Tag Archive: newsletter

Das ist ihr großer PLAN…so gehts JETZT weiter!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

"We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross," Danske notes.

Read More »

Read More »

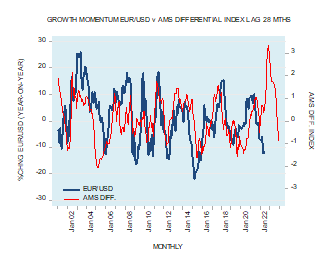

Will the US Dollar Weaken against Other Currencies?

In the July 26 Financial Times article entitled “Is the Dollar about to Take a Turn?,” Barry Eichengreen writes that the US dollar has had a spectacular run, having risen more than 10 percent against other major currencies since the start of the year. According to Eichengreen, the key reason behind the spectacular strengthening in the US Dollar is that the Federal Reserve has been raising interest rates faster than other big central banks, drawing...

Read More »

Read More »

Dax im Abwärtstrend? Und 3 Short Chancen…

Während der Euro wieder auf dem Weg zur Parität ist, droht der Dax erneut in den Abwärtstrend zu rutschen. Für den Fall weiter schwacher Indizes schaut unser Analyst Martin Goersch heute auf drei Short Chancen im Aktienuniversum...

Read More »

Read More »

USDCAD trades to the highest level since July 15

The USDCAD on the daily chart has admittedly been sloppy. There are a lot of moves higher and moves lower on the daily chart going back to October 2021.

In the short term, however, the price of the USDCAD has been up 5 of the last 6 trading days. Price action is more trending, or is it?

The price is approaching topside swing levels between 1.3076 to 1.3092. That area will be eyed for the next clues for that pair. Move above is more bullish....

Read More »

Read More »

Diese DIVIDENDEN-ETFs sind Perfekt für PASSIVES EINKOMMEN!

Der #DividendenDienstag Livestream findet jeden Dienstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

Read More »

Read More »

Überteuerte Immobilien und steigende Zinsen mit Prof. Dr. Max Otte

Ein spannendes Gespräch mit Prof. Dr. @Max Otte. Wir sprechen über die aktuelle Immobilienpreisentwicklung und ob sich Investments in Immobilien noch lohnen. Dies ist der vierte Teil des Gesprächs.

Read More »

Read More »

Star-Investoren kaufen JETZT diese 6 Aktien!

Daniel Loeb, David Einhorn, David Tepper, George Soros - die absolute Crème de la Crème der Hedgefonds-Manager hat im letzten Quartal kräftig eingekauft. Bei welchen Aktien, 6 sind es an der Zahl die ich euch heute vorstellen möchte, lohnt es sich, mal genauer hinzuschauen? Das möchte ich heute für euch besprechen. Legen wir los.

Read More »

Read More »

Heiner Flassbeck: Nord Stream 2 öffnen! + Darum wird die Inflation einfach verschwinden

"Daran wird die Demokratie scheitern", warnt Heiner Flassbeck. Der bekannte Ökonom macht sich große Sorgen, weil wir nach seiner Meinung keinen klaren Gedanken mehr fassen können und demnach zu keinen Lösungen kommen.

Read More »

Read More »

Rat zu Unternehmenskauf: Mach das noch Sinn in Deutschland?

Ein Zuseher plant ein Klein- oder Mittelunternehmen #KMU zu kaufen und findet in seiner Bekanntschaft Niemanden, der eine solche Aktion für sinnvoll hält. Ich nehme seine Mail zum Anlass und spreche allgemein über #Merger & #Acquisition (Fusionen und Übernahmen) mit deren Chancen und Risiken.

Read More »

Read More »

Sprott Money Ask The Expert August 2022 – David Garofalo

Precious metals industry veteran David Garofalo joins us to answer your questions regarding gold and the gold mining shares.

0:00 - Introduction

3:09 - What is the difference between a royalty company and a producing miner?

6:10 - Where do you see gold prices headed in the next 12 months?

8:10 - How do rising energy and inflation concerns impact future M&A in the mining sector?

10:25 - How can a company minimize or counteract higher costs to...

Read More »

Read More »

The morning technical report: The EURUSD/GBPUSD drag along lows.The USDJPY is up & down.

- The trading week is off and running.

- The EURUSD is lower and trading above and below the key parity level. Sellers in control. What might give a short term positive bias in the face of difficult fundamentals

- GBPUSD is also suffering largely from the same fundamental down bias. The price got closer to the low for 2022 at 1.1759. Sellers are more in contol, but the price action is confined

- USDJPY is up for the 5th day, in an up and down...

Read More »

Read More »

Has the 9-week Rally Ended? | 3:00 on Markets & Money

(8/22/22) Over-extended markets sold off on Friday after breaching the 50-DMA, and ran into resistance at the 200-DMA. This 9-week rally aligns with similar bear market rallies historically; one thing we're looking for is a sell-signal in the MACD indicator. The money flow indicator is also showing a sell-signal, suggesting some downward pressure follow-through this morning (futures are pointing lower.) The first support test will be at the 20-DMA....

Read More »

Read More »

The Economy Improved In July

The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7.

Read More »

Read More »

3 GRÜNDE FÜR DEN MARKT CRASH

Der Markt hat wieder einen Rücksetzer gemacht und wie immer schreiben mir unglaublich viele Leute, was die Gründe sein können und wie es jetzt weiter gehen kann. In diesem kurzen Video erkläre ich dir die Top 3 Gründe, nicht verpassen!

Read More »

Read More »

Börsen im Rückwärtsgang | Blick auf die Woche | KW 34

Wie von uns vermutet, haben die Börsen den Rückwärtsgang eingelegt. Die Bullen geraten zunehmend unter Druck und die spannende Frage ist, ob es das schon wieder mit der Aufwärtsbewegung war oder ist die kleine Verschnaufpause gerade lediglich als Korrektur zu bewerten und bietet gute Einstiegschancen auf der Long-Seite.

Read More »

Read More »

The Reddit Run-up on AMC Stock

(8/22/22) The Roberts' House Squirrel Infestation; Historic stats on Bear Market Rallies: 30% of the 17% market gain is on the backs of four stocks: Apple, Meta, Microsoft, & Tesla; Why 40% of executives are rescinding job offers; why we'll be lucky to hit 1% GDP in 2023; check out our "Five for Friday" report; comparing stock fundamentals to ETF performance; what's going to happen when ETF's sell-off? How Reddit ran up the price of...

Read More »

Read More »

No Relief for the Euro or Sterling

Overview: The euro traded below parity for the second time this year and sterling extended last week’s 2.5% slide. While the dollar is higher against nearly all the emerging market currencies, it is more mixed against the majors.

Read More »

Read More »

Why we couldn’t be happier that gold is boring

2022-08-23

by Stephen Flood

2022-08-23

Read More »