Tag Archive: newsletter

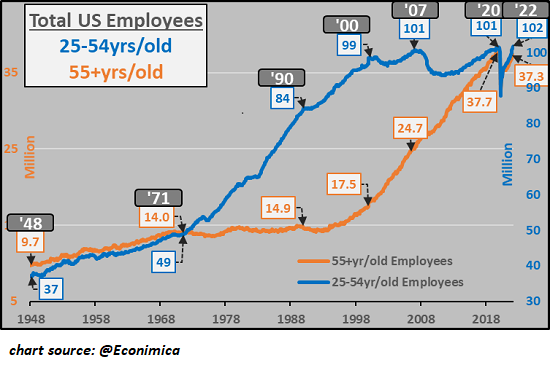

Are Older Workers Propping Up the U.S. Economy?

Are 55 and older workers propping up the U.S. economy? The data is rather persuasive that the answer is yes.The chart of U.S. employment ages 25 to 54 years of age and 55 and older reveals a startling change.There are now 20 million more 55+ employed than there were in 2000, an equivalent of the entire workforce of Spain.

Read More »

Read More »

US Opening Bell mit Marcus Klebe – 10.08.22

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler Anbieter von Multi-Asset-Trading- und Investmentlösungen.

Read More »

Read More »

It Is Time to Put the Red Flag to Red-Flag Laws

Nothing is certain except death and taxes, but antigunners exploiting tragedy to pass more gun control laws is close behind. On cue, the recent mass shootings in Buffalo, Uvalde, and Highland Park have brought demands for the typical disarmament stew of “assault weapon” and “high-capacity” magazine bans, licensing requirements, and universal background checks.

Read More »

Read More »

Russian oil transit halted via Druzhba pipeline to central Europe | Latest World News | WION

Energy supply concerns grip three European nations as Russian oil supply through Ukraine has been halted. According to Russian oil firm Transneft, transit payment issues was the reason behind its move.

Read More »

Read More »

Welches Währungspaar ist das Richtige?

Es gibt jede Menge FX Währungspaare. Welches dieser vielen Crosses soll man als Trader denn nun handeln? Unser Analyst Martin Goersch zweigt heute am Beispiel des japanischen Yen, wie man sich die Wahl leicht machen kann. Der japanische Yen ist weiter schwach. Aber tradet man nun USDJPY, AUDJPY, EURJPY, CHFJPY??? Hier gibt es eine kleine Anleitung...

Read More »

Read More »

Gravitas: Russia’s Wagner Group is hiring mercenaries from prisons

Russia's Wagner Group has reportedly launched a 'recruitment drive'. It is recruiting mercenaries from Russian prisons. Billboards with the group's ads have been installed in Russian cities. What is the Wagner Group? How does it help Moscow? Palki Sharma reports.

Read More »

Read More »

Nils, 50, verdient 300€ DIVIDENDEN im Monat

Der #DividendenDienstag Livestream findet jeden Dienstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

Read More »

Read More »

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300

This week, Dave Russell is joined by #PeterKrauth, editor of Silver Stock Investor and author of The Great Silver Bull book, who explains why he's so bullish on #silver. He discusses in length the reasons why he predicts silver will outperform gold and reach $300.

The third episode of our brand new show The M3 Report with David Morgan and Gareth Soloway is live now:

Highlights from the episode:

Why does Peter...

Read More »

Read More »

Was kann ich mit ETFs falsch machen?

Saidi reagiert im heutigen Video auf einen Beitrag vom Hessischen Rundfunk zum Thema ETFs.

Read More »

Read More »

MICHAEL BURRYS 144 Mio INFLATIONS DEPOT! Michael Burry sieht CRASH

Michael Burry erwartet einen Crash, sowie eine tiefe Rezession, bis hin zum 3. Weltkrieg. So bereitet er sich vor.

? bis zu 2 Gratisaktien bei Depotempfehlung für ETFs & Sparpläne ► http://link.aktienmitkopf.de/Depot *

Burrys Depot auf Spatz folgen ► https://gospatz.com/finance/portfolio/13098

? Kostenlose Anmeldung bei Spatz Portfolio Software ►►► https://gospatz.com/signup

MyDividends24 App Downloaden ► http://myfinances24.de/mydividends24

?...

Read More »

Read More »

Is the Fed Close to the End? | 3:00 on Markets & Money

(8/9/22) The debates are raging over whether we're seeing the dawning of a new Bull Market, or only a continuation of a Bear Market rally. Who'll be correct? More importantly, what should YOU do at this juncture? Markets have been improving, technically...a nice pattern of rising tops and bottoms has led markets back up to resistance levels from June of this year. If markets fail from this point, it will confirm the Bear Market Rally; however,...

Read More »

Read More »

The Pandemic Effect (8/9/22)

(8/9/22) Bemoaning the death of Olivia Newton-John and the loss of our youth; markets' behavior because there's no pressure on the Fed to pivot. Yet. Why flat beer may be the next thing: CO2 shortage, The Roberts' Family vacation: Driving in Italy and Yacht price inflation; hypocrisy of Millennials decrying capitalism on iPhones; NVIDIA & Peloton performance: The post-pandemic effect; lower expectations reflect return to "normal;"...

Read More »

Read More »

Die Rendite einer Aktie – Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Inflation

Am Mittwoch kommen die wichtigen Daten zur US-Inflation und im Video gehe ich sehr aktuell und ausführlich auf meine Wertartungen ein.

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

▬ ANGEBOT ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

❤️️❤️️❤️️ https://www.andre-stagge.de/pm/ ❤️️❤️️❤️️

✔️ 3 Monate Intensivausbildung

✔️ 12 Monate persönliche Betreuung und viel Platz für Deine Fragen

✔️ Lebenslanger Zugang zu allen Inhalten

✔️ Kostenlose Wiederholung der Ausbildung

✔️...

Read More »

Read More »

Vitalik Buterin glaubt an Crypto-Zahlungen für den Mainstream

Immer mehr Anbieter ermöglichen Crypto-Zahlungen – vor allem online. Doch von einer Akzeptanz dieser Zahlungen des Mainstreams sind wir dennoch weit entfernt. Vielmehr sind Cryptocoins primär zu einem Investitions- und Spekulationsobjekt geworden.

Read More »

Read More »