Tag Archive: newslettersent

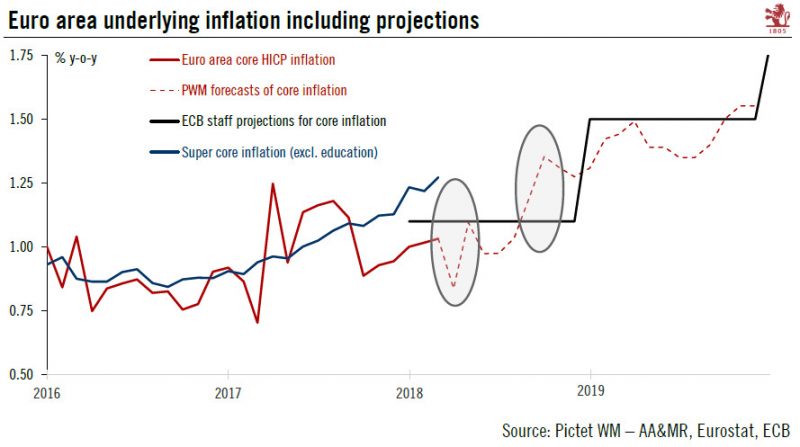

Euro area core inflation to rise again after Easter

The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through.

Read More »

Read More »

Healthcare costs rise further in Switzerland

Statistics published today show a further rise in Swiss healthcare costs. In 2016, spending on healthcare rose by 3.8% reaching over CHF 80 billion, 12.2% of GDP. In 2015, Swiss healthcare spending was equal to 11.9% of GDP. The challenge of rising healthcare costs is not confined to Switzerland. In the UK in 2015, healthcare costs rose 3.6% to reach 9.9% of GDP.

Read More »

Read More »

The Retail Sales Shortage

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months.

Read More »

Read More »

The “Turn of the Month Effect” Exists in 11 of 11 Countries

I already discussed the “turn-of-the-month effect” in a previous issues of Seasonal Insights, see e.g. this report from earlier this year. The term describes the fact that price gains in the stock market tend to cluster around the turn of the month. By contrast, the rest of the time around the middle of the month is typically less profitable for investors.

Read More »

Read More »

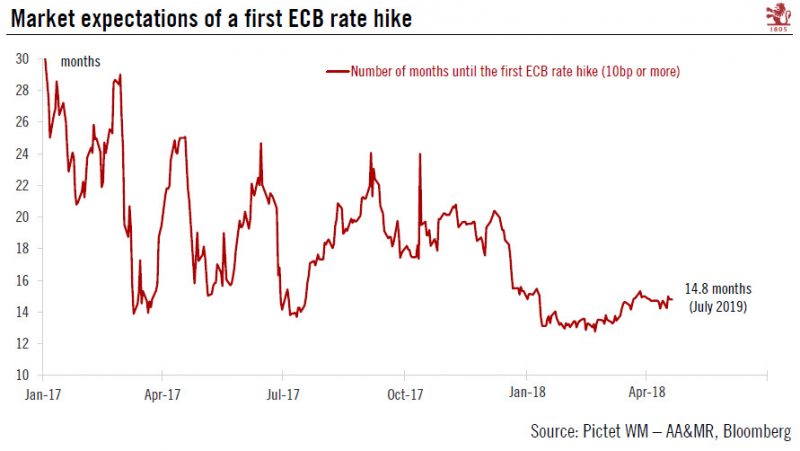

ECB policy: Stop Worrying and Love the Soft Patch

For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case.

Read More »

Read More »

Swiss unemployment at lowest in 3.5 years

Swiss unemployment is at its lowest for 3.5 years, according to the Swiss State Secretariat for Economic Affairs (SECO). The last time Swiss unemployment reached March 2018’s level was in October 2014. After reaching a peak of 3.7% in January 2017, the rate had fallen to 2.9% by March 2018. Unemployment has some seasonality however the rate for last March (2.9%) is low even when compared to March 2016 (3.5%) and March 2017 (3.4%).

Read More »

Read More »

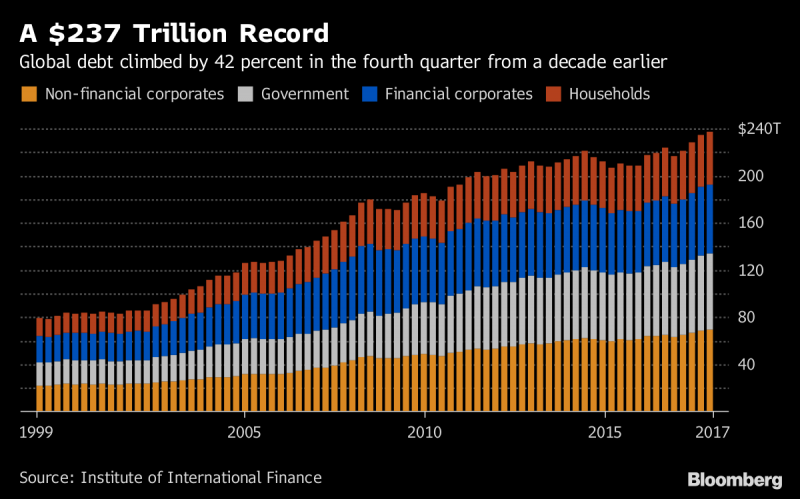

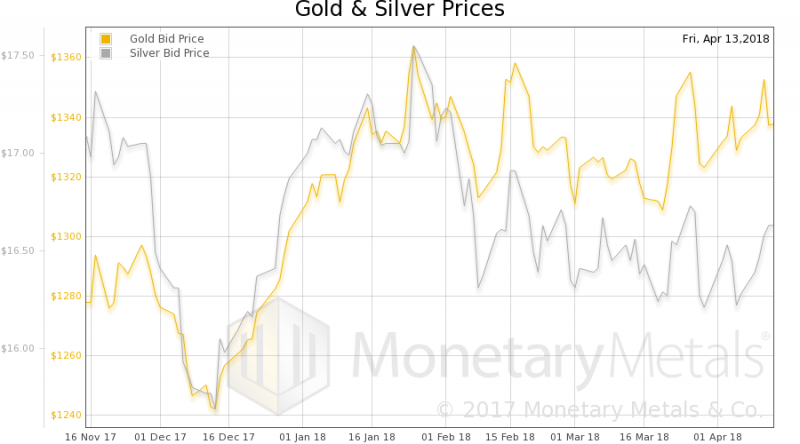

Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

Global debt bubble hits new all time high – over $237 trillion. Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD. Increase in debt equivalent to United States’ ballooning national debt. Global debt up $50 trillion in decade & over 327% of global GDP. $750 trillion of bank derivatives means global debt over $1 quadrillion. Gold will be ‘store of value’ in coming economic contraction. Global debt is the mother of all...

Read More »

Read More »

What Do We Know About Syria? Next to Nothing

Anyone accepting "facts" or narratives from any interested party is being played. About the only "fact" the public knows with any verifiable certainty about Syria is that much of that nation is in ruins. Virtually everything else presented as "fact" is propaganda intended to serve one of the competing narratives or discredit one or more competing narratives.

Read More »

Read More »

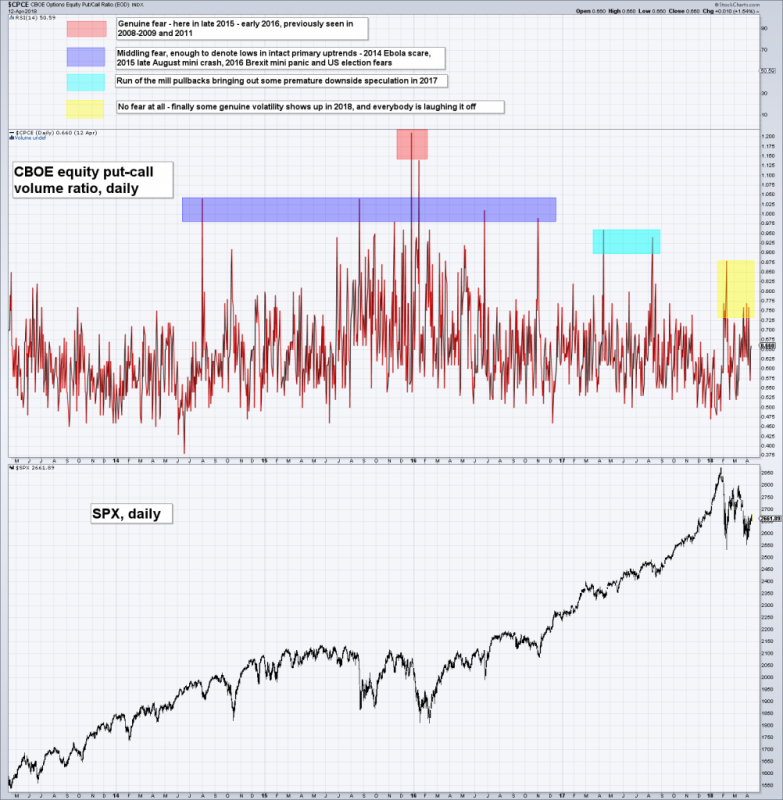

US Stock Market: Happy Days Are Here Again? Not so Fast…

Obviously, assorted crash analogs have by now gone out of the window – we already noted that the market was late if it was to continue to mimic them, as the decline would have had to accelerate in the last week of March to remain in compliance with the “official time table”. Of course crashes are always very low probability events – but there are occasions when they have a higher probability than otherwise, and we will certainly point those out...

Read More »

Read More »

Weakening franc approaches symbolic mark

As the Swiss franc weakens towards the threshold CHF1.20 exchange rate, the likelihood remains slim that Switzerland’s central bank will alter monetary policy any time soon. On Thursday morning a euro cost CHF1.198 francs. In February, the price of a single euro fell to under CHF1.150. The greater the number of francs needed to buy another currency signals a weaker franc, and vice versa if the exchange rate declines.

Read More »

Read More »

Europe’s most expensive hotels in Geneva, Paris and Zurich

Across the road from Lake Geneva, sits Geneva’s and the world’s most expensive hotel suite. The Hotel President Wilson’s Royal Penthouse Suite is reported to cost $83,500 per night – the price is not listed on the hotel’s website but costs this much according to CNN. For most of those planning to visit Geneva, this price is, thankfully, an outlier.

Read More »

Read More »

FX Daily, April 20: The Greenback is Alive

The US dollar is set to finish the week on a firm note. It reflects rising US yields, where the 10-year is above 2.90% for the first time since February and the widening two-year different between the US and Germany, which is holding just below 300 bp. It is the fourth consecutive advancing session for the Dollar Index, which is near a two-week high.

Read More »

Read More »

Volatile Week Sees Oil and Palladium Surge Over 8percent, Gold and Silver Marginally Higher and Stocks Gain

Gold & silver eke out small gains; palladium surges 8% and platinum 2%. Oil (WTI) surges over 8% to over $66.90/bbl; supply disruption risk. U.S. dollar and Treasuries fall; geopolitical, trade war and fiscal concerns. Stocks rally and shrug off trade war, macro and geo-political risks. Bitcoin, major cryptos (Ethereum, Ripple etc) rise sharply. Russia-US tensions high: Trump warns attack ‘could be very soon or not so soon at all’.

Read More »

Read More »

Sika stand-off with family heirs continues unabated

During another stormy annual general meeting, the majority stakeholders of Swiss chemical manufacturer Sika were once again controversially denied the chance to vote in a new chairman who would support their plans to sell the company to a French rival. At Tuesday’s AGM, the family heirs of Sika’s founder faced a familiar pattern of having their votes restricted when it came to electing board members.

Read More »

Read More »

FX Daily, April 19: Markets Calm But Lack Immediate Focus

A light news stream and less trade rhetoric lend the equity markets a positive impulse amid a strong US earnings season while leaving the dollar narrowly mixed. The MSCI Asia Pacific Index rose 0.5% and is up 1% for the week with one session left. It would be the second consecutive weekly advance. The Dow Jones Stoxx 600 has edged higher for a third consecutive session. It is up about 0.7% for the week, and if sustained, would extend the advance...

Read More »

Read More »

Weekly Technical Analysis: 16/04/2018 – USD/CHF, USD/JPY, EUR/GBP, GBP/USD, USD/CAD

The USDCHF pair breached 0.9675 level and closed the daily candlestick above it, to open the way to achieve more rise in the upcoming sessions, paving the way to head towards 0.9790 as a next main station. Therefore, the bullish trend will be suggested, supported by the EMA50, noting that breaking 0.9675 and holding below it will push the price to test 0.9581 level before determining the next trend clearly.

Read More »

Read More »

China’s Exports Are Interesting, But It’s Their Imports Where Reflation Lives or Dies

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a trade war (but isn’t really,...

Read More »

Read More »