Tag Archive: Precious Metals

European Energy Crisis: 4 Things You MUST Know!

European Energy Crisis: 4 Reasons You MUST Know! European households are facing rising prices on many goods and services, but one particular standout is electricity and gas bills.

Read More »

Read More »

Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold price fell to $1,808 an ounce in the wake of the release of the minutes of the December Federal Reserve meeting, having hit an intra-day high of $1,829. Silver price fell to $22.72 an ounce from an intra-day high of $23.26.

Read More »

Read More »

The Black Friday Stock Market Crash – Gareth Soloway

Black Friday 2021 saw the largest stock market sell-off since 1931.

Is this the start of a bigger crash, has the trend changed or is this just a one-time blip?

We ask Gareth Soloway of InTheMoneyStocks.com what his charts are suggesting and why he is so bullish on gold

Watch the Video to Learn More

Make sure you don’t miss a single episode… Subscribe to our YouTube channel

Click Here to Download Your...

Read More »

Read More »

Why Governments Hate Gold

Do governments hate gold? The answer: Yes — Governments hate gold because they cannot print it, and it is difficult for them to control.

Read More »

Read More »

The Inflation Tide is Turning!

In our post on January 28, 2021 “Gold, The Tried-and-True Inflation Hedge for What’s Coming!” we outlined four reasons that we expect higher inflation over the next several years.

Read More »

Read More »

Gold Leads the Way for Silver

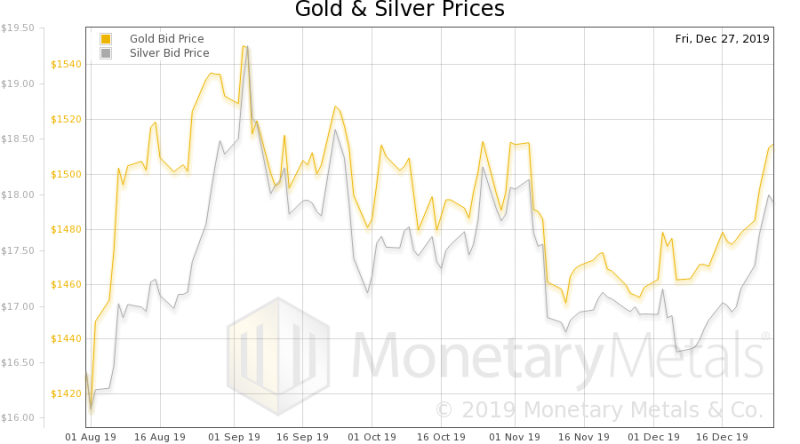

Last week we wrote about the gold to silver ratio. Our points were that it measures the price of one metal against the other, just as we use the dollars per ounce to measure daily metals prices, and just as we use ounces per Corvette to measure purchasing power preservation.

Read More »

Read More »

The Changing Role of Gold

In our post on August 11 titled End of an ERA: The Bretton Woods System and Gold Standard Exchange, we discussed the significance of then-President Nixon’s action of closing the gold window thereby ending the Bretton Woods Monetary system.

Under the Bretton Woods monetary system, central banks could exchange their US dollar reserves for gold. This also ended the gold fixed price of US$35 per ounce.

This week we explore the two...

Read More »

Read More »

A Look Back at Nixon’s Infamous Monetary Policy Decision

Putting the World on a Paper Standard Half a century ago one of the most disastrous monetary policy decisions in US history was committed by Richard Nixon. In a television address, the president declared that the nation would no longer redeem internationally dollars for gold. Since the dollar was the world’s reserve currency, Nixon’s closing of the “Gold Window” put the world on an irredeemable paper monetary standard.

Read More »

Read More »

Gold, Stocks & Commodities- A Complicated Correlation

In our July 29 post titled How Gold Stacks Up Against Stocks, Property, Commodities and Big Macs! we showed readers charts of gold as a ratio to other assets and products. We discussed that gold competes with crypto and stocks for the investment dollars.

Read More »

Read More »

Is Gold Still in a Bull Market?

Today Gareth Soloway, Chief Market Strategist of InTheMoneyStocks.com talks about his technical analysis of gold and silver as well as giving us insights in to the recent moves in Bitcoin and the stock markets.

Recent comments from the Federal Reserve Chairman Jerome Powell indicated that they may need to raise rates in 2023 (2 years away!). This is primarily due to the continued excessive money printing fueling a surge in inflation. Inflation is...

Read More »

Read More »

Inflation risk takes center stage – Part I of II

Over the past couple of weeks, we’ve been seeing more and more mainstream headlines about inflation fears being on the rise, both in the US and in Europe. Central bankers on both sides of the Atlantic have been doing their best to assuage these concerns, promising that they have everything under control and that the situation will without a doubt normalize soon.

Read More »

Read More »

Second lockdown in Europe

As the long-awaited “second wave” of the corona pandemic sweeps through Europe, another round of severe restrictions, travel bans and rules that prevent the proper function of international business and trade threatens to once again disrupt all kinds of sectors, including the gold industry.

Read More »

Read More »

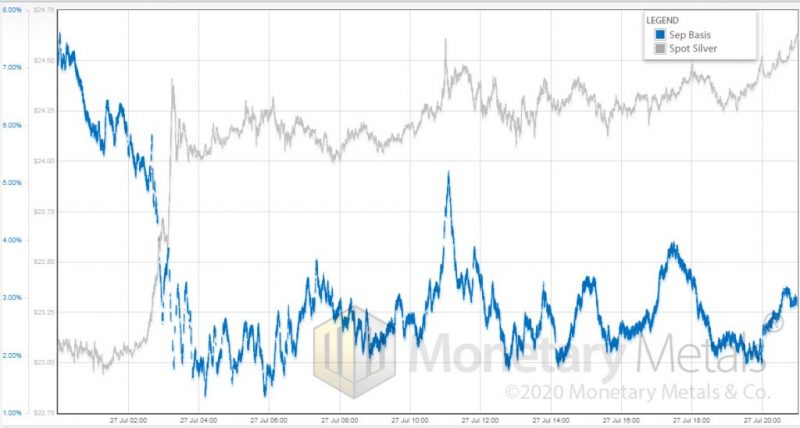

Silver “Scarcifies” – Precious Metals Supply and Demand

The action on 27 July was not. Notice the big drop in the basis starting around midnight (London time). It falls from over 7% to under 2%.

Read More »

Read More »

An Excellent Seasonal Buying Opportunity in Silver Lies Directly Ahead

Today I want to put a popular precious metal under the magnifying glass for you: silver. Silver, often referred to as the “little brother” of gold, has a particularly interesting seasonal pattern I would like to share with you.

Read More »

Read More »

“The illusions of Keynesianism create a morally corrupt society” – Part II

Claudio Grass (CG): Overall, apart from the obvious economic consequences of the crisis, do you also see geopolitical and social ones, on a wider scale? Given all these “moving parts”, from the upcoming US election and internal frictions in the EU to the Hong Kong tensions and the rising public discontent in Latin America, where do expect the chips to fall once this is over?

Read More »

Read More »

In Gold We Trust, 2020 – The Dawning of a Golden Decade

The New In Gold We Trust Report is Here! The In Gold We Trust 2020 report by our good friends Ronald Stoeferle and Mark Valek was released last week. It is the biggest and most comprehensive gold research report in the world.

Read More »

Read More »

Gold Stocks – A Show of Strength

Gold Sector Outperforms Broad Market. The gold sector is in an uptrend since September 2018. The initially rather labored move accelerated after a secondary low was established in May 2019 and the 50-day and 200-day moving averages were breached for the second time. Last week the two moving averages were once again overcome in the course of the post-crash rebound.

Read More »

Read More »

Wealth Consumption vs. Growth – Precious Metals Supply and Demand

GDP – A Poor Measure of “Growth” Last week the prices of the metals rose $35 and $0.82. But, then, the price of a basket of the 500 biggest stocks rose 62. The price of a barrel of oil rose $1.63. Even the euro went up a smidgen. One thing that did not go up was bitcoin. Another was the much-hated asset in the longest bull market. We refer to the US Treasury.

Read More »

Read More »

The Strongest Seasonal Advance in Precious Metals Begins Now

Plans and Consequences. You are probably already getting into the holiday spirit, perhaps you are even under a little stress. But the turn of the year will soon be here – an occasion to review the past year and make plans for the new one. Many people are doing just that – and their behavior is creating the strongest seasonal rally in the precious metals markets.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Wenig Gehalt, trotzdem glücklich?

Wenig Gehalt, trotzdem glücklich? -

unknown

unknown -

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos -

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan -

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!”

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!” -

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

unknown

unknown

More from this category

A new era for silver?

A new era for silver?28 Aug 2024

A perfect storm in the making

A perfect storm in the making 15 Feb 2024

Gold Hits New All Time Highs

Gold Hits New All Time Highs2 Nov 2023

This Will Be The Biggest Theft of This Century

This Will Be The Biggest Theft of This Century10 Feb 2023

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton27 Oct 2022

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!16 Oct 2022

Rick Rule – Gold Helps Me Sleep at Night

Rick Rule – Gold Helps Me Sleep at Night14 Oct 2022

Were the UK pension funds just the canary in the gold mine?

Were the UK pension funds just the canary in the gold mine?9 Oct 2022

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!5 Oct 2022

Episode 5 of The M3 Report with Steve St. Angelo

Episode 5 of The M3 Report with Steve St. Angelo28 Sep 2022

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks10 Sep 2022

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates4 Sep 2022

The Russian Gold Standard

The Russian Gold Standard28 Aug 2022

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming27 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

More energy blows are dealt to Europe, causing a cold chill to be even colder

More energy blows are dealt to Europe, causing a cold chill to be even colder13 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022

The ‘Fed Put’ – Gone Until There’s Blood in the Streets

2022-01-30

by Stephen Flood

2022-01-30

Read More »