Tag Archive: newslettersent

Is This The Greatest Stock Market Bubble In History? Goldnomics Podcast

GoldNomics Podcast (Episode 2) Is This The Greatest Stock Market Bubble In History? In our second GoldNomics podcast, we take a look at one of the important financial questions of our day – is this the greatest stock market bubble in history? Listen on iTunes, SoundCloud and Blubrry. Watch on YouTube below

Read More »

Read More »

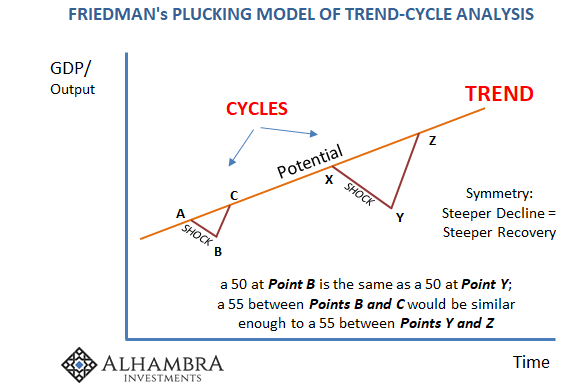

The Dismal Boom

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction.

Read More »

Read More »

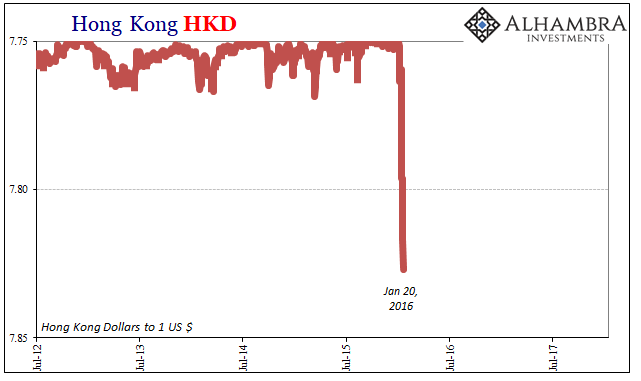

Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed.

Read More »

Read More »

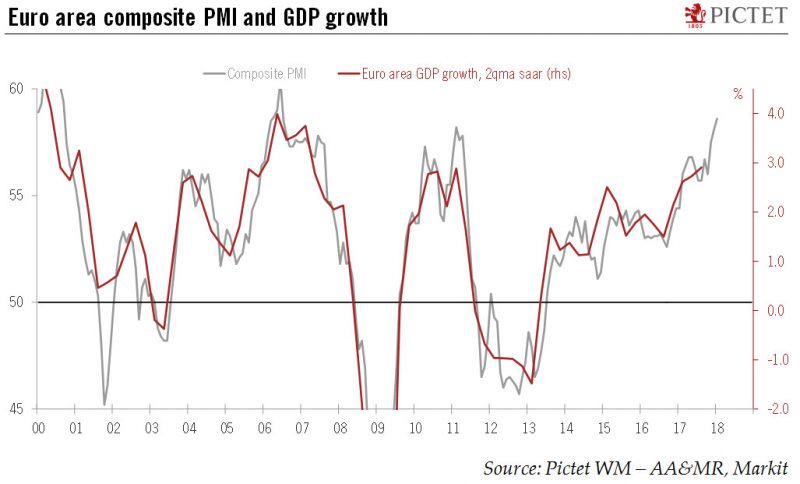

Euro area: Business activity expanding at its fastest pace in nearly 12 years

The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high.

Read More »

Read More »

FX Daily, January 24: Dollar Takes Another Leg Lower

North American session sold into the dollar's upticks and Asia followed suit, taking the greenback to new multi-year lows against the euro and sterling while pushing it below the JPY110 level for the first time since last September. US trade action has become latest element of the narrative the seeks to explain the dollar's slide and the decoupling of the greenback from interest rates.

Read More »

Read More »

Great Graphic: Is Aussie Cracking?

The Australian dollar bottomed in early December $0.7500 after having tested $0.8100 a couple of times in September. Since early December, however, the Australian dollar appreciated by nearly 6.5%. As it tested the $0.8000 area, the momentum faded.

Read More »

Read More »

Switzerland ranked second-most ‘globalised’ nation

Switzerland is the second-most globalised country in the world after the Netherlands, according to the latest edition of an index prepared by the University of Zurich. The Alpine nation has moved up from fifth place. The index prepared by the KOF Swiss Economic Instituteexternal link tracks countries’ levels of globalisation across politics, economics, and society. The current edition uses data up to and including the year 2015.

Read More »

Read More »

Tax amnesty programme turns up billions in undeclared assets

According to the results of a survey published Sunday in the NZZ am Sonntag newspaper, CHF31.7 billion ($32.9 billion) in undeclared assets have been reported to tax authorities in Switzerland over the last eight years.

Read More »

Read More »

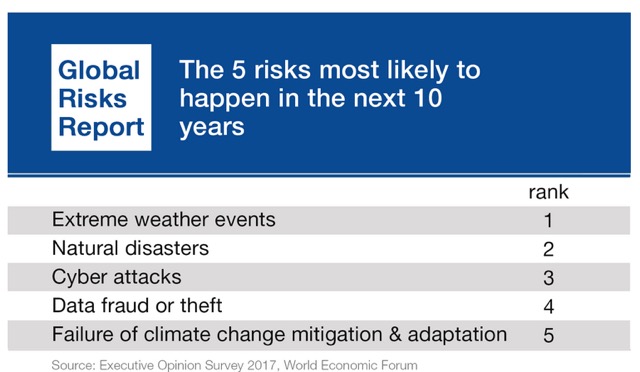

Cyber War Coming In 2018?

Cyber war is increasing threat – Investors are not prepared for. Third most likely global risk in 2018 is cyber war say WEF. “Scale and sophistication of attacks is going to grow”. EU, US, NATO lay down ground rules for offensive cyber war. Ireland is viable target for attackers but is ‘grossly unprepared for cyber war’. UK should expect attack that cripples infrastructure within 2 years.

Read More »

Read More »

Budget busting burgers – Swiss franc still the most overvalued

The Economist has just published its January 2018 Big Mac index, a light-hearted measure of whether currencies are under or overvalued. The underlying assumption is that a Big Mac is the same whether bought in Kiev or Chur, so any price difference must be due to the exchange rate.

Read More »

Read More »

FX Daily, January 23: Dollar Stabilizes Near Recent Lows

The US dollar has come back better bid in late Asian activity. The session highlight was the BOJ meeting. BOJ maintained forecasts and policy. There was a small tweak to the inflation assessment, noting that prices were skewed to the downside, and said there was no change in inflation expectations. Last time it has said expectations were weakening. It also reiterated that there was no policy implication to the bond operations.

Read More »

Read More »

Swiss fact: health insurance premiums cover only 37percent of Swiss healthcare costs

Figures published in 2017 show that only 37% of Swiss healthcare costs were covered by basic compulsory health insurance premiums. The remaining cost was covered by the government (20%), accident and social insurance (10%), private complementary health insurance (7%), charity (1%) and out-of-pocket spending by individuals (26%).

Read More »

Read More »

Swiss banks benefit from exchange rates, study finds

A study of over 40 Swiss finance institutions has revealed ‘striking’ differences in exchange rates for banknotes and currencies as well as the addition of hefty mark-ups and fees. Online banking and insurance comparison service moneyland.ch examined the exchange rates for euros, dollars, pounds, Swedish krona and Thai baht over the course of their six-day analysis, the results of which were released Wednesday.

Read More »

Read More »

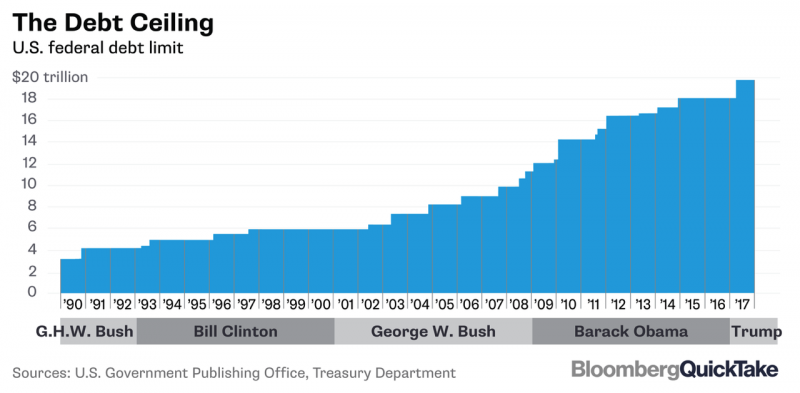

Government Shutdown Ends – Markets Ignore Looming Debt and Bond Market Threat

Government Shutdown Ends – Markets Ignore Looming Debt and Bond Market Threat For Now. U.S. Senate pass a temporary spending plan through Feb. 8 to end shutdown. Markets shrug off both government shutdown and re-opening. Markets, government and media ignoring worsening US debt position. Gold responding positively to U.S. dysfunction, rising US Treasury yields & weaker dollar. U.S. government national debt is $20.6 trillion and increasing rapidly....

Read More »

Read More »

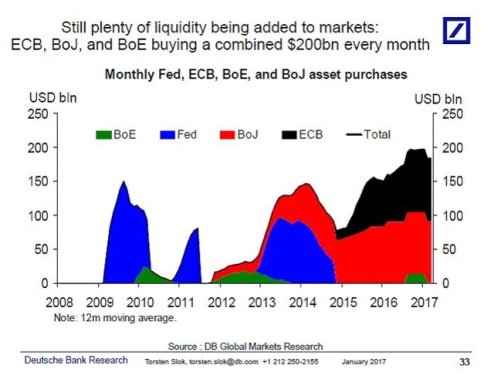

Central Banks: From Coordination to Competition

This is one reason why I anticipate "unexpected" disruptions in the global economy in 2018. The mere mention of "central banks" will likely turn off many readers who understandably have little interest in convoluted policies and arcane mumbo-jumbo, but bear with me for a few paragraphs while I make the case for something to happen in 2018 that will impact us all to some degree.

Read More »

Read More »

FX Daily, January 22: Dollar Remains Heavy

The US dollar closed last week on a firm note, but it has been unable to build on its gains to start the new week. News that Germany's SPD agreed to enter formal negotiations with Merkel's CDU/CSU alliance saw the euro open in Asia around a half a cent higher. However, sellers emerged near $1.2275 but seemed to lose their nerve as the pre-weekend low near $1.2215 was approached.

Read More »

Read More »

Weekly Technical Analysis: 22/01/2018 – USD/JPY, EUR/USD, GBP/USD, USD/CHF

The USDCHF pair found solid support at 0.9564 barrier, which forced the price to rebound bullishly to approach testing the key resistance 0.9655, met by the EMA50 to add more strength to it, while stochastic shows clear overbought signals now.

Read More »

Read More »

FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended last week on a soft note, but still enjoyed a relatively positive tone for the week as a whole. Best performers last week were MXN, ZAR, and CNY while the worst were ARS, TRY, and CLP. With little on the horizon to give the dollar some traction, we think EM FX will likely continue to firm this week. However, we again urge caution and look for divergences within EM.

Read More »

Read More »