Tag Archive: newsletter

Krisen als Rendite-Boost? So lange dauern Erholungen an der Börse!

Wie lange dauern Krisen? Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=509&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=509&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️ Weitere Infos zum Video:

Im heutigen...

Read More »

Read More »

SEHENDEN AUGES IN DIE KRISE!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst!

Read More »

Read More »

Alle meine BITCOIN sind weg… Celsius Insovlenz (kein Clickbait)

Alle meine BITCOIN sind weg… Celsius Insovlenz (kein Clickbait).

Es ist wahr geworden, 80 % meiner Kryptos sind weg, aus der Traum vom TESLA. Welchen Fehler ich gemacht habe und wie es dazu kam? Wie würdet Ihr jetzt vorgehen und habt Ihr ähnliche Erfahrungen gemacht? Schreibt es gerne in die Kommentare.

Read More »

Read More »

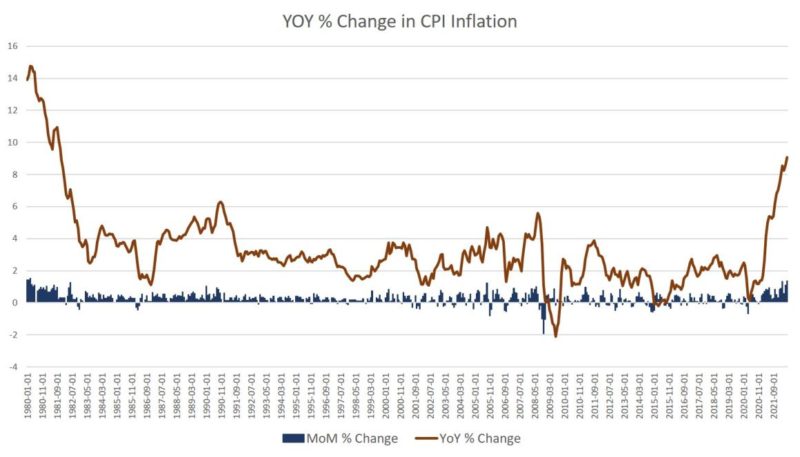

Inflation Hits 9.1 Percent after Months of Empty Talk at the Fed

The US Bureau of Labor statistics released new Consumer Price Index inflation estimates this morning, and the official numbers for June 2022 show that price inflation has risen to 9.1 percent year over year. That's the biggest number since November 1981, when the price growth measure hit 9.6 percent year over year.

Read More »

Read More »

Biggest soy traders enlist indirect suppliers to tackle hidden deforestation

Six of the world’s biggest commodity traders have committed to help some of their largest indirect suppliers source soy sustainably in Brazil’s vulnerable Cerrado region.

Read More »

Read More »

Solar tech company aims to cut Germany’s reliance on Russian gas amid Ukraine war | Tech In Trend

Europe is facing a major energy crisis amid the ongoing Russia-Ukraine war. However, there is a Solar tech company named WeDoSolar that aims to cut Germany's reliance on Russian gas.

Read More »

Read More »

Turns Out the Elites Like the Administrative State Better than Democracy

If there is a mantra among progressive American political and media elites, it would be “our democracy,” usually preceded by what they believe to be a threat from the Right. For example, progressives deemed the recent reversal of Roe “a threat to our democracy” because it removed laws regulating abortion from Supreme Court jurisdiction and returned the issue to democratically elected legislatures.

Read More »

Read More »

Augenöffner: Handel mit Hebel richtig verstehen

Unerfahrene Spekulanten nutzen oft einen zu hohen Hebel zum falschen Zeitpunkt und "überhebeln" sich, weil sie das Ausmaß der Wirkung nicht zu 100% verstehen. Wie der Handel mit Hebel richtig funtioniert, erläutert Jens Rabe in diesem Video.

Read More »

Read More »

Gold futures today and XAU trade idea

This Gold futures technical analysis and trade idea becomes applicable only if the 1700 round price is lost (crossed down) for gold.

1st buy at 1684.2

2nd buy at 1673.6

3rd buy at 1660.6

Average entry price, if all 3 orders are filled: 1672.80

The idea presents 2 parts, with the 2nd being a huge upside potential as explained.

Read More »

Read More »

Life Behind the Berlin Wall

Channel of izzitEDU: https://www.youtube.com/c/izzitorg

My Homepage - https://www.rainer-zitelmann.com/

Read More »

Read More »

JETZT WIRD ES SURREAL!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren? Wie funktioniert die Wirtschaft? Kommt die Bankenkrise?

Read More »

Read More »

Celsius kündigt Bankrott an

Der nächste größere Cryptocoin hat sein Ende gefunden. Celsius war erst 2019 als Lending Plattform gestartet und erlebte vor allem im Winter 2020 einen Bullenrun, der den zugehörigen Token in die erste Liga der Cryptocoins katapultierte. Doch jetzt ist alles aus und vorbei.

Read More »

Read More »

Fossil fuels will have to end. Are batteries the new ‘oil’?

There is an urgent need to cut greenhouse gas emissions in order to avoid global warming and create a society without fossil fuels. The solution is emission-free electrification 3 scientists received the 2019 Nobel Prize for their work on lithium-ion batteries.

Read More »

Read More »

Dairy substitutes filling up Swiss shelves

Plant-based dairy products continue to gain in popularity in Switzerland, with sales of plant-based milk more than doubling since 2017. However, dairy substitutes still occupy a niche in the overall market.

Read More »

Read More »

Like the Old McCarthyism, the New McCarthyism Targets Russia

In January 1956, the iconoclastic leftist American poet Allen Ginsberg wrote “America,” a prose poem that laments the state of the country and the poet’s place in it.

Read More »

Read More »

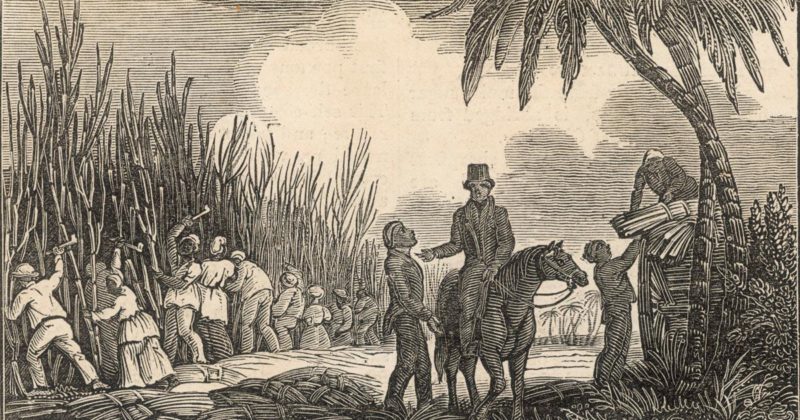

The Industrial Revolution and the West Indies: Did the Colonies Spark Progress in the Metropole?

There is a renewed interest in the West Indian colonies' relevance to the British industrial revolution and the subsequent economic transformations that substantially altered Western society's fortunes.

Read More »

Read More »

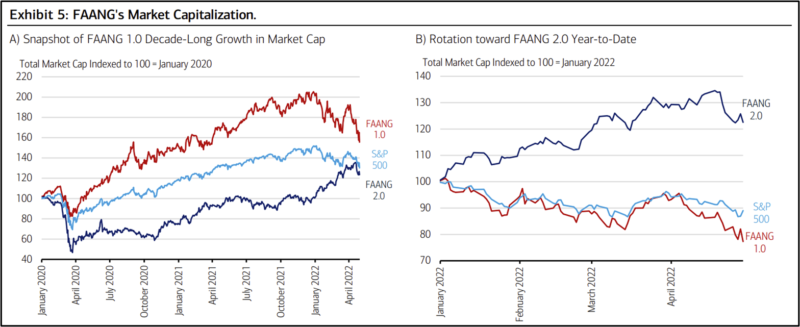

Higher Taxes are Coming: What You Can Do About it Now

Are we in an Earnings Recession? With sticky price-inflation, is 2% inflation even achievable? How people are changing habits; the recovery will likely take longer this time. Where should you park your money?

Read More »

Read More »

Axel Kaiser y Daniel Lacalle – Economía global inflación y crisis en la Unión Europea y España

Un especial agradecimiento al equipo de El Líbero por su maravillosa entrevista -

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »