Tag Archive: newsletter

The Real Diseased Body

Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter?For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work.

Read More »

Read More »

FINMA veröffentlicht weitere Aufsichtsmitteilung im Kontext der COVID-19-Krise

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht eine zweite Aufsichtsmitteilung mit Hinweisen für die Beaufsichtigten zu Erleichterungen und Präzisierungen der Aufsichtspraxis im Kontext der COVID-19-Krise.

Read More »

Read More »

Coronavirus: new infections slowing in Switzerland

The number of new recorded Covid-19 cases is slowing in Switzerland. By 8 April 2020 the total number of recorded cases was 23,574 according to Switzerland’s health authority.

Read More »

Read More »

Swiss banks bow to pressure to delay half of dividend payments

Switzerland’s two largest banks, UBS and Credit Suisse, have asked shareholders to accept a delay of several months for half of their dividend payments this year. The move follows a request from the financial regulator to hold on to more cash during the coronavirus pandemic.

Read More »

Read More »

The World Has Changed More Than We Know

Put another way: eras end. While the mainstream media understandably focuses on the here and now of the pandemic, some commentators are looking at the long-term consequences. Here is a small sampling: While each of these essays offers a different perspective, let's focus on the last two: Ugo Bardi's essay on Hyperspecialization and the technological responses described in the MIT Technology Review essay.

Read More »

Read More »

How Risk-Based Healthcare Could Make Us Healthier

It is generally the case that simple concepts in nature produce incredible complexity. This applies to the genome, where simple base pairs have evolved to express complex and multifunctional instructions that would take thousands of lines of code for any human to create. This applies to the economy, where simple ideas such as the price system become infinitely complex at scale.

Read More »

Read More »

Jp Cortez joins Phillip Kennedy on Kennedy Financial

Sound Money Defense League Policy Director Jp Cortez joins Phil Kennedy of Kennedy Financial to discuss sound money on the state and federal level, and the harms of inflation.

Read More »

Read More »

Bleibe ich in P2P-Kredite investiert? ??

Aktuell ist viel los bei P2P-Krediten, viele Leute ziehen aus Angst und Panik und teilweise auch aus berechtigten Gründen ihr Geld ab. Aber wie werde ich mit meinen Investments fortfahren? P2P-Kredite sind auch schon vor der Krise ein extrem risikoreiches Investment gewesen. Ich habe diese nur als Beimischung mit einem sehr kleinen Prozentsatz meines Vermögens genutzt.

Read More »

Read More »

FX Daily, April 10: Eight Things to Know about Global Capital Markets on Good Friday

Most of the financial centers in Europe and North America are closed today for the Good Friday holiday. Many markets in Europe will also be closed on Monday. Here is a summary of key developments.

Read More »

Read More »

USD/CHF Asia Price Forecast: Greenback holds above 0.9700 vs. Swiss franc

USD/CHF’s bull trend remains intact as the spot holds above the 0.9700 figure. The level to beat for bulls is the 0.9800 resistance. USD/CHF is trading below the 100 and 200 SMA on the daily chart as the market is consolidating the last leg up.

Read More »

Read More »

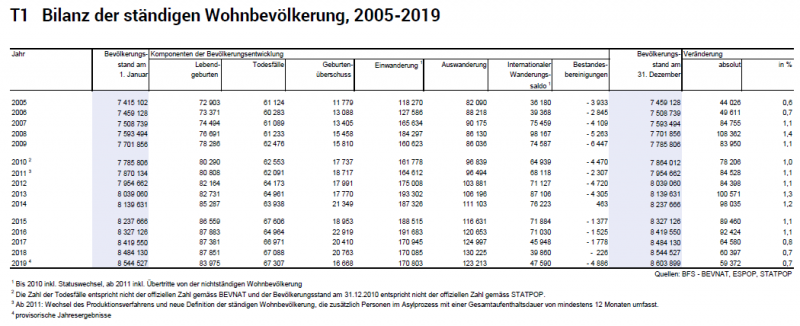

Switzerland’s population continued to increase and age in 2019

09.04.2020 - At the end of 2019, Switzerland had a population of 8 603 900, i.e. 59 400 persons (+0.7%) more than in 2018. Since 2017, the population has grown more slowly than in previous years. Zurich recorded the greatest increase while Appenzell Innerrhoden, Neuchâtel, Nidwalden and Ticino saw their population decline.

Read More »

Read More »

Swiss economy could lose up to CHF35 billion to pandemic

Coronavirus will cost the Swiss economy CHF22 billion ($22.7 billion) in lost productivity in the best-case scenario, economists have warned. Losses could easily mount up to CHF35 billion between March and June. A nationwide lockdown of non-essential high street shops and services has been accompanied by partial closures of industrial plants in some cantons.

Read More »

Read More »

Lessons from Singapore?

Singapore has been hailed for its quick response to the coronavirus that limited initial infections, but the outlook is shifting. Despite their early success, they will have to revert to a lockdown. Can Singapore’s experience offer any lessons for European and the US policymakers?

Read More »

Read More »

Nothing Is What It Seems

My latest interview about Corona, Liberty, Private Property, Authoritarism, and a fear-mongering global media campaign, which I call borderline criminal

[embedded content]

Read More »

Read More »

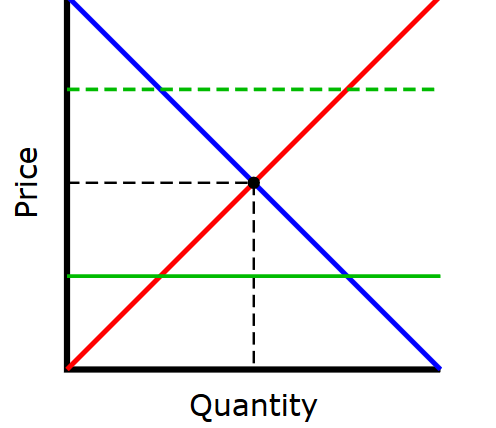

The Real Cost of Anti-Price-Gouging Laws

As has happened before with many natural disasters, the COVID-19 panic is leading to complaints of shortages and “gouging,” which about two-thirds of US states have passed laws against (often in terms so vague that it makes any enforcement discretionary, and thus discriminatory). But rather than complaining of shortages and gouging, critics should realize that “gouging” is the solution to shortages, not a cost in addition to them.

Read More »

Read More »

FX Daily, April 9: Three Deals Needed ahead of Holiday Weekend

Overview: Three deals need to be struck. First, the Eurogroup of finance ministers needs to reach an agreement of proposals for joint action to the heads of state. Second, oil producers need to cut output if prices are to stabilize. Third, the US Congress needs to strike a deal to provide more funding. Investor seems hopeful, and risk appetites are have lifted equities.

Read More »

Read More »

FINMA begrüsst Dividenden-Schritt der Grossbanken

Die Eidgenössische Finanzmarktaufsicht FINMA begrüsst den heute von der UBS Group AG und der Credit Suisse Group AG angekündigten Schritt, trotz deren Position der Kapitalstärke jeweils die Hälfte der geplanten Dividendenausschüttung für das Jahr 2019 zu verschieben.

Read More »

Read More »

Swiss firm helps reduce shortage of disinfectant in Bavaria

The Swiss chemical company Clariant has started monthly production of two million litres of disinfectant at its facilities in neighbouring Germany amid the coronavirus pandemic. In a joint venture with Germany’s CropEnergies, Clariant is using its available infrastructure in Bavaria to blend the necessary ingredients, notably ethanol, into disinfectant, the Swiss company said.

Read More »

Read More »

Cool Video: OIl, ECB, and Animal Spirits

I had the privilege to join Ben Lichtenstein at TD Ameritrade (from a remote location) this morning to talk about the global markets. I make four points. First, the reversal of the S&P 500 yesterday set the tone for Asia and Europe. Volatility throughout the capital markets remains elevated, even if off the peaks.

Read More »

Read More »