Tag Archive: newslettersent

Daily FX, May 13: Toward a New Mouse Trap

The Great Financial Crisis has exposed a deep chasm in economics and economic policy. No single institution is this crystallized more than at the Bank of Japan. The former Governor, Shirakawa brought policy rates to nearly zero to combat deflation. His successor, Kuroda, took the central bank in the completely other direction. He has introduced three …

Read More »

Read More »

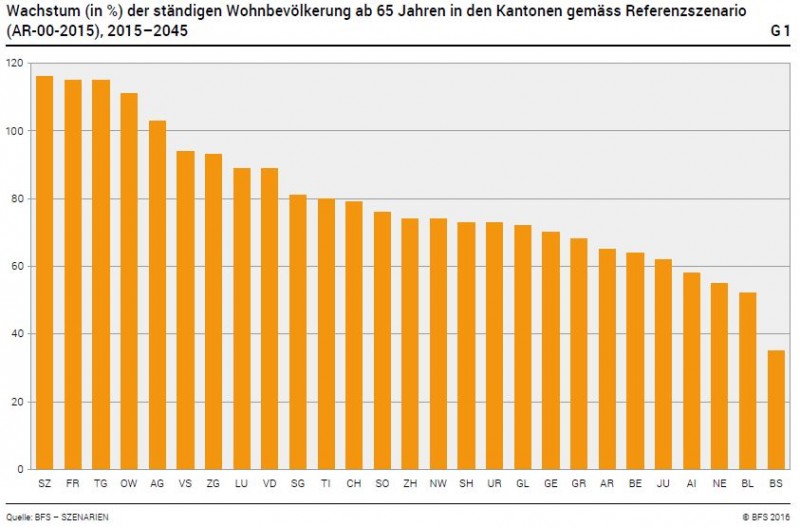

Switzerland 2015-2045: Population Increase by Immigration, Ageing Effects

Ageing effect: Swiss statistics expects that in many central and Southern cantons the number of elderly rises more strongly than in others.

Immigration of younger people to bigger towns like Zurich, Geneva, Basel or Bern, prevents such a strong ageing in other cantons.

French-speaking cantons will have less ageing issues, reasons might be found in higher fertility and higher immigration.

Read More »

Read More »

Arizona Governor Ducey Vetoes Gold

Unpersuaded by either the plight of the pensioners or the prospect of business growth in Arizona, Ducey vetoed gold. This is his second time to shoot down gold.

Read More »

Read More »

Heretical Thoughts and Doing the Unthinkable

Heresy! NORMANDY, France – The Dow rose 222 points on Tuesday – or just over 1%. But we agree with hedge-fund manager Stanley Druckenmiller: This is not a good time to be a U.S. stock market bull. Legendary former hedge fund manager Stanley Druck...

Read More »

Read More »

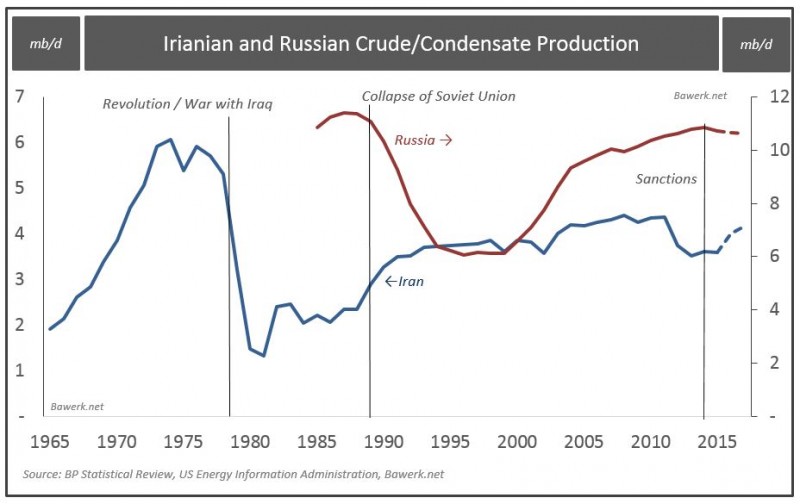

OPEC Politics: Russian King, Iranian Crown Prince?

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town.

Read More »

Read More »

Should the Gold Price Keep Up with Inflation?

The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true?

Read More »

Read More »

Staying Home on Election Day

Pretenses and Conceits The markets are eerily quiet… like an angry man with something on his mind and a shotgun in his hand. We will leave them to brood… and return to the spectacle of the U.S. presidential primaries. On display are all the pretens...

Read More »

Read More »

FX Daily, May 12: Yen Recovers After Being Thrown for 2 percent

The Japanese yen is recovering from two-day two percent decline. The yen is the strongest of the majors today, rising about 0.6%. The greenback initially extended its gains marginally in early Tokyo before the selling pressure emerging. Th...

Read More »

Read More »

65-Year-Old Swiss Native Lost His Life’s Savings For Failing To File A Form to the US

Submitted by Simon Black via SovereignMan.com,

By all accounts Bernhard Gubser was living the American Dream.

Born in Switzerland he moved to the Land of the Free in the early 1980s to work at an international shipping company based in Laredo, Texas....

Read More »

Read More »

The World’s 100 Most Influential Hacks, Yahoos and Monkey Shiners

Hacks and Has-Beens NORMANDY, France – What has happened to TIME magazine? Henry Luce, who started TIME – the first weekly news magazine in the U.S. – would be appalled to see what it has become. Time cover featuring the sunburned mummy heading t...

Read More »

Read More »

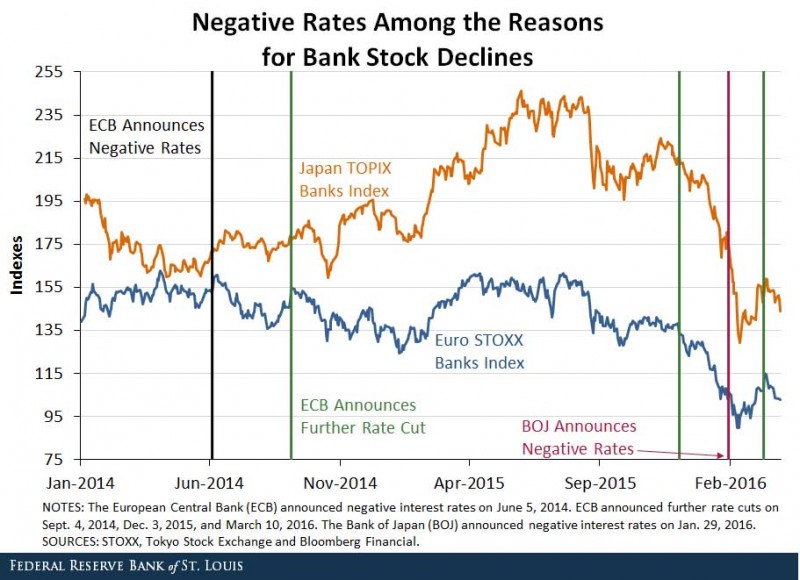

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

Reality is a Formidable Enemy

Political Correctness Comedy We have recently come across a video that is simply too funny not be shared. It also happens to dovetail nicely with our friend Claudio’s recent essay on political correctness and cultural Marxism. Since this is general...

Read More »

Read More »

Why is Freddie Mac Reporting a Loss?

A Sudden Turn for the Worse Freddie Mac posted a loss of $354 million this quarter, versus a $2.16 billion gain the previous quarter. Fannie Mae did slightly better with net earnings of $1.1 billion, which were still substantially down from $2.5 b...

Read More »

Read More »

St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

"At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?" Those are the shocking wor...

Read More »

Read More »

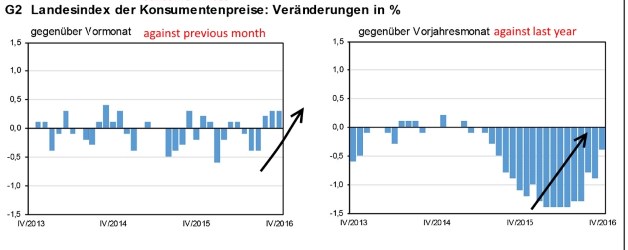

Swiss Consumer Price Index in April 2016: -0.4 percent against 2015, +0.3 percent against last month

For the second time in a row prices in Switzerland increased by 0.3% against the previous month. Inflation was -0.4% against last year. Still in 2015 inflation was mostly around -1.5%. Will this rising price tendency continue? It will be a problem for the SNB.

Read More »

Read More »

SNB Increased Equities Share to 20 percent, A High Risk Game for a Conservative Investor

A share of 20% equities is too much for a conservative investor.

- She increases the CHF debt with continuing interventions at a pace of 10% per year.

- yield on bond investments is less than 1% p.a. and equity markets might not improve a lot any more.

- Expensive dollar: she bought U.S. equities when the dollar was relatively expensive.

Read More »

Read More »