It is difficult to talk about the US dollar’s performance over the past couple of weeks. There has been a key divergence. The dollar has been trading higher against most currencies except the euro and those currencies, like the Swiss franc or the Scandis, that move in the euro’s orbit. Sterling is the exception in that it is in the euro’s orbit, but has broken down.

It is difficult to talk about the US dollar’s performance over the past couple of weeks. There has been a key divergence. The dollar has been trading higher against most currencies except the euro and those currencies, like the Swiss franc or the Scandis, that move in the euro’s orbit. Sterling is the exception in that it is in the euro’s orbit, but has broken down.

Last week, we posed the question whether the euro, and the Mexican peso, which was also resilient, were generating the true signal of pending dollar weakness, or whether the yen, dollar-bloc and sterling’s decline were signs of the underlying strength in the dollar. The issue was not resolved over the past week. The euro’s strength helped pull the currencies in its orbit higher against the dollar, while the greenback extended its gains against the yen, sterling and the dollar-bloc.

We had been persuaded by the potential double top in the euro near $1.34 and the divergence in the RSI that the dollar’s gains were likely to broaden. However, news that the banks repayment of the LTRO funds was greater than expected, and the backing up of Euribor rates, pushed the euro through the ceiling. The next immediate target is near $1.35, which also corresponds with a 50% retracement of the euro’s decline from its last attempt at $1.50 back in May 2011. The $1.3400 area should now provide support for the break out.

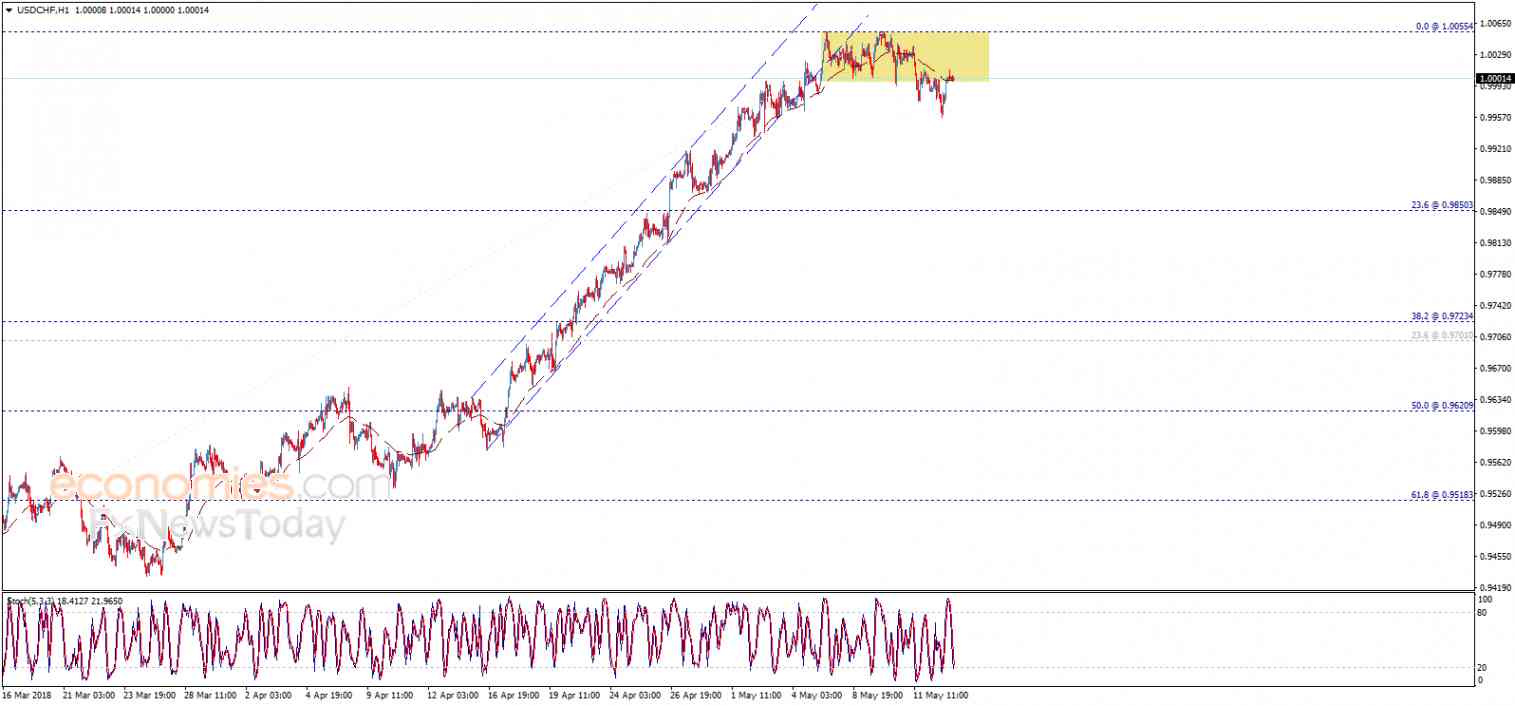

For medium and longer term participants this $1.35 area is important. It appears to be the neckline of a potential large head and shoulders bottom pattern that would, if valid, suggest a target near $1.45. More immediately, a convincing break of $1.35 could spur a move toward $1.38. We expect the Swiss franc to lag behind the euro in the move against the dollar.

A combination of continued official jawboning, a larger than expected trade deficit, evidence that deflation’s grip has not slackened and the widening of the US 10-year premium over Japan to its highest level in 8 months, helped push the dollar through the JPY90 and JPY91. While the official push back has begun, it is still in the early stages and market participants have been rewarded again for selling into yen bounces and will likely continue to do so. Technically, the next target is in the JPY94-JPY95 area.

The charts for sterling look horrible. The 7-month uptrend and 200-day moving average violations saw follow through selling. The short-term shelf built near $1.58 gave way amid news that the UK economy contracted more than expected in Q4 and for was essentially stagnant all of last year. The closes below the mid-Nov low near $1.5830 is important. It is potentially the neckline of a double top, which, if valid, would project toward $1.5300.

The market appears stretched, though with fresh five month lows ahead of the weekend, there is no sign of an immediate reversal in the technical indicators. Yet, for shorter-term participants, it may offer an attractive risk-reward for trying to pick a bottom. Stops would be placed tightly below $1.5840 in anticipation of bounce that could lift back initially to $1.5950.

Another reasonable candidate for bottom picking may be the Australian dollar. Before the weekend the Aussie successfully tested the support offered by the uptrend line drawn off the early Oct and late Dec lows, coming just above $1.04. Like sterling, the technical indicators we review do not show an imminent recovery. Yet the risk-reward would seem to favor long position with stops below the trend line in anticipation of a bounce toward $1.05.

The US dollar reached 7-month highs against the Canadian dollar with the help of a more dovish than expected statement from the central bank and a soft core inflation readings at the end of the week. The Canadian dollar may also attractive for the contrarian. The US dollar spent the entire session on Friday above the top of its Bollinger Band (2-standard deviations above the 20-day moving average), which now comes in near CAD1.0023. Stops, like we suggested in sterling and Australian dollar, would be best placed tightly below the pre-weekend Canadian dollar low (or US dollar high) near CAD1.01. The initial corrective target is near CAD0.9970.

While the fundamental case of the Mexican peso remains constructive, the technical condition is deteriorating, with momentum and MACD indicators turning up for the dollar-peso pair. The long peso position continues to seem to us to be an extremely crowded trade. We expect to see MXN12.90-MXN13.00 before seeing MXN12.55.

Lastly, we conclude with a few observations about the positioning in the futures market. First, the net speculative position was long euros for second consecutive week. This was more a function of short covering than the establishment of new longs. That said, the gross long position is the largest since mid-2011 and the gross short position is the smallest since Aug ’11

Second, it was the sixth consecutive week that the net short yen position fell. The gross short position has been essentially flat for the past three weeks. It is actually smaller than was in the last reporting period in 2012 (106k vs 112k). The gross long yen positions have trended higher and now are the largest in three months.

Third, the net long sterling, Swiss franc, Canadian dollar and Mexican peso futures positions were all trimmed. Each saw old longs cut and new shorts established, but nothing very dramatic. Given the price action since the end of the CFTC reporting period, it would not be surprising to see more of the same in the next report, with a possible exception of the Swiss franc.

Fourth, the Aussie bulls seem fairly resilient to the near-term price action. For the fourth consecutive week, the net long position grew, and this reflected both new longs and the covering of some shorts. The 1.5% decline in Aussie in the three sessions following the end of the recent reporting period may reflect the capitulation by some longs, but the gross long position as of Jan 22, was within 1500 contracts of the record high set last month. However, if the trend line discussed above fails, the long seems seem vulnerable, which also underscores the importance of a tight stop by would be bottom pickers.

| week ending Jan 22 |

Commitment of Traders |

|

|

(speculative position in000’s of contracts) |

|

|

Net |

Prior Week |

Gross Long |

ChangeGrossLong |

Gross Short |

ChangeGrossShort |

| Euro |

21.4 |

7.3 |

83.8 |

3.6 |

62.5 |

-10.4 |

| Yen |

-64.1 |

-65.7 |

42.0 |

2.5 |

106.0 |

0.9 |

| Sterling |

17.9 |

28.3 |

60.2 |

-3.6 |

42.3 |

6.8 |

| Swiss Franc |

6.4 |

17.8 |

15.2 |

-3.8 |

8.8 |

2.6 |

| C$ |

58.0 |

68.7 |

66.2 |

-6.9 |

8.3 |

3.8 |

| A$ |

97.0 |

89.1 |

143.8 |

6.7 |

46.8 |

-1.3 |

| Mexican Peso |

150.0 |

152.0 |

159.9 |

-0.6 |

9.9 |

1.0 |

Are you the author?

He has been covering the global capital markets in one fashion or another for more than 30 years, working at economic consulting firms and global investment banks. After 14 years as the global head of currency strategy for Brown Brothers Harriman, Chandler joined Bannockburn Global Forex, as a managing partner and chief markets strategist as of October 1, 2018.

Previous post

See more for 4.) Marc to Market

Next post

Tags:

Canadian Dollar,

Commitments of Traders,

COT,

Currency Positioning,

FX Positioning,

Japanese yen,

Marc Chandler,

MXP,

Net Position,

Non-Farm,

Peso,

Speculative Positions

It is difficult to talk about the US dollar’s performance over the past couple of weeks. There has been a key divergence. The dollar has been trading higher against most currencies except the euro and those currencies, like the Swiss franc or the Scandis, that move in the euro’s orbit. Sterling is the exception in that it is in the euro’s orbit, but has broken down.

It is difficult to talk about the US dollar’s performance over the past couple of weeks. There has been a key divergence. The dollar has been trading higher against most currencies except the euro and those currencies, like the Swiss franc or the Scandis, that move in the euro’s orbit. Sterling is the exception in that it is in the euro’s orbit, but has broken down.