Tag Archive: newslettersent

FX Daily, April 10: XI’s Day, but Not So Good for Putin

It did not look so good. The S&P 500 fell about 1.65% in the last couple hours of trading yesterday paring its gains. Press reports indicated that President Trump's lawyer's office, house and hotel were the subject of search warrants. A Bloomberg report citing people who knew said that China would consider devaluing the yuan.

Read More »

Read More »

US Jobs Data Optics Disappoint, but Signal Unchanged

The US jobs growth slowed in March more than expected, but the details of the report suggest investors and policymakers will look through it. The poor weather seemed to have played a role. Construction jobs fell (15k) for the first time since last July, and the hours worked by production employees and non-supervisory worker slipped.

Read More »

Read More »

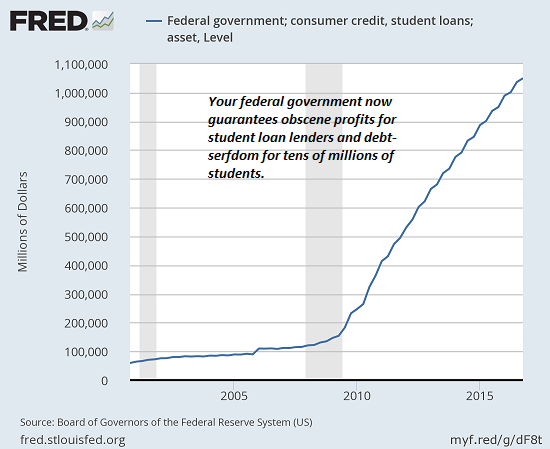

Why Systems Fail

Since failing systems are incapable of structural reform, collapse is the only way forward. Systems fail for a wide range of reasons, but I'd like to focus on two that are easy to understand but hard to pin down. Systems are accretions of structures and modifications laid down over time.Each layer adds complexity which is viewed at the time as a solution. This benefits insiders, as their job security arises from the need to manage the added...

Read More »

Read More »

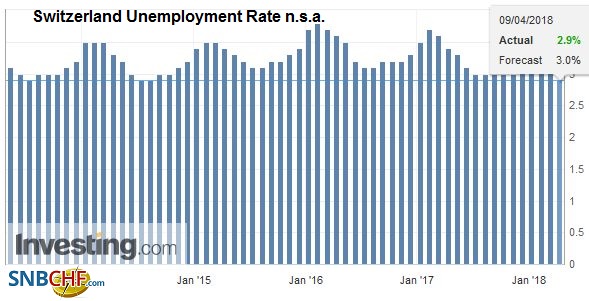

Switzerland Unemployment in March 2018: Down to 2.9 percent from 3.2 percent, seasonally adjusted unchanged at 2.9 percent

Unemployment registered in March 2018 - According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of March 2018 130'413 unemployed people were registered at the regional employment agencies (RAV), 13'517 less than in the previous month. The unemployment rate fell from 3.2% in February 2018 to 2.9% in the month under review. Compared to the same month of the previous year, unemployment fell by 21,867 persons (-14.4%).

Read More »

Read More »

FX Daily, April 09: Asian and European Equities Shrug Off US Decline

US shares slumped before the weekend amid concern that Trump Administration was prepared to escalate the trade tensions with China. However, cooler heads are prevailing, and there is a recognition that the conflict is still in the posturing phase. No sanctions have gone to into effect. As the Economist points out, nearly 100 of the Chinese products the US proposed slap a tariff on are not currently being exported to the US. The US has a 60-day...

Read More »

Read More »

Emerging Markets: What Changed

Reserve Bank of India cut its inflation forecast for the first half of FY2018/19 to 4.7-5.1%. Former South Korean President Park was sentenced to 24 years in prison. Malaysia Prime Minister Razak has called for early elections. Bahrain discovered its biggest oil field since it started producing crude in 1932. Local press reports Turkey’s Deputy Prime Minister Simsek tendered his resignation.

Read More »

Read More »

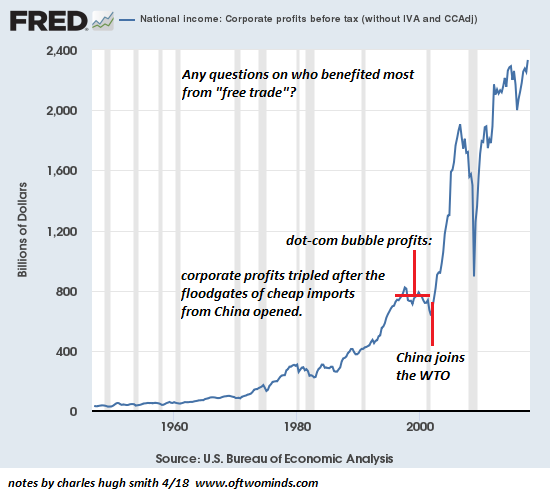

Were Trade Wars Inevitable?

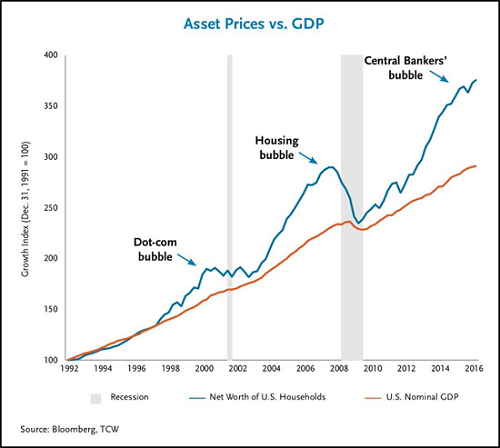

Were trade wars inevitable? The answer is yes, due to the imbalances and distortions generated by financialization and central bank stimulus. Gordon Long and I peel the trade-war onion in a new video program, Were Trade Wars Inevitable?

Read More »

Read More »

Trade War Game On!

“Things sure are getting exciting again, ain’t they?” The remark was made by a colleague on Tuesday morning, as we stepped off the elevator to grab a cup of coffee.

Read More »

Read More »

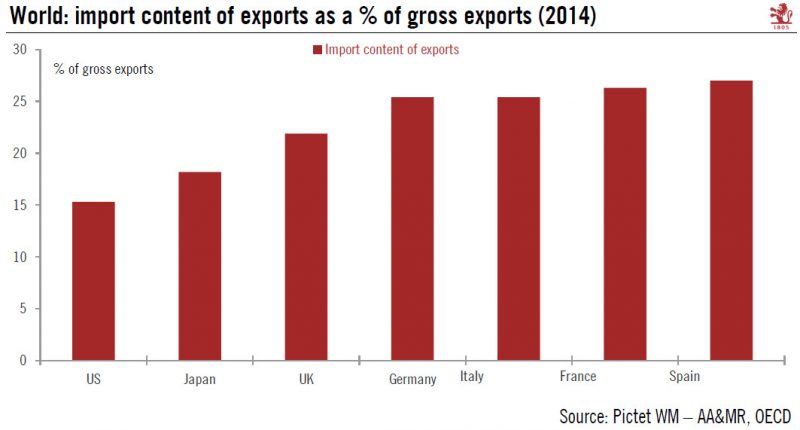

Europe has a lot to lose from trade wars

Any estimate of the economic costs of protectionist measures, let alone trade wars, is subject to uncertainty given the complexity of global supply chains. A common assumption is that new tariffs on exports will produce small direct effects on GDP growth but more significant indirect effects in the event of escalating trade conflicts, including on domestic investment.

Read More »

Read More »

Jamie Dimon Warns Of Potential ‘Market Panic’

Jamie Dimon Warns Of Potential ‘Market Panic’. JPMorgan Chase CEO Jamie Dimon sees ‘chance of market panic’. In annual letter to shareholders Dimon warns of increased inflation and interest rates. Concerned QE unwinding could cause chaos as ‘markets will get more volatile’.

Read More »

Read More »

Great Graphic: Has the Dollar Bottomed Against the Yen?

The US dollar appears to be carving a low against the yen. After a significant fall, investor ought to be sensitive to bottoming patterns. The first tell was the key reversal on March 26. In this case, the key reversal was when the dollar made a new low for the move (~JPY104.55) and then rallied to close above the previous session high.

Read More »

Read More »

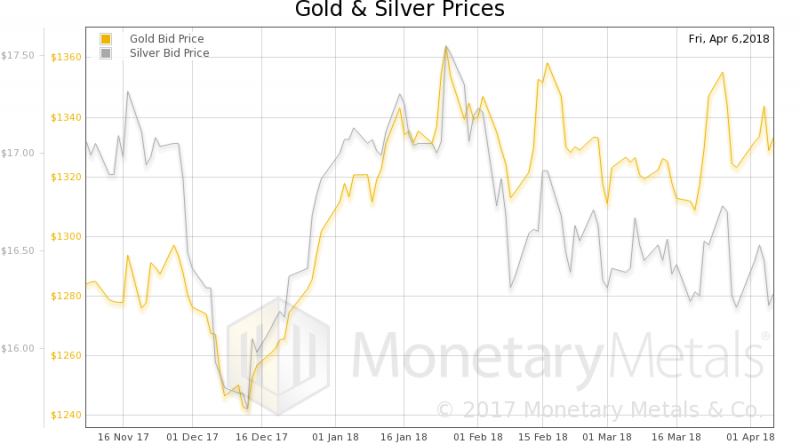

Silver Bullion: Should We Be Worried About Silver?

Silver Bullion: Should We Be Worried About Silver? Bloomberg’s Mike McGlone silver “set to test the $18 an ounce resistance level”. LBMA report: volume of silver ounces transferred in February fell by 24%. Standard Chartered: gold-silver ratio and supply/demand fundamentals favour silver. Gold/silver ratio at near two-year high on silver’s underperformance. Silver COT reports remain more bullish than at any time in history.

Read More »

Read More »

Playing for All the Marbles

Global Plunge Protection Teams must be ordering take-out food; every night is a long one now. The current stocks/bonds game is for all the marbles, by which I mean the status quo now depends on valuations and interest rates remaining near their current levels for the system to function.

Read More »

Read More »

FX Daily, April 06: Trade Trumps Jobs

Trade and equity market volatility, which are not completely separate, continue to dominate investors' interest. Many had come around to accept that while trade tensions were running high, it was likely to be mostly posturing. This conclusion may have helped lift the S&P 500 around 3% over the past three sessions.

Read More »

Read More »

Swiss corporate tax rates ‘likely to fall’ in some cantons

Impending corporate tax reforms are likely to reduce rates in higher tax cantons, such as Geneva, Vaud and Basel City, according to KPMG. Overall, the business consultancy group expects Switzerland to remain an attractive location for multinational corporations.

Read More »

Read More »

Brexit, Stagflation Pressures UK High Street

Brexit, Stagflation Pressures UK High Street. UK high street and wider consumer market feeling effects of financial crisis, Brexit and inflation. 350,000 retails jobs expected to disappear between 2016 and 2020. Centre for Retail Research predicts 9,500 shops to close this year and 10,200 in 2019. UK is ‘worst performing’ European market for new car registrations – Moody’s. UK’s growth outlook is the ‘worst in the G20’ – Institute of Fiscal...

Read More »

Read More »

China Vows Retaliation With “Same Scale, Intensity” To Any New US Tariffs

Trump’s aggressive trade war overtures and China's initial retaliatory moves have spooked Wall Street over the past week and again on Monday, which helped drive down the Dow Jones by 459 points, with the Nasdaq Composite quickly approaching correction territory. And as the mass exodus continues out of Wall Street’s highest-flying stocks, trade war concerns are sparking political, regulatory and market challenges that could soon derail the global...

Read More »

Read More »

Revenu universel, du néo-libéralisme jusqu’au bout

Les quantitative easing de la dernière décennie ont créé un assèchement de liquidités locales. Ceci est un fait observable. Les banques locales sont étranglées par diverses directives imposées par les tenants et « régulateurs » de la haute finance internationale (Finma pour la Suisse). L’échec économique se propage, avec de multiples faillites de commerces et d’entreprises? Vous n’avez plus accès à vos capitaux-épargne?

Read More »

Read More »