Tag Archive: newsletter

Farming lobby hurting Swiss chocolate sector, says industry association

Swiss chocolate sales went into steep decline in 2020, according to ChocoSuisse, Switzerland’s chocolate industry association. The amount of chocolate produced in Switzerland in 2020 was 10% lower than in 2019 and sales revenue was down by 14.5%, a sharp drop.

Read More »

Read More »

Die besten Wertpapierdepots 2021 im Test

Saidi präsentiert Euch unsere Empfehlungen für Wertpapierdepots 2021 und verrät, wie der Neo-Broker Scalable Capital in unserem Depottest abgeschnitten hat.

Read More »

Read More »

What Really Happened With the Texas Power Grid

[unable to retrieve full-text content]Since the deep freeze in February caused millions of Texas homes to lose their power, partisans have been fighting over the blame. The governor blamed wind turbines and the green agenda, whereas Paul Krugman said the fault was with natural gas. Bob shows the numbers; natural gas was to blame only in the sense that nobody expected wind to be useful during a winter crisis.

Read More »

Read More »

THORSTEN POLLEIT: Der Schock wird riesig!

Thorsten Polleit (4. Dezember 1967 in Münster) ist ein deutscher Ökonom. Er ist Chefökonom der Degussa Sonne/Mond Goldhandel, Partner der Polleit & Riechert Investment Management LLP, Präsident und Gründer der deutschen Abteilung des libertären Ludwig von Mises Institute (Ludwig von Mises Institut Deutschland) und Honorarprofessor an der Universität Bayreuth.

Read More »

Read More »

Aktien für Generation Y Inflationsbereinigt

Ein 60-Jähriger schaut auf seine inflationsbereinigte Performance über die letzten 30 Jahre.

Read More »

Read More »

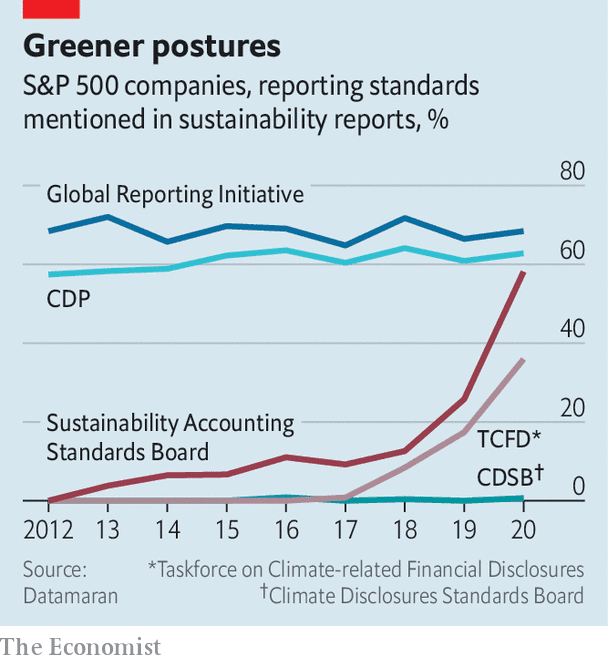

Regulators want firms to own up to climate risks

AMERICA’S MAIN financial regulator is taking an interest in climate change—and wants everyone to know. The Securities and Exchange Commission (SEC) has created a task-force to examine environmental, social and governance (ESG) issues, appointed a climate tsar and said it will “enhance its focus” on climate-related disclosures for listed firms.

Read More »

Read More »

Der große Knall kommt!

Markus Krall (* 10. Oktober 1962) ist ein deutscher Volkswirt, Unternehmensberater und Autor. Seit September 2019 ist Krall Mitglied und Sprecher der Geschäftsführung der Degussa Goldhandel GmbH. Er steht der Österreichischen Schule nahe.

Read More »

Read More »

Bitcoin: Das perfekte Märchen?!? [Statement und Prognose]

Bitcoin: Das perfekte Märchen?!? [Statement und Prognose]

Vermögensschutz: ► https://www.assetprotection.global/voranmeldung *

LONG & SHORT BÖRSENBRIEF: ▶︎ https://www.homm-longshort.com *

Meine Investment Ausbildung ► https://investmentmastersociety.de/ *

Kostenloses Buch: Die Kunst des Leerverkaufs

https://www.florianhomm.net/leerverkauf-digitalversion

Börsenbrief: https://www.homm-longshort.com *

Website:...

Read More »

Read More »

Warren Buffett & Charlie Munger: Mind of Successful Investor

Warren Buffett's longtime business partner Charlie Munger dispensed questions from shareholders eager to glean some of the great man's investing wisdom

Read More »

Read More »

Swiss Voters Approve ‘Burqa Ban’

Swiss voters have narrowly approved a proposal to ban face coverings in public spaces. The measure comes just over a decade after citizens voted to ban the construction of minarets, the tower-like structures on mosques that are often used to call Muslims to prayer.

Read More »

Read More »

MEJORES FRASES de Inversión de WARREN BUFFETT, CHARLIE MUNGER y P LYNCH en Tiempos de CRISIS

Fue PRESIDENTE del NASDAQ y provoco la MAYOR ESTAFA PIRAMIDAL de la Historia:

INVIRTIO 10.000 USD y GANO 18 Millones. De ALBAÑIL a MILLONARIO:

Esto lo TIENES que SABER para Decidir el Mejor MOMENTO para Invertir: _2-IaNlxk

DESCUBRIÓ el SECRETO del TRADING y Convirtió 5.000 Dolares en 16 Millones:

LA TEORIA DE DOW. Aprende con CHARLES HENRY DOW porque "Los PRECIOS lo Descuentan Todo":

Read More »

Read More »

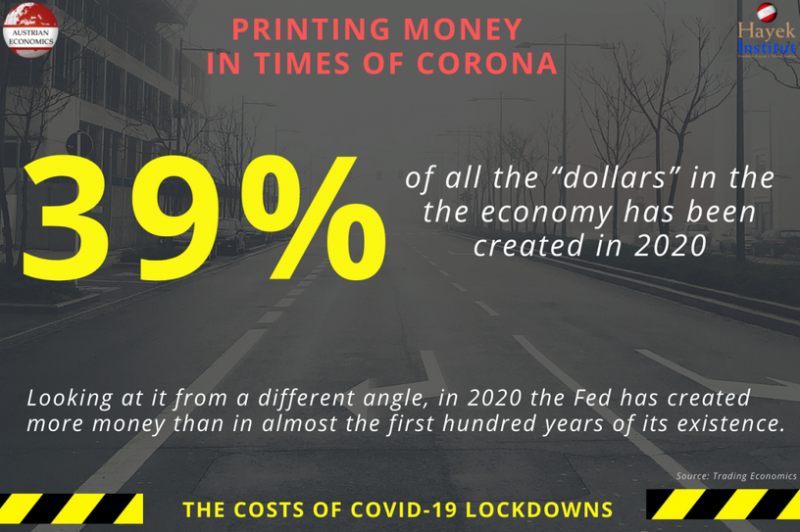

Printing Money in Times of Corona

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

The Cannibalization Is Complete: Only Inedible Zombies Remain

Poor powerless Fed, poor starving cannibals, poor zombies turning to dust. That's the American economy once the curtains are ripped away. Setting aside the fictional flood of zombie movies for a moment, we find the real-world horror is

the cannibalization of our economy, a cannibalization that is now complete.

Read More »

Read More »

Das sind die wirklichen Probleme!

Thorsten Polleit (* 4. Dezember 1967) ist ein deutscher Ökonom. Er ist Chefökonom der Degussa Sonne/Mond Goldhandel, Partner der Polleit & Riechert Investment Management LLP, Präsident und Gründer der deutschen Abteilung des libertären Ludwig von Mises Institute und Honorarprofessor an der Universität Bayreuth. Er tritt für eine marktwirtschaftliche Gesellschafts- und Wirtschaftsordnung ohne solche Störungen ein.

Read More »

Read More »

Markus Krall | Eine enorme Inflation wird den Wert des Geldes verschlingen!

Videoinhalte: Banken, Wirtschaft, Finanzen, Geld, Kapital, Aktien, Börse, Immobilien, Politik, Medien, Gold, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise, Währungsreform, Finanzpolitik, Finanzmarkt, Banken, Finanzcrash, Eurocrash, Bankencrash,

Read More »

Read More »

DO NOT buy the dip!

? Vereinbare jetzt dein kostenfreies Beratungsgespräch: https://jensrabe.de/DONOTBuyTheDip?Bestelle jetzt das neue Buch “Optionsgewinne mit System”: https://duo-strategie.com

Read More »

Read More »

More parcels, fewer letters: pandemic dents Swiss Post finances

The Covid-19 pandemic cost the state-owned Swiss postal service CHF139 million ($150 million) last year, which was largely responsible for driving down profits by 30%. Swiss Post delivered a record 182.7 million parcels in 2020, up nearly a quarter in volume from the previous year.

Read More »

Read More »

More rare earth metals detected at Swiss wastewater plants

Rare earth metals like cerium and gadolinium, which are used in industry and hospitals, are increasingly being detected at Swiss wastewater plants, new research shows.

Read More »

Read More »

Freisicht mit Marie-Christine Ostermann

Heute, 10. März, habe ich im Rahmen meines Instagram-Formats "Freisicht" mit der Unternehmerin und jetzt auch Spiegel-Bestsellerautorin Marie-Christine Ostermann gesprochen. Im Februar erschien das von ihr herausgegebene Buch "Zukunfts Republik".

Read More »

Read More »

Conspiracies, Flawed Democracy, & Socialist Policy [3/9/21]

The late Tom Clancy has a new political thriller release coming soon (how does he do that?) and there are theories as to how long President Joe Biden will remain in that role with VP Harris waiting in the wings with a copy of the 25th Amendment at the ready.

Read More »

Read More »