Tag Archive: newslettersent

Survey on the use of payment methods in Switzerland

The Swiss National Bank (SNB) is this year conducting a survey on payment methods for the first time. Over the coming months, 2,000 people resident in Switzerland will be asked about their habits regarding the use of payment methods. The aim of the survey is to obtain representative information on the Swiss population’s use of various payment methods and to identify any changes in this respect.

Read More »

Read More »

Swiss banks defy Brexit to recruit in London

At the same time as big global banks are considering alternatives to London in the wake of the Brexit vote, Swiss newspaper Le Matin Dimanche reports, financial institutions are also recruiting new staff in the City. Rather than in commercial banking, however, these employees specialise in private wealth management.

Read More »

Read More »

Bank of England Crushes Sterling

Sterling reached a new 11-month high against the dollar earlier today, but the dovish take away from the Bank of England has seen sterling reverse lower. It has now fallen below the previous day's low, and a close below there (~$1.3190) would confirm the bearish key reversal pattern. Support near the week's low just below $1.3100 is holding, and if that goes, the $1.30 level can be tested. A break of $1.2930, the low from the second half of July...

Read More »

Read More »

Popularity of diesel becoming exhausted

Last June in Munich, Greenpeace symbolically showcased a diesel engine in a coffin. After decades of rapid growth, the popularity of diesel vehicles in Switzerland is on the wane following scandals and concerns about environmental impact.

Read More »

Read More »

Emerging Markets: What has Changed

The Reserve Bank of India started an easing cycle by cutting all policy rates 25 bp. Bank Indonesia has tilted more dovish after signaling earlier this year that the easing cycle was over. Czech National Bank became the first in Europe to hike. Political risk is rising in Israel. President Trump signed the Russia sanctions bill. Nigeria is trying to unify its system of multiple exchange rates.

Read More »

Read More »

Why We’re So Risk-Averse: “We Can’t Take That Chance”

If our faith in the future and our resilience is near-zero, then we can't take any chances. You've probably noticed how risk-averse Hollywood has become: the big summer movies are all extensions of existing franchises--mixing up the superheroes in new combinations, or remaking hit films from the past--all safe bets.

Read More »

Read More »

Worin die populäre Geldschöpfungskritik irrt – Teil 2

Wie der erste Teil darzulegen versuchte, muss einer Ausweitung der Geldmenge durch Geschäftsbanken zwangsläufig eine Vermehrung der Basisgeldmenge vorausgegangen sein. Ohne eine Entscheidung der Zentralbank, den Geschäftsbanken –vorgängig oder nachträglich – Basisgeld zur Verfügung zu stellen, ist eine jede Geschäftsbank aufgrund der gegenseitigen Konkurrenz untereinander in deren Möglichkeit, Geld zu schöpfen, beschränkt.

Read More »

Read More »

Constructive US Jobs, but Where Do the Euro Bulls make a Stand?

The US created 209k jobs in July and jobs growth in June was revised higher (+9k) to 231k. The underemployment rate was unchanged at 8.6%. The unemployment rate ticked down to 4.3%, matching the cyclical low set in May. This is all the more impressive because the participation rate also ticked up (62.9% from 62.8%).

Read More »

Read More »

FX Daily, August 04: Does the Employment Report Matter?

There are some chunky option strikes that could come into play today. There are 920 mln euros struck at $1.1850 that expire today. There are A$523 mln struck at $0.7950 expiring today. There are $680 mln struck at CAD1.2550 that will be cut.

Read More »

Read More »

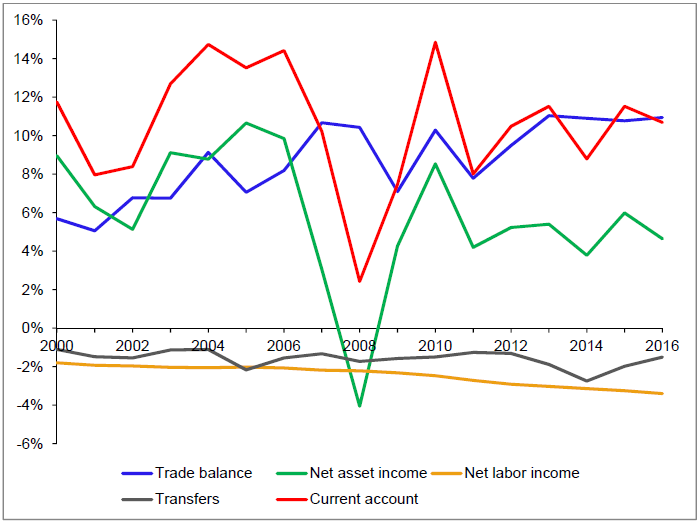

The Changing International linkages of Switzerland: An Overview

Being a small open economy Switzerland is highly exposed to the girations of the world economy, both through international trade and financial flows. The country’s trade surplus for instance accounted for nearly half the GDP growth between 2000 and 2007.2 While the growth contribution from trade has slowed during the global crisis, the linkages with the world economy remain important for Switzerland.

Read More »

Read More »

Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook.

Read More »

Read More »

This Is Why Shrinkflation Is Impacting Your Financial Wellbeing

Shrinkflation has hit 2,500 products in five years. Not just chocolate bars that are shrinking. Toilet rolls, coffee, fruit juice and many other goods. Effects of shrinkflation been seen for “good number of years”. Consumer Association of Ireland. Shrinkflation is stealth inflation, form of financial fraud. Punishes vulnerable working and middle classes. Gold is hedge against inflation and shrinkflation.

Read More »

Read More »

FX Daily, August 03: Dollar-Bloc Currencies Turning, but Euro Downticks Limited

The high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the $1.2620 area. The US dollar has not traded above its 20-day moving average since the Fed hiked rates on June 14. It is found today near CAD1.2625.

Read More »

Read More »

Switzerland’s Changing International Linkages

Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding robustly in recent years despite the European crisis and the strong Swiss franc.

Read More »

Read More »

Cool Video: Dollar Drivers on Bloomberg

There were three talking points. First was the observation that while the President took credit for the record stock market, the strength of the economy, the low unemployment rate, and business confidence, there was no mention of the dollar, which poised to close lower for its seventh consecutive month.

Read More »

Read More »

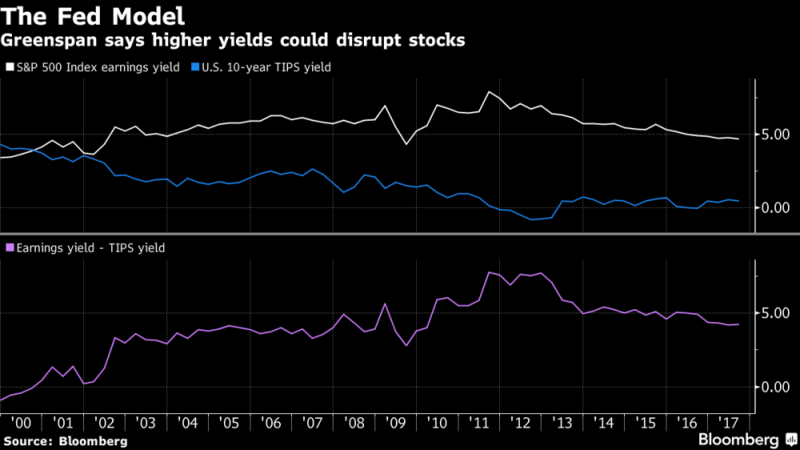

Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

‘We are experiencing a bubble, not in stock prices but in bond prices. This is not discounted in the marketplace.’ There are a lot of warnings on Bloomberg, CNBC and other financial media these days about a bubble in the stock market, particularly in FANG stocks and the tech sector.

Read More »

Read More »

Winning: U.S. Crushes All Other Countries In Latest Obesity Study

When President Trump promised last fall that under a Trump administration America would "would win so much you'll get tired of winning," we suspect this is not what he had in mind. According to the latest international obesity study from the Organization For Economic Co-operation and Development (OECD), America is by far the fattest nation in the world with just over 38% of the adult population considered 'obese.'

Read More »

Read More »

Views From the Top of the Skyscraper Index

On a warm Friday Los Angeles morning in spring of 2016, we found ourselves standing at the busy corner of Wilshire Boulevard and South Figueroa Street. We were walking back to our office following a client wire brushing for events beyond our control. But we had other thoughts on our mind.

Read More »

Read More »

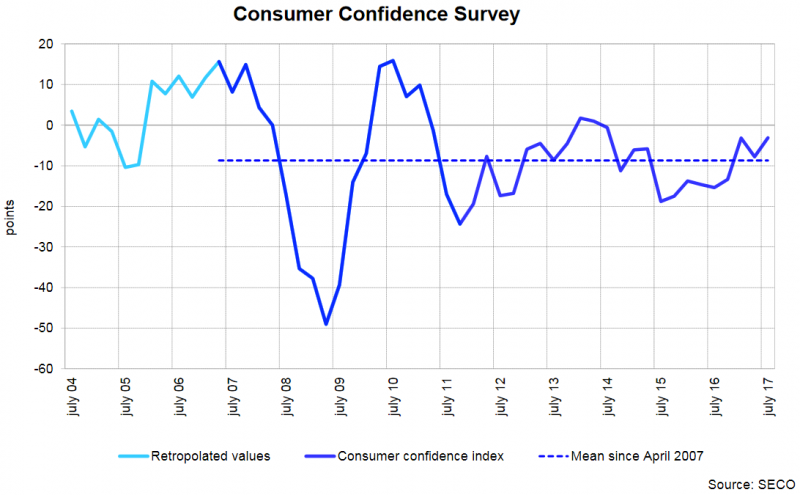

Swiss Consumers more Optimistic about Economy and Job Market

Consumer sentiment in Switzerland is on the rise again in July. The index reached -3 points – well above the long-term average (-9 points). This confirms the recovery in sentiment from the lows following the sharp rise in the Swiss franc. In comparison to the survey of April, consumers’ expectations for economic growth and for the job market have become considerably more optimistic.

Read More »

Read More »

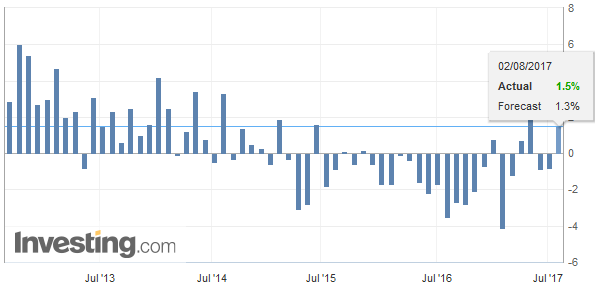

Swiss Retail Sales, June: 1.1 percent Nominal and 0.5 percent Real

Turnover in the retail sector rose by 1.1% in nominal terms in June 2017 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.5% compared with the previous month. Real turnover in the retail sector also adjusted for sales days and holidays rose by 1.5% in June 2017 compared with the previous year.

Read More »

Read More »