Tag Archive: newsletter

200 Mrd.€ für 0 mehr Gas. DAX gegen Ampel. Hans A. Bernecker.

Quelle: _yl0qqQKqw

Deutshland ist ein klarer Verlierer....

#gruenesaboteure

#dieampelhatversagt

#baerbokruektritt

#habekruektritt

Read More »

Read More »

Can Markets Hit 4100? | 3:00 on Markets & Money

(10/18/22) Why is the 200-WMA considered critical support for the markets? While we've been in a correction-mode, we're technically not in a bear market...yet...because we haven't violated the bullish trend of the 200-WMA.

Read More »

Read More »

Want to catch up to the technicals driving the forex markets today? Watch…

The technical report for October 18, 2022.

In the morning forex report for October 18, 2022, I look at the EURUSD, GBPUSD, USDJPY, USDCAD, AUDUSD and NZDUSD. Take less than 8 minutes and catch up to the market technicals driving the currency markets today.

Read More »

Read More »

Greenpeace mit Kampagne gegen Bitcoin

Wieder einmal versucht die Umweltschutzorganisation Stimmung gegen den Cryptomarkt und Bitcoin im Speziellen zu machen. Doch inzwischen stellt sich die Frage, ob tatsächlich Umweltschutz oder Politik hinter der Kampagne steckt. Bitcoin News: Greenpeace mit Kampagne gegen BitcoinVor allem das Proof of Work Prinzip hinter dem BTC soll laut Greenpeace die „Klimakrise verschärfen und der Gemeinschaft schaden“.

Read More »

Read More »

The Chase is On

(10/18/22) Markets appear to have plenty of fuel for a rally today; tracking the 200-Week Moving Average; the Bear hasn't appeared yet; Halloween spending and pumpkin methane; the chase is on: has the rally commenced?

Read More »

Read More »

How to draw Vladimir Putin #cartoon #Putin

How do you draw Putin? We asked KAL, our political cartoonist.

#cartoon #Putin #shorts #art #politics

Read More »

Read More »

Turn Around Tuesday Aside, is the Dollar Topping?

Global equities moved higher in the wake of the strong gains in the US yesterday. US futures point to the possibility of a gap higher opening today. Most of the large Asia Pacific bourses rallied 1%-2%, with China’s CSI a notable exception, slipping fractionally.

Read More »

Read More »

Markus Krall Solar, Gas, Strom „Echte Gefahr

#geldanlage #gold #goldbarren #goldpreis #goldpreise #ernstwolff #wolffofwalstreet #dirkmüller #finanzcommunity #reset #börse #corona #inflation #enteignung

Read More »

Read More »

Major cracks in financial markets! | Ronald Stöferle & James Connor

Ronald Stöferle was interviewed by James Connor of “Bloor Street Capital”. Together they discussed the current market setup, what the cracks in financial markets mean for the course of the Federal Reserve, as well as its implications on gold.

History often rhymes

We are currently witnessing another period of stagflation. Already before the COVID crisis, we saw strong indicators, which pointed to a decrease in globalization and a slowing economy....

Read More »

Read More »

Edward Chancellor’s Much-Needed (But Not Heeded) Wisdom on Interest Rates

The subject of time and money has hit a boiling point. Just look at Sri Lanka and Iran, where food riots have turned deadly, or, shall we say, currency riots have. People can’t buy food, and “protesters angry at the soaring prices of everyday commodities including food, have burned down homes belonging to 38 politicians as the crisis-hit country plunged further into chaos, with the government ordering troops to ‘shoot on sight,’” reports...

Read More »

Read More »

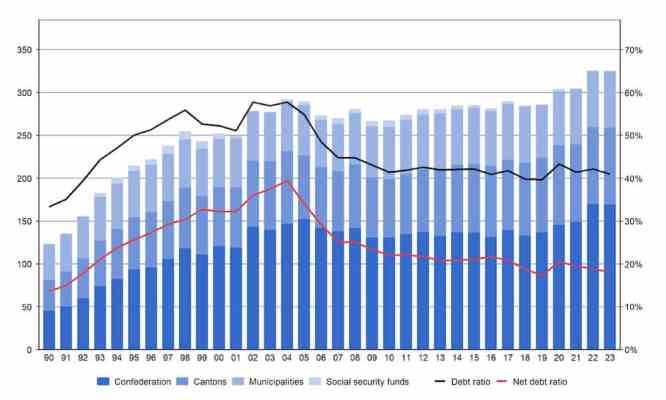

Switzerland expects government surplus in 2022 and lower public debt from 2023

After a roughly CHF 40 billion blow to Swiss public finances due to the Covid pandemic, Switzerland’s financial outlook is beginning to look positive, according to a recent government press release.

Read More »

Read More »

What Everybody Knows No Longer Matters

What nobody yet knows (or the few insiders who do know are keeping to themselves) is what will matter. Being a doom-and-gloom Bear stops being fun when the Bear Bar gets crowded.

Read More »

Read More »

Swiss state pensions to get a boost in 2023

On 12 October 2022, Switzerland’s Federal Council announced an increase in state pensions from 1 January 2023 by 2.5%.

Read More »

Read More »

CCP Congress: what will Xi do next?

What's it like to attend the Chinese Communist Party’s most important political meeting? Our correspondent, who was at the opening of the 20th National Congress, explains what it was like and what we might learn about Xi Jinping’s plans for China's future in the coming days

00:00 - What is the Chinese Communist Party congress?

00:38 - Our correspondent’s journey

01:50 - Xi Jinping's speech

02:55 - What else is on the agenda?

Sign up to The...

Read More »

Read More »

When it’s OK to take on debt

How you should think about #debt. @Yahoo Finance #personalfinance #money #raydalio

----------------------------------------

For more from Ray:

Principles | #1 New York Times Bestseller: https://amzn.to/2JMewHb

Principles for Success, distills Principles into an easy-to-read and entertaining format for readers of all ages: https://amzn.to/34lgnNJ

Download his free app: https://principles.app.link/PFS

Connect with him on Facebook:...

Read More »

Read More »

GOLD Backed Chinese Yuan! Be Ready For What’s Coming! – Alasdair Macleod | Gold Price Prediction

GOLD Backed Chinese Yuan! Be Ready For What's Coming! - Alasdair Macleod | Gold Price Prediction

⬇ Inspired By: ⬇

#goldprice #alasdairmacleod

--------

? Checkout These Similar Videos?:

-------

? Don't Forget To Subscribe For More: shorturl.at/twPQ2

Read More »

Read More »

Silver Alert ️: This Is About To Happen To Gold & Silver – Alasdair Macleod | Silver Forecast

Silver Alert ?️: This Is About To Happen To Gold & Silver - Alasdair Macleod | Silver Forecast

Alasdair Macleod talks about the coming Gold & Silver reversal.

#AlasdairMacleod #Silver

--------------

⬇ Inspired By: ⬇

Financial Crisis Is Already Here, Don’t Let the Market Exuberance Fool You Warns Lynette Zang

-tnozmGa4

Fed’s Credibility is Destroyed, Why Cash, Gold and Silver Will Be Best Lifeline | Outlook 2022

Silver spikes through $27...

Read More »

Read More »

Dieser Fehler wird Dich viel Geld kosten!

► Hier kannst du meinen Kanal abonnieren: https://www.youtube.com/erichsengeld?sub_confirmation=1

► Hier findest Du das Video "Inflation: Das Pulverfass aus Krieg, Lockdown, EZB (reale und monetäre Inflation)", von Prof. Dr. Christian Rieck:

Bedauerlicherweise ist diese Marktphase geeignet, um Vermögen zu zerstören die über Jahre oder gar Jahrzehnte hinweg aufgebaut wurden. Ich werde dieses Video extra kompakt halten, aber ich möchte...

Read More »

Read More »

Politikkrise: Netzwerke der “Alternativmedien” zeigen schöne neue Parallelwelt – ARD, Auf1, Max Otte

Original-Video: https://www.ardmediathek.de/video/zapp/schoene-neue-parallelwelt-netzwerke-der-alternativmedien/ndr/Y3JpZDovL25kci5kZS8wZTE5MTNjNy0zMTQ4LTQ2NDUtYWQ0Zi02YzQyZGNiODE1NTA

Read More »

Read More »