Tag Archive: newsletter

GBPCHF Strengthens on News That COVID-19 Spread Appears to Be Slowing

The pound continued to strengthen against the Swiss franc yesterday following the news that the UK’s current lockdown situation appears to be slowing the spread of COVID-19, causing a 0.85% movement in GBPCHF exchange rates throughout the day.

Read More »

Read More »

Coronavirus: Swiss tourism expected to lose 6.4 billion francs

Tourism is one of the sectors hardest hit by the coronavirus and the response to it. Figures from a study by HES-SO Valais published by the newspaper Blick suggest the industry will see revenues in Switzerland drop 18%, or CHF 6.4 billion, in 2020.

Read More »

Read More »

Businesses reach out to people at home

While most businesses have temporarily shut down, others are starting up or finding new ways to reach the public in their homes. Some Swiss farm shops, like Thierry Miauton'sexternal link in Oleyres, canton Fribourg, are delivering local produce to people’s doorsteps, so the clients don’t have to risk possible contact with virus-contaminated shoppers in supermarkets.

Read More »

Read More »

April Monthly

In March, the G10 and many emerging market countries, governments, and central banks unveiled large emergency measures. The motivation is to blunt the economic impact of the novel coronavirus that has seen more than two billion people around the world have their movement restricted. Large swathes of the world's economy have shut down.

Read More »

Read More »

Banks Or (euro)Dollars? That Is The (only) Question

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes.

Read More »

Read More »

Dollar Bid as Market Sentiment Worsens

The virus news stream out of Europe has improved a bit. The US is already taking about the next relief bill; the Fed continues to roll out measures to address dollar funding issues. ADP and ISM manufacturing PMI are the US data highlights. Regulators across Europe are asking banks to stop paying dividends; eurozone and UK reported final manufacturing PMIs.

Read More »

Read More »

The Crisis Has Exposed the Damage Done By Government Regulations

As we watch in real-time how governments respond to the novel coronavirus pandemic, some of the most predictable forms of state overreach—from restrictions on the freedom of assembly to the suppression of regular commerce—have been rolled out. Thankfully, there is no unified world government, so there exist various examples of how certain countries are dealing with the crisis that we can closely examine and learn from.

Read More »

Read More »

FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly higher, with Japan and Australia the notable exceptions.

Read More »

Read More »

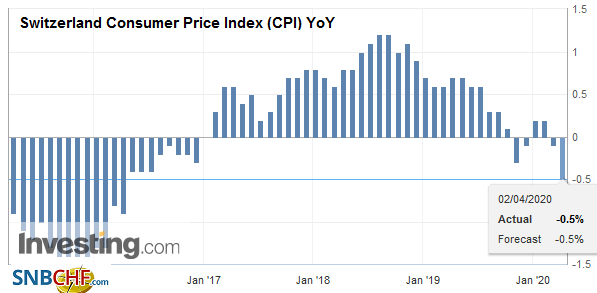

Swiss Consumer Price Index in March 2020: -0.5 percent YoY, +0.1 percent MoM

02.04.2020 - The consumer price index (CPI) increased by 0.1% in March 2020 compared with the previous month, reaching 101.7 points (December 2015 = 100). Inflation was –0.5% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

USD/CHF Price Analysis: US dollar bulls nearing 0.9700 handle vs. Swiss franc

USD/CHF is trading up for the third consecutive day. The level to beat for bulls is the 0.9700 resistance. USD/CHF is rebounding from the 0.9500 level while challenging the 50 SMA on the daily chart. DXY (US dollar index) is gaining some ground vs. most of its rivals.

Read More »

Read More »

EasyJet Switzerland seeks state aid as virus empties skies

Airlines around the world are battling to survive the coronavirus pandemic. After grounding its fleet of planes on Monday, EasyJet Switzerland has confirmed that it is hoping to receive Swiss state aid. EasyJet said on Monday that it had grounded its fleet of 344 planes and had no clear idea when it might resume flights. In Switzerland, the airline normally operates flights to Geneva, Basel-Mulhouse and Zurich airports.

Read More »

Read More »

Coronavirus: loss of smell indicates “very high likelihood” of infection

While there is currently no scientifically proven link between anosmia (loss of smell) and Covid-19, more and more experts are saying the symptom is a strong indicator. Gilbert Greub, head of the microbiology department at the CHUV hospital in Lausanne, is one such expert. “Given the widespread Covid-19 epidemic, I think that everyone who has a problem tasting or a problem smelling has a very high likelihood of testing positive and should be tested.

Read More »

Read More »

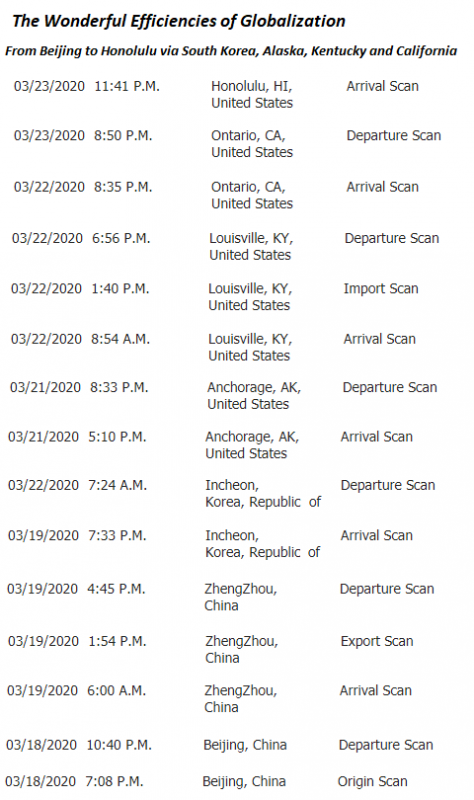

The Wonderful Insanity of Globalization

So here's an April Fools congrats to globalization's many fools. The tradition here at Of Two Minds is to make use of April Fool's Day for a bit of parody or satire, but I'm breaking with tradition and presenting something that is all too real but borders on parody: the wonderful insanity of globalization.

Read More »

Read More »

FX Daily, April 1: Hemorrhaging Resumes

Overview: There is no reprieve for investors. Equities are falling sharply. Nearly all the Asia Pacific markets slumped but Australia. Chinese markets fared better than most, but the Nikkei was off 4.5%, and India was down almost as much in late dealings. Europe's Dow Jones Stoxx 600 is off more than 3% near midday, led by a sell-off in banks that are suspending dividends and share buybacks.

Read More »

Read More »

FINMA-Aufsichtsmitteilung: Befristete Erleichterungen für Banken infolge der COVID-19-Krise

Mit der FINMA-Aufsichtsmitteilung 02/2020 gibt die Eidgenössische Finanzmarktaufsicht FINMA den Banken Präzisierungen zur Behandlung der bundesgarantierten COVID-19-Kredite im Rahmen der Eigenmittel- und Liquiditätsvorschriften, zu befristeten Erleichterungen bei der Leverage Ratio und bei den Risikoverteilungsvorschriften.

Read More »

Read More »

UBS: Does Anyone Know What Is Happening?

Does anyone know what is happening? Economic data is likely to become increasingly unreliable as a result of the coronavirus lockdown. We know the global economy will be bad. We will not know, with much accuracy, just how bad.

Read More »

Read More »

Coronavirus: deciding who gets a ventilator

By 31 March 2020, there were around 326 Covid-19 patients in intensive care and 228 on ventilators in Switzerland. It is estimated that there are around 750 ventilators across the country. If the health system reaches overload, medical professionals in Switzerland might be forced to make the kinds of difficult decisions being made in neighbouring France and Italy.

Read More »

Read More »

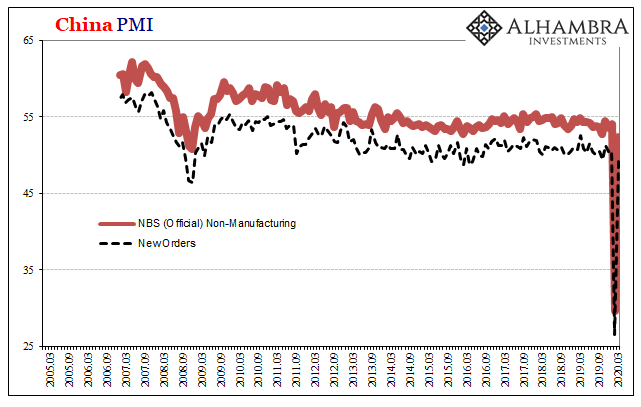

China’s Back!

The Washington Post began this week by noting how the US economy seems to have lost its purported zip just when it needed that vitality the most. Never missing a chance to take a partisan swipe, of course, still there’s quite a lot of truth behind the charge. An actual economic boom produces cushion, enough of one that President Trump and his administration may have been counting on it when opting for full-blown shutdown.

Read More »

Read More »