Tag Archive: newslettersent

Great Graphic: Despite Higher Oil Prices, Middle East Pegs Remain Under Pressure

With today’s gains, the price of Brent has nearly doubled from its lows in January. Of course, the price of oil is still less than half of levels that prevailed two years ago. At the same time, many leveraged investors cast a jaundiced eye toward currency pegs. Many have concluded that the Middle East currency pegs …

Read More »

Read More »

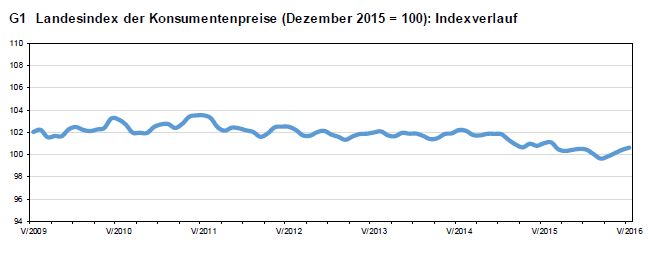

Swiss Consumer Price Index in May 2016: -0.4 percent against 2015, +0.1 percent against last month

For the third time in a row, prices in Switzerland increased against the previous month. Inflation was -0.4% against last year. Still in 2015 yearly inflation was mostly around -1.5% y/y. Now yearly HCPI inflation is -0.5%. Will this rising price tendency continue?

Read More »

Read More »

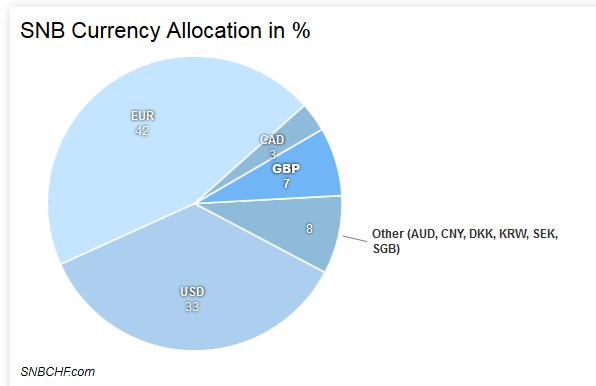

Swiss Reserves: Not what They Seem

This posts shows again the stupidity of the financial media, that mixes up assets and liabilities for central banks.

SNB FX reserves are assets. They are in different foreign currencies and subject to the valuation effect of these currencies.

Read More »

Read More »

The Real Reason We Have a Welfare State

From Subject to Citizen BALTIMORE – June 5th, the Swiss cast their votes and registered their opinions: “No,” they said. We left off yesterday wondering why something for nothing never works. Not as monetary policy. Not as welfare or foreign aid. N...

Read More »

Read More »

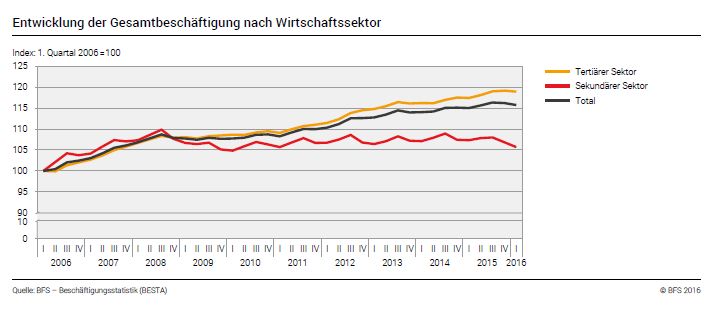

Employment barometer in 1st quarter 2016: Employment growth, but only in tertiary sector

In the 1st quarter 2016 total employment (number of jobs) rose by 0.6% compared with the same quarter a year ago (0.0% compared with the previous quarter). In full-time equivalents, employment in the same period fell by 0.2%. The other employment indicators also showed a downward trend. These are the findings of the Federal Statistical Office (FSO).

Read More »

Read More »

Moving Closer to BREXIT

Polls Show Growing Support for a Break with the EU In the UK as elsewhere, the political elites may have underestimated the strength of the trend change in social mood across Europe. The most recent “You-Gov” and ICM pools show a widening lead in f...

Read More »

Read More »

Free Money Leaves Everyone Poorer

Destroying Lives BALTIMORE – A dear reader reminded us of the comment, supposedly made by Groucho Marx: “A free lunch? You can’t afford a free lunch.” Groucho dispensing valuable advice Photo via imdb.com He was responding to last week’s Diary ...

Read More »

Read More »

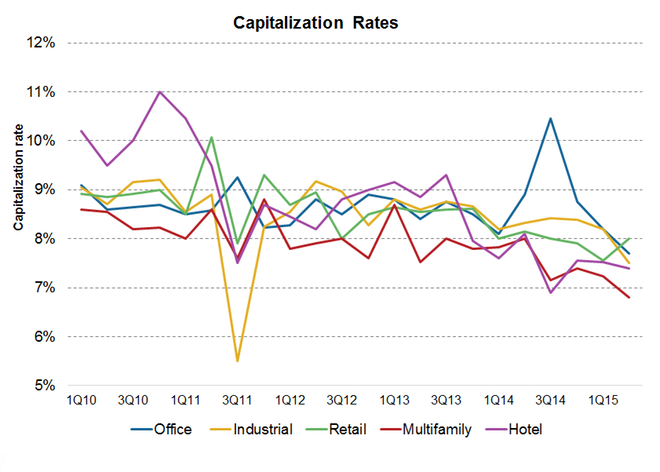

Is it Time to Buy Real Estate? Yes and No

Is it Time to Buy Income-Producing Real Estate? No, No, No. Much to the dismay of my real estate buddies, who are complaining about how high prices while watching the cash flow of their portfolios bursting at the seams from a few good years of ren...

Read More »

Read More »

Great Graphic: Brexit Risks Rise

Brexit Predict This Great Graphic shows the price people are willing to pay to bet that the UK votes to leave the EU at the June 23 referendum on the PredictIt events markets. We included the lower chart to give some sense of volume of activity on this wager in this event market. Presently, one … Continue reading »

Read More »

Read More »

FAQ: ECB’s Corporate Bond Buying Program Starts

In March, the ECB decided to increase its asset purchases from 60 to 80 bln euros a month and to include corporate bonds. The corporate bond buying program begins this week. We use an FAQ format to discuss the key issues. What is the ECB doing? The ECB will buy euro-denominated, investment grade bonds … Continue reading...

Read More »

Read More »

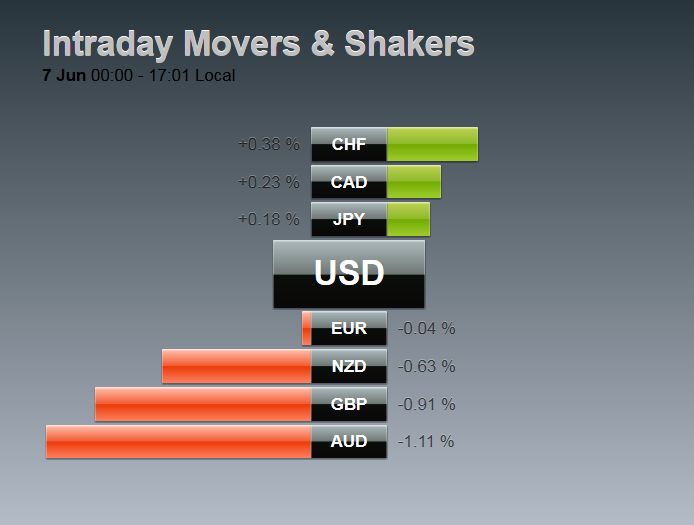

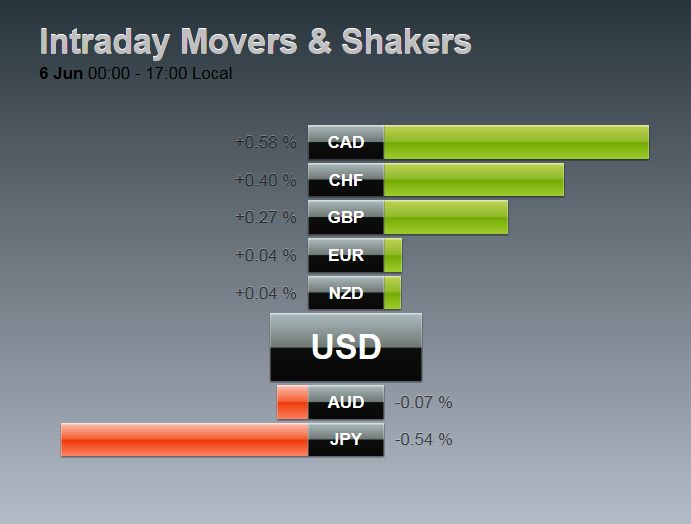

FX Daily, June 6: Shallow Bounce in Dollar, though Sterling Pressured by Brexit Polls

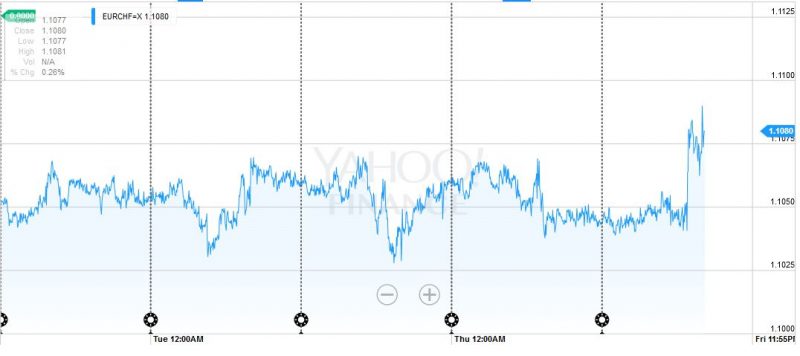

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

Russian central bank meets Friday and is expected to keep rates steady at 11.0%. However, the market is split. Of the 25 analysts polled by Bloomberg, 13 see no move and 12 see a 50 bp cut to 10.5%. The central bank has been on hold since the last...

Read More »

Read More »

“Marxist Dream” Crushed – In Landslide Vote, Swiss Reject Proposal To Hand Out Free Money To Everyone

This weekend the Swiss population was called upon to make a historic decision, when Switzerland became the first country worldwide to put the idea of free money for everyone, technically known as Unconditional Basic Income (of CHF2,500 per month for every adult). The Swiss rejected the proposal with a big majority.

Read More »

Read More »

FX Weekly Preview: Macro Developments Will Not Stand in Way of Dollar Move Lower

Through the first part of the year, the swinging pendulum of expectations for the trajectory of Fed policy has been a major driver in the foreign exchange market. This is true even though the ECB and BOJ continue to ease monetary policy aggressively. The Australian and New Zealand dollars appear to influenced more by the … Continue...

Read More »

Read More »

FX Weekly Review May 30 to June 3: Dollar’s Rally Ends with a Bang

The dollar peaked on May 30, but it was not clear until the poor US jobs report sent the greenback reeling on June 3. The EUR/CHF surprisingly increased, despite weak US data. No wonder, speculators had to cover their short EUR positions.

Read More »

Read More »

Weekly Speculative Positions: Little Adjustment ahead of ECB and US Jobs

The Swiss Franc net position was reduced from 4.0 contracts long to 0.1 thousand contracts long. Apart from the yen., other speculative position barely changed. We are keen on next week's data that should reflect the dismal US jobs report.

Read More »

Read More »

Emerging Markets: What has Changed

Local press is reporting that RBI Governor Rajan does not want to serve another term

The incoming Philippine government is signaling looser fiscal policies ahead

Read More »

Read More »