Tag Archive: Norwegian Krone

FX Daily, October 10: Setback for the Greenback

Conflicting headlines about US-China trade whipsawed the markets in Asia, but when things settled down, perhaps, like the partial deal that has been hinted, net-net little has changed. Asian equities were mixed, with the Nikkei, China's indices, and HK gaining, while most of the others slipped lower. The 0.9% gain in the S&P 500 yesterday failed to lift European stocks, and the Dow Jones Stoxx 600 is near the week's lows.

Read More »

Read More »

FX Daily, September 19: Investors Looking for New Focus

Overview: Central bank activity is still very much the flavor of the day, but investors are looking for the next focus. The Bank of Japan and the Swiss National Bank stood pat, while Indonesia cut for the third consecutive time and the Hong Kong Monetary Authority and Saudi Arabia quickly followed the Fed. Brazil cut its Selic rate yesterday by 50 bp as widely expected.

Read More »

Read More »

FX Daily, June 20: Doves Rules the Roost Except in Oslo

Overview: The prospect of "lower for longer" continues to fuel the bond and stock rally. The initial US equity response to the Fed was positive but not strong and closed about 0.3% higher. Asia Pacific equities followed suit with mostly modest gains, except for China and Hong Kong, where gains of more than 1% were recorded.

Read More »

Read More »

FX Daily, March 11: Greenback Starts New Week Decidedly Mixed, with Brexit Anxiety Weighing on Sterling

Overview: Asian shares recovered from opening losses to finish mostly higher, with the Shanghai Composite up nearly 2% and India tacking on 1% after the election was called, starting April 11. European markets, led by energy, communication, and materials sectors, is up about 0.5% through midday. The S&P 500, which closed lower every day last week is looking a little firmer.

Read More »

Read More »

FX Daily, February 11: Dollar Starts New Week on Firm Note

Lifted by the re-opening of Chinese markets after the week-long Lunar New Year holiday, global equities are trading firmer. Outside of Japanese markets that were closed, the large markets in Asia--China, Taiwan, South Korea, and Hong Kong advanced.

Read More »

Read More »

FX Weekly Preview: Europe Moves to the Center Ring

In recent weeks, the macro story focused on the shifting outlook for Fed policy and the Sino-American trade relationship. There is unlikely to be further progress on either issue in the week ahead. The Fed won't raise interest rates until toward the middle of the year at the earliest.

Read More »

Read More »

FX Weekly Preview: Dollar Pullbacks Remain Shallow as Rate Differentials Widen

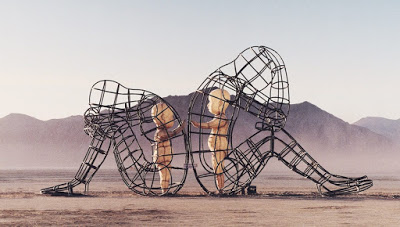

The trajectory of monetary policy in the US and Europe has been fairly clear. There is practically no doubt that the Fed will hike rates on September 26. Despite softer than expected PPI and CPI figures, the market has become more confident of another move in December. The Federal Reserve's balance sheet unwind reaches its maximum velocity of $50 bln a month in Q4.

Read More »

Read More »

FX Weekly Preview: Testing the Dollar’s Breakout

The US dollar surged last week, with the Dollar Index rising 1.25%, the most since April. The dollar is being boosted by two drivers. The first is the policy mix and interest rate divergence. The other is the intensification of pressure on emerging market. Turkey has a disastrous combination of more fundamentals, large short-term foreign currency debt obligations, unorthodox policies, and the lack of credibility.

Read More »

Read More »

FX Daily, April 12: Geopolitics Overshadow the Fed, Greenback Steadies

The US dollar steadied at lower levels, while equities eased as investors remain focused on the preparations to strike Syria and still tense rhetoric on trade. Reports indicate that the US and France have moved warships into the area and the UK has moved submarines within striking distance as well.

Read More »

Read More »

FX Daily, March 07: Renewed Threat of Trade War Makes Investors Angry

In response to the resignation of one of the few "globalist" advisers in the US Administration, the resignation Cohn has sent ripples through the capital markets. Stocks have been marked down across the world. The prospects of a trade war are also not good for growth and it may be adding to the pressure on yields.

Read More »

Read More »

FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude of the regional losses. At one point the CSI 300 of the large Chinese mainland shares was off more than 6% before closing off 4.3% (and 10% for the week). The H-shares index was down 3.9% and 12% for the week.

Read More »

Read More »

FX Daily, December 11: Dollar Mixed to Start the Week, While Equities Firm

The US dollar is narrowly mixed in relatively quiet activity. Year-end adjustment is well underway, and the news stream is light to start the week that sees more than a dozen central bank meetings. There is little doubt in the market that the Federal Reserve will hike rates for the third time this year at mid-week.

Read More »

Read More »

FX Daily, September 21: Market Digests Fed, Greenback Consolidates, Antipodeans Tumble

The market has mostly interpreted the Fed's action in line with our thinking. Despite the lowering of the long-run Fed funds rate, the shifting one of the three hikes from 2019 into 2020, and recognizing that the weaker price impulses are somewhat mysterious, the Fed clearly signaled its bias toward hiking rates one more time this year and three next year.

Read More »

Read More »

FX Daily, September 12: Dollar Sports Heavier Tone as Yesterday’s Bounce Runs out of Steam

The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe. The euro advanced yesterday from NOK9.30 to NOK9.40. It is consolidating in a tight range today. The election results may have been a bit closer than expected, but the weight on the krone yesterday seemed to stem more from the unexpectedly soft inflation report.

Read More »

Read More »

FX Daily, June 23: Dollar Pares Gains Ahead of the Weekend

The US dollar is trading lower against all the major currencies today, which pares its earlier gains. The greenback is holding on to small gains for the week against most of them, except the New Zealand dollar, Swiss franc and Norwegian krone.

Read More »

Read More »

FX Weekly Preview: Events Not Data Key in Week Ahead

Light economic data calendar, but look for downtick in eurozone flash PMI. Soft Canadian retail sales (volume) and softer CPI (base effect) could take some of the sting from the recent BoC official comments. MSCI decision on China, Argentina, Saudi Arabia, and South Korea may have the broadest and long-lasting impact of the five key events we highlight.

Read More »

Read More »

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »

FX Weekly Preview: Succinct Views of Ten Events and Market Drivers: Week Ahead

The week ahead is the busiest week of the first quarter. It sees four major central meetings, including the Federal Reserve which is likely to raise rates for the second time in four months. The Dutch hold the first European election of the year, and the populist-nationalist party remains in contention for the top slot. The week concludes with the G20 meeting, the first that the Trump Administration's presence will be felt.

Read More »

Read More »

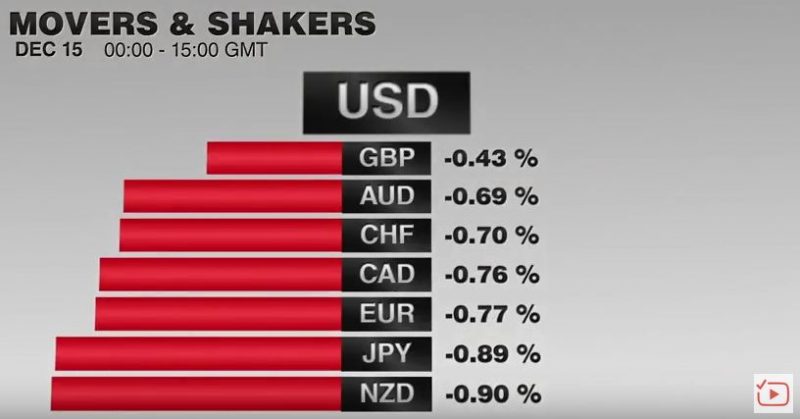

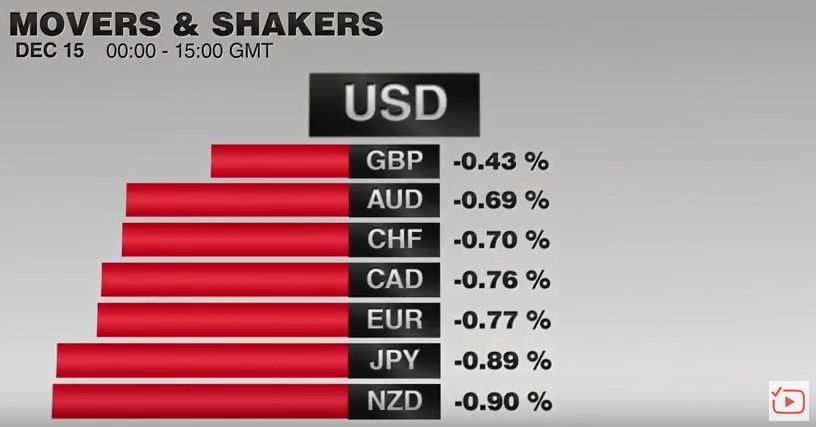

FX Daily, December 15: Greenback Extends Gains on Back of Fed

Sterling has made steady gains against the CHF over the past month and although the spike has levelled this week, the Pound has certainly gained a foothold. Yesterday’s decision by the US Federal Reserve to raise their base rate from 0.25% to 0.5% did little to shift the value of GBP/CHF but with investors still digesting the outcome, we may yet find it still has an effect.

Read More »

Read More »

Riksbank and Norges Bank Policy Meetings

Six major central banks meeting over the next six sessions. Sweden's Riksbank is the most likely ease policy of these central banks, but it is not particularly likely. Norway is decisively on hold, as fiscal policy does some of the heavy lifting.

Read More »

Read More »