and … Continue reading »

Read More »

Read More »

Against Irredeemable Paper – Precious Metals Supply and Demand

Something needs to be said. We are against the existence of irredeemable paper currency, central banking and central planning, cronyism, socialized losses and privatized gains, counterfeit credit, wealth transfers and bailouts, and welfare both corporate and personal.

Read More »

Read More »

Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

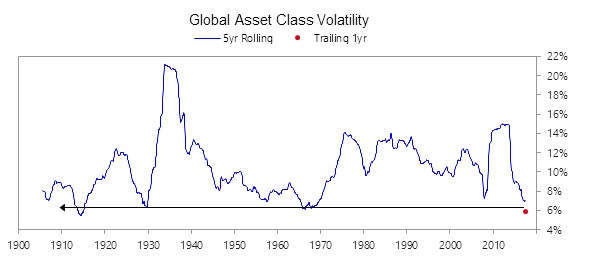

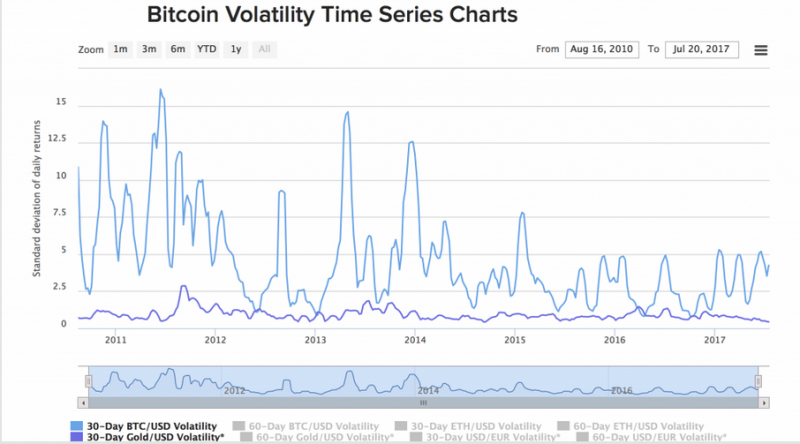

Bitcoin volatility shows not currency or safe haven but speculation. Volatility still very high in bitcoin and crypto currencies (see charts). Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900. Bitcoin least volatile of cryptos, around 75% annualised volatility. Gold much more stable at just 10% annualised volatility.

Read More »

Read More »

Stockholm Syndrome – Precious Metals Supply and Demand

Stockholm Syndrome is defined as “…a condition that causes hostages to develop a psychological alliance with their captors as a survival strategy during captivity.” While observers would expect kidnapping victims to fear and loathe the gang who imprison and threaten them, the reality is that some don’t.

Read More »

Read More »

Putting the Latest Silver Crash Under a Lens

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold and Silver Capitulation – Precious Metals Supply & Demand Report

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Unveiling the Silver in the LBMA London vaults

Sometime in the coming days, the London Bullion Market Association (LBMA) plans to begin reporting the amount of real physical gold and silver that is actually stored in the network of LBMA vaults in London. This follows an announcement made by the LBMA on 8 May.

Read More »

Read More »

A Look at the Gold and Silver Price Drop of 3 July, 2017

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

What Really Happened When Gold Crashed, Monday June 26?

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Shrinkflation – Real Inflation Much Higher Than Reported

600 new words entered our official lexicon this week as the Oxford English Dictionary announced the latest new additions to their online records.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

8 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

8 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Physical Gold vs ETFs: Ownership, Risk and Liquidity Compared

-

Meine Top Favoriten: Edelmetalle für 2026! #thorstenwittmann #edelmetalle #finanzstrategien

-

Wenig Gehalt, trotzdem glücklich?

Wenig Gehalt, trotzdem glücklich? -

Why Silver Shortages Appear Without Spot Price Spikes

-

How to Buy Gold Online Safely

-

unknown

unknown -

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos -

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

More from this category

A new era for silver?

A new era for silver?28 Aug 2024

A perfect storm in the making

A perfect storm in the making 15 Feb 2024

Gold Hits New All Time Highs

Gold Hits New All Time Highs2 Nov 2023

This Will Be The Biggest Theft of This Century

This Will Be The Biggest Theft of This Century10 Feb 2023

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton27 Oct 2022

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!16 Oct 2022

Rick Rule – Gold Helps Me Sleep at Night

Rick Rule – Gold Helps Me Sleep at Night14 Oct 2022

Were the UK pension funds just the canary in the gold mine?

Were the UK pension funds just the canary in the gold mine?9 Oct 2022

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!5 Oct 2022

Episode 5 of The M3 Report with Steve St. Angelo

Episode 5 of The M3 Report with Steve St. Angelo28 Sep 2022

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks10 Sep 2022

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates4 Sep 2022

The Russian Gold Standard

The Russian Gold Standard28 Aug 2022

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming27 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

More energy blows are dealt to Europe, causing a cold chill to be even colder

More energy blows are dealt to Europe, causing a cold chill to be even colder13 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022