Tag Archive: NZD

FX Daily, September 12: Dollar Sports Heavier Tone as Yesterday’s Bounce Runs out of Steam

The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe. The euro advanced yesterday from NOK9.30 to NOK9.40. It is consolidating in a tight range today. The election results may have been a bit closer than expected, but the weight on the krone yesterday seemed to stem more from the unexpectedly soft inflation report.

Read More »

Read More »

FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that have played down such expectations, and warn a decision on next year’s intentions may not be...

Read More »

Read More »

FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

It is difficult to walk back the saber-rattling rhetoric. US Secretary of State Tillerson tried to defuse the situation, which had appeared to ease nerves in North America yesterday. However, references to the modernization of US nuclear forces, a multi-year project begun last year, spurred a fresh threat by North Korea to fire four intermediate range missiles near Guam in week's time.

Read More »

Read More »

FX Daily, August 02: Euro Climbs Relentlessly, While Greenback is Mixed

The euro's strength is surely partly a reflection of US dollar weakness, but it is also a reflection of the improved sentiment among investors. The initial dollar losses at the start of the year was largely a correction that is common after a Fed hike. This is more or less what happened at the start of 2016 as well, following the Fed hike in December 2015.

Read More »

Read More »

FX Daily, July 21: Dollar Licks Wounds as News Stream Doesn’t Improve

The euro has depreciated by 0.13 to 1.1043 CHF. ECB President Draghi did not argue forcefully enough at yesterday's press conference to dampen the enthusiasm for the euro. The initial dip was quickly bought and the euro chased above last year's high near $1.1615, and the gains have been extended to nearly $1.1680 today. The next target is the August 2015 near $1.1715 is near.

Read More »

Read More »

FX Daily, July 14: Aussie Scales New Highs for the Year, as the Greenback Remains on the Defensive

The Australian dollar has taken over leadership in the dollar bloc from the Canadian dollar. The Aussies are up about 0.35% today to extend this week's gains to more than 2% and reach a new high for the year a little more than $0.7760. The Canadian dollar is up 1.1% this week, in comparison.

Read More »

Read More »

Great Graphic: Aussie is Approaching 15-month Trendline

This Great Graphic, made on Bloomberg, depicts the Australian dollar since April 2016. We drew in the trendline from that April high, through the November high and the March 2017 high. It nearly catches last month's high as well. It comes in now near $0.7725.

Read More »

Read More »

FX Weekly Preview: Events Not Data Key in Week Ahead

Light economic data calendar, but look for downtick in eurozone flash PMI. Soft Canadian retail sales (volume) and softer CPI (base effect) could take some of the sting from the recent BoC official comments. MSCI decision on China, Argentina, Saudi Arabia, and South Korea may have the broadest and long-lasting impact of the five key events we highlight.

Read More »

Read More »

FX Daily, May 24: Dollar Consolidates, While Market Shrugs Off China Downgrade

After staging a modest recovery in North America yesterday afternoon, the greenback is consolidating in narrow ranges. Momentum traders, who appeared to dominate activity recently, paused. To be sure, the greenbacks upticks have been modest, and little technical damage has been inflicting on the major foreign currencies.

Read More »

Read More »

FX Daily, May 11: Canadian and New Zealand Dollars Get Whacked, While Greenback Consolidates

The US dollar has been mostly confined to about a 30 pip range against the euro and yen in Asia and the European morning. Sterling is under a little pressure after a series of poor data, including larger than expected falls in manufacturing and construction output, and a sharp widening of the trade deficit.

Read More »

Read More »

FX Daily, May 03: Marking Time

The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact on the broader investment climate.

Read More »

Read More »

FX Daily, April 26: Dollar Stabilizes Ahead of Trump and ECB

The US dollar was marked down in response to the French election and saw some follow through selling yesterday, but the momentum had slowed, and now it is stalled. The greenback is posting upticks against nearly all the major currencies. There is a good reason to be cautious.

Read More »

Read More »

FX Daily, April 20: Dollar and Yen Push Lower

With the exception of the yen, the US dollar is lower against all the major currencies. US Treasury yields are firm, extending yesterday's rise a little. This may help keep the dollar straddling JPY109, but unwinding long yen cross positions is helping underpin the other major currencies. The Dollar Index is making a new low for the week and appears poised to test support around 98.85-99..00.

Read More »

Read More »

FX Weekly Preview: Politics Not Economics is Driving the Markets

The Fed is more confident this year of stable growth and rising inflation. The new US Administration's economic agenda is beginning to take shape, though it is not clear that consumer interests will be pursued. There are several considerations, including politics in Europe, that are driving European rates higher. The RBA and RBNZ meet next week. Neither is expected to change policy.

Read More »

Read More »

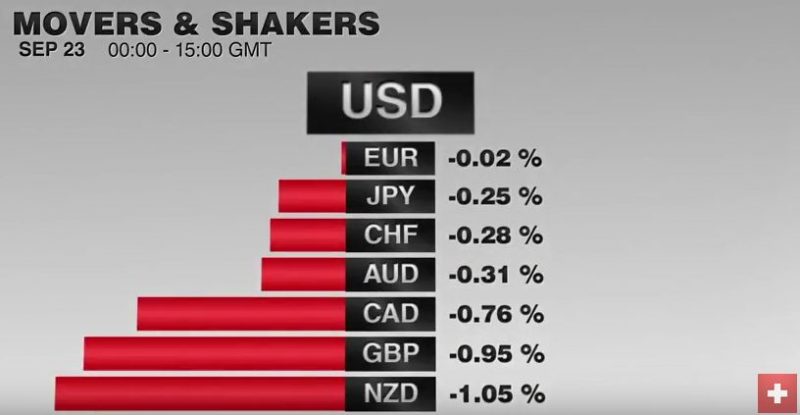

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

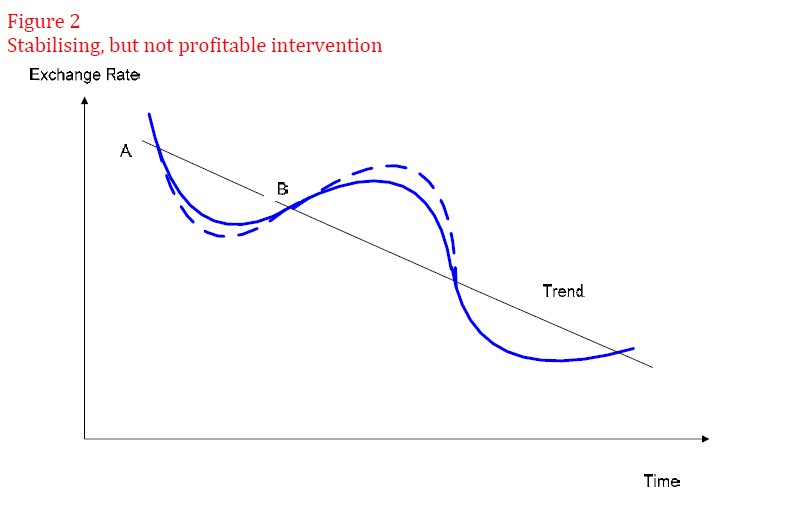

Currency intervention for Central Banks: When and at which level?

The papers from the Reserve Bank of New Zealand describes in easy words where central banks should intervene based on economic history and experience. It avoids the often used econometric considerations. For FX rates those often do not incorporate sufficient long-term data.

Read More »

Read More »