Tag Archive: newsletter

El PARO REAL en España es ABRUMADOR

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Inflationary Expectations Do Not Cause Inflation

Many economists believe that inflationary expectations cause general increases in prices. For instance, if there is a sharp increase in oil prices, people will form higher inflationary expectations that set in motion general increases in the prices of other goods and services. According to the former Federal Reserve chairman Ben Bernanke, “Undoubtedly, the state of inflation expectations greatly influences actual inflation and thus the central...

Read More »

Read More »

The Dollar is Having One of Its Best Days This Month

Overview: After being bludgeoned, the dollar

is having one of its best days of the month. It is rising against all the major

currencies. The Dollar Index is up about 0.5%, which is the most since the end

of October. The greenback is also firmer against all the emerging market currencies

but the Turkish lira and Russian ruble. Some of the demand for the dollar may

be a function of month end, but also the disappointing Chinese PMI, revisions

that...

Read More »

Read More »

“Ich will Grünes Schrumpfen und staatliche Rationierung”!

Ulrike Herrmann spricht klar und deutlich aus, was viele Grüne wollen, aber versuchen uns anders zu verkaufen. Immerhin ist Frau Herrmann in ihrer Feindlichkeit gegenüber Menschlicher Selbstbestimmung ehrlich.

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

Bildrechte: Elena Ternovaja, CC BY-SA 3.0...

Read More »

Read More »

Gold Technical Analysis

Here's a quick technical analysis on Gold with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #220

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉 https://oliverklemmtrading.com/apply-now-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=2

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM AUF FACEBOOK (Bisher 6500+ Mitglieder): ►Jetzt Beitreten &...

Read More »

Read More »

Is Suze Orman Right About Taking Vacations?

Some financial gurus say the only way out of debt is by cutting up your credit cards, forgoing your daily coffee (or avocado toast), or even putting your credit card in a freezer. Basically, what they’re saying is “Live below your means.”

At Rich Dad, we say you shouldn’t live below your means. Rather we say you should expand your means by purchasing assets so that eventually the income from your assets pays for things like clothes, an iPhone, a...

Read More »

Read More »

Der tiefe Fall des Rene Benko [Was passiert jetzt?] Investmentpunk LIVE!

👉https://kurs.betongoldtraining.com/yt 🏢🤑Wie Du Dir mit Immobilien ein Vermögen aufbaust

Die #Signa Holding vom Tiroler Immobilien Tycoon Rene #Benko meldet Insolvenz an. Insgesamt geht es um Schulden in Milliardenhöhe. Wer aller betroffen ist und welche Kreise der Bankrott nach sich ziehen könnte, analysiert heute der österreichische Selfmade Immobilien Millionär Gerald Hörhan aka. Der Investmentpunk.

Wer ist Gerald Hörhan?

Der österreichische...

Read More »

Read More »

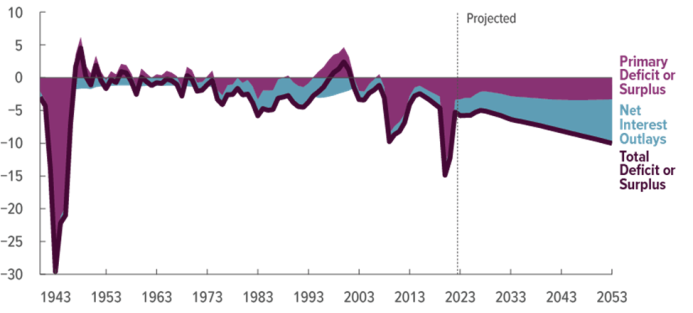

As the US Treasury Runs Out of Creditors, Its Options Dwindle

Are the chickens coming home to roost for the US Treasury? As Ryan McMaken noted in a recent Mises Wire article, the United States is in a debt spiral and there’s no easy way out.

The problem is multifaceted, but the origin is profligate government spending. While it typically spikes during crises, spending is increasing at an alarming rate even outside of crisis periods. And tax revenues are not keeping up, which means ever-deepening deficits....

Read More »

Read More »

Time Preference Is the Key Driver of Interest Rates

Forget the other mainstream explanations for interest. Time preference explains this phenomenon and gives a true picture of why interest exists in the first place.

Original Article: Time Preference Is the Key Driver of Interest Rates

Read More »

Read More »

AUDUSD breaks above key resistance at 0.6656, but fails to sustain bullish momentum

The AUDUSD has surpassed its 200-day moving average and swing area, establishing them as support levels. However, the pair struggles to close above the 61.8% retracement, which now acts as resistance.

Read More »

Read More »

Reserve Bank of New Zealand hints at possible tightening to control inflation. NZDUSD up.

Reserve Bank of New Zealand leaves rates unchanged but suggests potential future tightening to tackle inflation, pushing NZDUSD higher. Buyers and sellers battle for control as market awaits the next move.

Read More »

Read More »

Steinmeier von Emir in Katar maximal gedemütigt!

1.500 Mitarbeiter in Deutschland verlieren ihren Job! Denn Michelin schließt seine LKW-Reifen Werke in Deutschland!

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

Bildrechte:Heinrich-Böll Stiftung via Wikimedia Commons

https://upload.wikimedia.org/wikipedia/commons/2/27/Robert_Habeck_%2846687148461%29.jpg

👉🏽5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

Bildrechte: By Michael von...

Read More »

Read More »

Die größte Gefahr für 2024?

► Höre Dir meine Podcast-Folge "Durchschnittlich 20,7% Rendite? So geht es!" an! Hier findest Du sie bei: https://lars-erichsen.de/podcasts.html

Ein ziemlich robuster Arbeitsmarkt in den USA, stabile Unternehmensgewinne, die Erwartungshaltung eines Soft Landings und darüber hinaus sehr sicher sinkende Zinsen, machen das Jahr 2024 zu einem Guten für die Börse? Das ist zumindest die allgemeine Erwartungshaltung. Ich möchte euch gleich eine...

Read More »

Read More »

Should We Embrace the Stateless Roman Political Thought?

The traditionalist author Álvaro d’Ors emphasized in his work that the political thought of Rome was essentially stateless as it had a personalistic character. In contrast, Greek political thought had a territorial focus, giving rise to the idea of the state. Intellectuals who created and legitimized the idea of the state in modernity drew from Greek political thought. To abolish the state, we need to investigate what both the Greeks and Romans...

Read More »

Read More »

Was versteckt sich hinter grünen ETF-Kürzeln? SRI & ESG erklärt

Grüne Aktien-ETFs gibt es viele – aber wie findest Du den, der Deiner Vorstellung von Nachhaltigkeit am ehesten entspricht? Saidi erklärt Dir kurz und knapp SRI, ESG und Co. und erleichtert Dir die Auswahl für Deine Geldanlage.

Unsere Depotempfehlungen ► https://www.finanztip.de/wertpapierdepot/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=shorts

Unsere ETF-Empfehlungen ►...

Read More »

Read More »

USDCHF test support and bounces back, boosting the dip buying traders confidence

USDCHF falls to support target area near 0.8728 – 0.8743 but rebounds, giving dip buyers confidence. What next?

Read More »

Read More »

GBPUSD reverses a key retracement level, potential for further downside

The GBPUSD reached the 61.8% retracement level but failed to sustain above it, leading to a reversal. Traders cautious for a correction lower would want the price to stay below this level at 1.27189.

Read More »

Read More »

The Dollar Will Fail – Robert Kiyosaki, David Garofalo

Host Robert Kiyosaki and guest David Garofalo, Chairman and CEO of Gold Royalty Corp, discuss the current state of the mining industry, the value of gold and silver, and the concept of royalties. They highlight the decreasing purchasing power of the US dollar and the increasing price of gold since the decoupling from the gold standard. Garofalo explains that owning a royalty in a mining company can provide protection against cost inflation and...

Read More »

Read More »