Tag Archive: newsletter

Krieg gegen die EU-Bürger – Wie sich Deutschland selbst zerstört in 10 Schritten

Der Krieg der Politik gegen die eigenen Bürger?

Geldtraining: https://thorstenwittmann.com/geldsicherheit-garantiert/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Schaffen sich Deutschland, Österreich und die EU selbst ab?

Das heutige Freitagstippvideo hat es thematisch in sich, denn wir schlüsseln in 10 verschiedenen Bereichen auf, wie – ich kann es einfach nicht anders sagen - gegen die Bevölkerung Krieg geführt wird....

Read More »

Read More »

3rd quarter 2022: the number of employed persons rose by 0.8%, the unemployment rate based on ILO definition fell to 4.3%

In the 3rd quarter of 2022, the number of employed persons in Switzerland increased by 0.8% compared with the same quarter of 2021 and the number of actual hours worked per week, per employed person, increased by 2.0%.

Read More »

Read More »

Prof. Dr. Max Otte – Gold bleibt gefragt, Deutsche investieren stark

Eine reale Edelmetallmesse ist kein Vergleich zu den zurückliegenden virtuellen Veranstaltungen. Vor über 10 Jahren interessierte sich nur ein kleiner Kreis der Deutschen für Edelmetalle, doch das hat sich in Zeiten hoher Inflation geändert. Beim Pro-Kopf-Besitz an Edelmetallen sind die Deutschen ganz oben mit dabei. Und Gold bietet Potential und ist nicht überbewertet, natürlich auch Silber. Wer neu ist, bleibt besser beim physischen Metall und...

Read More »

Read More »

DAS MACHT DEN UNTERSCHIED BEI UNTERNEHMEN – Einsichten aus der Geschichte für Karriere & Investments

Wie die Geschichte den Blick auf die Zukunft verändert und welchen riesigen Effekt die Firmengeschichte auf Unternehmen hat.

_

2.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch *https://amzn.to/3xnT6rW

1.? "Des klugen Investors Handbuch" *https://amzn.to/38UCXQg

Als Hörbuch *https://amzn.to/3nAM7IU

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ - WKN: 663307

„ME...

Read More »

Read More »

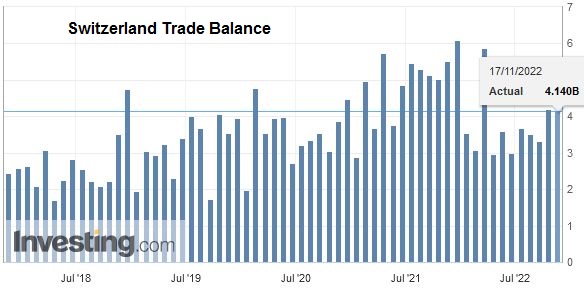

Swiss Trade Balance October 2022: declining foreign trade

In October 2022 and after two consecutive monthly increases, seasonally adjusted exports fell by 1.1% (real: −1.8%). However, they remain on a positive trend. Imports fell by 1.4% over one month (actual: −0.8%), but have stagnated since the middle of the year. The trade balance ends with a surplus of 3 billion francs, the highest recorded in the last six months.

Read More »

Read More »

Global goods inspector SGS to shed 1,500 jobs

The world’s largest goods inspection and testing group SGS will shed 1,500 jobs worldwide in a cost saving drive.

Read More »

Read More »

What I Learned from my Grandfather about Money

When I was a child, my mother and I would take the Long Island Railroad to Brooklyn to see relatives a few times a year. My grandfather was always outside in front of the apartment house in Park Slope, where he and my aunts and uncles lived. Upon seeing him, I would run down the sidewalk to greet him, but before I could say “Hi, Grandpa!,” he would without fail press a shiny silver dollar into my hand.

Read More »

Read More »

SNB-Maechler: Rückkehr zu positiven Zinsen bedingt neuen Ansatz für Geldpolitik

Die erste Leizins-Erhöhung seit 15 Jahren im Juni bezeichnet SNB-Direktoriumsmitglied Andréa Maechler als historischen Moment.

Read More »

Read More »

2022 Year-end Economic Review

Here is an encore presentation of the November 15, 2022 Lunch & Learn. our Year End Economic Review with RIA Advisors Director of Financial Planning, Richard Rosso, CFP, Senior Advisor, Danny Ratliff, CFP, and special guest Chief Investment Strategist, Lance Roberts.

01:00 - That Was the Year That Was

03:52 - What to do with Cash?

08:55 - The Wisdom in Buying Bonds

Why Inflation Doesn't Really Matter over the long haul

Safer is Always Better:...

Read More »

Read More »

Michael, Monatlich 150€ Dividenden Cashflow-Portfolio | Sparkojote Dividenden Donnerstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDonnerstag Livestream findet jeden Dienstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDonnerstag #communityportfolio #Finanzrudel...

Read More »

Read More »

IST DIE UKRAINE AM GEWINNEN?

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Die globalen Umwälzungen | Prof. Dr. Max Otte bei Mario Lochner

Vielen Dank für Ihr Ineresse! @Mario Lochner

Ganzes Inerview: _ooP9FXl9A

Der Welsysemcrash spiegel sich sark in den globalen Umwälzungen unserer Zei wider. Wir befinden uns mien in der Resrukurierung der Welmäche und nähern uns einem neuen Zeialer.

Unersüzen Sie unseren unabhängigen Journalismus mi einem Abonnemen unseres Poliik-Magazins, das 10mal pro Jahr erschein....

Read More »

Read More »

Woher Geld zum Investieren?

??https://sale.punkfriday.com/yt-2022 GRATIS ? PUNK FRIDAY Reveal Party ? 24.11.

Erfahre, wie Du erfolgreich durch die Krise navigierst und sichere dir - VOR ALLEN ANDEREN - die besten Deals des Jahres!?

#Investieren macht mehr Sinn, als der Inflation dabei zuzusehen, wie sie dein hart erarbeitetes Geld auffrisst, soweit so klar. Aber woher nimmt man das nötige Kapital zum Investieren? Sollte man im Alltag sparen? Das Netflix Abo kündigen, im...

Read More »

Read More »

Dieser Milliardär kauft jetzt Aktien!

Ein Milliardär hat wieder im Aktienmarkt zugeschlagen. Um wen es sich handelt und welche Aktien er gekauft bzw. verkauft hat, zeige ich dir im heutigen Video.

KOSTENLOSES BUCH - "Börse ist ein Business" von Jens Rabe

https://jensrabe.de/MilliardaerKauftAktienBuch

Nur für kurze Zeit. Solange der Vorrat reicht.

0:00 Quartalsreport

2:05 Größter Kauf

4:56 Weitere neue Positionen

7:45 Verkäufe

15:00 Kaufen am ATH

Vereinbare jetzt Dein...

Read More »

Read More »

Der große Marktausblick | Mario Lüddemann mit FX Flat | 15.11.2022

Ein wildes Jahr an den Börsen geht zu Ende und heute folgt der letzte Marktausblick im Jahr 2022. Wie sonst auch werde ich in der Analyse auf die großen Märke schauen – heute besonders auf den S&P 500, NASDAQ und den DAX. Aber auch den Euro und US-Dollar werde ich mir genauer ansehen, da sich hier in der letzten Woche auf Grund der Inflationszahlen viel getan hat.

► Jetzt Termin vereinbaren und vom Experten beraten lassen!...

Read More »

Read More »

The USD moves higher today. What does that mean for the EURUSD, USDJPY, GBPUSD and USDCAD?

A technical look at 4 major currency pairs to start your trading day.

In the morning forex technical report, Greg Michalowski of Forexlive takes a technical look at the price action impacting EURUSD, USDJPY, GBPUSD and the USDCAD in early North American trading. What next?

Get in synch with the market and the technicals as they help define the bias and the risk for your trading.

Read More »

Read More »

The Fed’s Anti-Inflation Campaign is Good for Bonds | 3:00 on Markets & Money

(11/17/22) Markets rallied towards our target of 4,100, but failed short of the goal. We're looking for some follow-through selling this morning; a retracement towards support won't be surprising. Markets are still on a buy-signal, but getting a bit extended. The risk is in a violation of both the 20- and 50-DMA. Inflation data of late supporting this market rally, and hopes of a Fed pivot, is also helping bonds. Weakening inflation is good for...

Read More »

Read More »

Is FTX a ‘Lehman Moment?’

(11/17/22) There's a problem with market rallies: The Fed doesn't like 'em. Estimates for Q4 GDP = 4.4% The tell will be Christmas sales; what are valuations telling us? Price must adjust for lower earnings. Things are starting to crack in financial markets; things we see during boom times vs bust times corrections: The Fed's Goal is to pull excess out of the markets. No question the Fed will pivot: But When?? FTX is not a "Lehman...

Read More »

Read More »

The Dollar Comes Back Better Bid

Animal spirits are retreating today. Asia Pacific and European equities are lower, and US futures are narrowly mixed. US 2- and 10-year yields are edging higher, while European benchmark 10-year yields are mostly softer. Italy and the UK are notable exceptions.

Read More »

Read More »