Tag Archive: newslettersent

Swiss Post to start delivering with drones this summer

Swiss post has said it will deliver the first packages by air this summer. The first deliveries will be made between two medical laboratories on the southern side of the Alps. Test flights were conducted in the canton of Bern last year. Now Swiss Post is ready to make commercial deliveries starting in Lugano.

Read More »

Read More »

The Long Run Economics of Debt Based Stimulus

Something both unwanted and unexpected has tormented western economies in the 21st century. Gross domestic product (GDP) has moderated onward while government debt has spiked upward. Orthodox economists continue to be flummoxed by what has transpired.

Read More »

Read More »

Emerging Markets: What has Changed

The PBOC increased the rates it charges for OMO and MLF by 10 bp. Indian Prime Minister Modi’s BJP won elections in the state of Uttar Pradesh. Czech central bank broached the possibility of a koruna cap exit later than mid-2017. Kuwait became the first OPEC member to call for extended output cuts.

Read More »

Read More »

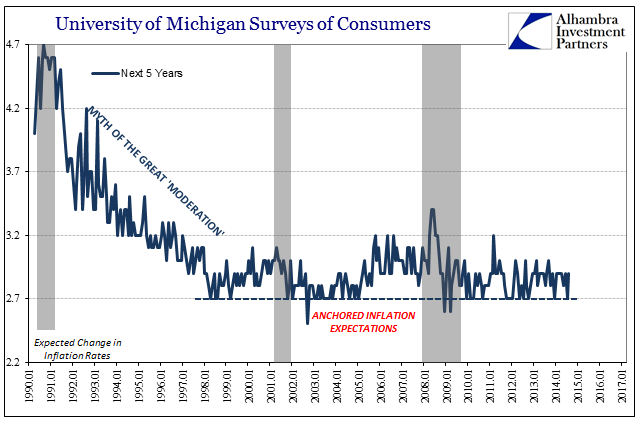

Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate.

Read More »

Read More »

The Swiss Franc Hits its Lowest Since December

According to some experts, the weaker franc can be partly explained by the market activities of the Swiss National Bank (SNB). The cantonal bank of Thurgau said that the SNB appeared to be targeting a weaker franc ahead of the Dutch elections on Wednesday. Adding that they think an exchange rate of around 1.085 against the euro is possible.

Read More »

Read More »

FX Daily, March 17: Dollar Remains Heavy

The dollar is softer against most of the major currencies to cap a poor weekly performance. The Dollar Index is posting what may be its biggest weekly loss since last November. The combination of the Federal Reserve not signaling an acceleration of normalization, while the market remains profoundly skeptical of even its current indications, and perceptions that the ECB and BOE can raise earlier than anticipated weighed on the dollar. The PBOC...

Read More »

Read More »

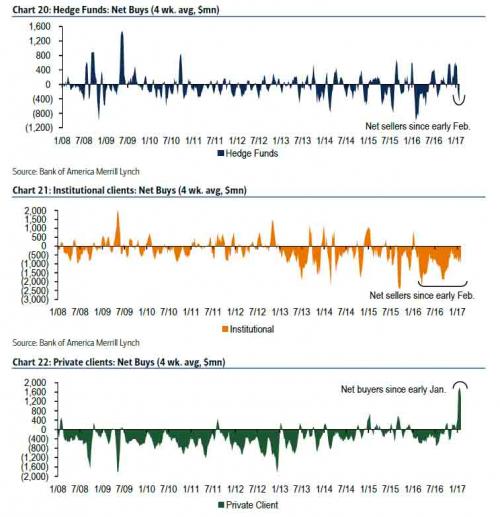

CS and UBS Tell Wealthy Retail Clients To Buy Stocks…”Here, Can You Please Hold This Bag”

Warren Buffett has frequently advised aspiring investors to take a contrarian view on markets and "be fearful when others are greedy and be greedy when others are fearful." In fact, being dismissive of the wall street 'herd mentality' has resulted in some of Buffett's most successful trades over the years including his decision to load up on bank stocks during the 'great recession'.

Read More »

Read More »

Trump: Unilateralism or Isolationism?

Many who think that the US is becoming isolationist are wrong. The thrust is now more about unilateralism. Unilateralism can lead to the US being more isolated.

Read More »

Read More »

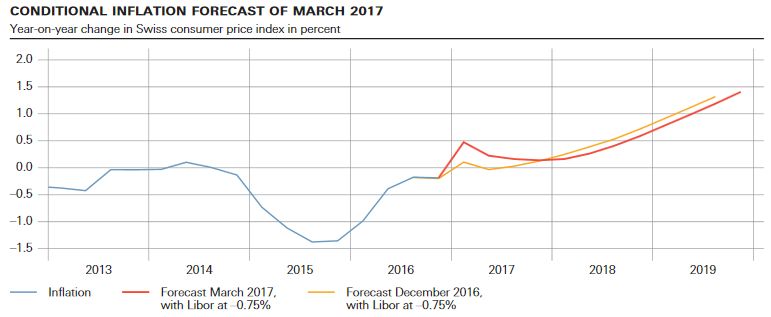

SNB Monetary Policy Assessment March 2017: EUR/CHF lower again

The EUR/CHF collapsed after the monetary assessment meeting of the Swiss National Bank. The SNB did not fulfill the wishes of currency traders with a more dovish policy, i.e. with lower rates or the thread of stronger interventions.

Read More »

Read More »

FX Daily, March 16: Greenback Consolidates Losses as Yields Stabilize

The US dollar remained under pressure in Asia following the disappointment that the FOMC did not signal a more aggressive stance, even though its delivered the nearly universally expected 25 bp rate hike. News that the populist-nationalist Freedom Party did worse than expected in the Dutch elections also helped underpin the euro, which rose to nearly $1.0750 from a low close to $1.06 yesterday.

Read More »

Read More »

Federal Reserve Hikes, but Changes Little Else

Fed made mostly minor changes in the statement as it hiked the Fed funds rate for the third time in the cycle. The average and median dot for Fed funds crept slightly higher. There was only one dissent to the decision.

Read More »

Read More »

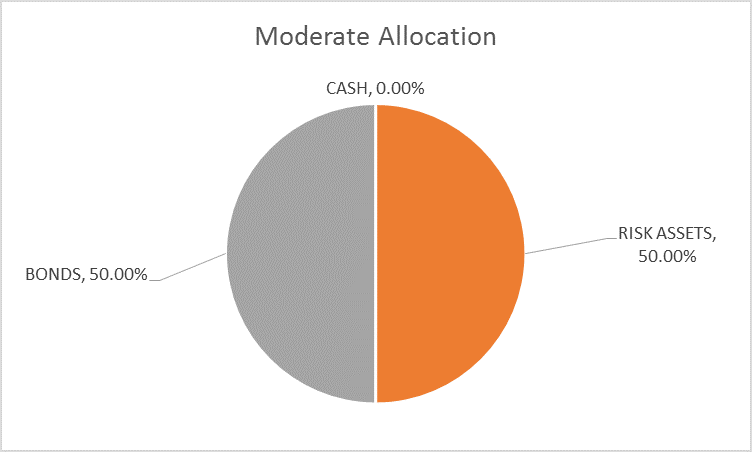

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle.

Read More »

Read More »

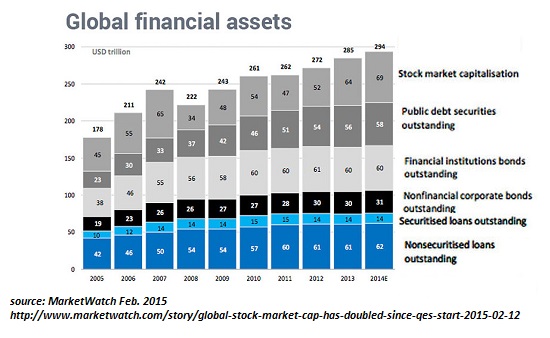

Now That Everyone’s Been Pushed into Risky Assets…

If we had to summarize what's happened in eight years of "recovery," we could start with this: everyone's been pushed into risky assets while being told risk has been transformed from something to avoid (by buying risk-off assets) to something you chase to score essentially guaranteed gains (by buying risk-on assets).

Read More »

Read More »

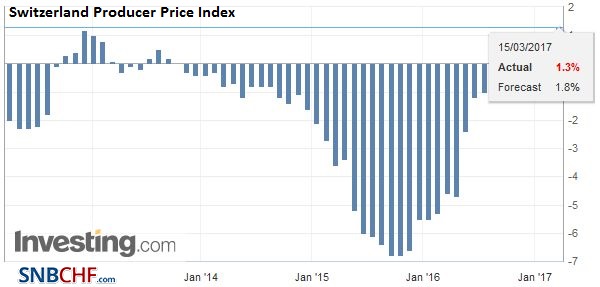

Swiss Producer and Import Price Index in February 2017: -0.2 percent

The Producer and Import Price Index fell in February 2017 by 0.2% compared with the previous month, reaching 100.2 points (base December 2015 = 100). This decline is due in particular to lower prices for scrap, petroleum products and pharmaceutical products. Compared with February 2016, the price level of the whole range of domestic and imported products rose by 1.3%. These are the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, March 15: Greenback Softens Ahead of FOMC

The US dollar is paring yesterday's gains as the market awaits the outcome of the well-telegraphed FOMC meeting. In recent weeks, the combination of data and official comments have swayed market, which had previously anticipated a hike in May or June.

Read More »

Read More »

Vaud Discusses Extending Winter School Holiday to 2 Weeks

In Switzerland, this ski season has been disappointing, particularly if you have school aged children. During the Vaud school holiday this season, the fourth week of February, there was limited snow. Even at high resorts like Verbier, snow conditions were fairly average across the week. The week before there was good snow. But then everyone was still at school. A two-week school holiday in February would increase the chances of striking good snow.

Read More »

Read More »

China’s NPC Ends with New Initiatives

China will make its mainland bond market more accessible. As China's portfolio of patents grows it will likely become more protective of others' intellectual property rights. PRC President Xi will likely visit US President Trump early next month.

Read More »

Read More »

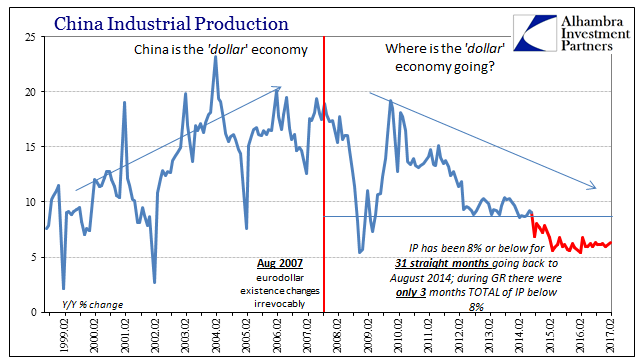

China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%.

Read More »

Read More »

FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland.

Read More »

Read More »