Rising bank credit flows confirm that domestic fundamentals remain solid across most of the euro area.

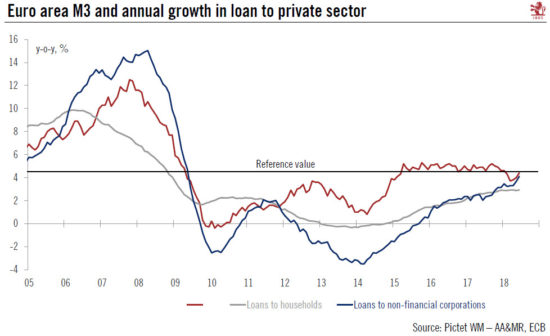

The ECB’s M3 and credit report for June just published confirms that lending dynamics continue to be in a good shape in the euro area, boding well for private investment. Bank credit flows to non-financial corporations (adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in May. Corporate-sector lending increased 4.1% year-over-year in June, its fastest rate since May 2009. On a country-by-country basis, flows were positive in Germany, France and Spain, but negative in Italy. Bank credit flows to euro area households rose strongly again in June, extending their upward trend. Forward-looking indicators suggest that credit growth should continue over the coming months.

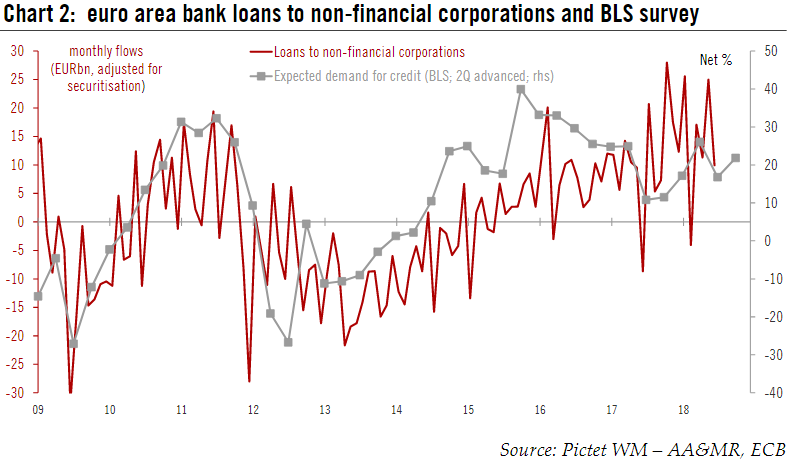

Separately, the ECB’s latest Bank Lending Survey showed further strong improvement in credit demand across most countries and sectors. Demand accelerated in Q2 and is expected to rise further in Q3. Low interest rates were again cited as one of the main factors driving higher demand for corporate credit and mortgages.

All in all, financial conditions remain supportive in the euro area and are not expected to tighten too much. In a context of increasing downside risks, the ECB’s is likely to remain cautious when it comes to policy normalisation and will try to avoid any unwarranted tightening in financial conditions in the coming months.

Flows slowed in June, but were still strongBank credit flows to non-financial corporations (NFC, adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in May. Corporate-sector lending increased 4.1% year-over-year in June, its fastest rate since May 2009 and up from 3.7% in May. On a country-by-country basis, flows to NFC were positive in Germany (+€5bn), France (+€3bn) and Spain (+€3bn), but negative in Italy (-€1bn). Bank credit flows to households rose strongly again in June (+€15bn), extending their upward trend on the back of further increases in loans for house purchases (+€17bn). Annual growth in loans to households was unchanged at 2.9% in June.

|

Euro Area M3 and Annual Growth in Loan to Private Sector |

Positive credit outlook, but downside risks increaseForward-looking indicators suggest that credit growth should remain favourable over the coming months. The ECB’s Bank Lending Survey (BLS) showed that access to credit improved again for both enterprises and households in Q2, albeit at a slower pace than in Q1. Banks expect continued easing of credit standards Q3 across the three loan categories (loans to enterprises, loans to households for house purchase and consumer credit) but at a more moderate pace. Demand in Q2 increased faster than in Q1 and is expected to rise further in Q3, albeit at a slower pace except in consumer credit. Low interest rates were again cited as one of the main factors driving higher demand for corporate credit and mortgages.

All in all, financial conditions remain supportive in the euro area and are not expected to tighten too much. In a context of increasing downside risks, the ECB’s is likely to remain cautious when it comes to policy normalisation.

|

Euro Area Bank Loans |

Full story here Are you the author? Previous post See more for Next post

Tags: Macroview,newslettersent