Tag Archive: OIL

FX Daily, June 13: Financial Statecraft or Whack-a-Mole

Overview: After roiling the markets by threatening escalating tariffs on Mexico, US President Trump has threatened China that if Xi does not meet him and return to the positions that the US claims it had previously, he will through on imposing tariffs to the remaining goods the US buys from China that have not already been penalized.

Read More »

Read More »

FX Daily, May 06: Trump’s Tariff Tweets Help Investors Discover Volatility

Reports that a US-China deal could be struck by May 10 before the weekend left investors ill-prepared for the presidential tweets yesterday that announced that the US was ending the tariff truce. Trump indicated that the 10% tariff on $200 bln of Chinese goods would be lifted to 25% at the end of the week and that the remaining $325 bln of Chinese goods that have not been subject to an extra levy, will be slapped with a 25% tariff soon.

Read More »

Read More »

FX Daily, May 03: Ahead of US Jobs Report, the Greenback Remains Firm

Overview: The US April jobs data stand before the weekend, and the greenback is holding on to most of yesterday's gains as participants wait for the report. Equities in the Asia Pacific region were mixed without leadership from China and Japan, where the markets remain closed for the extended holiday. On the week, Australia's ASX was the worst performing.

Read More »

Read More »

FX Daily, April 23: Oil Extends Gains While Markets Await Fresh Incentives

Overview: Financial centers that have been closed for the extended holiday have re-opened, but the news stream is light and market participants are digesting developments and positioning for this week's central bank meetings and the first look at Q1 US GDP. The US decision to end exemptions to the embargo against Iran led to a surge in oil prices, which are extending gains to new six-highs today.

Read More »

Read More »

FX Daily, April 22: Surge in Oil Punctures Holiday Markets

Overview: With many centers closed for the extended holiday, the calm in the global capital markets has been punctuated by reports that the US is considering ending its exemption for eight countries to have bought Iranian oil over the past six months. The waivers were to end on May 2, but previously it was thought that a couple of waivers, like for China and India, would be extended.

Read More »

Read More »

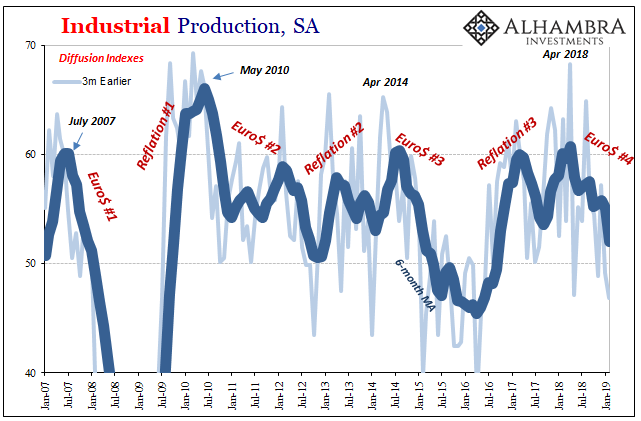

Green Shoot or Domestic Stall?

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it might actually recover.

Read More »

Read More »

FX Weekly Preview: Important Steps Away from the Abyss

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession.

Read More »

Read More »

FX Daily, February 05: Greenback Remains Firm

Overview: The US dollar is little firmer against most of the major currencies. Despite some disappointing data (retail sales, trade, PMI), the Australian dollar has recovered from initial losses below $0.7200 on the back of the central bank's reluctance to adopt an easing bias. A small upward revision in the eurozone's flash service and composite PMIs help steady the euro after it neared $1.14.

Read More »

Read More »

FX Weekly Preview: Europe Moves to the Center Ring

In recent weeks, the macro story focused on the shifting outlook for Fed policy and the Sino-American trade relationship. There is unlikely to be further progress on either issue in the week ahead. The Fed won't raise interest rates until toward the middle of the year at the earliest.

Read More »

Read More »

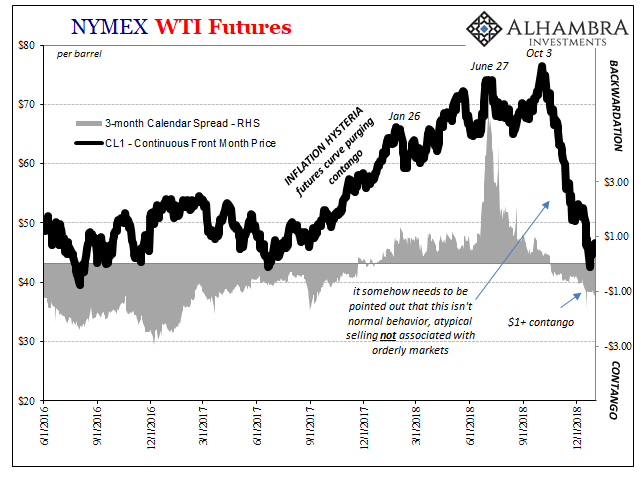

Nothing To See Here, It’s Just Everything

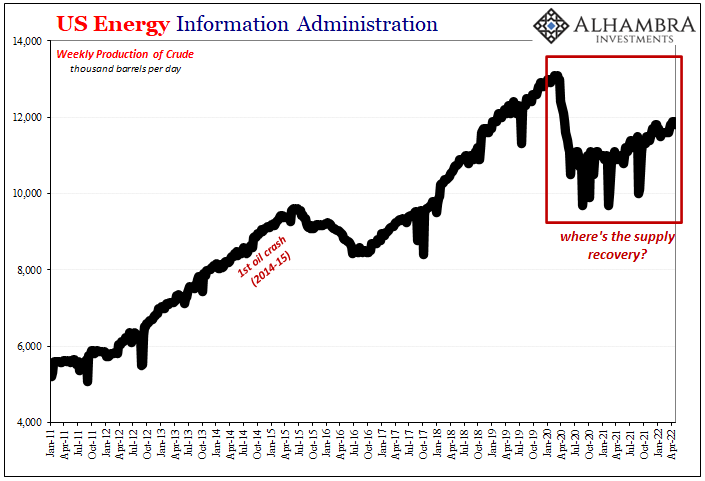

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal.

Read More »

Read More »

Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword.

Read More »

Read More »

FX Daily, November 15: UK Political Drama Roils Sterling

Overview: The resignation of the UK's Brexit negotiator after Prime Minister May had secured support from a majority of the cabinet sent sterling sharply lower. Raab's resignation underscores the difficulty the Brexit agreement faces in the UK Parliament. Sterling was hammered nearly 2.5 cents on the news and trade below $1.28.

Read More »

Read More »

FX Daily, November 12: Sterling’s Losses Lead Dollar Rally

Overview: The US dollar is enjoying broad gains against most major and emerging market currencies. Sterling, dragged down by Brexit concerns, is leading the way. With today's losses, sterling has shed nearly 3.7 cents over the last four sessions. The euro, for its part, is at a new 17-month low (~$1.1250).

Read More »

Read More »

FX Weekly Preview: DOTS in the Week Ahead: Divergence, Oil, Trade and Stocks

The Federal Reserve's confidence in the economy and its need to continue to gradually increase interest rates stands in sharp contrast to most of the other major central banks. The European Central Bank will finish its asset purchases at the end of the year, but it is in no position to begin to normalize interest rates. Indeed, the risk is that it may feel compelled to off another Targeted Long-Term Repo, which would, in effect, allow the borrowers...

Read More »

Read More »

FX Daily, November 07: Equities and Bonds Jump While the Dollar Slumps

The dollar has fallen against nearly every currency. It had been moving lower at the start of the week, but what seems like a correction broadened and deepened following the US midterm election. The outcome was largely in line with expectations for the Republicans to hold the Senate and the Democrats to take a majority of the House for the first time since 2010.

Read More »

Read More »

FX Daily, October 15: Monday Blues

Despite the pre-weekend gains that lifted the S&P 500 above its 200-day moving average, global equities are moving lower today. The main news over the weekend included the US renewing its threat to impose more tariffs on China and Saudi Arabia threatening retaliation for any sanctions relating to the disappearance of the journalist Khashoggi, and the lack of a breakthrough in UK-EU negotiations.

Read More »

Read More »

FX Daily, October 11: Equity Swoon Takes Spotlight, Pushes Dollar to Backfoot

There is one story today, and that is the sell-off in global equities. Although the narratives put the US at the center, the fact of the matter is that US equities have been among the best performers this year, despite the rise of interest rates and a President that is not above criticizing the central bank.

Read More »

Read More »

FX Weekly Preview: Has an Inflection Point been Reached for Investors?

Interest rates, led by the US, have accelerated to the upside. With price pressures generally rising and oil prices at four-year highs, it is understandable. Market participants need to see the breakout that has lifted US 10-year yields to their highest level in seven years is confirmed in subsequent price action.

Read More »

Read More »

5 Things Investors Should Know About US Strategic Petroleum Reserves

US Department of Energy announced yesterday offered for delivery between October 1 and November 30, 11 mln barrels of sour crude oil from the Strategic Petroleum Reserves. The move has nothing to do with operationalizing President Trump's complaint that oil prices were too high. Instead, the sales are part of the fiscal compromise in 2015 budget legislation and the health care act of 2016.

Read More »

Read More »

Great Graphic: Crude Approaches Year-Old Trend Line

Crude oil has been climbing a trendline for the past year. This Great Graphic depicts this trend on a weekly bar chart. Depending exactly the line is drawn, it comes in now near $65 a barrel. The technical indicators are consistent with further losses.

Read More »

Read More »