Tag Archive: newslettersent

Will the Dollar Bloom like May Flowers after April Showers?

April was a cruel month for the US dollar. It fell against all the major currencies; even those whose central banks have negative yields. The greenback also fell against nearly all the emerging market currencies, but the Philippine peso and the Polish zloty. Through the first four months of the year, the dollar is lower …

Read More »

Read More »

The ‘Strange’ Death of Mr. Abadi

As expected, PM Abadi was always going to come off worse in his last ditch attempt to try and regain some kind of political initiative by appointing a new look ‘technocratic’ government in Baghdad. But the ailing Prime Minister has managed to back hi...

Read More »

Read More »

With Fiat Money, Everything Is Relative

What Determines a Currency’s Value? At the end of March the price of the euro in terms of US dollars closed at 1.1378. This was an increase of 4.7 percent from February when it increased by 0.3 percent. The yearly growth rate of the price of the eu...

Read More »

Read More »

Do You Believe Six Impossible Things before Breakfast?

The White Queen in Alice in Wonderland (Through the Looking Glass) confesses that when she was younger, she could believe six impossible things before breakfast. She encourages Alice to do the same. It appears many in the market are taking ...

Read More »

Read More »

Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and ...

Read More »

Read More »

FX Daily, April 29: Dollar Losses Extended Ahead of the Weekend

There are two main forces in the foreign exchange market that are rippling through the capital markets. The first is the continued weaker dollar tone. The combination of what appears to be a stagnating US economy (0.5% annualized pace in Q1) and a market that does not believe the Federal Reserve will hike rates in … Continue reading...

Read More »

Read More »

Podcast Discussing Dollar, Fed, BOJ on Futures Radio Show

I had the privilege of being interviewed by Anthony Crudele, who is trader at the CME, for the Futures Radio Show.

There was much to discuss. The FOMC met yesterday. The market, judging from the Fed funds futures see little chance of a Ju...

Read More »

Read More »

FX Daily April 28: What is the Next Shoe to Drop?

One can appreciate the frustration in Tokyo. The Bank of Japan surprised the world by adopting negative rates in January and the yen rallied. Today it disappointed many by not easing, and the yen rallied. The BOJ next meetings in mid-June and like this week, the outcome of its meeting will be announced the day … Continue reading »

Read More »

Read More »

Central Banks Roil Markets

The Bank of Japan defied expectations and its economic assessment to leave policy unchanged. The inaction spurred a 3% rally in the yen and an even larger slump in stocks. The financial sector took its the hardest and dropped almost 6%. The...

Read More »

Read More »

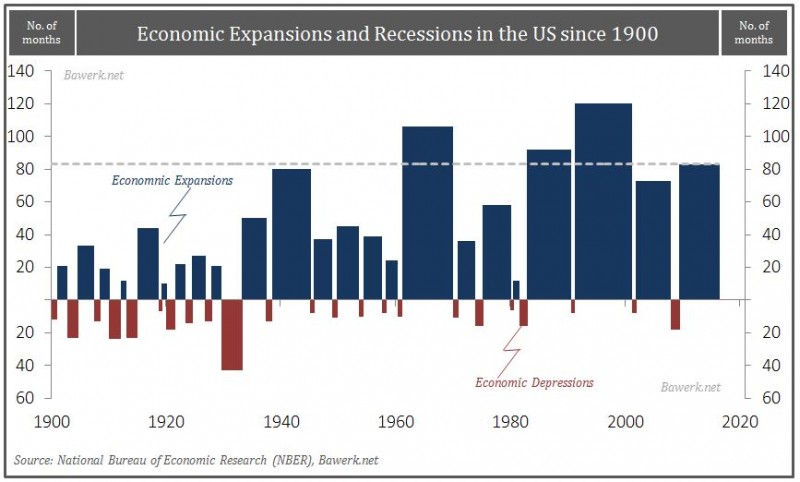

Hillary Will be the Least of Your Worries – America has Economic Diarrhea

According to the National Bureau of Economic Research (NBER), the official recession arbiter, the US economy is currently at its fourth longest expansion in history. By the sheer nature of a capitalistic society with its inherent cyclicality it is a ...

Read More »

Read More »

FOMC Statement Demonstrates Firm Grasp of the Obvious

The FOMC delivered a statement largely as expected. It upgraded its assessment of the global economy by dropping the reference to risks. It downgraded its assessment of the domestic economy by acknowledging that growth has slowed.

Otherwi...

Read More »

Read More »

What is the BOJ Going to Do?

Under Kuroda's leadership the BOJ has surprised the market a number of times, most recently with the move to negative rates at the end of January.

It is not that such a move, which has been tried by several European central banks, was without...

Read More »

Read More »

With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing t...

Read More »

Read More »

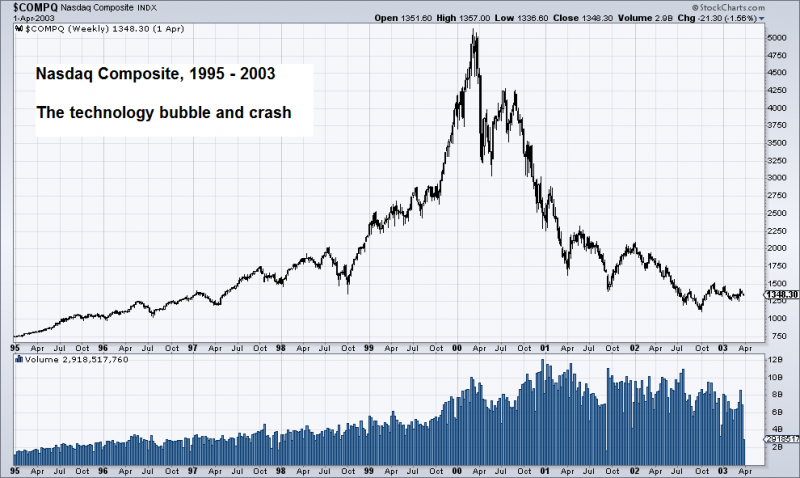

Peak Data: When Not Enough Is Already Too Much

The Wild 1990s Not so long ago, during 1990’s, the connecting world of the connected world we now know was literally and comprehensively in the development stage during those wild crazy go go years before the crash in technology stocks in 2000. T...

Read More »

Read More »

FX Daily April 27: Two Issues Loom Large Today: Soft Australia CPI and FOMC

The foreign exchange market is largely quiet as the market awaits fresh trading incentives and the FOMC statement later in the North American session. The main exception to the consolidative tone is the Australian dollar, which is posting its largest loss (~1.7%) in a couple of months. The short-term market was caught the wrong-footed when …

Read More »

Read More »

Political Pundits, or Getting Paid for Wishful Thinking

Bill Kristol – the Gartman of Politics? It has become a popular sport at Zerohedge to make fun of financial pundits who appear regularly on TV and tend to be consistently wrong with their market calls. While this Schadenfreude type reportage may st...

Read More »

Read More »

Old School Investment Lessons

Laughing at Blue Monday On May 28, 1962 – dubbed “Blue Monday” – the market fell 6%… its worst single-day slide since 1929. Peter Stormonth Darling was an investment manager at investment bank S. G. Warburg & Co. at the time. He strolled in to tell...

Read More »

Read More »