Tag Archive: Pictet

Weekly View – One country, two systems at risk

Last week, German chancellor Merkel delivered a surprise about-face when she and French president Macron announced a proposal for a EUR 500bn recovery fund in the wake of the coronavirus crisis. The unprecedented plan involves the distribution of grants, rather than loans, to member states in economic need.

Read More »

Read More »

Modern Monetary Theory makes inroads following coronavirus crisis

US policymakers’ bold actions in response to the coronavirus bear some traces of the free-wheeling deficits, repressed interest rates and central bank activism (money creation) that form the cornerstones of the Modern Monetary Theory (MMT) playbook.

Read More »

Read More »

House View, May 2020

With leading economies likely facing double-digit declines in GDP in Q1 and Q2, we expect Brent oil in the USD10–20 range in Q2 before reaching a long-term equilibrium of USD18 at year’s end. With consumers tempted to remain cautious, the oil sector in deep difficulty and a big rise in unemployment, we expect dire Q2 GDP figures for the US. We have reduced our GDP forecast for 2020 as a whole to -7.7%.

Read More »

Read More »

A reality check on China’s return to work

The recent recovery in industrial activity seems to have stalled, probably because of the collapse in external demand and high levels of vigilance inside China. Since the large-scale coronavirus infection was contained, the Chinese government has been trying hard to get the economy back on track. The end of the lockdown in Wuhan after two in a half months is an important milestone in that respect.

Read More »

Read More »

Central banks to the rescue

While expecting long-term yields to be capped, we remain neutral on US Treasuries. We think peripheral euro area bonds to avoid the levels of stress seen during the sovereign debt crisis.

Read More »

Read More »

Weekly View – Merkel under pressure

Euro-area growth has hit a slow patch. Following promising signs of having turned a corner, economic data released last week revealed that Q4 growth in the euro area reached its slowest pace since the European debt crisis. German growth was flat for Q4, in line with expectations. As far as Germany’s outlook goes, dark clouds have taken the form of an uncertain political environment and China’s recent weakness.

Read More »

Read More »

House View, January 2020

Our asset allocation is dominated by a wish to stay diversified in a fragile environment. Continued ‘noise’ around trade is likely to leave markets alternating between disappointment and hope. With this in mind, we have a neutral stance on government bonds and developed-market equities alike, although we still see select opportunities in equities and appreciate the protective function of safe-haven bonds.

Read More »

Read More »

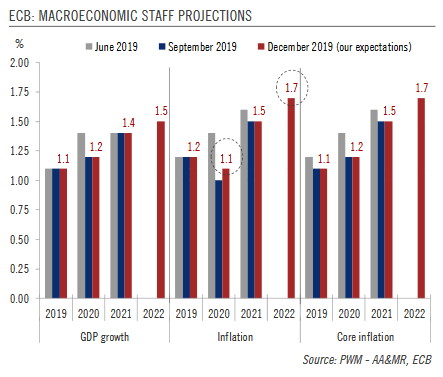

ECB: Preview of the review

We see the ECB remaining on hold throughout next year although we believe it could tweak some of the technical parameters of its toolkit. The first press conference of any new ECB President is an event in itself, and this time will be no different. Christine Lagarde's debut this week will understandably attract a lot of attention as the media and market participants scrutinise both form and substance.

Read More »

Read More »

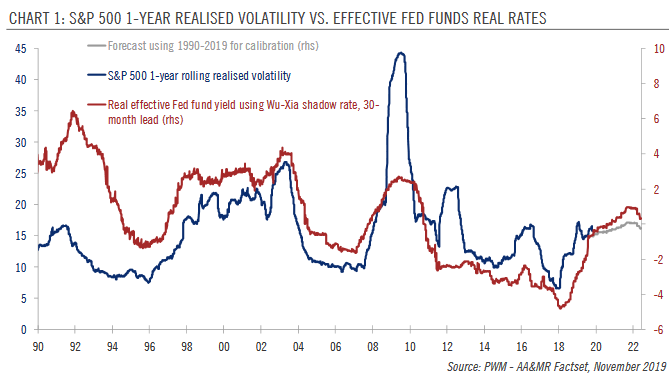

Upward pressure on equity volatility mitigated by fund flows

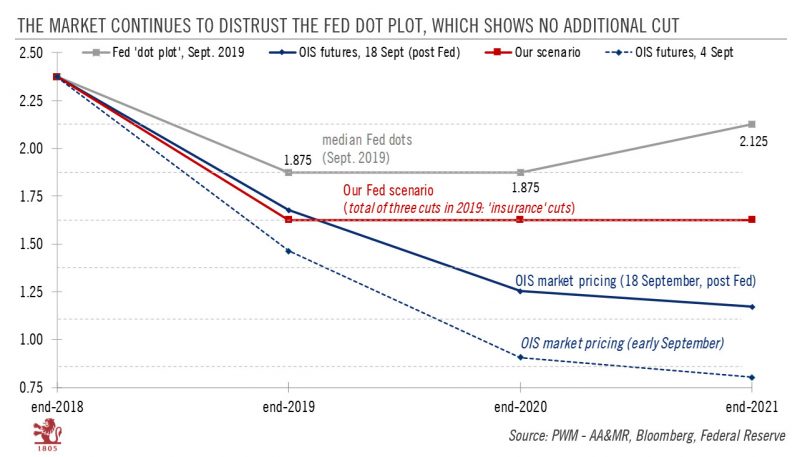

Whereas inflation is expected to be dormant next year, our expectation of real GDP growth of just 1.3% in the US in 2020 could put upward pressure on equity volatility. Since monetary policy tends to lead volatility by two and a half years, the Fed’s turn toward quantitative tightening in 2017 is also continuing to exert upward pressure on volatility levels for now.

Read More »

Read More »

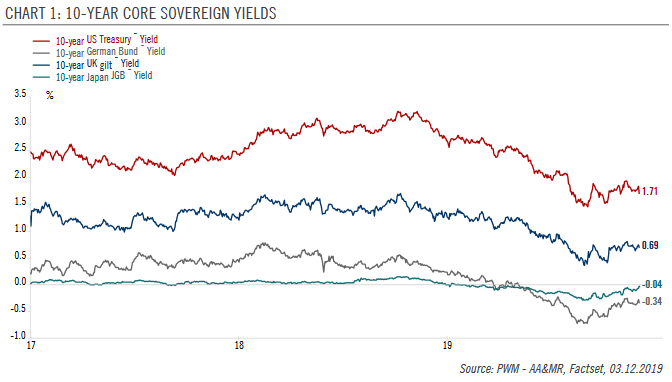

Core sovereign bonds 2020 Outlook

Neutral US Treasuries. We expect the US 10-year yield to fall towards 1.3% in H1 as US growth falters and the US Federal Reserve starts signalling additional rate cuts. However, continued monetary easing and election promises (i.e. fiscal stimulus) could boost inflation expectations in H2, with the 10-year yield ending 2020 at around 1.6% in our central scenario.

Read More »

Read More »

Euro Area 2020 Macro Outlook

After an estimated 1.2% in 2019, we expect GDP growth of 1.0% in the euro area in 2020. Country wise, we expect more manufacturing-intense countries to underperform more domestically driven ones. Thus, we project weak growth of 0.7% in Germany and 0.4% in Italy in 2020, while we expect France and Spain to remain relatively resilient, growing by 1.2% and 1.7%, respectively.

Read More »

Read More »

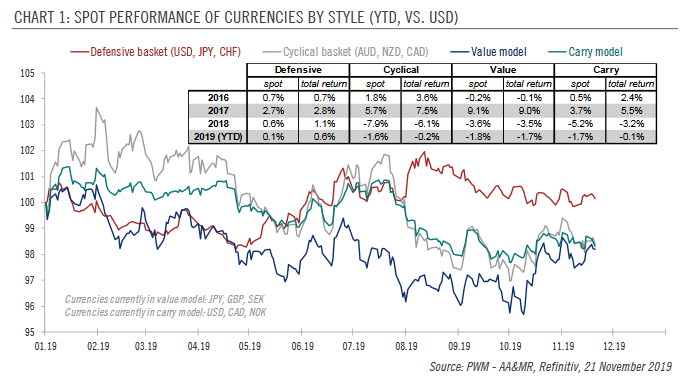

Currencies: do it with style

Our scenario of ongoing global growth moderation and elevated political uncertainties should, we believe, support defensive currencies. We consider a currency ‘defensive’ if it is likely to remain resilient should global risk appetite falter.

Read More »

Read More »

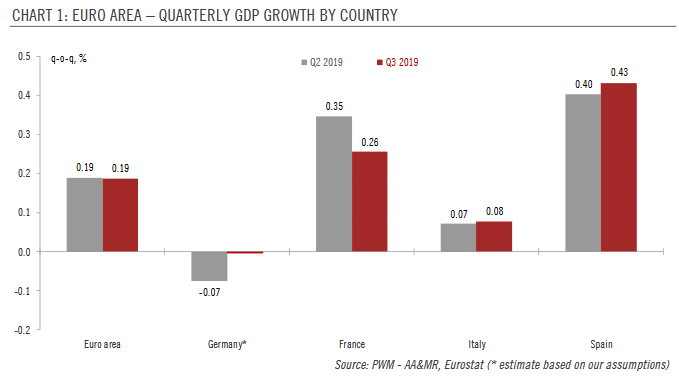

Steady euro area growth and rise in core inflation

According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations. Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November.

Read More »

Read More »

MMT, la nouvelle théorie en vogue à Washington

L’influence du ‘Modern Monetary Theory’ est susceptible d’augmenter dans les milieux économiques et politiques américains.La nouvelle théorie monétaire (Modern Monetary Theory/MMT), théorie macroéconomique défendue par des économistes hétérodoxes, commence à faire son chemin aux Etats-Unis.

Read More »

Read More »

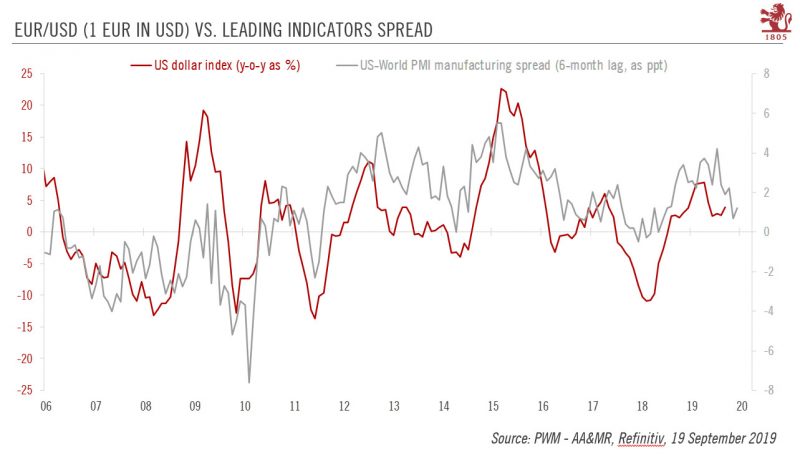

Euro/USD: things look pretty stable

Competing forces mean the two currencies could remain in a holding pattern for a while.The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way.

Read More »

Read More »

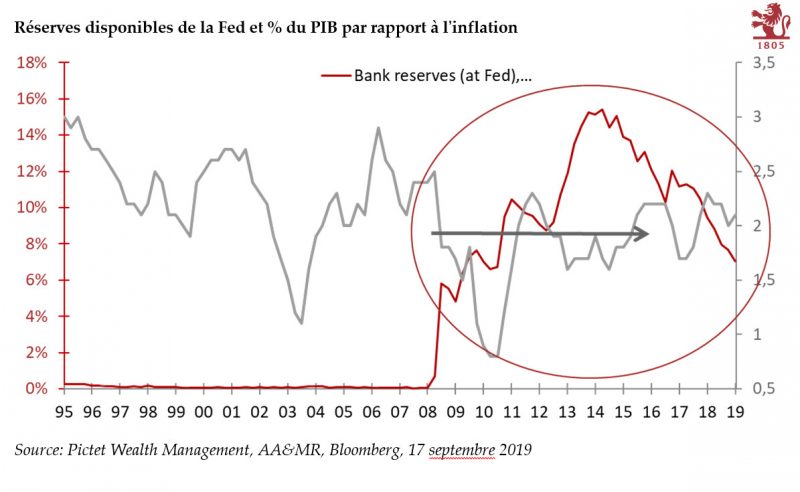

Powell plays the ‘insurance’ card again

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market.The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%.

Read More »

Read More »

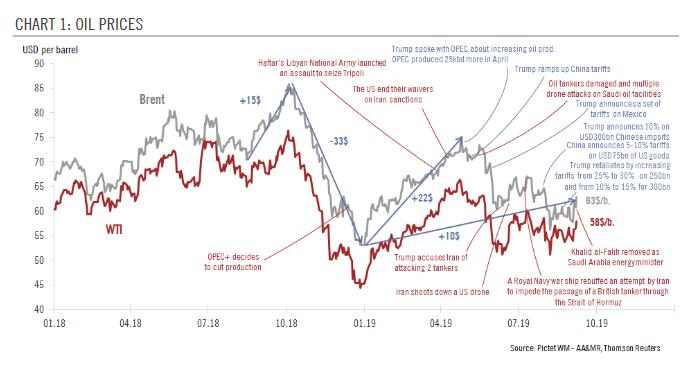

Oil prices and the global economy

Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down.Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment.

Read More »

Read More »

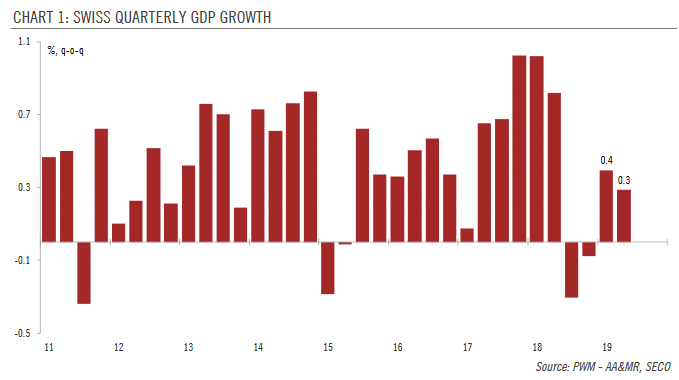

Swiss National Bank – Between a rock and a hard place

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings.Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy.

Read More »

Read More »

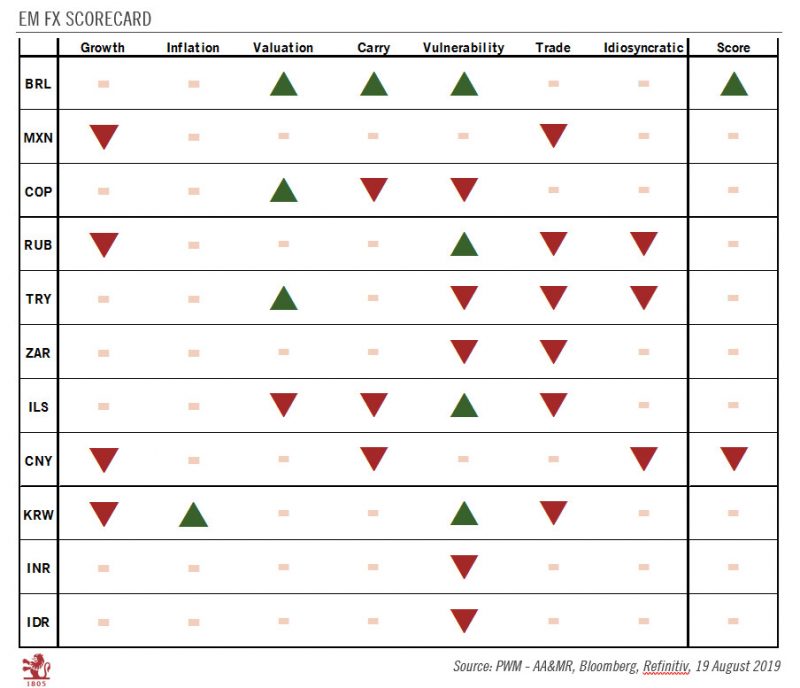

Brazilian real stands out in EM currency scorecard

Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others.In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen.

Read More »

Read More »

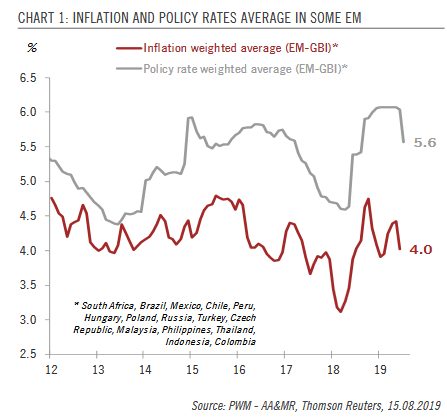

Emerging market sovereign debt update: yields are falling

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward.Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks.

Read More »

Read More »