Tag Archive: newsletter

Should Libertarians be Monarchists?

If we are to consider the desirability of monarchy through a libertarian lens, it is important to make distinctions between greatly differing types of monarchy.

Read More »

Read More »

USDCAD technicals. USDCAD is testing the extremes of the narrow trading range. What next?

The USDCAD was in a 30 pip trading range since Friday. That is too narrow. The buyers tried to break higher. That failed. The sellers are trying to break lower in the early NA session. Can the sellers keep the momentum going?

Read More »

Read More »

The USD is higher to start the day with the USDJPY leading the way again

In the video, I take a technical look at the 3 major currency pairs - the EURUSD, USDJPY and GBPUSD.

investingLive is a real-time market news and analysis platform, built on the legacy of ForexLive. Covering forex, stocks, commodities, and global markets, it delivers fast, reliable updates to support informed trading and investment decisions. With a global team of expert analysts, investingLive combines speed and clarity to keep professionals...

Read More »

Read More »

Die Unterschiede zwischen Girokonten sind groß

Ob Zinsen auf dem Girokonto, kostenlose Bargeldabhebungen oder Fremdwährungsgebühren – die Unterschiede zwischen Girokonten sind groß. In unserem Vergleich erfährst du, welches Girokonto 2025 für dich am besten passt ℹ️

Ein neues Girokonto sorgt gerade für frischen Wind im Markt – mit 3% Zinsen aufs Guthaben und 3% Cashback auf deine Einkäufe. Da stellt sich natürlich die Frage: Was sind aktuell eigentlich die besten Girokonto-Angebote? Und vor...

Read More »

Read More »

Swiss government rejects initiative against animal testing

Animal experiments should not be banned in Switzerland, according to the Swiss government, which submitted its views to Parliament on the initiative “Yes to a future without animal experiments”. This comes three years after a similar text was widely rejected by the Swiss people. +Get the most important news from Switzerland in your inbox The …

Read More »

Read More »

10-8-25 Markets, Money & Mindset: Live Q&A with Lance Roberts

JJoin Lance Roberts for a live open Q&A on markets, money, and investing.

We’ll cover what’s on your mind—from market melt-ups and Fed policy to portfolio positioning and economic risks. No scripts, no fluff—just real talk and real answers about what’s moving markets and shaping investor behavior.

0:19 - Markets are Absorbing Money

4:14 - Profit Taking in Bitcoin

9:15 - YouTube Poll - The #1 Thing on Your Mind About Markets

10:09 - How Do You...

Read More »

Read More »

SI HAMÁS CAE, ESTO PASARÍA

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

Eilmeldung: Kemmerich zerlegt sich komplett selbst! SCHON WIEDER!

✅ Sichere dir 30 € in Bitcoin bei deiner ersten Investition in eine Kryptowährung bei Coinbase 👉 https://coinbase-consumer.sjv.io/c/6428886/3162518/9251 *

Mehr Infos zu Coinbase:

✅ In Deutschland reguliert seit 2021

💹 260+ Kryptowährungen

💰Ab 0,15% Gebühren (Advanced-Modus)

📦Limit-, Markt-& Stop-Orders

📅Flexible Sparpläne (täglich bis monatlich)

💳Visa-Karte zum Zahlen mit Krypto oder Euro

Haftungsausschluss:

Investieren ist mit Risiken...

Read More »

Read More »

Dollar Jumps by Default

The US dollar's recovery accelerated today, and it has not deterred gold from surging through the $4000-mark in the spot market. With the US government still shut and no apparent negotiations to end it, greenback's gains seem to be a reflection of poor developments elsewhere.

Read More »

Read More »

The Doctrine of the Ruling Party in Paraguay

In Paraguaya, democracy was suitable from the start for the genuine expression of demagoguery, persuading the public, while essentially racketeering and assuring mob rule by the mob.

Read More »

Read More »

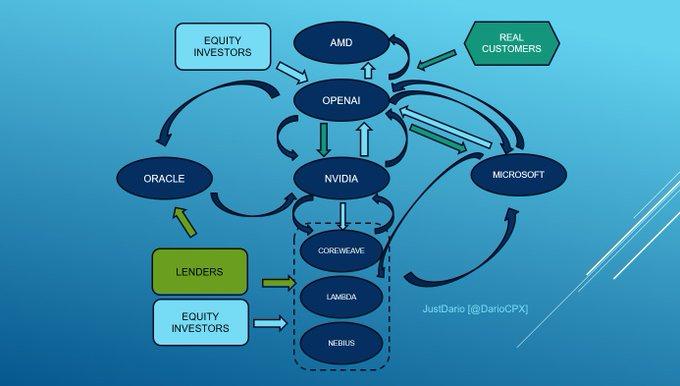

OpenAI: Fueling Massive AI Stock Gains

As we led in yesterday's Commentary, AMD rose 25% on the news that OpenAI would purchase 10% of AMD. In exchange, OpenAI will become a significant customer of AMD. This symbiotic relationship is just one of many that OpenAI is forming with companies at the forefront of the AI revolution. The bullet points and graphic …

Read More »

Read More »

Recession And Bonds: Navigating The Next Recession

It's odd to consider, but a recession could flip our bullish outlook on bonds to bearish. It's unusual because typically, inflation drops during a recession, leading to lower yields and higher bond prices. While we believe that if an economic downturn or recession occurs soon, the immediate effect on bonds will be favorable. However, the …

Read More »

Read More »

Swiss SMEs ramp up adoption of AI in workplaces

Artificial intelligence (AI) is increasingly being used by Swiss small-and-medium enterprises (SMEs) according to a survey by research institute Sotomo. +Get the most important news from Switzerland in your inbox This is especially the case for translation and correspondence. Around half of the 300 companies surveyed use AI in this area. AI is also popular …

Read More »

Read More »

Swiss fragrance firm Givaudan to build site in US

Givaudan announced on Wednesday that it is investing CHF187 million ($233 million) in the construction of a new production plant near Cincinnati, Ohio, in the US. The flavours and fragrances giant intends to strengthen its presence in the North American region. +Get the most important news from Switzerland in your inbox Construction has begun on …

Read More »

Read More »

Länder mit den höchsten Beschäftigungsquoten #oecd

Länder mit den höchsten Beschäftigungsquoten 💼 #oecd

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Apollo News Chef zerlegt die Linke in alle Einzelteile!

✅ Sichere dir 30 € in Bitcoin bei deiner ersten Investition in eine Kryptowährung bei Coinbase 👉 https://coinbase-consumer.sjv.io/c/6428886/3162518/9251 *

Mehr Infos zu Coinbase:

✅ In Deutschland reguliert seit 2021

💹 260+ Kryptowährungen

💰Ab 0,15% Gebühren (Advanced-Modus)

📦Limit-, Markt-& Stop-Orders

📅Flexible Sparpläne (täglich bis monatlich)

💳Visa-Karte zum Zahlen mit Krypto oder Euro

Haftungsausschluss:

Investieren ist mit Risiken...

Read More »

Read More »

Study: Swiss watch industry shows resilience in face of US tariffs

The Swiss watch industry is facing difficulties in the face of US tariffs. However, according to a study by the consulting firm Deloitte, the industry has proved resilient so far. +Get the most important news from Switzerland in your inbox Import duties of 39% on Swiss watches have been in force in the US since …

Read More »

Read More »

ABB to sell robotics division to Softbank Group

The Swiss-Swedish technology group ABB is selling its robotics business to the SoftBank Group for $5.4 billion (CHF4.3 billion). +Get the most important news from Switzerland in your inbox The original idea of a spin-off of the business as an independently listed company will therefore not be pursued further, as ABB announced on Wednesday. The …

Read More »

Read More »

LVMH-ABSTURZ: Die Jahrhundert-Chance für Dein Geld!

Sichere dir dein Ticket für den Kapitaltag am 20.03.2026 in München! 👉 https://kapitaltag.de

Die LVMH-Aktie ist gefallen – doch ist sie jetzt auch günstig? Wir verlassen uns nicht auf Bauchgefühl, sondern auf harte Daten! In diesem Video zeigen wir dir unsere detaillierte Analyse und eine Methode, die weit über normale Charttechnik hinausgeht.

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch🤝🏽:

►...

Read More »

Read More »

„Gold und Silber lieb’ ich sehr, kann’s auch gut gebrauchen…“

Dieses Volkslied ist derzeit der Schlager an den Anlagemärkten. Tatsächlich, was für ein Höhenrausch: Gold bei 4.000 und Silber kurz vor 50 US-Dollar. Und das geopolitische und (finanz-)wirtschaftliche Umfeld spricht nicht dafür, dass der Aufwärtstrend - abgesehen von zwischenzeitlichen Konsolidierungen - beendet ist.

Read More »

Read More »