Tag Archive: newslettersent

Cool Video: Chat with the FT’s John Authers

I was just as surprised as anyone by the election outcome. The initial market reaction was not as surprising, but the dramatic reversal was. About a dozen hours after the election was called, John Authers from the Financial Times came to my office and we chatted. Check out the cool video here.

Read More »

Read More »

FX Daily, November 10: US Dollar, Equities, and Commodities Firmer as Reflation Trade Takes Hold

GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald Trump had won the race for the White House, news which sent shockwaves through the market. How the outcome will affect the global markets is difficult to analyse at this point but could yesterday’s positive spike indicate better...

Read More »

Read More »

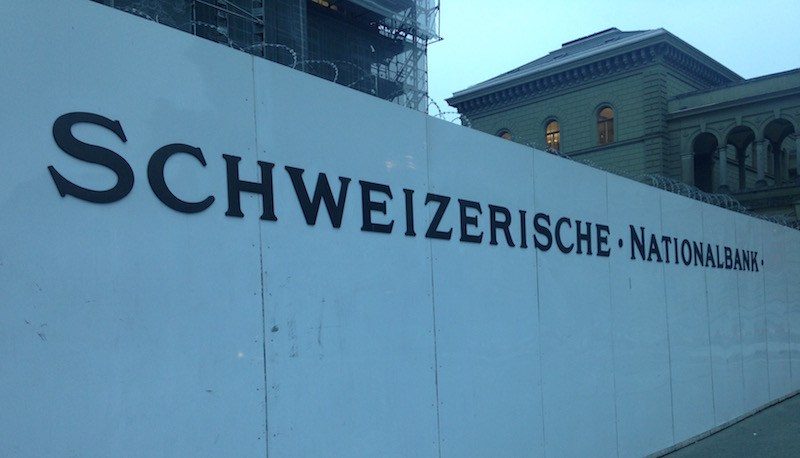

Federal Department of Finance and SNB enter new distribution agreement

The Federal Department of Finance (FDF) and the Swiss National Bank (SNB) have signed a new agreement regarding the SNB’s profit distribution for 2016 to 2020. Subject to a positive distribution reserve, the SNB will in future pay CHF 1 billion p.a. to the Confederation and cantons, as was previously the case. In future, however, omitted distributions will be compensated for in subsequent years if the distribution reserve allows this.

Read More »

Read More »

China Update

The evolving political situation in China is worth monitoring. China's trade surplus with the US has fallen this year. It has been roughly 20 years since China was formally labeled a currency manipulator. Trump has indicated he would do so.

Read More »

Read More »

Who Lost: A Biased Media, Pundits, Pollsters, Political Parties, Warmongers, the Corporatocracy, Pay-to-Play Grifters, Neoliberals

Let's start with the Corporatocracy, which expected to once again wield unlimited influence by funding political campaigns with millions of dollars in contributions and speaking fees. A biased mainstream media. My mom-in-law was watching CBS all night, so that's what we watched. All the pundits/anchors spoke in the hushed tones of a funeral.

Read More »

Read More »

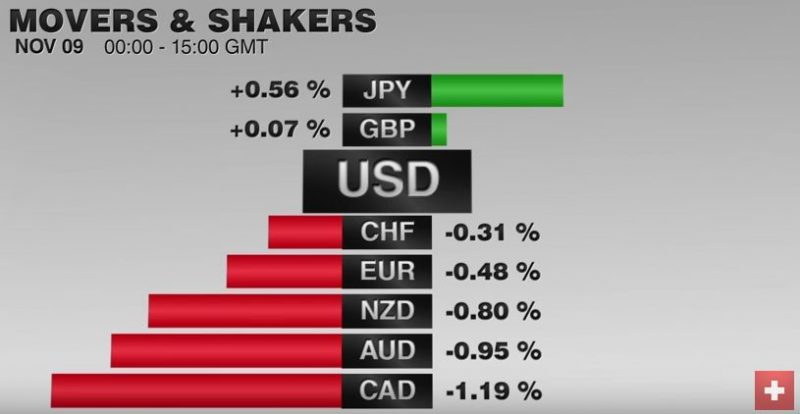

FX Daily, November 09: Mourning in America?

Global capital markets have been roiled by Trump's stunning victory Swiss National Bank's Andrea Maechler promised interventions for the case that Trump wins the elections. It was probably not necessary. Only the EUR/CHF fell to 1.0753. Strangely the dollar and markets recovered.

Read More »

Read More »

Swiss government opposes initiative to transform monetary system

The Swiss government urged rejection of a popular initiative that would transform the monetary system and end fractional-reserve banking, according to its dispatch to Parliament. The measure seeks to put the central bank solely in charge of money supply and forbid commercial banks from granting loans that aren’t fully backed by deposits, effectively ending the way banking has been conducted for centuries.

Read More »

Read More »

Europe stocks split on Trump win with pharma gaining

The region’s largest industry group headed for its biggest jump in more than 14 months, tempering losses for equity benchmarks after Donald Trump won the race to govern the region’s biggest export market. Novo Nordisk A/S and Shire Plc rose more than 5 percent, after investors punished the shares in recent weeks amid disappointing earnings and speculation Hillary Clinton would push for drug-price controls as president. Citigroup Inc. had cut its...

Read More »

Read More »

Cool Video: Bloomberg Interview – Peso, Equities, Yuan

Even before the my polling station opened today, I had the privilege of being on Bloomberg Surveillance today with Gina Cervetti and Tom Keene. We talk about a wide range of issues directly and tangentially related to the US election. We discuss the outcome the market appears to be discounting.

Read More »

Read More »

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

Romanticizing the Gig

Gigs are part of the new lexicon for a long existing phenomenon. It is largely but not solely a capital offensive to lower labor input costs. There may be short-run advantages but long-term challenges from the growth of the gig or contingent workforce.

Read More »

Read More »

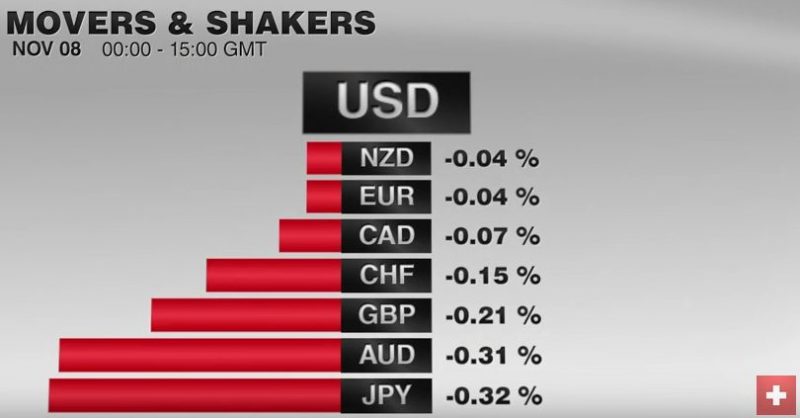

FX Daily, November 08: Consolidation Featured as Market Catches and Holds Breath

The equity markets snapped their losing streak yesterday and are consolidating today. The US dollar is narrowly mixed. The euro and sterling are slightly firmer, but well within yesterday's ranges. The dollar-bloc is a bit lower, and once again the Australian dollar is struggling to sustain moves above $0.7700.

Read More »

Read More »

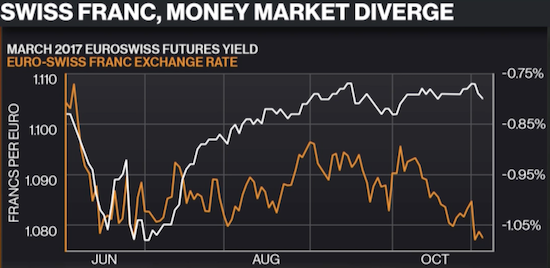

THIS Time A Swiss Franc Hedge Makes More Sense

Money markets and the Swiss franc have diverged despite a presumed increase in event risk from the U.S. Presidential election. Moreover, shorts against the Swiss franc have risen. This surprising divergence opens up a presumed opportunity use the franc as a hedge against a surprise outcome from the election. This time I agree with the strategy even as I suspect that, once again, any subsequent incremental strength in the Swiss franc will be...

Read More »

Read More »

Stock Market Volatility, Gold and the Election

Before this Monday, the S&P 500 Index went down nine days in a row. While this was almost unprecedented (or in any case, a very rare event) the decline was quite small overall. The timing of the pullback and the subsequent strong rebound on Monday suggests that Mr.

Read More »

Read More »

Major Currency Pairs & The Election (Video)

We focus on the Election effects regarding the major currency pairs and the US Dollar in this video. Check out the Swiss Franc and the Mexican Peso Price Action after the election. This election has probably been great for CNN`s ratings, that would be a short after the election cycle is over.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM should trade firmer this week on news over the weekend that the FBI said its conclusion on Clinton’s emails remained unchanged. That should lift the cloud of suspicion that grew when the FBI said new emails had been uncovered. With risk appetite likely to rebound a bit, the Mexican peso should benefit the most as the week gets under way.

Read More »

Read More »

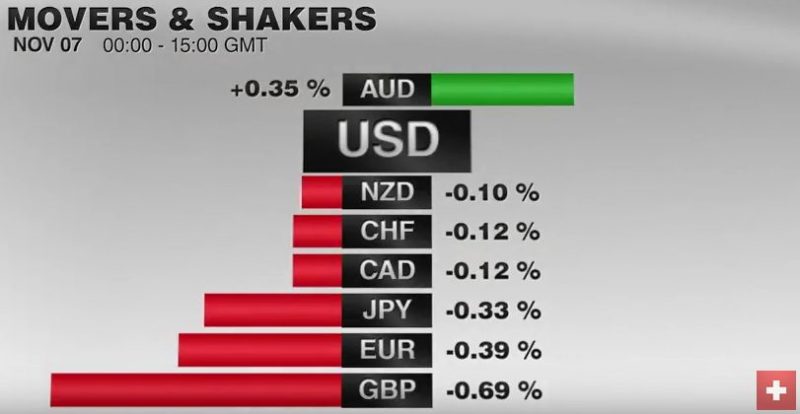

FX Daily, November 07: Dollar Stabilizing After Bounce

The DAX also gapped lower before the weekend and gapped higher today. It is stalling just ahead of the earlier gap from last week (10460-10508). It is up about 1.6% in late-morning turnover. The strongest sector is the financials, up 2.5%, with the banks up 3.4%. Deutsche Bank is snapping a five-session drop. It fell 9.1% last week. It has recouped more than half of that today.

Read More »

Read More »