- USD/CHF’s bull trend remains intact as the spot holds above the 0.9700 figure.

- The level to beat for bulls is the 0.9800 resistance.

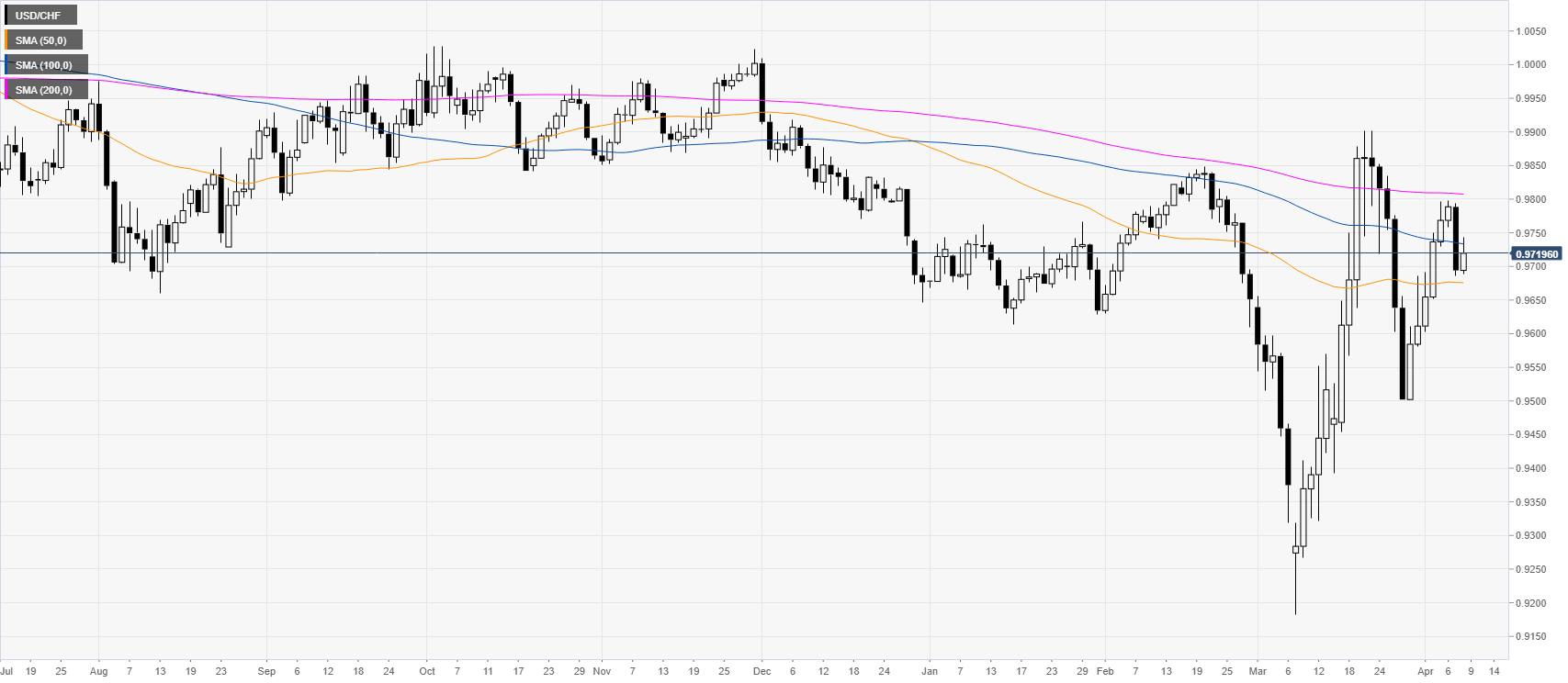

USD/CHF daily chartUSD/CHF is trading below the 100 and 200 SMA on the daily chart as the market is consolidating the last leg up. |

USD/CHF daily chart |

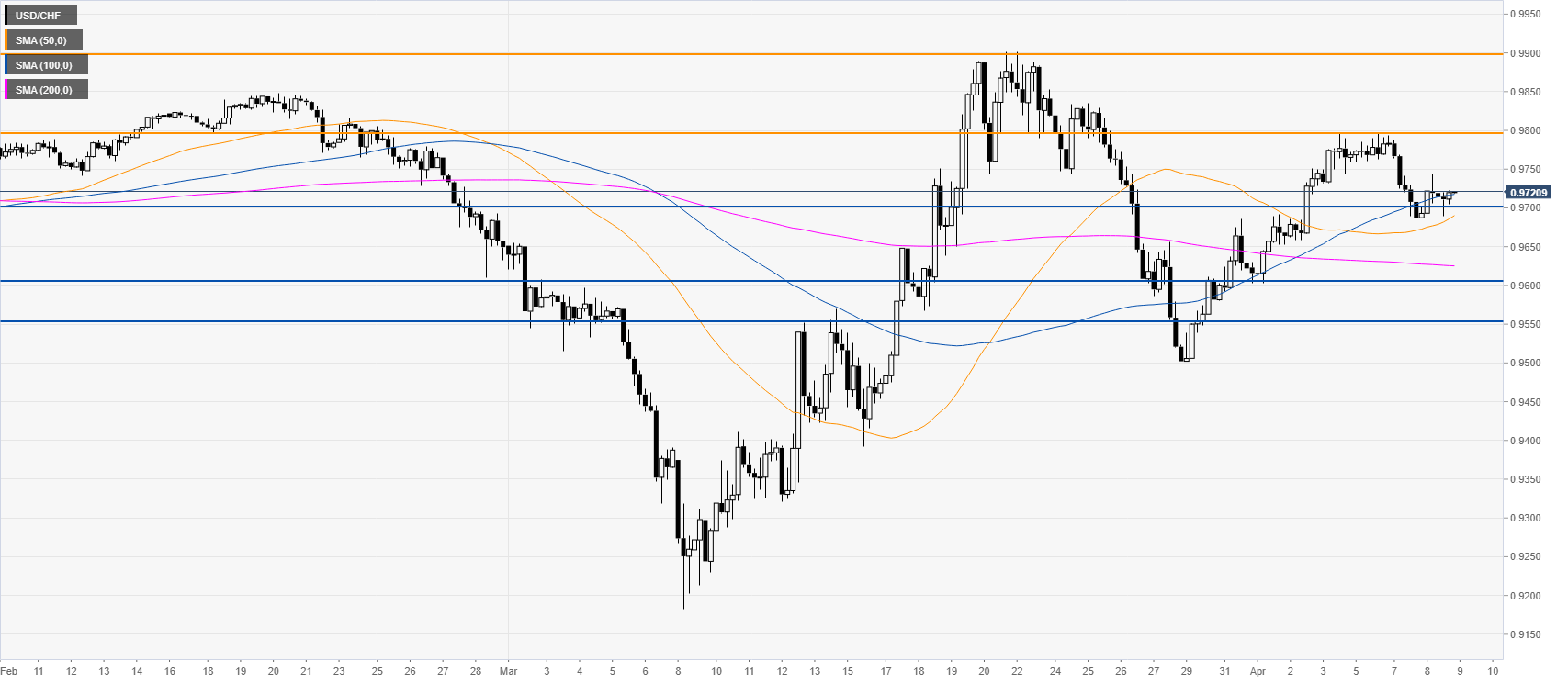

USD/CHF four-hour chartUSD/CHF is trading above the 50/200 SMAs on the four-hour chart leaving the bull trend intact as bulls will be looking for a break above the 0.9800 handle en route towards the 0.9900 figure while support is expected to emerge near the 0.9700 and 0.9600 levels on the way down. |

USD/CHF four-hour chart |

Full story here Are you the author? Previous post See more for Next post

Tags: newsletter