Tag Archive: newsletter

Mein Schnitt-PC – Intel, AMD, NVIDIA Geforce 4090 – Gamer-Laptop

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Für den Schnitt meiner Videos habe ich mir vor ein bis zwei Jahren einen Gamer-Laptop gekauft. Warum der genau der Richtige zum Schnitt von YouTube-Videos ist, erkläre ich in diesem Video.

10 Jahre UnterBlog ► -g

Read More »

Read More »

FTX Collapse Explained – Robert Kiyosaki, @Mark Moss

As you may have heard, FTX, a popular cryptocurrency trading site that gained popularity after it featured A-list athletes like Steph Curry and Tom Brady in its commercials has collapsed. Today's guest explains how the Enron-style scheme lost billions of dollars overnight.

Mark Moss, a nationally syndicated radio host on the iHeart network, a content creator on YouTube, a Podcaster, and the author of the new book “UnCommunist Manifesto,” says,...

Read More »

Read More »

Futures Edge Ep 34 : Why Gold is better than Bitcoin with Keith Weiner

** BuyMeACoffee- https://www.buymeacoffee.com/pathtrading

** Patreon - https://www.patreon.com/pathtradingpartners

** TradingView - https://www.tradingview.com/gopro/?share_your_love=spekul8r

** Twitter - http://www.twitter.com/Path_Trading

-+-+-+-+

Get caught up on our free YouTube ‘trading training’ videos

How I set up my Charts

--

EMA - 'Exponential Moving Average' : Crypto Technical Analysis

SMA - 'Simple Moving Average' Crypto...

Read More »

Read More »

Ein Lichtblick für die Infaltion – US Opening Bell mit Marcus Klebe – 21.11.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de...

Read More »

Read More »

Have Markets Found the Bottom? | 3:00 on Markets & Money

(11/21/22) The inmates are running the asylum during this holiday-shortened trading week, making for higher volatility on lighter trading volume. Last week markets bounced right off the 100-DMA to rally, tested support, and bounced off of that to turn previous resistance into support, with a follow-through rally on Friday. Markets are now just below the 200-DMA, and look to open a little weakly this morning. The 20-DMA has crossed above the 50-DMA,...

Read More »

Read More »

Midterms 2022 geben Rückenwind auf die Aktienmärkte | Blick auf die Woche | KW 47

In den letzten Wochen haben wir im NASDAQ, im S&P 500 und im DAX eine extrem starke Rallye gesehen. Und auch die Midterm-Wahlen in den USA am 8. November versprechen einen weiteren Aufwind in den Aktienmärkten. Welche Märkte davon besonders betroffen sind, auf Grund welcher Statistik das passiert und wie ich mich als Trader und als Investor in dieser Marktphase positioniere, dazu mehr in meinem heutigen Video.

► Jetzt Termin vereinbaren und...

Read More »

Read More »

The morning forex technical report for November 21, 2022

A technical review of the major currency pairs as Monday trading in the US gets underway.

In the morning forex technical report for November 21, 2022, Greg Michalowski of Forexlive.com outlines the key levels in play as the USD starts the week with a bid.

Read More »

Read More »

Futures Edge Ep 34 : Why Gold is better than Bitcoin with Keith Weiner

** BuyMeACoffee- https://www.buymeacoffee.com/pathtrading

** Patreon - https://www.patreon.com/pathtradingpartners

** TradingView - https://www.tradingview.com/gopro/?share_your_love=spekul8r

** Twitter - http://www.twitter.com/Path_Trading

-+-+-+-+

Get caught up on our free YouTube ‘trading training’ videos

How I set up my Charts

--

EMA - 'Exponential Moving Average' : Crypto Technical Analysis

SMA - 'Simple Moving Average' Crypto...

Read More »

Read More »

Bob is Back (at Disney)

(11/21/22) It's the Week of Thanksgiving, and up and down on the Street, traders are vacationing before Year's End they will meet. Will there be a Recession in 2023? The markets' final outcome remains to be seen. Iger's back at Disney, and the Yield Curves are spread, with hopes of a Santa Claus rally dancing in their heads. The FTX fail has raised such a clatter; will the SEC really find what's the matter? As 2022 draws to a close, the final...

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 21 novembre 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

Dollar Jumps, while Surge in Covid Cases Raise Questions about China’s Pivot

Overview: Surging Covid cases in China and Hong Kong

are undermining hopes of a Covid-pivot and the US dollar is broadly higher.

Equities are under pressure to start the week. Most of the large bourses in the

Asia Pacific but Japan, fell earlier today. Europe’s Stoxx 600 is paring last

week’s minor gain, which was the fifth consecutive weekly rise. US stock futures

are lower, while the 10-year US Treasury yield is flat near 3.83%. European

yields...

Read More »

Read More »

Hans-Werner Sinn: “Die Apokalypse ist die Realität” l The Pioneer Briefing l 21. November 2022

The Pioneer Briefing von Gabor Steingart. Am 21. November 2022 mit den folgenden Themen:

Im Interview: Der Ökonom und ehemalige Präsident des ifo-Instituts Prof. Hans-Werner Sinn spricht über seine Sorgen in Zeiten von Inflation und Rezession.

Die Börsenreporterinnen Anne Schwedt und Annette Weisbach über den größten Skandal der Silicon-Valley-Geschichte und geben einen Ausblick auf die kommende Börsenwoche.

Nach Elon Musk-Umfrage: Trump wieder...

Read More »

Read More »

Russell 2000 technical analysis in 30 seconds.

Looks like RTY is headed towards the area close to the 1800 round number, next. Watch the double technical support as mentioned within the chart.

Updates may be provided within the comment section on:

https://www.forexlive.com/technical-analysis/russell-2000-technical-analysis-in-30-seconds-20221121/

Read More »

Read More »

Total Funding to Portuguese Fintech Companies Surpasses EUR 1B Mark

In 2022, the Portuguese fintech ecosystem entered a new stage of development, marked by greater maturity of the sector, continued innovation through partnerships and a dynamic venture capital (VC) market, a new report by industry trade group Portugal Fintech, in collaboration with KPMG, Visa and law firm Morais Leitao, claims.

The Portugal Fintech Report 2022, released in October, shows a resilient fintech industry that has continued to grow,...

Read More »

Read More »

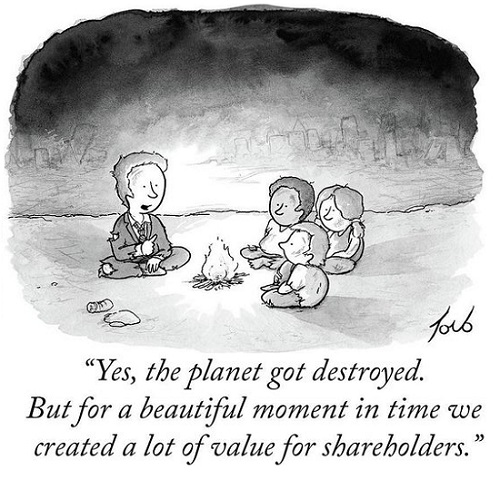

There’s No Bottom Until Frenzied Speculation Turns to Dust

Only when speculative sizzle attracts no buyers / marks will the bottom be in. There hasn't been a truly organic bottom in stocks in decades. Fifteen years of relentless central bank manipulation since the 2008-09 Global Financial Meltdown has persuaded punters that central banks will always save us should the market turn down because relentless central bank suppression of interest rates and expansion of liquidity (a.k.a. free money for financiers)...

Read More »

Read More »

Morning News mit Oliver Klemm

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Two out of three Swiss resorts raise ski-pass prices

Some ski lift companies are charging up to 15% more for passes this winter as high energy prices bite, a survey by CH Media shows.

Read More »

Read More »

China macht uns Sorgen! DAX = Short? – “DAX Long oder Short?” mit Marcus Klebe – 21.11.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de...

Read More »

Read More »

Relying on Experts: A Proven Path to Failure

The warning lights on the dashboard of your car suddenly light up. You naturally take it to a mechanic to diagnose and repair. Cars are complex. You don’t have the time or accumulated expertise to figure out what is happening or to fix it.

We rely on experts daily.

Read More »

Read More »