Tag Archive: newsletter

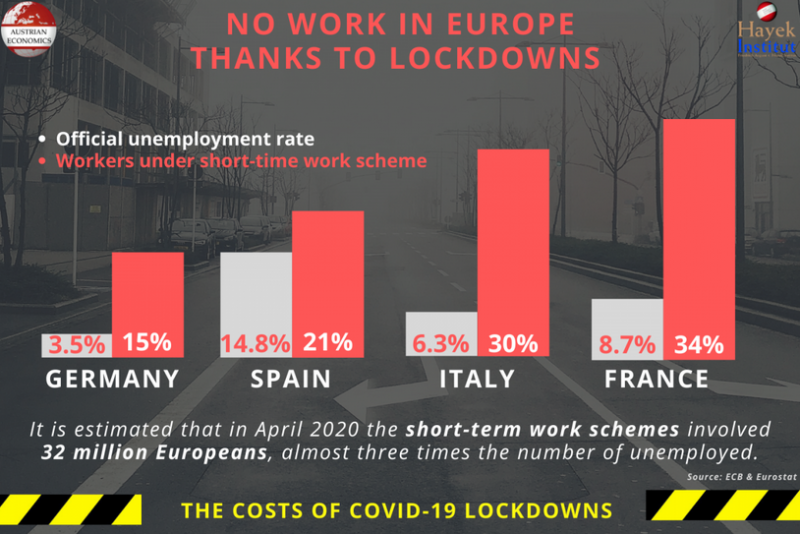

No Work in Europe Thanks to Lockdowns

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

SocGen Slashes Banker Bonuses Amid ECB Pressure

Despite banks, broadly speaking, having a banner year in 2020 as central-bank-liquidity more-than-washed over the losses due to COVID and policy restrictions, banker bonuses have come under pressure.In Europe, the picture is more uncertain as banks' performance has been mixed.

Read More »

Read More »

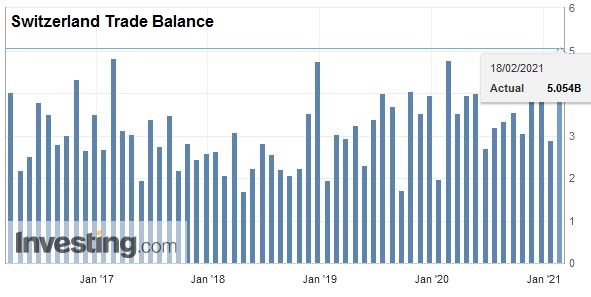

Swiss Trade Balance An exceptional year 2020: border crossings closed and online commerce booming

Bern, 04.03.2021 - The 2020 statistics of the Federal Customs Administration (AFD) are strongly influenced by the COVID-19 pandemic. In order to reduce the risk of transmission of the coronavirus, Switzerland has reintroduced systematic checks at national borders for the first time since joining Schengen, imposed entry restrictions and temporarily closed small border posts.

Read More »

Read More »

Frauen im BVG benachteiligt? Vorsorge für Frauen in der Schweiz Teil 4

Lösungsmöglichkeiten für ein vermutetes "Gender-Problem" im BVG.

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

Dreht der März negativ – “DAX Long oder Short?” mit Marcus Klebe – 04.03.2021

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler Anbieter von Multi-Asset-Trading- und Investmentlösungen.

Read More »

Read More »

Alasdair Macleod – Gold A Perfect Storm For 2021

alasdair macleod keiser report,alasdair macleod carbon,alasdair macleod facebook,alasdair macleod goldmoney,alasdair macleod podcast,alasdair macleod youtube,alasdair macleod youtube 2021,Alasdair Macleod,santander uk login,goldmoney foundation,gold price,inflation,what is hyperinflation,economy,deflation.

Read More »

Read More »

The Real Investment Show [3/3/21]

Technical Market Analysis & Commentary from RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Advisor, Danny Ratliff, CFP

Read More »

Read More »

In Bitcoin investieren als Unternehmen, Holding, GmbH? Steuerberater Prof. Dr. Juhn im Interview 2/2

Nicht nur als Privatperson, sondern auch als Gewerbetreibender und Unternehmer, gibt es Möglichkeiten Bitcoins zu kaufen. So hat beispielsweise Elon Musk Bitcoins im Wert von über einer Milliarde für seine Firma Tesla gekauft. Aber wann ist es überhaupt sinnvoll als Unternehmen Bitcoins zu kaufen? Wie sind die steuerlichen Regelungen und wann ist es vorzuziehen die Bitcoins doch eher als Privatperson zu kaufen?

Read More »

Read More »

Yanis Varoufakis rages at BBC Newsnight after he is cancelled for Nicola Sturgeon deb@te

#Brexit

#Boris_Johnson

#EU

#Brussels

#Nicola_Sturgeon

#Keir_Starmer

#Angela_Merkel

#Brussels

#Emmanuel_Macron

#US

Read More »

Read More »

In welche Regionen sollte man Investieren?

In welche Regionen sollte man Investieren? Heute wieder ein Interview mit dem lieben David Kunz von der BX Swiss zum Thema Diversifikation in Länder und Regionen. Der Fokus lag dieses mal bei Asien und speziell China, wie am besten dort investieren und was sollte man beachten.

Read More »

Read More »

Die wirtschaftliche Lage (22.01.2021 Corona-Ausschuss #36)

Interview mit dem Ökonom und Fondsmanager Prof. Dr. Max Otte über

- Schnelles Denken, langsames Denken

- Kardinaltugend: Wo könnte ich falsch liegen?

- Kognitive Dissonanz

- Wer hat Interesse an dieser Pandemie?

- Die Macht der Netze

Read More »

Read More »

Familienstiftung in Liechtenstein: 0-15 % Steuern bei Aktien, Immobilien, Unternehmensbeteiligungen

Im Interview mit Prof. Dr. Dr. Gierhake erörtert Christoph Juhn die Vorteile einer Familienstiftung in Liechtenstein. Dabei stehen die drei Asset-Klassen Aktien/Festgeldguthaben, Immobilien und Unternehmensbeteiligungen im Vordergrund. Aber auch die steuerlichen Effekte der Übertragung des jeweiligen Vermögens auf die Stiftung sowie die zukünftige Besteuerung der Destinatäre und der Aspekt des Vermögensschutzes finden bei diesen Betrachtungen...

Read More »

Read More »

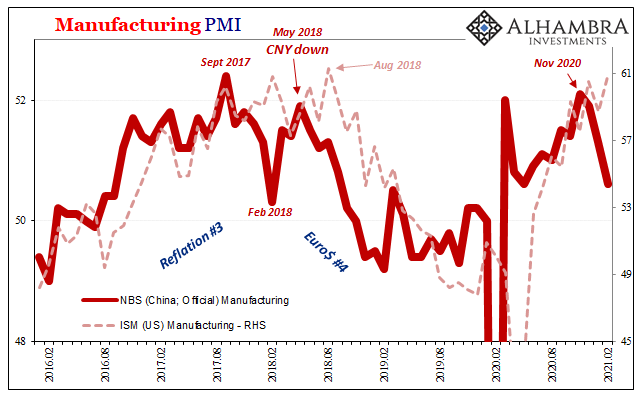

There’s Two Sides To Synchronize

The offside of “synchronized” is pretty obvious when you consider all possibilities. In economic terms, synchronized growth would mean if the bulk of the economy starts moving forward, we’d expect the rest to follow with only a slight lag. That’s the upside of harmonized systems, the period everyone hopes and cheers for.

Read More »

Read More »

Trading Karriere starten: Soviel Startkapital brauchst Du!

Trading Karriere starten: Soviel Startkapital brauchst Du! Wie viel Startkapital brauchst Du für den Start Deiner Trading-Karriere? Die Antwort auf diese Frage erhältst Du in meinem Video.

Read More »

Read More »

Is a Market Rally Likely This Week? | Three Minutes on Markets & Money [3/1/21]

Our monthly review shows a pattern of positive performance at the start, decaying to market failures by month's end; opportunity for rebalancing will come when markets rally. Markets need to set new highs, but there are negative concerns, as money flows are in decline. Watch 10-year rates for clues as discounts to equities.

Read More »

Read More »

GELDSPIEL GEHT IN ENDPHASE & UBER! MARKUS KRALL PROGNOSE & ANALYSE &UBER GELD

Markus Krall Analyse & Prognose - Markus Krall über die Wirtschaft, das Geldsystem & die Zentralbanken

Read More »

Read More »

Stagflation Cometh

A gentleman who does work for us sent me a text recently saying the price of his supplies has increased 20 percent, so he wants to increase his monthly fee 10 percent. It was a nice way to ask, and I said sure, especially given that he’s willing to take a haircut on his labor to make the increase more palatable.

Read More »

Read More »

TUI heisser Turn Around – Depot Update Februar 2021

Heute das Depotupdate für euch mit den Zahlen aus dem Monat Februar, wie hat sich mein Depot entwickelt, welche Performance hat es gemacht und wie hoch waren meine Erträge aus Dividenden und Zinsen. Ausserdem erzähle ich euch welche Änderungen in der Zukunft kommen werden. Viel Spass und schreibt mir gerne in die Kommentare was ihr davon haltet.

Read More »

Read More »

FX Daily, March 2: The Dollar Finds Better Footing

Overview: A warning from China's top banking regulator about the frothiness of foreign markets appeared to blunt the knock-on effect of yesterday's largest rise in the S&P 500 since last June (~2.4%) and weighed on global equities. The large markets in the Asia Pacific region but India and South Korea fell.

Read More »

Read More »

Ende des Euros in 2021 01.03.2021

Markus Krall spricht darüber, dass wir heute schon die massivste Bankenrettung im Umfang von tausenden von Milliarden haben. Die Kernfrage lautet also nicht waren die Bilanzen der Banken ausgehöhlt, sondern die Kernfrage lautet, wann es sichtbar wird. Wenn es unvermeidlich sein wird dass es sichtbar wird und die Antwort darauf ist wenn die Cashflows aus den ausgefallenen Krediten soweit ausgetrocknet sind dass die Banken ständig Nachschüsse...

Read More »

Read More »