Tag Archive: newslettersent

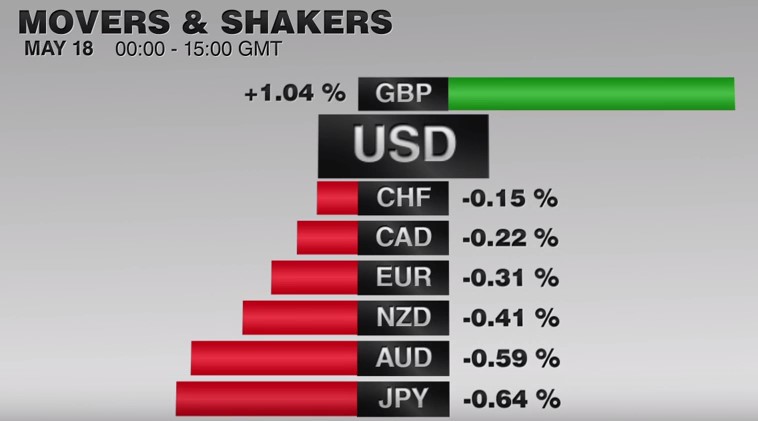

FX Daily, May 18: Greenback Recovers as Rate Support is Enhanced

Apart from GBP, the US dollar is rising against all the major currencies today. The Australian dollar is retracing a sufficient part of its recent gains to suggest that the current phase of the US dollar’s recovery is not over. Given that the Aussie topped out a week before the other major currencies, it is reasonable …

Read More »

Read More »

Cool Video: Chatting with Bloomberg’s Angie Lau in Hong Kong

As the second week of this Asian business trip gets underway, I am in Hong Kong. I was on Bloomberg TV in the Asian morning to discuss market developments with Angie Lau. The 4.5 minute discussion covers a number of topics, including the outlook for Fed policy, the BOJ, dollar outlook and game theory. … Continue...

Read More »

Read More »

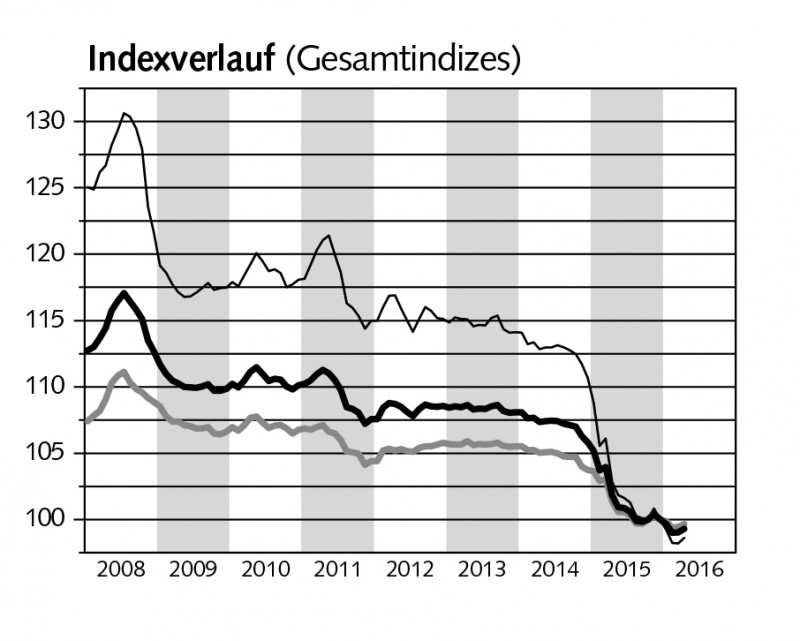

Swiss Producer and Import Price Index in April 2016: Down 2.4 percent to last year, up 0.3 vs last month

The Producer and Import Price Index (PP) rose in April 2016 by 0.3% compared with the previous month. The Producer Price Index increased by 0.2%, the Import Price Index rose by 0.4%. The rise is due in particular to higher prices for petroleum products. Compared with April 2015, the PPI is down 2.4%

Read More »

Read More »

FX Daily, May 17: The Meaning of Sterling and Aussie’s Advance Today

The US dollar is mostly weaker today. It appears to be consolidating the gains scored since the reversal on May 3. Sterling and the Australian dollar are leading the way early in Europe. The Australian dollar’s gains appear more intuitively clear. The minutes from the recent RBA meeting indicated that it was a closer decision. This …

Read More »

Read More »

Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. Some hope for the Swiss National Bank or will Berkshire shares sink together with Apple and the SNB?

Read More »

Read More »

China’s Rolling Boom-Bust Cycle

Pater Tenebrarum looks on the most important China charts that indicate a boom-bust cycle: annual rate of growth of M1 and M2, China fixed asset investment, China Money Supply M1, Shanghai Stock Exchange, China commodity futures, Steel Rebar futures, China residential real estate prices

Read More »

Read More »

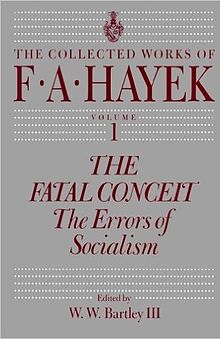

The Fatal Conceit

Bonner shows that Hayek's Fatal Conceit is valid today: central economic planning is literally impossible – there can be no centrally planned rational economy. Individual planning is distinct from central planning, in that the many individual plans pursued by self-interested individuals mesh and create a spontaneous order.

Read More »

Read More »

Brief Look at the Start of the New Week’s Activity

The most notable thing is not what has happened, but what has not happened. The market has not responded to the soft Chinese data over the weekend. Chinese equities began softer but recovered fully and the Shanghai Composite closed on its highs. The MSCI Asia Pacific Index is snapping a two-day losing streak with a … Continue reading...

Read More »

Read More »

Emerging Markets Preview: Week Ahead

EM ended last week on a soft note, and that weakness seems likely to carry over into this week. Dollar sentiment turned more positive after firm retail sales data on Friday, though US rates markets have yet to reflect any increase in Fed tightening expectations. Over the weekend,

Read More »

Read More »

Are Dollar Fundamentals Lagging the Technical Improvement?

The US dollar extended its recovery that began on May 3. Its technical condition remains constructive, even though up until now, the gains are still consistent with a modest correction rather than a trend reversal. The details of the employment report, if not the headline, coupled with the 1.3% increase in retail sales, have boosted …

Read More »

Read More »

Weekly Speculative Positions: Significant Position Adjustments

The US dollar staged an impressive reversal against many of the major foreign currencies on May 3. In the following week, speculators in the currency futures market made significant adjustment in their holdings. We identified a change in the gross position in the currency futures of 10k contracts or more to be significant. In the week …

Read More »

Read More »

Dollar’s Technical Tone Improves, but No Breakout (Yet)

The US dollar continued the recovery begun May 3 and rose against most of the major currencies over the past week. A nearly 3.5% rally in oil prices, the fifth weekly gain in the past six weeks (a $9.5 advance over the period), helped the Norwegian krone turn in a steady performance. The Canadian dollar’s 0.2% … Continue...

Read More »

Read More »

As Carl Icahn Was Selling Apple, This Central Bank Was Furiously Buying

We hope for the sake of Swiss residents that equity markets never suffer a dramatic drop. The SNB has “invested” 20% of Swiss GDP in stocks. When will the ivory tower economists ultimately lose control of the most manipulated, centrally-planned market in history?

Read More »

Read More »

Kuroda-San in the Mouth of Madness

Deluded Central Planners Zerohedge recently reported on an interview given by Lithuanian ECB council member Vitas Vasiliauskas, which demonstrates how utterly deluded the central planners in the so-called “capitalist” economies of the West have bec...

Read More »

Read More »

Even Death Won’t Save Us

Hazards and Benefits Rubbernecking at the economic train wreck of central planners is not without hazard. A strained collar and dry eyes, for instance, are common perils. So, too, is the lasting grimace of disbelief that comes with the roll-out o...

Read More »

Read More »

Retirement Torpedoes and Democracy

Bonner compares Total credit market debt, federal government debt and GDP – an economy running on debt, and now running on empty.

Read More »

Read More »