Tag Archive: newslettersent

Switzerland Consumer Price Index in October 2016: -0.2 percent against 2015, +0.1 percent against last month

Swiss consumer price inflation remain the lowest in comparison with different countries in the euro zone and the United States. Consumer prices in the U.S. are driven by rising health care costs and asset price inflation in shelter.

Read More »

Read More »

SNB Sight Deposits November 7: No interventions, EUR/CHF under 1.08 with political jitters

Sight Deposits: show that the SNB has not intervened to sustain the euro, that dipped under EUR/CHF 1.08. We considered the 1.08 as line in sand for the SNB. The odds of Trump are rising. This causes fear and demand for Swiss Franc. The EUR/CHF fell to 1.0750. Speculators were net short CHF January 2015, shortly before the end of the peg, with 26K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25K contracts. We see...

Read More »

Read More »

FX Weekly Preview: The US Election is The Driver in the Week Ahead

Neither the Mexican peso's performance nor the fed funds futures seem to show that investors think the election is very close. Not all poll analysis showed what the Financial Times called "knife-edge". None of the poll analysis showed Trump winning, and many appear to have stabilized over the last couple of days.

Read More »

Read More »

The One Thing that Will Change Everything

The American populace counts down to Election Day with impatient intent. Will their party man occupy the White House come January 21, 2017? Or will their party woman occupy a federal prison cell? These are questions that only the good wisdom of time can answer. Here at the Economic Prism we watch with indifferent curiosity. We don’t think either candidate’s worthy of high office. But we’re eager to know the election outcome, nevertheless.

Read More »

Read More »

Merkel says Brexit talks mustn’t impact Swiss-EU negotiations

Swiss talks with the European Union about immigration restrictions mustn’t be impacted by the U.K.’s decision to leave the bloc, German Chancellor Angela Merkel said. “In the EU, we should carry on negotiations with Switzerland in the same way as we would have if there were no question on Britain,”.

Read More »

Read More »

Former Treasury Secretary Summers Calls For End Of Fed Independence

At an event in Davos, Switzerland earlier today, Former U.S. Treasury Secretary, Larry Summers, argued that Central Bank independence from national governments should be scrapped in favor of a coordinated effort between politicians, central bankers and treasury to engineer inflation. Seems reasonable, right?...what could possibly go wrong?

Read More »

Read More »

Brexit is making it too expensive to go skiing in Alps

The promise of snow across the Alps this weekend won’t be enough to lift the gloom at some of Europe’s top ski resorts as the pound’s post-Brexit slide dents British bookings. Jon Fricker, a property developer in Beaconsfield, west of London, said some of his friends would probably back out of their annual piste reunion if the cost of a long weekend in the Portes du Soleil ski area straddling the border between France and Switzerland climbs much...

Read More »

Read More »

Is there a Savings Glut?

In his speech at the New York Federal Reserve of New York on October 5, 2016, the Federal Reserve Vice Chairman Stanley Fischer has suggested that a visible decline in the natural interest rate in the US could be on account of the world glut of saving. According to Fischer, both increased saving and reduced investments have potentially significantly lowered the natural rate of interest.

Read More »

Read More »

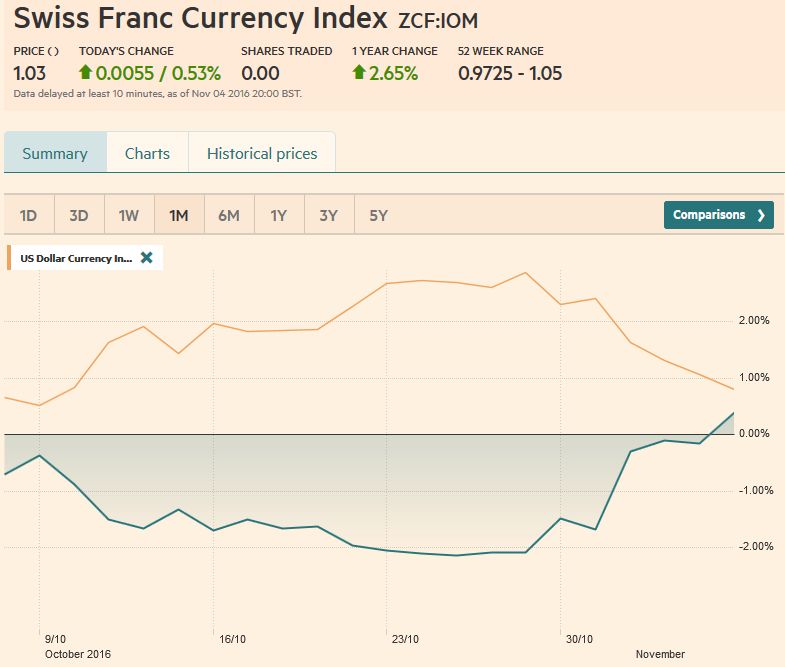

FX Weekly Review, October 31 – November 04: Dollar at Crossroads

Swiss Franc Currency Index As visible in the graph, the Swiss Franc index recovered most of its losses against the US Dollar Index for the last 30 days. In the last 30 days, both the USD currency index and the CHF currency index have had a positive performance.

Read More »

Read More »

Hillary Is The Perfection of a Corrupt System

Exposing the Clintons' perfection of a corrupt political system won't change the conditions and incentives that created the Clintons' harvester of corruption. Let's set aside Hillary Clinton as an individual and consider her as the perfection of a corrupt political system. As I noted yesterday, Politics As Usual Is Dead, and Hillary Clinton is the ultimate product of the political system that is disintegrating before our eyes.

Read More »

Read More »

Crude Oil Has Entered a Seasonal Downtrend

Many market observers are probably expecting crude oil prices to enter a seasonal uptrend due the beginning heating season. After all, the heating season in the Northern hemisphere means that energy consumption will rise. The effect of the heating season on demand is however offset by other factors, such as the use of alternative energy sources and fixed prices agreements made in advance. The question is: what is the actual seasonal trend in crude...

Read More »

Read More »

Carney’s Tenure: Brief Thoughts

Not only is Carney not resigning, but he agreed to stay a year longer than initially agreed. He will stay for the two years that Brexit is negotiated. Sterling rallied, but did not challenge last week's highs.

Read More »

Read More »

FOMC Says Little New, December Hike Remains Likely Scenario

Fed does not expand much on Sept. statement. Bar to December hike seems low. There were two rather than three dissents.

Read More »

Read More »

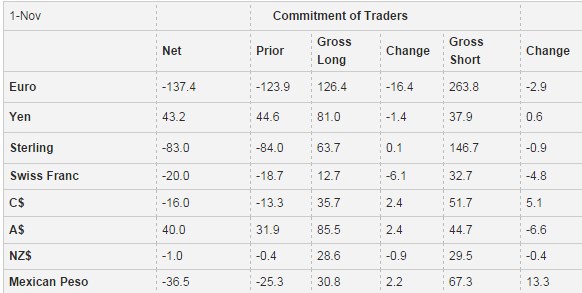

Weekly Speculative Positions: Rising Net Short Euro and CHF, but Stronger Euro and CHF

The weekly speculative position shows increasing short positions on the euro and on the Swiss Franc. On the other side, both currencies have appreciated, what they should not do if net short positions increase. This implies that there is real money, .e.g in the form of cash, bonds, stocks or real estate that is invested in the euro area or in Switzerland. For Switzerland, we will see this in the weekly sight deposits.

Read More »

Read More »

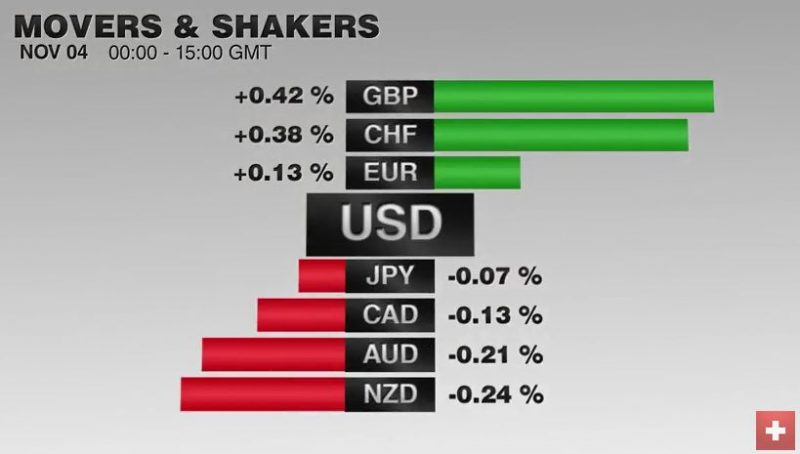

FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions

Read More »

Read More »

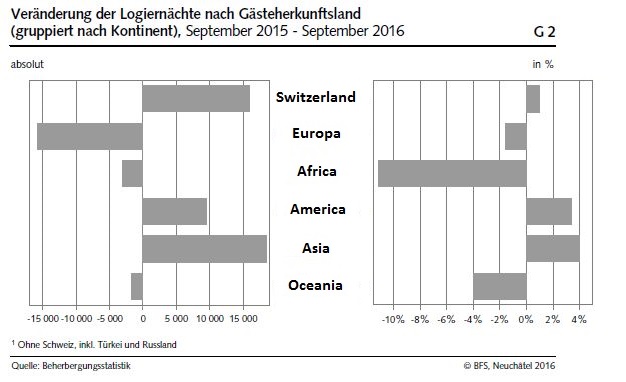

Statistics on tourist accommodation in September 2016: Increase in overnight stays in September

The Swiss hotel industry registered 3.4 million overnight stays in September 2016, which corresponds to a growth of 0.7% (+23,000 overnight stays) compared with September 2015. Domestic visitors registered 1.6 million overnight stays, i.e. an increase of 1.0% (+16,000). Foreign visitors registered 1.8 million overnight stays, i.e. an increase of 0.4% (+7300). These are provisional results from the Federal Statistical Office (FSO).

Read More »

Read More »

SMI down as investors eye the US election

The SMI is set to finish the week notably lower as investors continue to dump equities amid worries about the implications of next week’s US election, the trajectory of interest rates and mixed corporate earnings.

Read More »

Read More »

Did Carney Really Open the Door to a Rate Hike?

Sterling's recovery began before today and went through technical levels that accelerated the advance. The interest rate market did not change sufficiently to indicate a change in policy expectations. The High Court decision will be appealed.

Read More »

Read More »

US Jobs Data Maintains Fed Hike Expectations

US jobs data was largely in line or better than expected. The stronger earnings growth may be more important than the headline. Canada's data was mostly disappointing.

Read More »

Read More »