Tag Archive: newslettersent

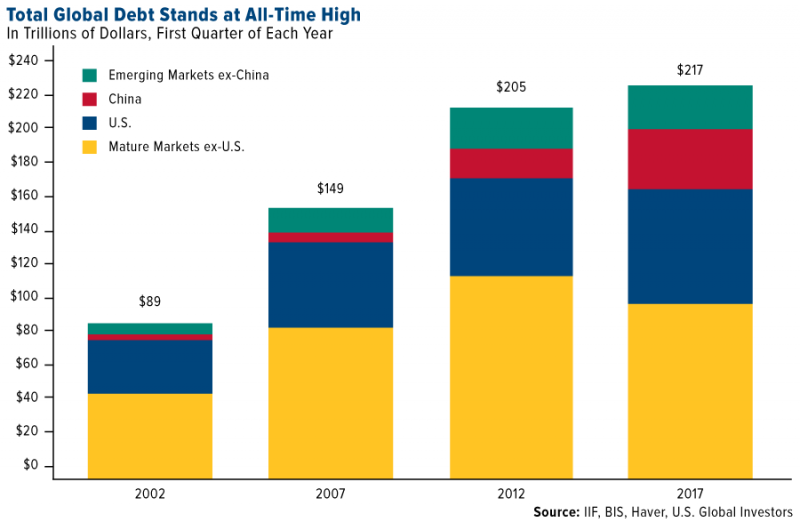

Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble

‘Mother of all debt bubbles’ keeps gold in focus. Global debt alert: At all time high of astronomical $217 T. India imports “phenomenal” 525 tons in first half of 2017. Record investment demand – ETPs record $245B in H1, 17. Investors, savers should diversify into “safe haven” gold. Gold good ‘store of value’ in coming economic contraction.

Read More »

Read More »

UN group demands reversal of Swiss minaret ban

Switzerland should take steps to ensure that people's initiatives do not contravene international law, the United Nations Human Rights Committee says. It notably called for the repeal of a Swiss vote banning the construction of minarets.

Read More »

Read More »

Dollar View: Discipline or Stubbornness

Fundamental driver, divergence is still intact. The dollar's losses have barely met the minimum retracements of a bull market. Sentiment may be exaggerating the positive developments in Europe and the negative developments in the US.

Read More »

Read More »

Why Surging UK Household Debt Will Cause The Next Crisis

Easy credit offered by UK banks is endangering “everyone else in the economy”. UK banks are “dicing with the spiral of complacency” again. Bank of England official believes household debt is good in moderation. Household debt now equals 135% of household income. Now costs half of average income to raise a child. Real incomes not keeping up with real inflation. 41% of those in debt are in full-time work. £1.537 trillion owed by the end of May...

Read More »

Read More »

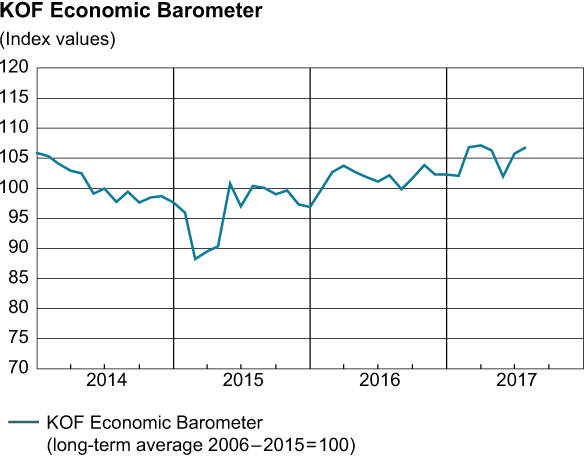

Great Graphic: What Is the Swiss Franc Telling Us?

Swiss franc weakness is a function of the demand for euros. SNB indicates it will lag behind the other major central banks in normalization process. Easing of political anxiety in Europe is also negative for the franc.

Read More »

Read More »

FOMC Sticks to Script: Balance Sheet Unwind to Begin “Relatively Soon” and USD Retreats

Little new in FOMC statement. Seems consistent with a Sept announcement to begin reducing the balance sheet in Oct. USD sold off as if reflecting sentiment held in bay until the statement was out of the way.

Read More »

Read More »

Missing glass eye? Contact Swiss railways

A glass eye, wedding dress and fakir costume were among the 127,000 items passengers left behind on Swiss trains last year. Wheelchairs, prostheses and dentures counted among the unusual objects on the list, which was dominated by clothes and mobile phones.

Read More »

Read More »

Swiss students reveal prototype for experimental hyperloop

A pod built by students at Zurich’s Federal Institute of technology (ETHZ) will be competing to be the fastest to navigate the Hyperloop experimental high-speed transportation system in California. The Swiss pod, named Escher after the 19th century Swiss entrepreneur Alfred Escher, was unveiled at ETHZ at a ceremony on Thursday.

Read More »

Read More »

Emerging Markets: What has Changed

Indonesia’s parliament approved a revised budget for 2017 that sees a wider deficit. Pakistan’s Supreme Court has ousted Prime Minister Sharif. Polish President Duda vetoed portions of the judicial reform bill submitted by the Law and Justice party.

Read More »

Read More »

FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015.

Read More »

Read More »

Swiss franc weakens to symbolic low

The Swiss franc has fallen to its lowest point since the January 2015 unpegging of the currency from the euro. The symbolic moment will be a huge relief to Swiss exporters and the tourism industry. As of Thursday morning, the franc was trading at 1.12 to the euro, a drop of 1.8 percent since Monday. It is the weakest level reached since the decision by the Swiss National Bank (SNB) to remove the cap two-and-a-half years ago.

Read More »

Read More »

Strong franc forces Swiss paper mill to close

The closure of a paper factory in canton Bern will leave only one such plant supplying the newspaper and magazine industry in Switzerland from next year. The 125-year-old Utzenstorf factory will close its doors at the end of 2017, management announced on Tuesday.

Read More »

Read More »

Great Graphic: Surprise-S&P 500 Outperforming the Dow Jones Stoxx 600

Many asset managers have been bullish European shares this year. European and emerging market equities are among the favorite plays this year. Surveys of fund managers find that the allocation to US equities is among the lowest in nearly a decade. The case against the US is based on overvaluation and being a crowded trade. Many are concerned about too hawkish of a Federal Reserve (policy mistake) or the lack of tax reform.

Read More »

Read More »

The Myth of India’s Information Technology Industry

When I was studying in the UK in early 90s, I was often asked about cows, elephants and snake-charmers on the roads in India. A shift in public perception— not in the associated reality — was however starting to happen. India would soon become known for its vibran

Read More »

Read More »

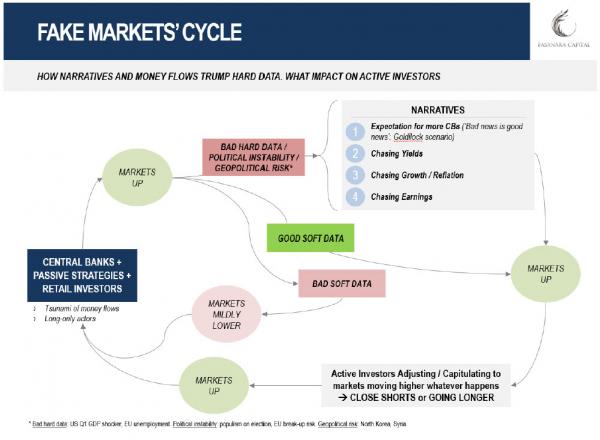

When Do We Know These Are Delusional Markets

Signs of complacency and disconnect from fundamentals abound. So to sanity check, it may still be helpful to periodically remind ourselves of a few recent ones. In no particular order. The Swiss National Bank bought $ 100bn between US and European stocks. It now owns 26 million Microsoft shares (read).

Read More »

Read More »

FX Daily, July 27: Dollar Remains on the Defensive

The US dollar is narrowly mixed after selling off following the FOMC statement. Sometimes the narrative explains the price action, and sometimes the price action explains the narrative. This seems to be the case of the latter. The dollar and interest rates fell, and so the Fed was dovish.

Read More »

Read More »

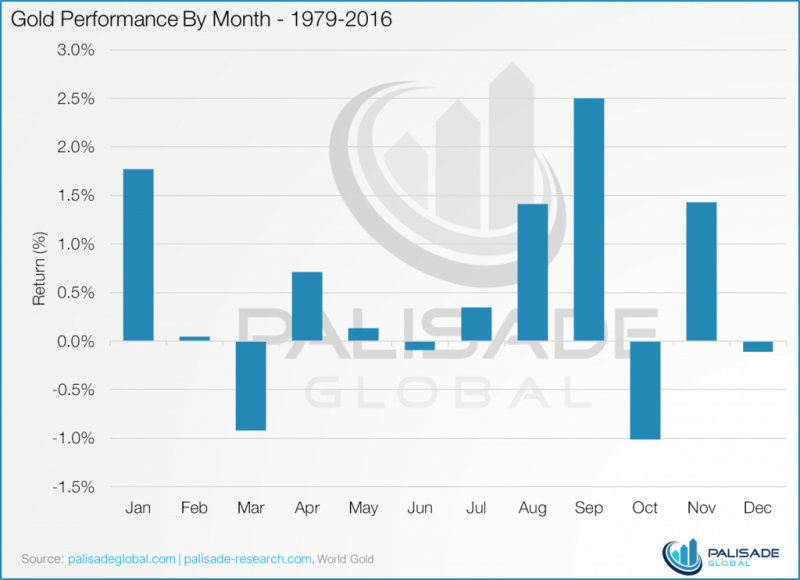

Gold Seasonal Sweet Spot – August and September – Coming

Gold seasonal sweet spot – August and September – is coming. Gold’s performance by month from 1979 to 2016 – must see table. August sees average return of 1.4% and September of 2.5%. September is best month to own gold, followed by January, November & August.

Read More »

Read More »

Progress in St. Petersburg

Expectations going into the OPEC monitoring meeting in St. Petersburg were low. The OPEC agreement to reduce output appeared to be fraying. June output appeared to have increased in several countries, and private sector estimates suggest output rose further in July. Russia expressed reluctance to extend the agreement further.

Read More »

Read More »

Zurich airport reports record passenger numbers

Switzerland’s main airport of Zurich is going from strength to strength, setting a new daily record. On Sunday about 107,000 passengers travelled through the airport in just one day, a spokeswoman said. The figure compares with the average daily figure of 30,000 passengers. Travellers flying to a destination in the United States have been asked to arrive at the airport at least three hours before departure, as separate security checks for...

Read More »

Read More »