Tag Archive: newsletter

Demokratie

Provided to YouTube by Medienmanufaktur Wien

Demokratie · Thomas Andreas Beck · Thomas Andreas Beck · Thomas Andreas Beck · Thomas Pronai

Ernst

℗ Medienmanufaktur Wien

Released on: 2022-10-21

Auto-generated by YouTube.

Read More »

Read More »

Ernst

Provided to YouTube by Medienmanufaktur Wien

Ernst · Thomas Andreas Beck · Thomas Andreas Beck · Thomas Andreas Beck · Thomas Pronai

Ernst

℗ Medienmanufaktur Wien

Released on: 2022-10-21

Auto-generated by YouTube.

Read More »

Read More »

Strones

Provided to YouTube by Medienmanufaktur Wien

Strones · Thomas Andreas Beck · Thomas Andreas Beck · Thomas Andreas Beck · Thomas Pronai

Ernst

℗ Medienmanufaktur Wien

Released on: 2022-10-21

Auto-generated by YouTube.

Read More »

Read More »

Dollar Trades Above JPY150 and Truss Gets No Reprieve

Overview: China and Japan continue to struggle to stabilize their currencies, while global interest rates rise. The offshore yuan has fallen to new lows but in late dealings the onshore and offshore yuan have recovered.

Read More »

Read More »

Hass

Provided to YouTube by Medienmanufaktur Wien

Hass · Thomas Andreas Beck · Thomas Andreas Beck · Thomas Andreas Beck · Thomas Pronai

Ernst

℗ Medienmanufaktur Wien

Released on: 2022-10-21

Auto-generated by YouTube.

Read More »

Read More »

Börsenstrategien im Bärenmarkt mit @André Stagge

Das Geheimnis für den Börsenerfolg besteht darin, dem großen Geld zu folgen und gleichzeitig die Flexibilität und Schnelligkeit auszuspielen, die private Investorinnen und Investoren gegenüber dem institutionellen Geld haben.

Read More »

Read More »

Credit Suisse prepares Swiss business sales to raise capital

Credit Suisse is preparing to sell parts of its Swiss domestic bank as it attempts to close a capital hole of around CHF4.5 billion, according to people briefed on the discussions.

Read More »

Read More »

“Bonds Have Fallen to 4%, FED Is Way Behind in History.”

“Pensions and Bonds Are Useless In This Recession as Fed And Banks Are Sleeping For 12 Years”-Marc Faber

Read More »

Read More »

Relai Partners Checkout.com to Enable Instant Bitcoin Purchases

Swiss Bitcoin investment app Relai has partnered with global payments provider Checkout.com to enable its users to buy the cryptocurrency via Visa, Mastercard and Apple Pay in real time through its self-custodial wallet.

The partnership with Checkout.com is expected to allow users to have constant access to instant liquidity while also ensuring that they have full say over what happens to their assets.

Founded in 2020, Relai currently serves over...

Read More »

Read More »

Haben Aktien ein Zinsrisiko?

Natürlich. Und wie!

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

Market Currents: Fed Confusion

The Federal Reserve seems confused about its role in inflation and unemployment. Alhambra’s Steve Brennan and Joe Calhoun discuss it.

Read More »

Read More »

Should I buy TSLA stock after earnings?

Tesla posted unimpressive earnings, and the stock is down over 6% after hours. It's almost $200. When a stock price is near a natural "magnet," it's more likely to be inspected.

Stocks that underperform following results seldom recover quickly, if at all. It takes weeks to restart the stock's basic assumptions.

The following piece of technical analysis shows how the stock is approaching the VAL (value area low) of the price range's...

Read More »

Read More »

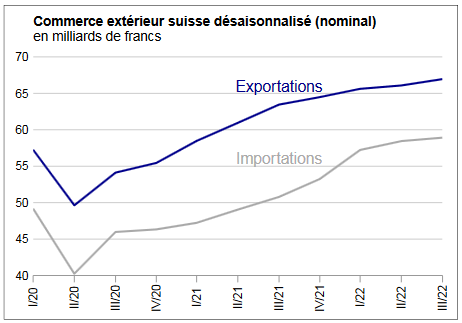

Swiss Trade Balance 3nd quarter 2022: foreign trade remains in rise

Also in the 3rd quarter of 2022, Swiss foreign trade experienced a positive development: while exports increased by 1.3%, imports grew by 0.8%. However, the latter have lost their vigor since the middle of the year. Both imports and exports nevertheless posted a record quarterly result. The trade balance closes with a surplus of 8 billion francs.

Read More »

Read More »

The U.S. Can’t Keep Spending and Bring Down Inflation

The U.S. can’t keep spending and bring down #inflation. #cavuto #stagflation #principles #raydalio #shorts

Read More »

Read More »

Are you ready for the Australian jobs report? What is video and you will be…

The September Australian jobs report will be released in the new trading day. Are you ready?

Do you know the bias defining levels?

Do you know the risks?

Do you know the targets on a trend like move?

In this video, I outline all the levels in play that will make you aware and prepared.

Read More »

Read More »

Ist unsere POLITIK noch kompetent? | Markus Krall, Christian Rieck, Marc Friedrich

Im Rahmen der World of Value 2022 treffen Dr. Markus Krall, Prof. Christian Rieck und Marc Friedrich im alphaTrio aufeinander und bieten den Zuhörern eine belebte Diskussionsrunde. Elegant lenkt Moderator Steffen Krug hier die Gesprächsthemen der Gäste von geopolitischen Brennpunkten, über planwirtschaftliche Interventionsmaßnahmen bis hin zum Fiat-Geld-System und der Anreizstruktur der Zentralbank.

Read More »

Read More »

How to Profit from Real Estate, Stocks, & Green Investing – Robert Kiyosaki, Kim Kiyosaki

What is one strategy recommended for every investor? What could potentially be bigger than Bitcoin? For answers to these questions and more, don’t miss this insightful conversation about today’s most lucrative wealth strategies.

Come ready to learn with Robert and Kim Kiyosaki along with their two incredible guests, Rich Dad Advisor for Paper Assets, Andy Tanner, and Marin Katusa, a professional investor, author, and founder of Katusa Research as...

Read More »

Read More »

1’800 CHF pro Monat über Sparpläne investieren (Komplett automatisiert in der Schweiz)

1'800 CHF pro Monat über Sparpläne investieren (Komplett automatisiert in der Schweiz)

Sparpläne sind hervorragend zum langfristigen Vermögensaufbau geeignet. Sie kommen damit auch als Mittel zur Altersvorsorge infrage

#sparplan #vorsorge #Finanzrudel

Read More »

Read More »

Ketchup-Zeiten – Robert Stein im Gespräch mit Prof. Max Otte

Diese Sendung ist werbefrei! Damit wir auch weiterhin diese Arbeit machen können, bitten wir euch um eure Unterstützung in Form eines Abos auf http://nuoflix.de (Den Preis bestimmst Du selbst und erhältst vollen Zugang zum Premiumbereich)

Read More »

Read More »