Tag Archive: Non-Farm

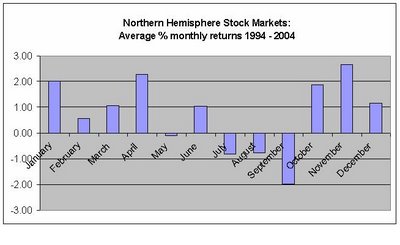

The “Sell in May, Come Back in October” Effect and the 19 Fortune-Tellers of the FOMC

The U.S. economy regularly improves between October and April, this year additionally fueled by "unlimited" quantitative easing, weaker gas prices and higher competitiveness thanks to a stronger Chinese yuan and weaker Asian economies. Update 2013: The Case-Shiller index continued to climb in April 2013; it became clear that this year the "Sell in May" …

Read More »

Read More »

Net Speculative Positions, Technical Forecast, Week February 17

Submitted by Mark Chandler, from marctomarkets.com The official talk around the G7 statement and the G20 meeting generated a great deal of needless noise in the foreign exchange room. It is almost like a librarian yelling “Quiet”. It may be more disruptive than the initial noise. With the meetings out of the way, we expect …

Read More »

Read More »

Net Speculative Positions, Technical Forecast, Week February9

Submitted by Mark Chandler, from marctomarkets.com Last week the euro was the weakest of the major currencies and the recently beaten up sterling and yen were the strongest. A similar pattern was also evident in the dollar-bloc. The New Zealand dollar had been the strongest and last week had was the weakest, with the …

Read More »

Read More »

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

Net Speculative Positions, Technical Forecast, Week February4

Submitted by Mark Chandler, from marctomarkets.com The main drivers of the foreign exchange market have strengthened. This means that the current trends, especially euro strength and yen, sterling and dollar bloc weakness are likely to persist. The recent price action will likely reinforce the trader behavior of buying euros on pullbacks and selling into bounces …

Read More »

Read More »

Net Speculative Positions, Week January 28

Submitted by Mark Chandler, from marctomarkets.com It is difficult to talk about the US dollar’s performance over the past couple of weeks. There has been a key divergence. The dollar has been trading higher against most currencies except the euro and those currencies, like the Swiss franc or the Scandis, that move in the euro’s …

Read More »

Read More »

Net Speculative Positions, Week January 21

Submitted by Mark Chandler, from marctomarkets.com The technical tone of the major foreign currencies deteriorated in recent days. It appears to be a cascading effect. Favorite risk-on currencies, like the dollar-bloc, failed to participate in the move against the greenback. The Swiss franc took the dubious honor of being the weakest currency last week, losing 2.2% …

Read More »

Read More »

Net Speculative Positions, Week January 14

Submitted by Mark Chandler, from marctomarkets.com There have been some large moves in the foreign exchange market in recent days. The euro posted its largest rally in four months last week. The yen has fallen to its lowest level against the dollar since June 2010 and extended the declining streak to nine consecutive weeks, something …

Read More »

Read More »

Net Speculative Positions, Week November 19

Submitted by Mark Chandler, from marctomarkets.com The US Dollar Index bottomed on September 14, the day after QE3+ was announced. It reached a 2-month high before the weekend. It has now retraced half of the ground lost from ECB President Draghi’s pledge to “to do whatever it takes” through hints, and then delivery, of …

Read More »

Read More »

Net Speculative Positions, Global Stock Markets, Week October 29

Submitted by Mark Chandler, from marctomarkets.com The US Dollar Index reached its best level in more than six weeks on Friday. Yet it managed to only close a couple of ticks higher, as if warning short-term participants against ideas that a breakout is at hand. This also appears to be the message of the …

Read More »

Read More »

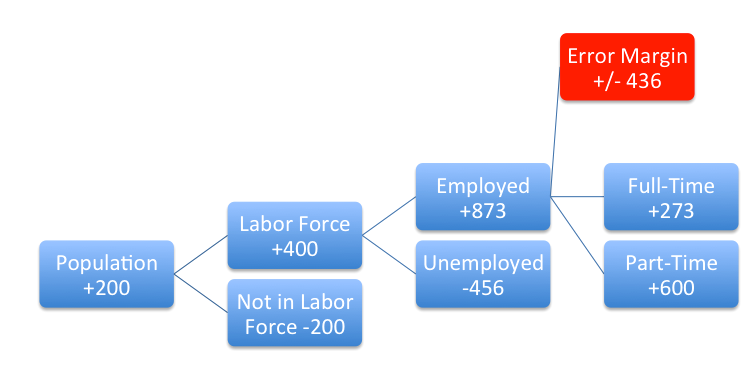

Conspiracy? Why the Jobs Report Was not Cooked, but simply Flawed

Conspiracy ? Huge Differences Between the Payrolls Report and the Household Survey based on the extracts of Robert Oak, Noslaves.com and his blog on Economic Populist It’s a conspiracy! The BLS is trying to swing the election! They’re cookin’ de books! By now you’ve seen the claims, accusations and mumblings by the pundits, press, twitter and blogosphere. So …

Read More »

Read More »

FX Technical Outlook, Net Speculative Positions, Global Markets, week August 27

Submitted by Mark Chandler, from marctomarkets.com There are two main drivers behind the price action in the foreign exchange market and they will likely persist in the days ahead. First, there continues to be position adjustment ahead of the what promises to be eventful few weeks. Second, the release of the minutes from the August 1 …

Read More »

Read More »

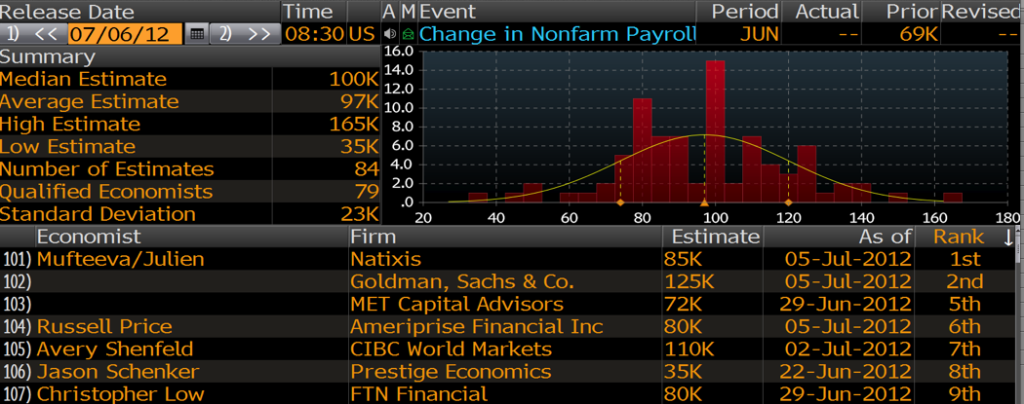

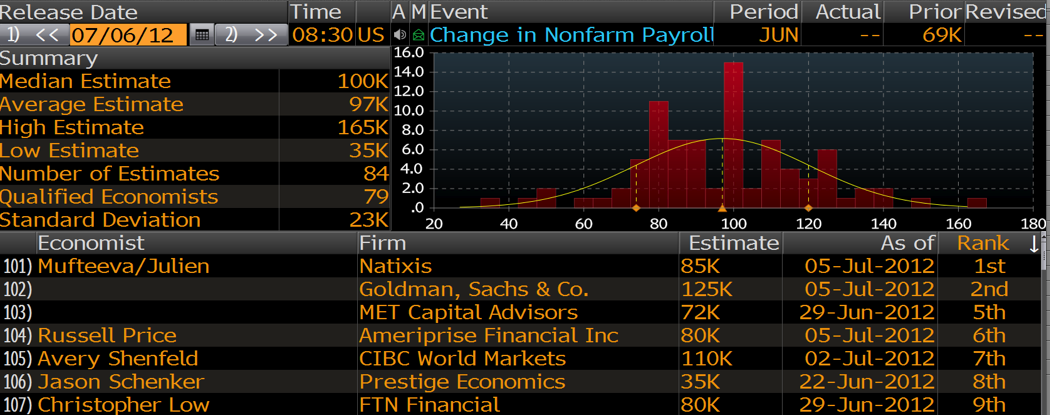

Non-Farm Payrolls: Today’s preview

A detailed comparison of Non-Farm Payroll estimators from six different sources, like Bloomberg, ISM, Department of Labor and ADP.

Read More »

Read More »

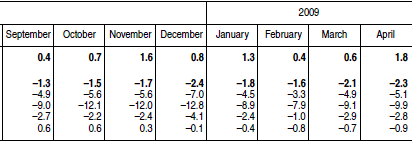

The “Sell in May, come back in October” effect and its equivalent for the SNB

The "Sell in May, come back in October" effect It is the same seasonal anomaly nearly every year: The statistically flawed (see here and here) Non-Farm Payrolls (NFP) report delivers some good winter readings with 200K new jobs, this time additionally fuelled by a weather effect; biased data that let hard-core Keynesian policy makers doubt Okun's law. Consequently the stock markets rally …

Read More »

Read More »

Forget Non-Farm Payrolls, Take US Personal Disposable Income as Lead Economic Indicator

The unreliable Non-Farm Payrolls has far too much importance Interesting to see that markets needed two relatively bad NFPs to really believe that their main indicators, the “Non-Farm Payroll” reports were strongly biased in January and February by a positive weather effect. HFT algorithms that highly influence stock market prices, are not able to take …

Read More »

Read More »