Tag Archive: newsletter

Dr. Andreas Beck: Märkte verstehen und erfolgreich wissenschaftlich Investieren – 2/2

Was machen die Profis in Zeiten hoher Inflation?

Welche Chancen und Risiken ergeben sich aus der Sicht eines Insiders?

In Teil 2/2 spricht Dr. Andreas Beck im Interview mit Nicolas Kocher über die Evolution von Wissenschaft und die daraus folgenden Chancen und Risiken für Anleger.

Read More »

Read More »

What are the consequences of the war in Ukraine for the SNB’s monetary policy?

Russia's attack on Ukraine has fundamentally changed the geopolitical situation. However, it also has far-reaching economic consequences and poses the question as to whether the integration of the global economy will decrease again.

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 29.04.22

"DAX Long oder Short?" mit Marcus Klebe - 29.04.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende...

Read More »

Read More »

Doom Porn and Empty Optimism

If we can't discern the difference between doom-porn and investing in self-reliance, then solutions will continue to be out of reach. I'm often accused of calling 783 of the last two bubble pops (or was it 789? Forgive the imprecision). Like many others who have publicly explored the notion that the status quo isn't actually sustainable despite its remarkable tenaciousness, I am pilloried as a doom-and-gloomer (among other things, ahem).

Read More »

Read More »

Die GROSSE Freiheit – Mein Leben verbessern in 5 Schritten

Die 5 Schritte-Gebrauchsanleitung, wie du dein Leben für immer veränderst!

Geldtraining LIVE: https://thorstenwittmann.com/geldsicherheit-garantiert/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Freiheit 3.0

Kann man in diesen intensiven Zeiten ggf. die eigene Freiheit steigern?

Klare Antwort: Nein.

Du kannst sie nicht nur steigern, sondern ich behaupte (und beweise) dir, dass du sie auch gerade jetzt revolutionieren...

Read More »

Read More »

Top 5 Dividenden Aktien 2022 GEGEN die Inflation! (ACHTUNG!)

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Top 5 Dividenden Aktien 2022 zum Schutz der Inflation! (ACHTUNG!)

Meine Top 5 Dividenden Aktien gegen die Inflation. Willst du mehr Stabilität und Sicherheit in deinem Portfolio dann erfährst du hier wie. Welches sind deine TOP 5? Schreib es mir gerne in die Kommentare.

#Aktien #Dividenden #Finanzrudel

?Yuh 50 CHF...

Read More »

Read More »

The New World Order and Dehumanization on the Left and Right

Bob critiques the economic views of Yuval Harari, who predicts “useless people” because of technological advances. Bob then showcases similar thinking from right-wingers. He ends by addressing a common critique of the Christian God.

Read More »

Read More »

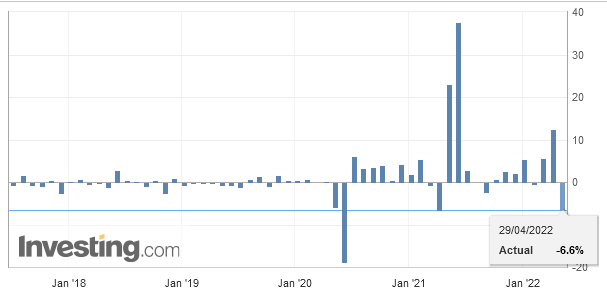

Swiss Retail Sales, March 2022: -5.9 percent Nominal and -6.6 percent Real

Turnover adjusted for sales days and holidays fell in the retail sector by 5.9% in nominal terms in March 2022 compared with the previous year. This decline can mainly be explained by the high figure of March 2021, when the COVID-19 protection measures were lifted before the end of the month and turnover rebounded. Seasonally adjusted, nominal turnover rose by 0.9% compared with the previous month.

Read More »

Read More »

Is Putin Right About a U.S. Proxy War?

On the surface of things, it appears that Russia is at war with Ukraine. But Russian president Vladimir Putin is saying that in actuality it is the United States that is warring against Russia and is simply using Ukraine as a proxy to conduct that war. Putin, therefore, is also saying that given that the United States is waging war against Russia, the possibility of nuclear war continues to rise with each passing day.

Read More »

Read More »

ENTSCHEIDENDE ÜBERLEGUNGEN für ihre AKTIEN – Umgang mit Fehlinvestitionen

Wie geht man mit Fehlinvestitionen um? Eine Kleinigkeit die langfristig den entscheidenden Unterschied macht!

_

Dr. Markus Elsässer, Investor und Gründer des Value Fonds

„ME Fonds - Special Values“ [WKN: 663307]

„ME Fonds - PERGAMON“ [WKN: 593117]

_

1.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch*: https://amzn.to/3xnT6rW

2.? "Des klugen Investors Handbuch" *https://amzn.to/38UCXQg

Als...

Read More »

Read More »

Love the Weakness When It Comes—and Buy More – Monthly Wrap Up – 04.28.22

It’s been a tumultuous month, with a market correction where all the latecomers got flushed fast. Does this mean the bull market is over? Host Craig Hemke sits down with Dave Kranzler of The Mining Stock Journal to break down all the month’s gold and silver news.

You can check out all our bullion products here: www.sprottmoney.com/bullion

Got questions for our experts? Send them to [email protected].

Read More »

Read More »

Rainer Zitelmann diskutiert mit Dietmar Bartsch von der LINKEN und anderen Gästen bei BILD TV

Bild-TV auf YouTube: https://www.youtube.com/channel/UC4zcMHyrT_xyWlgy5WGpFFQ

Seminare und Bücher von Dr. Dr. Rainer Zitelmann finden Sie hier: https://linktube.com/zitelmann Der Podcast von Dr. Dr. Rainer Zitelmann: Erfolg, Reichtumsforschung und Finanzen iTunes: https://podcasts.apple.com/us/podcast/dr-dr-rainer-zitelmann-erfolg-reichtumsforschung-und/id1519670241?ign-mpt=uo%3D4 Spotify: https://open.spotify.com/show/4iOCtLF6d2pvhZgS4JgtW8...

Read More »

Read More »

7,4% Inflation – So werden wir alle enteignet | Mario Lüddemann

► KOSTENLOS: 2-tägiges Beginner-Seminar vom 30. April bis 1. Mai 2022. Mit dem Gutschein-Code RU100 Deinen Teilnahmeplatz sichern: https://www.digistore24.com/product/321357/?ds24tr=Youtube

► Von 50.000 € auf 1 Million in 10 Jahren

Willst du wissen, wie das auch für dich geht? Dann melde dich hier zum kostenfreien Beratungsgespräch an: https://deinmillionendepot.com/termin-buchen/

- - -

► Für Trader: sicher dir hier kostenfrei mein E-Book, damit...

Read More »

Read More »

How I Define Success

Excellent work, excellent relationships and evolution are keys to a happy successful life, for me #principle #raydalio #shorts

Read More »

Read More »

Prof. Max Otte: Es wird brenzlig

Prof. Max Otte ist Freitag 18 Uhr Gast im Live-Call beim MMnews-Club, unser neuer Abodienst mit hochkarätigen Infos: https://www.copecart.com/products/5fe41a87/checkout - Mit dem Abo unterstützt ihr unsere Arbeit.

Zugang zum Live-Call Freitag 18 Uhr:

https://us06web.zoom.us/j/81028393678?pwd=WGdTUHY1NTBmcURvUTZWa1NkYlg3Zz09

Meeting-ID: 810 2839 3678

Kenncode: 938193

Teilnehmer sind begrenzt, MMnews-Club Mitglieder werden bevorzugt.

Read More »

Read More »

DJ Genesis: The Miami Pro League and it’s growing reputation for pro’s to play in the off-season

In this segment DJ Genesis talks about the Miami pro League and it's growing reputation for nbe players to come play in the off-season.

FIYE show instagram: https://www.instagram.com/fiye.show/

DJ Genesis Instagram: https://www.instagram.com/iamdjgenesis/

Read More »

Read More »

Techs halbiert – Was jetzt? / Hans A. Bernecker im Gespräch vom 27.04.2022

Themen-Check mit Hans A. #Bernecker ("Die Actien-Börse") - in diesem Video als verkürzte FreeTV-Variante des ansonsten umfangreicheren Gesprächs im Rahmen von Bernecker.tv vom 27.04.2022. Schlaglichter:

++ Auf gutem Wege, aber noch nicht unten!

++ Risiko gebrochener Aufwärtstrends

++ Billionenschwund bei Marktwerten

++ Lawinengefahr im Techsektor?

++ Es geht um die Bewertung im Markt

++ #Tesla perspektivisch ohne Elon Musk an der...

Read More »

Read More »

Vorbild China: Die “totale Kontrolle” kommt zu uns! (Prof. Dr. Max Otte)

✅ Prepare for Weltsystemcrash: https://kettner.shop/Prepare_for_Weltsystemcrash_3J

Wir haben wieder einmal einen sehr gern gesehenen Gast bei uns: Prof. Dr. Max Otte. Wir haben über die Entwicklung der geopolitischen Spannungen gesprochen, aber auch welche Zukunftsszenarien Prof. Max Otte auf unser Land zukommen sieht.

Ist der Welts-System-Crash da? Das ist die große Frage des Videos.

⭐ GOLD KAUFEN

↪︎ Münzen: https://kettner.shop/gold-m_3Jml...

Read More »

Read More »

Ich verschenke einen Goldbarren – Die Verlosung des Jahres!

Bestellt euch ein Exemplar des neuen Buches, teilt ein Bild davon auf Instagram und verlinkt mein Profil via florian.homm.official (oder schickt eine E-Mail an [email protected]).

Hier gelangt ihr zum neuen Buch ➡️ https://florianhomm.net/buch-ytv

#prinzipiendeswohlstands

Read More »

Read More »