Tag Archive: newslettersent

G7 Summit: Risk of a Global Crisis, Maritime Disputes and the Dollar

The G7 heads of state summit has begun. The host, Japan’s Prime Minister Abe began with doom and gloom. Accounts suggest he warned of the risk of a crisis on the scale of Lehman if appropriate policies are not taken. It is not clear to whom Abe was addressing. It may not have been the … Continue...

Read More »

Read More »

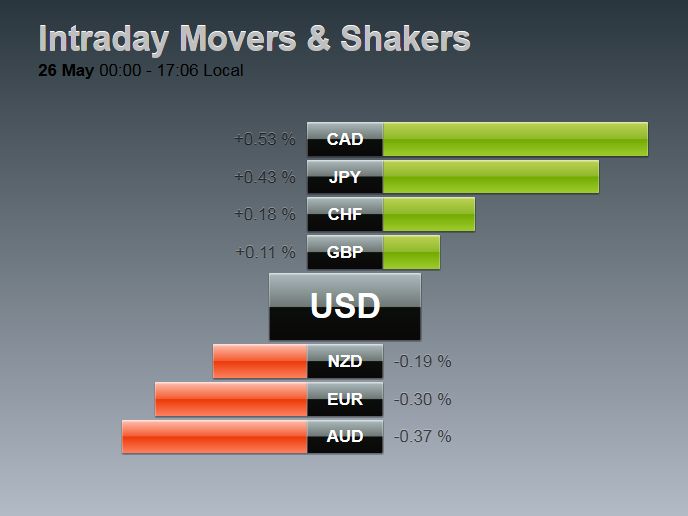

FX Daily, May 26: Dollar Softer in Consolidation Mode

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the …

Read More »

Read More »

Nigeria Currency Devaluation Looms As FX Forwards Crash To Record Lows

Despite US equity investors' exuberance over bouncing crude oil prices, the world's crude producers continue to suffer and while Venezuela is in the headlines every day (having already collapsed into chaos), Nigeria appears the nearest to that abyss ...

Read More »

Read More »

What the Greek Deal Does and Does Not Do

For investors, the most important thing about the successful review of Greece’s implementation of last year’s agreement is that it effectively removes it from the list of potential disruptive factors in the coming quarters. There will be no repeat of last year’s drama. Assuming Greece resolves a few outstanding issues in the next few days, …

Read More »

Read More »

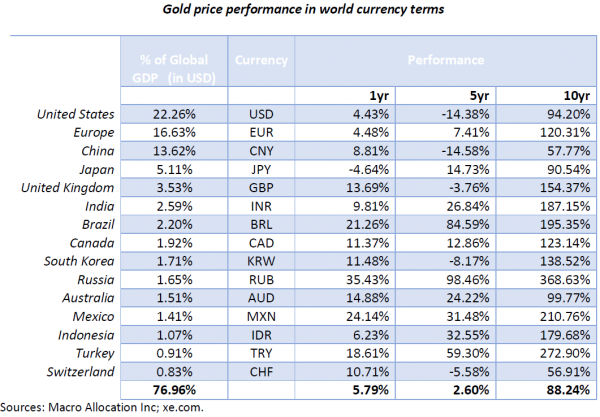

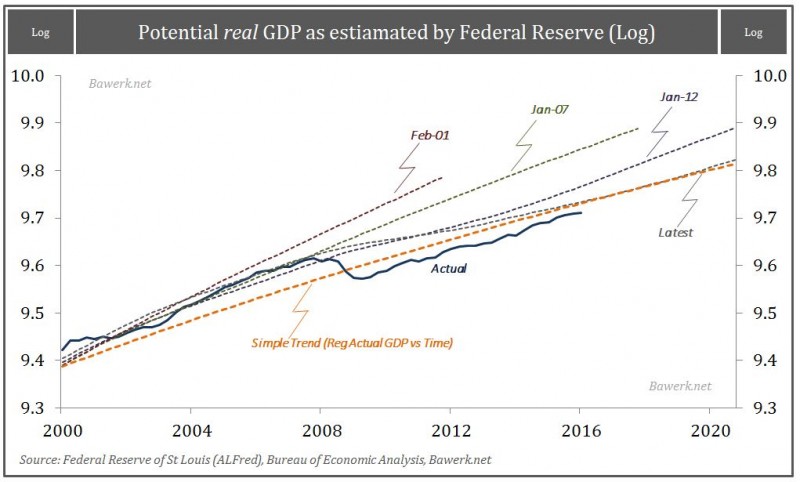

The Global Monetary System Has Devalued 47 percent Over The Last 10 Years

Authored by Paul Brodsky via Macro-Allocation.com,

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most political...

Read More »

Read More »

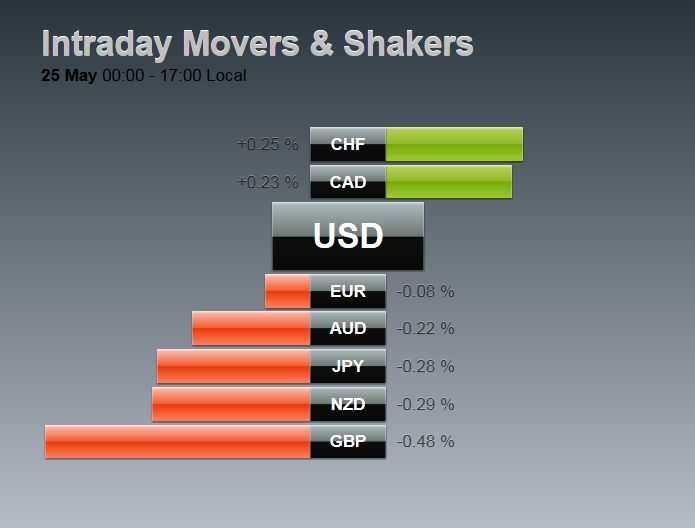

FX Daily, May 25: Dollar Marks time

The US dollar is little changed against the major currencies as yesterday’s moves are consolidated and traders wait for fresh developments. Global equities were higher after Wall Street’s advance yesterday. Asia-Pacific bond yields were firm, following the US lead, but European 10-year benchmark yields are lower, led by the continued rally in Greek bonds …

Read More »

Read More »

Switzerland About to Vote on “Free Lunch” for Everyone

Will the Swiss Guarantee CHF 75,000 for Every Family? In early June the Swiss will be called upon to make a historic decision. Switzerland is the first country worldwide to put the idea of an Unconditional Basic Income to a vote and the outcome of ...

Read More »

Read More »

The Yuan and Market Forces: Declaratory and Operational Policy

The Wall Street Journal is reporting that minutes of a meeting in China two months ago reveal that officials there have abandoned their commitment to give market forces greater sway in setting the yuan’s exchange rate. Reportedly, in response to economists and banks request that officials stop resisting market pressure, one PBOC official explained that …

Read More »

Read More »

LIBOR Alternatives Taking Shape

Since the LIBOR scandal erupted, US officials have been working toward an alternative benchmark. In 2014, the Fed set up a working committee that includes more than a dozen large banks and regulators Before the weekend the committee (Alternative Reference Rates Committee) proposed two possible replacements for LIBOR. There reportedly was some consideration of …

Read More »

Read More »

BSI: The End of a Swiss Private Bank

Authorities in Switzerland and Singapore are punishing BSI, the private bank based in the Ticino region of Switzerland, for alleged money-laundering offenses, shutting their activities in Singapore and seizing part of its profits.

Read More »

Read More »

Three unintended consequences of NIRP

Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues differently: Falling prices are a consequence of low interest rates.

Read More »

Read More »

Are Investors Idiots?

Black-and-Blue Crash Alert Flag Let us begin the week “on message.” The Diary is about money. Today, we’ll stick to the subject. Old friend Mark Hulbert has done some research on the likelihood of a crash in the stock market. Ye olde tattered C...

Read More »

Read More »

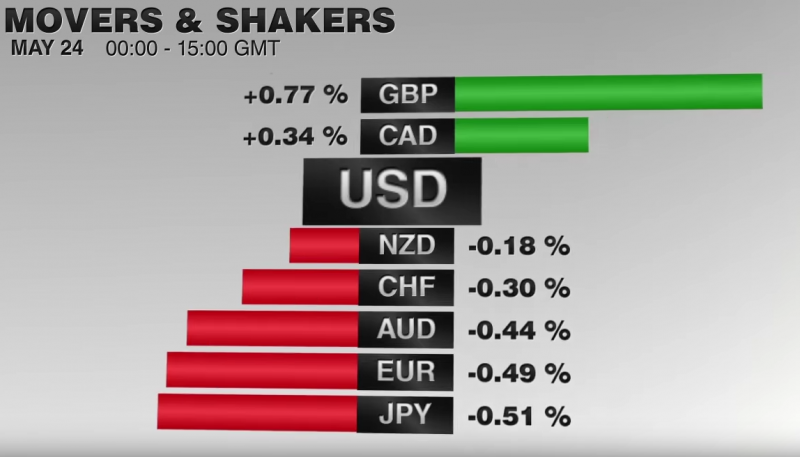

FX Daily, May 24: Dollar Regains Momentum, Sterling Resists

The US dollar lost momentum yesterday but has regained it today. The euro has been pushed through last week's lows near $1.1180. The next immediate target is $1.1145, which corresponds to the lower Bollinger Band today, though the intraday te...

Read More »

Read More »

Austria’s Presidential Elections – Europe’s Social Mood Keeps Worsening

Austria is a small European nation that has made the grievous mistake of needlessly joining the EU in 1995, together with Finland and Sweden. Austria’s neighbor Switzerland, which is of roughly similar size and likewise militarily neutral, proved to have far better instincts. The Swedes subsequently at least had the good sense to stay out of the euro zone. It seems if there is a mistake to be made, Austrian governments will eagerly make it.

Read More »

Read More »

Academic Skulduggery – How Ivory Tower Hubris Wrecks your Life

In the 1970s economists started to incorporate rational expectations into their models and not long after the seminal Kydand & Prescott (1977) article named Rules Rather than Discretion: The Inconsistency of Optimal Plan was published. Their work has...

Read More »

Read More »

Great Graphic: Dollar Pushes Back Below JPY110

The yen is the strongest of the major currencies. It has gained about 0.65% against the dollar. It has been grinding lower throughout the Asian and European session and has remained in narrow ranges near its highs in the US morning. Japan still seems isolated in terms of it desire to intervene. Ahead of the … Continue reading...

Read More »

Read More »

Revolution at the Ranch

Alarming News BALTIMORE, Maryland – An alarming email came on Tuesday from our ranch in Argentina: “Bad things going on… We thought we had the originarios problem settled. Not at all. They just invaded the ranch.” Originarios on the march… Photo ...

Read More »

Read More »

Cool Video: Bloomberg Surveillance: Dollar to trend higher

Returning from a two-week business trip to Asia, I was invited to appear on Bloomberg Surveillance with Tom Keene and Francine Lacqua. Check out the video clip here. Key Points My key points include,the driver now is changing perceptions of the trajectory of Fed policy and the reemergence of divergence. I suggest that “real news” …

Read More »

Read More »