Tag Archive: newslettersent

Swiss firms face greater shareholder opposition

Shareholder rebellion over executive pay at Credit Suisse earlier this year is just one example of growing dissent by Swiss company owners. While annual general meetings are hardly a hotbed of revolutionary unrest, shareholders are slowly - but perceptibly - demanding more accountability.

Read More »

Read More »

Swiss business lobby rejects idea of ‘robot tax’

The Swiss Business Federation (economiesuisse) rejects imposing a so-called robot tax on companies to make up for lost income taxes as workers are gradually replaced by machines. Rather than focusing on a robot tax, Switzerland should encourage the development of a faster internet network and cooperation between business and Swiss research institutes, declared a new economiesuisse reportexternal link on the digital economy, which was published on...

Read More »

Read More »

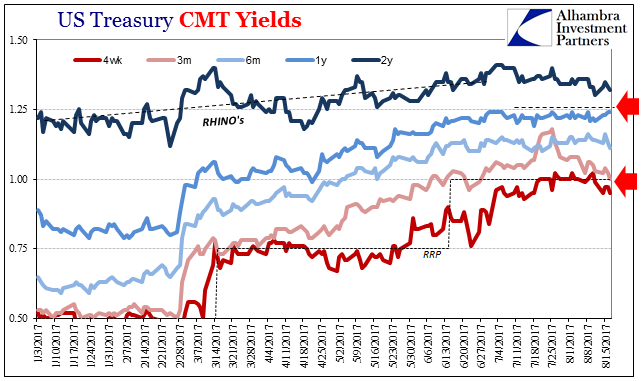

United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day.

Read More »

Read More »

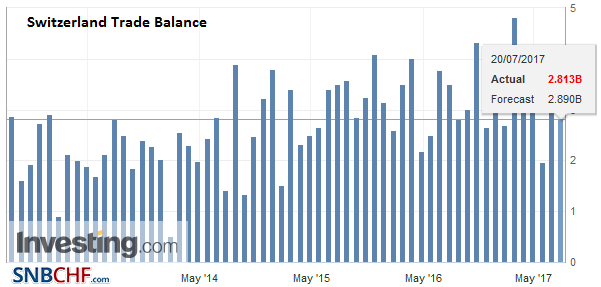

Swiss Trade July 2017: Exports and Imports Decline after Reaching Highest in History

In July 2017, after adjusting for working days, exports grew by 4.5%, which were less dynamic than the previous two months. Imports rose red (-0.5%). The trade balance loops with a surplus of 3.6 billion francs.

Read More »

Read More »

FX Daily, August 22: Turn Around Tuesday Sees Firmer Dollar, Rates, and Equities

The US dollar has recouped most of yesterday's declines. However, as we have seen over the past couple of sessions, he North American market appears more dollar negative than Europe or Asia. The dollar's rise through the European morning has left the intraday technical indicators a bit stretched, warning that this short-term pattern continues today.

Read More »

Read More »

Payerne Airport Finally Starts to take off

After years of negotiations, Payerne’s regional civilian airport and future business aviation hub is starting to take shape. The first stone of an airport building in northwest Switzerland has been laid. “It’s a day of celebration and joy,” Fribourg businessman Damien Piller told reporters at a ceremony to mark the start of construction of the main airport building on Monday. Work should last 18 months.

Read More »

Read More »

Michel Santi: comment achever la bête immonde?

Quelle est la raison profonde – intime –des crises financières ? Comment sont provoqués les kracks et pourquoi les bulles implosent-elles ? Toujours pour une simple et unique raison qui est que les paris irraisonnés et démesurés entrepris par le monde de la finance le sont avec de l’argent emprunté !

Read More »

Read More »

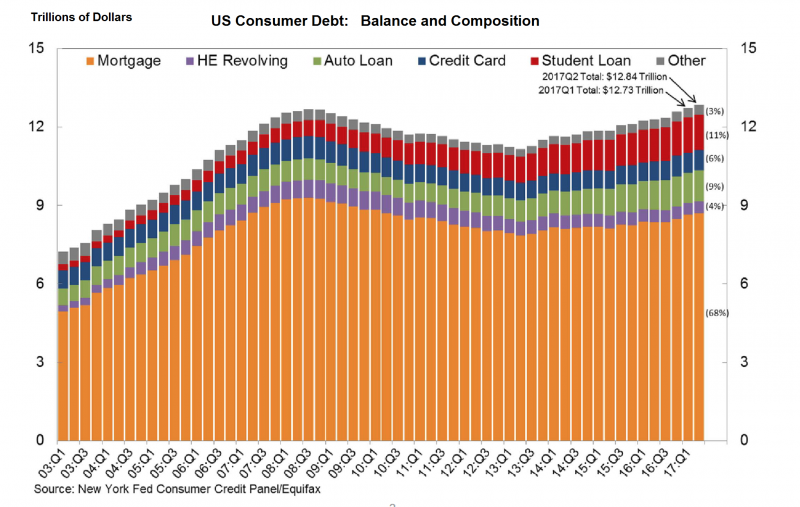

Why There Will Be No 11th Hour Debt Ceiling Deal

A new milestone on the American populaces’ collective pursuit of insolvency was reached this week. According to a report published on Tuesday by the Federal Reserve Bank of New York, total U.S. household debt jumped to a new record high of $12.84 trillion during the second quarter. This included an increase of $552 billion from a year ago.

Read More »

Read More »

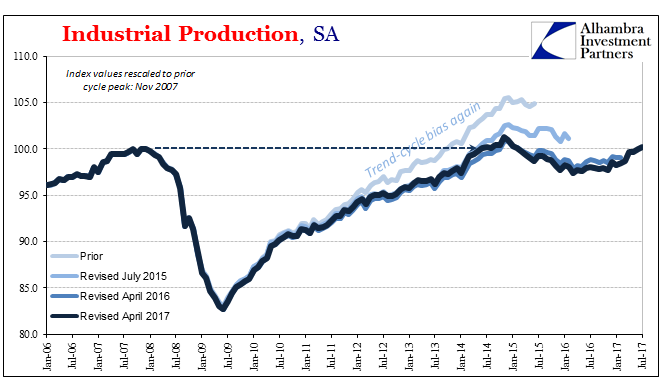

United States: Lack Of Industrial Momentum Is (For Now) Big Auto Problems

Industrial Production disappointed in the US last month, dragged down by auto production. Despite the return of an oil sector tailwind, IP was up just 2.2% year-over-year in July 2017 according to Federal Reserve statistics. It marks the fourth consecutive month stuck around 2% growth. The lack of further acceleration is unusual in the historical context, especially following an extended period of contraction.

Read More »

Read More »

FX Daily, August 21: Dollar Edges Higher, While Equities Trade Heavily to Start the New Week

The US dollar is mostly firmer against most of the major and emerging market currencies. The main impetus appears to be some position adjustment emanating from equities. The equity markets turned south in the second half of last week and are moving lower today. Foreign investors appeared to have sold around $100 bln of European equities in 2016 and bought around a third back this year.

Read More »

Read More »

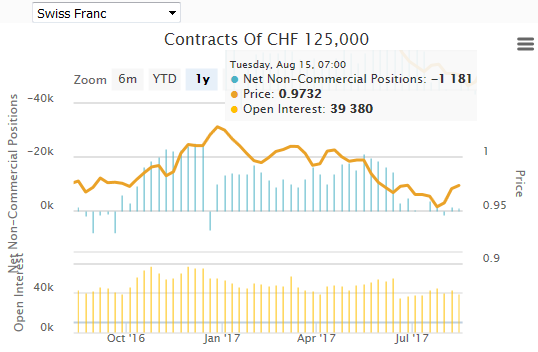

Weekly Speculative Positions (as of August 15): Speculators Add to Sterling and Peso Shorts, While Cutting Euro and Canadian Dollar Longs

The net speculative CHF position has fallen from -1.4K short to -1.2K contracts short (against USD). Speculators made several significant position adjustment in the CFTC reporting week ending August 15, that included an escalation of aggressive rhetoric by the US and North Korea.

Read More »

Read More »

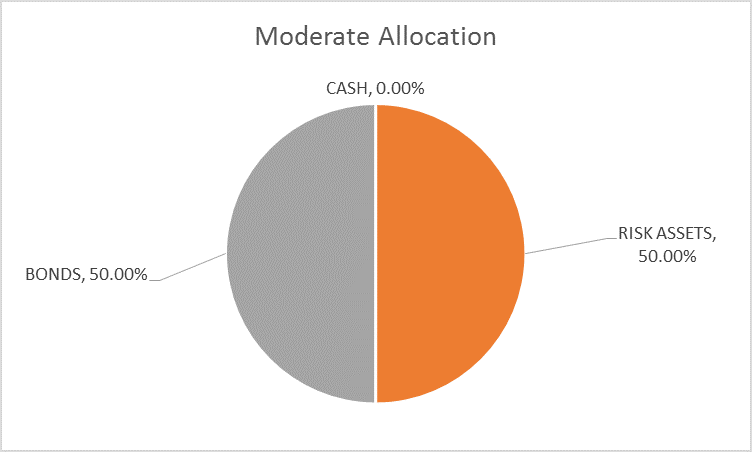

Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

Buffett Sees Market Crash Coming? His Cash Speaks Louder Than Words

The Sage of Omaha’s adage is “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” But for Warren Buffett the current environment doesn’t appear to be offering up any wonderful companies at fair valuations. The situation is so bad that the cash stockpile of Berkshire Hathaway has more than doubled in the last four years, from under $40 billion to $100bn.

Read More »

Read More »

Stories making the Swiss Sunday papers

A wide range of topics occupied Swiss newspapers this weekend, from Swiss investments in US arms companies and requirements for FIFA World Cup host countries, to what to do in the event of a terror attack. A critique of Geneva’s relationship with the Red Cross also made headlines.

Read More »

Read More »

FX Weekly Preview: Transitioning to a New Phase

Jackson Hole marks the end of the investors' summer and a beginning of a challenging several weeks. The abandonment of national business leaders from Trump's advisory board and strong words by Republican Senator Corker, followed by the dismissal of the controversial Bannon, could be a turning point. Neither Yellen nor Draghi may not even address the current policy stance as they discuss the topic at hand, "Fostering Dynamic Global Economy", which...

Read More »

Read More »

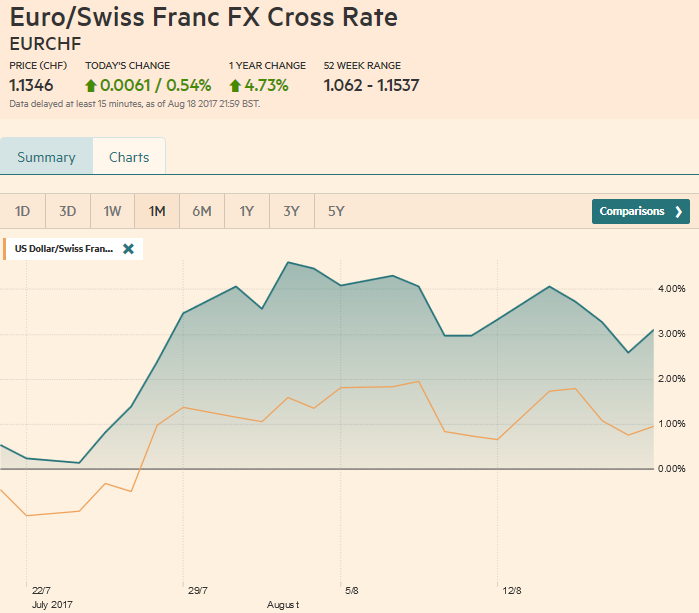

FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

The euro has lost some momentum, Draghi does not want to talk about an early end of his bond buying programming. Confirmed by economic data, 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swiss appreciated during the week.

Read More »

Read More »

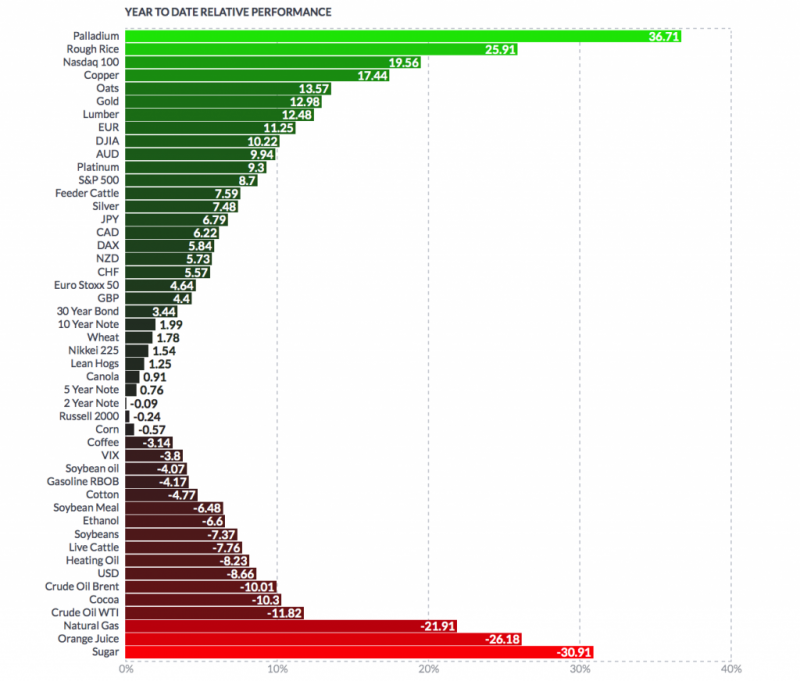

Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

Gold and silver rise as stocks fall sharply after Barcelona attack. Gold, silver 0.6% higher in week after last weeks 2%, 5% rise. Palladium +36% ytd, breaks out & reaches 16 year high (chart). Gold to silver ratio falls to mid 75s after silver gains last week

Read More »

Read More »

Swiss Asset Manager Settles US Tax Evasion Charges

The Geneva asset management firm Prime Partners has agreed to pay $5 million (CHF4.8 million) to the United States to settle charges for tax evasion and assisting US taxpayers in opening and maintaining undeclared foreign bank accounts from 2001 to 2010.

Read More »

Read More »

Higher Swiss health premiums for those with high deductibles challenged by commission

In June 2017, Switzerland’s Federal Council announced plans to reduce the discounts offered to those willing to risk paying the first chunk of their annual medical bills. The plan included reducing the maximum premium discounts given for opting for deductibles, the amount paid by the insured before insurance kicks in.

Read More »

Read More »

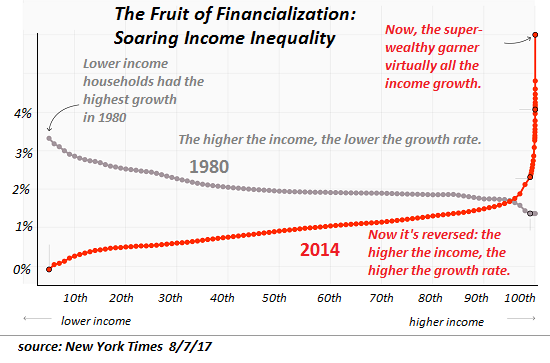

Why We’re Doomed: Our Economy’s Toxic Inequality

Why are we doomed? Those consuming over-amped "news" feeds may be tempted to answer the culture wars, nuclear war with North Korea or the Trump Presidency. The one guaranteed source of doom is our broken financial system, which is visible in this chart of income inequality from the New York Times: Our Broken Economy, in One Simple Chart.

Read More »

Read More »