Tag Archive: newsletter

Swiss Consumer Price Index in November 2022: +3.0 percent YoY, 0.0 percent MoM

The consumer price index (CPI) remained stable in November 2022 compared with the previous month, remaining at 104.6 points (December 2020 = 100). Inflation was +3.0% compared with the same month of the previous year.

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #10

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

So gehen Sie sich richtig mit der Inflation um!

Anpassung an die Inflation

Empfohlenes ? *https://amzn.to/3GWP4Q1

_

3.? *https://amzn.to/3V6SbsO - jetzt vorbestellen!

2.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch *https://amzn.to/3xnT6rW

1.? "Des klugen Investors Handbuch" *https://amzn.to/38UCXQg

Als Hörbuch *https://amzn.to/3nAM7IU

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ - WKN: 663307

„ME Fonds -...

Read More »

Read More »

Credit Suisse looks to speed up cuts as revenue outlook worsens

Swiss bank Credit Suisse is looking for ways to accelerate cost cuts announced just weeks ago as client outflows and a slowdown in activity weigh on its revenue outlook, according to three people with knowledge of the talks.

The cost savings are likely to involve more job cuts than previously announced for the first wave of reductions, including in its mainstay wealth business, said the sources, who asked to remain anonymous because the...

Read More »

Read More »

Deflation Is Not a Problem: Reversing It Is

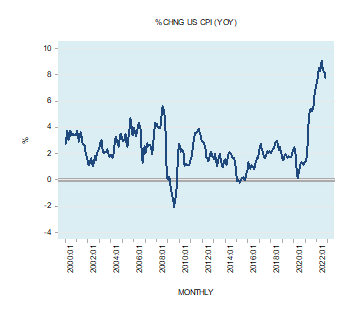

The yearly growth rate of the Consumer Price Index (CPI) fell to 7.7 percent in October from 8.2 percent in September. Note that in October 2021 the yearly growth rate stood at 6.2 percent. Some experts are of the view that it is quite likely that the momentum of the CPI might have peaked.

Read More »

Read More »

On Secession and Small States

The international system we live in today is a system composed of numerous states. There are, in fact, about two hundred of them, most of which exercise a substantial amount of autonomy and sovereignty. They are functionally independent states. Moreover, the number of sovereign states in the world has nearly tripled since 1945.

Read More »

Read More »

Unpredictable Outcome In Gold & Silver Price Coming – Alasdair Macleod | Gold Price Prediction

Unpredictable Outcome In Gold & Silver Price Coming - Alasdair Macleod | Gold Price Prediction

#goldprice #goldpriceprediction #alasdairmacleod

Credits: Alasdair MacLeod

Twitter: https://twitter.com/MacleodFinance

--------------

⬇ Inspired By: ⬇

Financial Crisis Is Already Here, Don’t Let the Market Exuberance Fool You Warns Lynette Zang

-tnozmGa4

Fed’s Credibility is Destroyed, Why Cash, Gold and Silver Will Be Best Lifeline | Outlook...

Read More »

Read More »

GOLD UPDATE: This Is About To Happen To Gold PRICE – Alasdair Macleod

[Free Guide] Protect Your Wealth With A Gold IRA - https://GoldIRABlueprint.com/Freedom

Download Our Free "Inflation Fighter Kit" To Beat The Herd - https://GoldIRABlueprint.com/BeatInflation

If You Prefer Silver, Get Your Free Silver IRA Guide - https://goldirablueprint.com/SilverYoutube

---

With our free Gold & Silver IRA Guides you'll learn:

- How To Find Retirement Peace Of Mind With A Gold Or Silver IRAs

- 15 Bad Reasons To Buy...

Read More »

Read More »

The 3rd Factor Impacting the World Order: the Rise of China

The third factor impacting the world order is the rise of China. #geopolitics #principles #raydalio

Read More »

Read More »

DU SOLLST DICH IMPFEN LASSEN???

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

1000€ – wie investieren? (WEIHNACHTSSPECIAL)

Im letzten Livestream habe ich euch gefragt, ob ihr ein "Wie investiere ich ... Betrag" Special sehen wollt und dieses wurde enorm von euch begrüßt. Deswegen starten wir auch gleich heute! Dabei besprechen wir gemeinsam, wie ich Investments (Bitcoin, ETF, Gold, Silber, Rohstoffe usw.) prozentual auf verschiedene Generationen gewichten würde und worauf ihr achten müsst. Anfangen werden wir bei 1.000€ und gehen nächste Woche auf die...

Read More »

Read More »

Vergiss Aktien. Diese Anlage ist jetzt viel besser!

Vor allem Tech-Aktien sind im letzten Jahrzehnt extrem gut gelaufen. Was sich daran in Zukunft ändern könnte und welche Anlage daher die bessere sein könnte, erkläre ich dir im heutigen Video.

KOSTENLOSES BUCH - "Börse ist ein Business" von Jens Rabe

https://jensrabe.de/VergissAktienAnlageBuch

Nur für kurze Zeit. Solange der Vorrat reicht.

0:00 Aufgaben der FED

3:12 Arbeitslosigkeit

6:23 Was macht momentan Sinn?

10:20 Das macht die FED...

Read More »

Read More »

Diese 5 Titel kaufe ich JETZT | Mario Lüddemann

Nach der Rede des US-Notenbankchefs Jerome Powell gestern Abend ist klar, dass die Zinserhöhungen in den USA langsam auslaufen werden. Das hat die Aktienmärkte beflügelt: Der S&P 500 stieg um 3 % und der NASDAQ sogar um 4,5 %. In meinem heutigen Video verrate ich Dir, welche Aktien davon am meisten profitiert haben und welche Aktien ich jetzt in meinem Live-Depot umsetze werde.

- - -

► KOSTENLOS: 2-tägiges Beginner-Seminar vom 03. bis 04....

Read More »

Read More »

The cost of health care: how to make it affordable

The cost of health care is unaffordable for many in the developing world. But while universal health care may sound like an impossible dream, it’s more achievable than you might think.

Film supported by @bainandcompanyinsights

00:00 – The argument for universal health coverage is clear

00:57 – Thailand’s path to universal health coverage

03:31 – Universal health care around the world

04:48 – How to finance universal health coverage?

05:30 –...

Read More »

Read More »

Andreas Beck: Trendwende für Aktien in der Krise (Was steckt dahinter?)

Andreas Beck: Trendumkehr für Aktien in der Krise (stimmt das?)

✘ Abonniere hier den Kanal:►► https://bit.ly/3j64j9V ?

Video auf dem Kanal von Atlas Initiative für Recht und Freiheit

►► &t=56s

Dr. Andreas Beck glaubt an die Jahresendrally. Er spricht darüber, dass die Inflation besiegt ist und die Notenbanken die Zinsen nicht weiter erhöhen werden. Andreas Beck ist sich sicher, dass wir derzeit einen guten Zeitpunkt haben um in Aktien zu...

Read More »

Read More »

The morning forex technical report. The USD moves down w/ the EURUSD testing its 50% level

A look at some of major currency pairs near the start of the US session.

In the morning forex technical report:

- The EURUSD is trading higher and in the process moving away from its 200 day moving average and testing its 50% midpoint of the 2022 trading range at 1.05155.

- The USDJPY move below a key target at the 38.2% retracement of the move up from the 2022 low at 137.24. Sellers push lower after the break.

- The GBPUSD has moved above its...

Read More »

Read More »

Is the Fed Worried About Over-tightening? | 3:00 on Markets & Money

(12/1/22) Fed Chairman Jerome Powell Wednesday implied concern about over-tightening the economy, a very different tack than was expressed just a month ago, when he said he WASN'T worried about over-tightening because the Fed had "tools to solve that problem." What's changed? Employment is showing signs of weakening, manufacturing is showing signs of slowing, so NOW he's worried about over-tightening. That's all market bulls needed to...

Read More »

Read More »

December 2022 Monthly

As the year of aggressive monetary tightening winds down, the

Federal Reserve, the European Central Bank, and the Bank of England will likely

slow the pace of rate hikes. All three delivered 75 bp hikes in November and

will probably hike by 50 bp this month and moderate the pace again in the first

part of next year.Price

pressures remain elevated even if near or slightly past the peaks. The G10

central banks are not finished tightening, though...

Read More »

Read More »

The way forward:

A practical roadmap to reclaiming individual and financial sovereignty – Part II of II

Essential ingredients

There have always been people with a passion for liberty. Since the earliest historical records, we can find questioners, dissenters, “trouble makers”, contrarians and all kinds of free and inquisitive minds. In this day and age, however, technology has played a decisive role in the influence they can have. Sure, the “bad guys” might...

Read More »

Read More »