Tag Archive: newslettersent

FX Weekly Preview: Three Central Bank Meetings and US Jobs data

The week ahead sees three major central bank meetings and the US employment report. It will likely be the most important work before a hiatus that runs through the end of August. Of course, and perhaps more than ever, market participants are well aware that the US President's communication and penchant for disruption is a bit of a wild card.

Read More »

Read More »

Economiesuisse warns of economic dangers of vote against foreign judges

The business and industry association Economiesuisse says the up-coming vote on 25 November 2018 on self-determination puts the Swiss economy at risk. The Swiss People’s Party led initiative entitled: Federal law instead of foreign judges, aims to cement the primacy of Swiss law over international law by adding a clause to Switzerland’s constitution.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX.

Read More »

Read More »

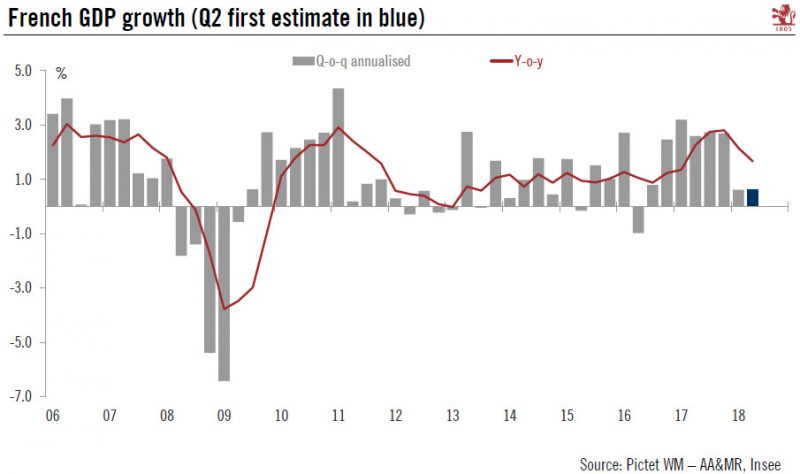

French Q2 GDP growth marks time

A number of one-off factors hurt growth dynamics, but there are many reasons to think that expansion will pick up in the rest of this year. France is the first country in the euro area to publish Q2 GDP figures. The economy expanded by 0.2% q-o-q in Q2, the same pace as the previous quarter and below consensus expectations of 0.3%.

Read More »

Read More »

Geneva set to vote on maintaining public spending in the face of company tax reform

An initiative entitled: zero losses, was filed this week in Geneva. It aims to ring fence current public spending in the face of future company tax reform. The initiative gathered 9,147 signatures, more than the 7,840 required.

Read More »

Read More »

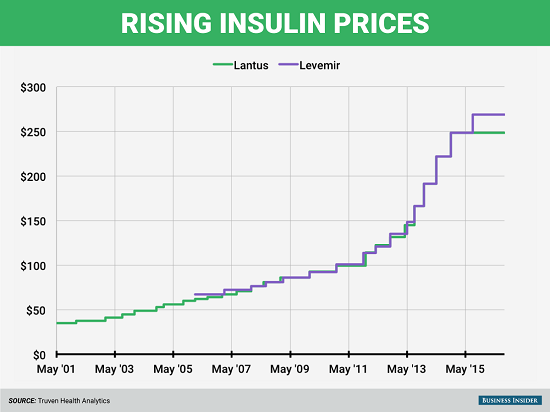

Here’s How Systems (and Nations) Fail

These embedded processes strip away autonomy, equating compliance with effectiveness even as the processes become increasingly counter-productive and wasteful. Would any sane person choose America's broken healthcare system over a cheaper, more effective alternative?

Read More »

Read More »

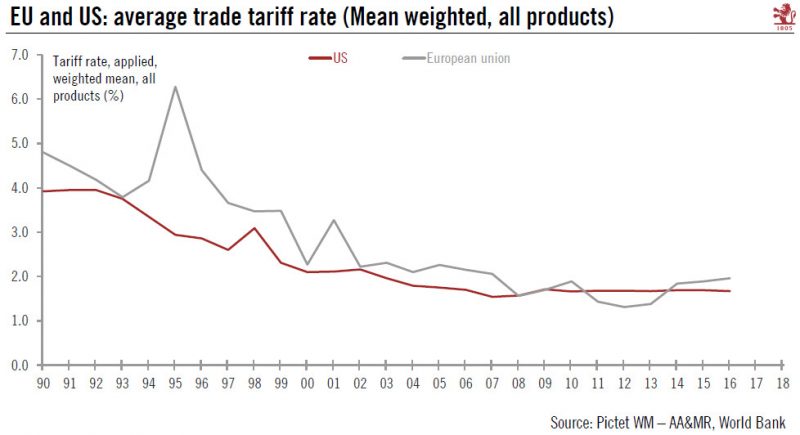

Ceasefire in US/EU tariff dispute

The two sides have agreed to discuss lowering barriers to transatlantic trade, helping to de-escalate tensions. While positive, the US’s dispute with China still needs watching.US President Trump and EU Commission President Juncker this week struck an unexpected deal to de-escalate the trade dispute between the EU and the US.

Read More »

Read More »

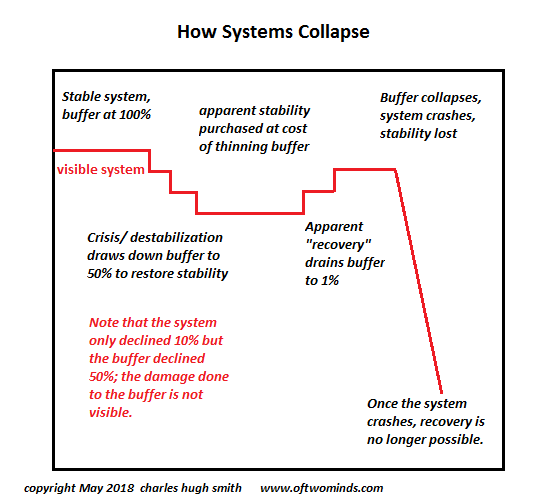

When Long-Brewing Instability Finally Reaches Crisis

The doom-and-gloomers among us who have been predicting the unraveling of an inherently unstable financial system appear to have been disproved by the reflation of yet another credit-asset bubble. But inherently unstable / imbalanced systems can stumble onward for years or even decades, making fools of all who warn of an eventual reset.

Read More »

Read More »

Switzerland’s special tax deals less attractive from 2021

Foreigners who don’t work in Switzerland can benefit from special tax deals known as lump sum taxation, or for fait fiscal in French. Instead of paying tax on their worldwide income and assets their tax is calculated based on their living expenses. When someone becomes Swiss they automatically lose eligibility.

Read More »

Read More »

FX Daily, July 27: Greenback Remains Firm Ahead of Q2 GDP

The US dollar is trading firmly in Europe after consolidating yesterday's gains during the Asian session and ahead of the first look at Q2 GDP. Yesterday's economic reports, including durable goods orders and inventory data, saw the Atlanta Fed's GDPNow tracker lower its forecast to 3.8% from 4.5%.

Read More »

Read More »

Message from the ECB: Enjoy summer!

Today’s Governing Council meeting did little to break the seasonal torpor. We continue to expect its first rate hike to come in September 2019. There was no change in interest rates or forward guidance at today’s ECB Governing Council meeting.

Read More »

Read More »

Majority favours later retirement for women, according to survey

In Switzerland, the official retirement age for women is 64, a year earlier than it is for men. A poll by gfs.bern shows that around two thirds are in favour of raising the retirement age of women to 65. Only 16% are against the idea, with a further 18% somewhat against it. Men (78%) are more in favour of the change than women (54%), according to the newspaper 20 Minutes.

Read More »

Read More »

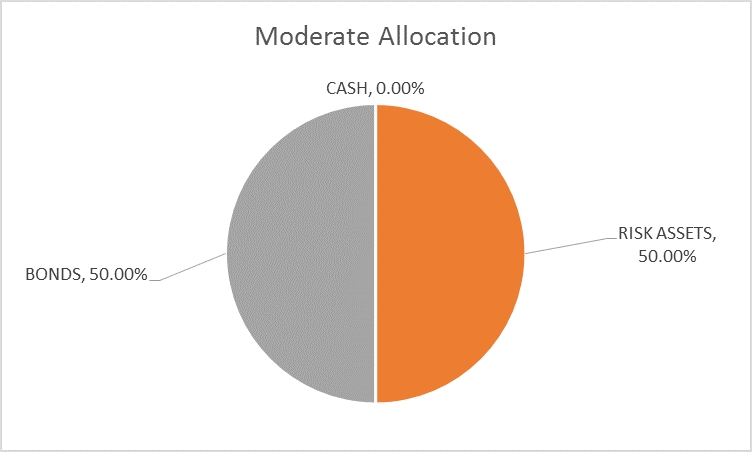

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

FX Daily, July 26: Equities like EU-US Trade Truce more than the Euro

The markets generated a collective sigh when Juncker and Trump announced that there would be no new tariffs while new trade negotiations took place. This was particularly important because Trump reportedly wanted to press ahead with a 25% tariff on car imports. It was also announced that the EU would buy more soy and liquid natural gas from the US.

Read More »

Read More »

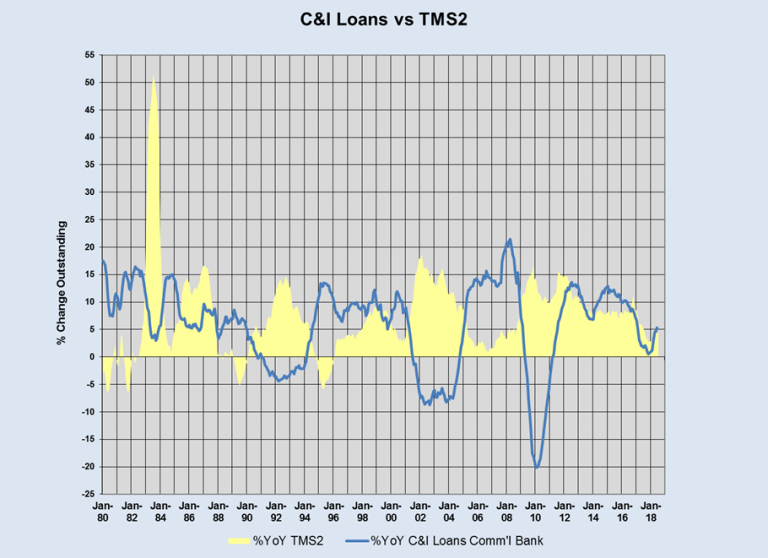

A Scramble for Capital

A Spike in Bank Lending to Corporations – Sign of a Dying Boom? As we have mentioned on several occasions in these pages, when a boom nears its end, one often sees a sudden scramble for capital. This happens when investors and companies that have invested in large-scale long-term projects in the higher stages of the production structure suddenly realize that capital may not be as plentiful as they have previously assumed.

Read More »

Read More »

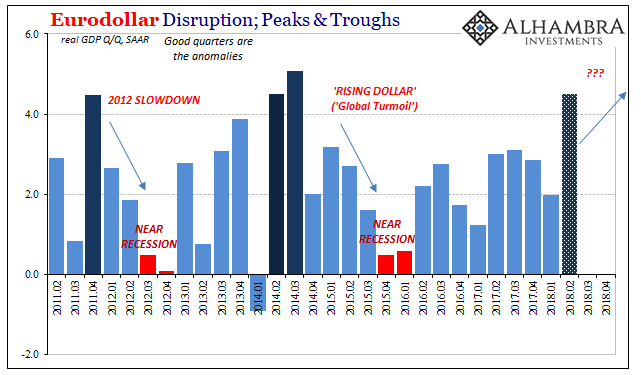

The Top of GDP

In 1999, real GDP growth in the United States was 4.69% (Q4 over Q4). In 1998, it was 4.9989%. These were annual not quarterly rates, meaning that for two years straight GDP expanded by better than 4.5%. Individual quarters within those years obviously varied, but at the end of the day the economy was clearly booming.

Read More »

Read More »

Great Graphic: US 2-year Premium Grows and Outlook for G3 Central Banks

A cry was heard last week when President Trump expressed displeasure with the Fed's rate hikes. Some, like former Treasury Secretary Lawrence Summers, claimed that this was another step toward becoming a "banana republic." Jeffrey Sachs, another noted economist, claimed that "American democracy is probably one more war away from collapsing into tyranny."

Read More »

Read More »

UBS Boss Bemoans Geopolitical Jitters

UBS may have seen quarterly profits rise year-on-year, but chief executive Sergio Ermotti says the threat of trade wars and political unrest has dampened investor enthusiasm and continues to hold back financial markets.

Read More »

Read More »

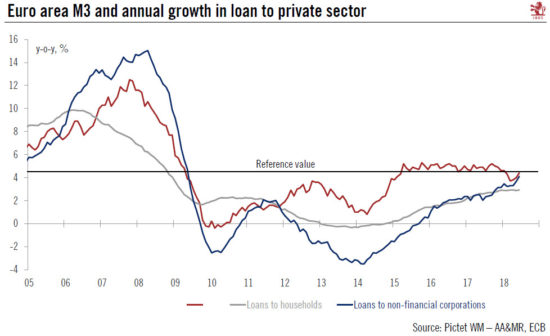

Euro Area Lending Dynamics in Good Shape

The ECB’s M3 and credit report for June just published confirms that lending dynamics continue to be in a good shape in the euro area, boding well for private investment. Bank credit flows to non-financial corporations (adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in May.

Read More »

Read More »

FX Daily, July 25: Narrow Ranges Prevail

The US dollar is trapped in narrow trading ranges. That itself is news. At the end of last week ago, the US President seemed to have opened another front in his campaign to re-orient US relationships by appearing to talk the dollar down. Contrary to fears, and media headlines of a currency war, the dollar is fairly stable.

Read More »

Read More »