Tag Archive: newslettersent

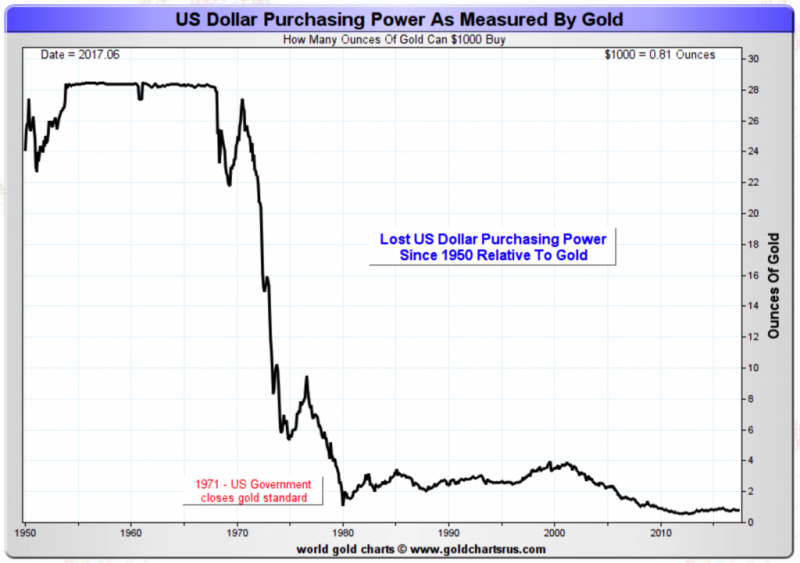

Gold Hedges USD Devaluation, Rise in Oil, Food and Cost of Living Since 1971 – Must See Charts

Gold hedges massive ongoing devaluation of U.S. Dollar. 46th anniversary of ‘Tricky Dicky’ ending Gold Standard (see video). Savings destroyed by currency creation and now negative interest rates. Long-term inflation figures show gold a hedge against rising cost of fuel, food and cost of living. $20 food and beverages basket of 1971 cost $120.17 in 2017.

Read More »

Read More »

Markets Exaggerate, That is what They Do

FOMC minutes were not as dovish as spins suggest. ECB record was not as dovish as market response appears. Divergence is still intact.

Read More »

Read More »

Swiss companies pull out of Venezuela

Swiss firms have been cutting hundreds of jobs in long-established branch offices in Venezuela, as the oil-producing country experiences an economic and political crisis. “The disaster – economic, social, political and humanitarian – which is engulfing Venezuela with the government of [president] Nicolas Maduro is forcing Swiss companies to resize their presence or to gradually leave the country,” wrote French-language newspaper Le Temps, which...

Read More »

Read More »

L’explosion de la fortune des plus riches en France grâce au Casino. Liliane Held-Khawam

2007. Crise des subprimes. De l’argent public se déverse en abondance dans les circuits financiers mondiaux qui turbinent à la monnaie centrale. Comprenez que c’est de l’argent scripturale bancaire qui a été élevé au rang d’argent garanti par les Etats via leurs banquiers centraux.

Read More »

Read More »

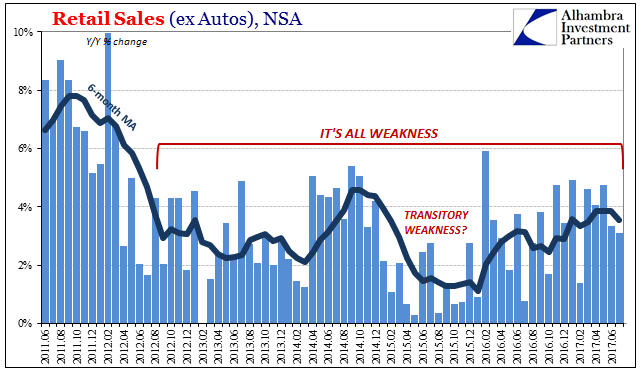

United States: Still No Up

The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general.

Read More »

Read More »

FX Daily, August 18: Dollar and Equities Trade Heavily Ahead of the Weekend

The second largest drop in US equities this year has spilled over to drag global markets lower. The MSCI Asia Pacific Index fell nearly 0.5%, snapping a four-day advance and cutting this week's gain in half. The Dow Jones Stoxx did not completely escape the US carnage yesterday, but losses are accelerating today, with a nearly 1% decline following a 0.6% decline yesterday.

Read More »

Read More »

L’impact de la délocalisation de la production sur la balance commerciale US.

Dans la série sur la balance des paiements et les zooms sur les balances commerciales, voici l’évolution de la balance commerciale américaine. Nous voyons clairement qu’elle était neutralisée à 0 durant l’ère où les devises du monde devaient être arrimées, selon les Accords de Bretton Woods, au dollar qui lui-même était partiellement couvert par l’or.

Read More »

Read More »

Government compromises on medical tariffs

The Swiss cabinet has approved an amended billing system for medical treatments aimed at creating more transparency and limiting a further increase in healthcare costs.The decision is expected to lead to annual savings of CHF470 million ($483 million) and a drop of about 1.5 percentage points in insurance fees for patients, according to Interior Minister Alain Berset.

Read More »

Read More »

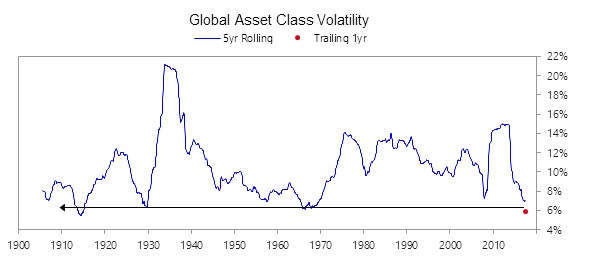

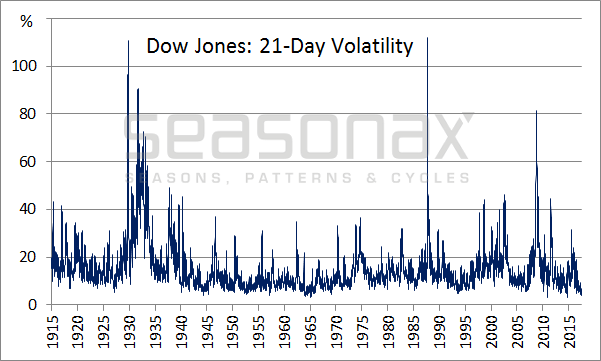

Is Historically Low Volatility About to Expand?

You have probably noticed it already: stock market volatility has recently all but disappeared. This raises an important question for every investor: Has the market established a permanent plateau of low volatility, or is the current period of low volatility just the calm before the storm?

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

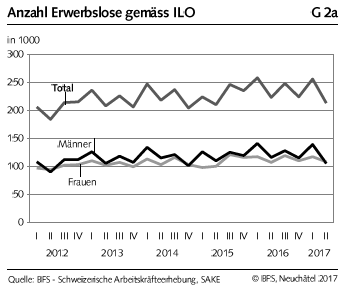

Swiss Labour Force Survey in 2nd quarter 2017: Labour Supply: Number of Persons in Employment rises by 1.3 percent

The number of employed persons in Switzerland rose by 1.3% in the 2nd quarter 2017 compared with the same quarter of the previous year. The unemployment rate as defined by the International Labour Organisation (ILO) fell during the same period in Switzerland from 4.6% to 4.4%. The EU's unemployment rate decreased from 8.6% to 7.6%.

Read More »

Read More »

FX Daily, August 17: Euro Softens on Crosses, Treasuries Stabilize

The US dollar had steadied after softening in the North American afternoon yesterday when the dissolution of President Trump's business councils as a series of executives stepped down. The FOMC minutes added more fuel to the move.

Read More »

Read More »

Is the Yen or Swiss Franc a Better Funding Currency?

Yen and Swiss franc are funding currencies. This goes a long way to explaining why they rally on heightened anxiety. The Swiss have lower rates than Japan and the franc is less volatile than the yen, but technicals argue for caution.

Read More »

Read More »

Passengers may pay price for Air Berlin strife

Airline passengers in Switzerland are bracing themselves for a hike in prices for flights to Germany following the insolvency of budget carrier Air Berlin. The airline had been running at a loss for several years, prompting owner Etihad to pull the plug on Tuesday.

Read More »

Read More »

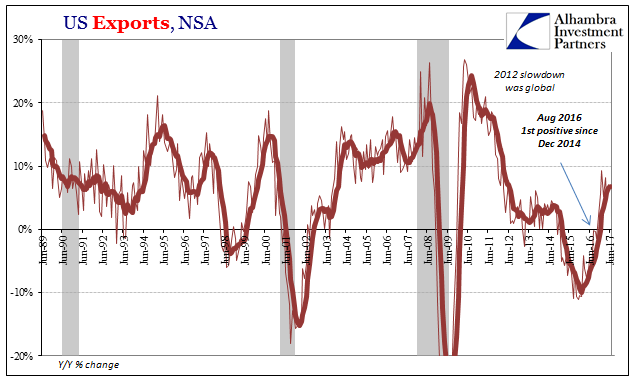

U.S. Export/Import: Losing Economic Trade

The oil effect continued to recede in late spring for more than just WTI prices or inflation rates. US trade on both sides, inbound and outbound, while still positive has stalled since the winter.

Read More »

Read More »

FX Daily, August 16: Swiss Franc and Yen Improve after Dovish Draghi Comments

Swiss Franc and Yen Improve after Dovish Draghi Comments, A return to the macroeconomic agenda is being deterred by new drama from Washington and reports suggesting that ECB's Draghi will not be discussing the central bank's monetary policy course at Jackson Hole confab, which will take place next week.

Read More »

Read More »

Jumbolinos Wheeled out to Pasture

Swiss International Air Lines has for the last time flown passengers in an Avro RJ100, fondly called a Jumbolino by many pilots, flight attendants and passengers. The full plane, which flew from London to Zurich on Monday night, carried 81 passengers.

Read More »

Read More »

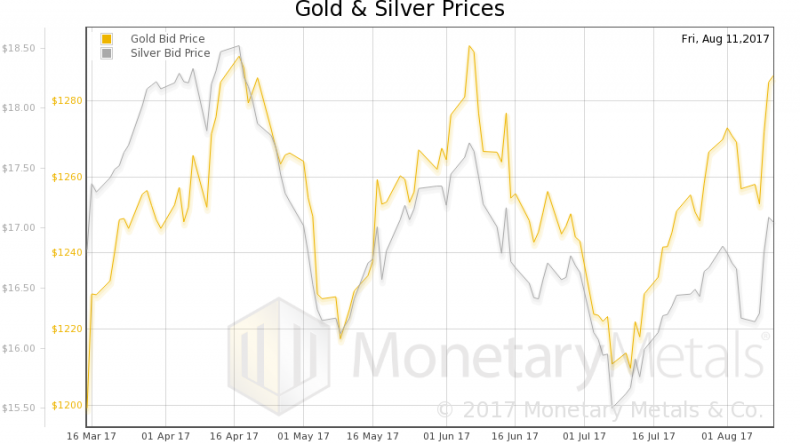

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Latest developments show risks in crypto currencies. Confusion as bitcoin may split tomorrow. SEC stepped into express concern over ICOs. ICOs have so far raised $1.2 billion in 2017. ICOs preying on lack of understanding from investors. Physical gold not vulnerable to technological risk. Beauty and safety in simplicity of gold and silver.

Read More »

Read More »