Tag Archive: newslettersent

Argentina – The Times, They Are A-Changing

Our Argentine “Ranch Rebellion” Is Over… for Now… BUENOS AIRES, Argentina – Not much action on Wall Street yesterday. The Dow sold off slightly. Gold and oil were up a bit. How about here in Argentina? “Everything has changed. Everything.” Mauric...

Read More »

Read More »

Dueling Fed GDP Trackers

The decentralized nature of the Federal Reserve lends itself to both a division of labor and competitive analysis. Some Federal Reserve branches have alternative inflation measures and trade-weighted indices of the dollar. On the whole, this seems beneficial for investors and policymakers. One tool developed by the Atlanta Fed has been widely embraced. It is …

Read More »

Read More »

FX Daily, April 13: US Dollar Comes Back Bid

The US dollar is well bid in the Europe and is poised to start the North American session with the wind to its back. Despite firmer equity and industrial metal prices, most emerging market currencies are also succumbing to the rebounding greenback. The euro has yet to convincingly breakout of the range that has confined … Continue reading »

Read More »

Read More »

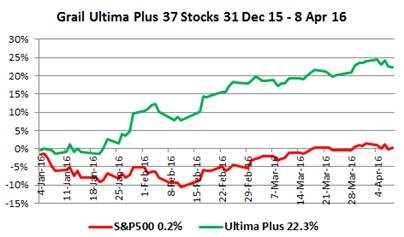

The Free Portfolio and the Age of the Alpha Stock

This free portfolio is offered to help investors understand that what they may have learnt about risk and return do not correspond to the realities of investing today.

Read More »

Read More »

State of Fear – Corruption in High Places

Mr. X and his Mysterious Benefactors As the Australian Broadcasting Corporation (ABC) reports, a money-laundering alarm was triggered at AmBank in Malaysia, a bank part-owned by one of Australia’s “big four” banks, ANZ. What had triggered the alarm...

Read More »

Read More »

Yes, the Dollar Should Be Backed by Gold…

A Return to Gold BUENOS AIRES, Argentina – “What if you were appointed to head the Fed? In your first week on the job, what would you do?” The question was not exactly serious. Neither was the answer. “We’d call in sick.” Sorry boys and girls, y...

Read More »

Read More »

More Thoughts about the Yen

Every so often there is a market move that appears inexplicable. The conundrum now is the yen's strength. Of course, there are numerous attempts to shed light on the yen's rise, but many, like ourselves, are not very satisfied.

Perhaps par...

Read More »

Read More »

Great Graphic: Beware of Sophistry about the Yen and Nikkei

There is a common ploy used by many analysts and reporters that often simply does not stand up to close scrutiny, and would in fact be mocked in the university. The ploy is to take two time series and put them on the same chart but use different scales. Such a ploy often is used … Continue reading »

Read More »

Read More »

FX Daily, April12: Higher Inflation Lifts Sterling, Yen Stabilizes

There are three highlights to the foreign exchange market today. First, the yen is marginally softer. The yen's strength this month has been the main development. After making a marginal new high yesterday, some semblance of stability emerge...

Read More »

Read More »

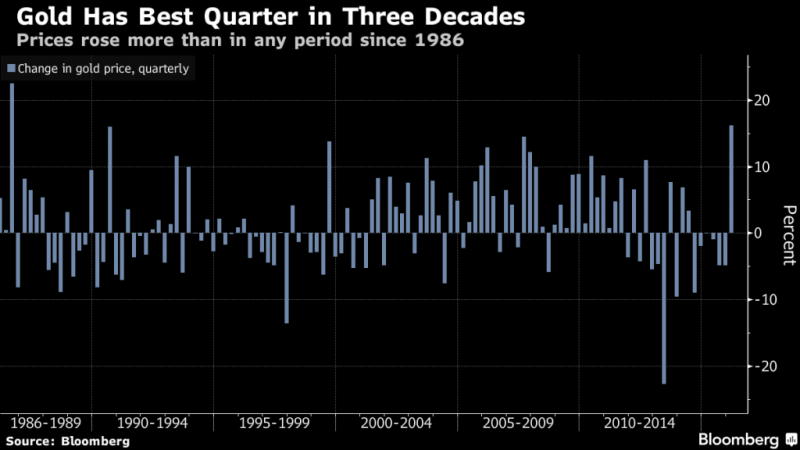

Gold Stocks Break Out

No Correction Yet Late last week the HUI Index broke out to new highs for the move, and so did the XAU (albeit barely, so it did not really confirm the HUI’s breakout as of Friday). Given that gold itself has not yet broken out to a new high for th...

Read More »

Read More »

In Memoriam: Dr. Tibor Machan

A Rara Avis – The World Is Poorer Without Him In It Our friend Dr. Tibor Machan, a greatly valued contributor to this site, has passed away on March 24. Dr. Tibor Machan, libertarian philosopher Unfortunately, we haven’t known Tibor for very lo...

Read More »

Read More »

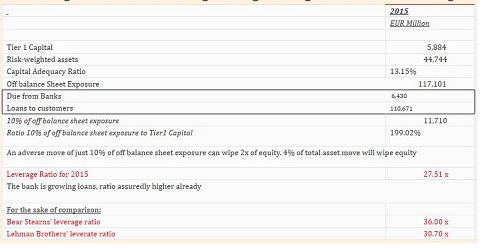

ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It's official, I'm calling a banking crisis in Europe. Things didn't go well the last time I did this. Of course, many will say, "But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks...

Read More »

Read More »

A Fatal Flaw in the System

The Hard Rocks of Real Life BALTIMORE – The Dow dropped 174 points on Thursday, the biggest fall in six weeks. Not the end of the world. Maybe not even the end of this year’s bounce-back bull run. As you’ll recall, stocks sold off at the beginning ...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

Some dovish signals from the Fed and a bounce in oil prices helped EM end last week on a firm note. This week, the US retail sales report could be important, and the same goes for CPI and PPI data too. The Fed?...

Read More »

Read More »

FX Daily, April 10: Same Drivers, Different Direction

Over the past three months and the past month, the dollar has fallen against all the major currencies but the British pound. Sterling's underperformance can largely be explained by uncertainty created by the Tory government's sponsored referendum on continued EU membership. Most of the polls show those wanting to remain hold on to a slight …

Read More »

Read More »

Weekly Speculative Position: Switch to Net Long Canadian Dollar and Set New Record Gross Long Yen

Speculators in the futures market were not particularly active in Commitment of Traders reporting week ending April 5. There was only one gross position adjustment which we regard as significant (defined as a 10k contract change), and that was in the yen. Yen bulls extended their gross long position by 13.3k contract to new record …

Read More »

Read More »

FX Daily: Little Technical Evidence that Greenback’s Slump is Over

Although there is no convincing technical evidence that dollar's retreat in Q1 is over, we suspect it is nearly complete. We will be especially sensitive to reversal patterns, divergences with technical indicators, and other signs that the move is exhausted. The fundamental economic driver of our medium term constructive outlook for the US dollar, the …

Read More »

Read More »