Tag Archive: newsletter

Die “Titanic”-Analogie, die Sie noch nicht gehört haben | Von Charles Hugh Smith

Den vollständigen Tagesdosis-Text (inkl. ggf. Quellenhinweisen und Links) finden Sie hier: https://apolut.net/die-titanic-analogie-die-sie-noch-nicht-gehoert-haben-von-charles-hugh-smith

Read More »

Read More »

Buy & Hold über Dekaden, macht dich zum Millionär. | Sparkojote feat. @TimSchaeferMedia

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

??Kanal von Tim ►► @TimSchaeferMedia

#Millionär #TimSchäfer #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★ Herzensprojekte von Thomas dem Sparkojoten ★

Ich betreibe viele Projekte die mir ungemein Spass machen. Ich gebe mir Mühe, alle Projekte unter einen Hut zu bekommen: Sparkojote, Amazingtoys.ch, das Finanzrudel… Falls ihr euch...

Read More »

Read More »

6 Irrtümer über ETFs, die Du hoffentlich nicht mehr begehst

Kennst Du schon ganz gut aus bei ETFs? Dann entdeckst Du sicher Fehler in einem Text, der eigentlich für ETF-Einsteiger geeignet ist. Saidi testet im heutigen Video Dein Wissen anhand von einem Quiz.

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Finanztip ETF-Finder ►...

Read More »

Read More »

Ich hasse Gold, aber…

Gold wird von vielen als Krisenschutz angesehen. Warum ich gern auf den Besitz von Gold und Silber verzichte, jetzt aber trotzdem gekauft habe, erkläre ich dir im heutigen Video.

KOSTENLOSES BUCH - "Börse ist ein Business" von Jens Rabe

https://jensrabe.de/HasseGoldAberBuch

Nur für kurze Zeit. Solange der Vorrat reicht.

0:00 Produktivität

4:05 Chart

7:32 Direktional, Indirektional

11:07 Learnings

Vereinbare jetzt Dein kostenfreies...

Read More »

Read More »

TESLA Erfahrung mit MAELO | Thomas Kovacs Podcast Clips

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

TESLA⚡ Erfahrung mit MAELO | Thomas Kovacs Podcast Clips

@MaeloRomani

Link zum Podcast:

?? Der BLOG zum YouTube-Kanal ►► http://sparkojote.ch

#Thomas #Sparkojote #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★ Herzensprojekte von Thomas dem Sparkojoten ★

Mittlerweile betreibe ich einige Projekte und es macht mir ungemein...

Read More »

Read More »

Sprott Money Precious Metals Monthly Projections – December 2022

It’s the holiday season! But is the Grinch coming for gold and silver? Host Craig Hemke and analyst Chris Vermeulen of the Technical Traders break down all the charts you need to see how long the coming downturn could last…and why you want to be ready when it turns up again.

Have questions for us? Send them to [email protected] or simply leave a comment here.

Check out https://www.sprottmoney.com, or to learn more about Chris...

Read More »

Read More »

The major forex currency pairs are seeing up and down price action.What to look for today?

A technical look at the EURUSD, USDJPY, GBPUSD and AUDUSD after the RBA rate hike.

There is up and down price action in some of the major currency pairs. In the morning forex technical report, I look at the EURUSD, GBPUSD, USDJPY and the AUDUSD after the RBA rate hike and outline the levels in play after up and down activity dominated the trading action so far today.

Read More »

Read More »

Will A Hawkish Fed Return Next Week? | 3:00 on Markets & Money

(12/6/22) Markets took a tumble back below the 200-DMA as the Fed's own market whisperer, Nick Timiraos of the Wall Street Journal, published comments that the Fed may not only hike rates more aggressively, but are nowhere near a pivot or pause in their monetary policy. The potential for more rate hikes in 2023 sent markets lower. The reality is that the Fed is still raising rates and reducing liquidity. The recent rally was predicated on slowing...

Read More »

Read More »

The Problem with The Fed is The Fed

(12/6/22) The Fed is hell-bent on continuing the most aggressive interest rate hike campaign in 40-years. There is no hint of Fed softening or relenting, reinforced by comments published in the WSj to knock down spending, hiring, and inflation; Christmas shopping progress & supporting small businesses: The Houston gasoline station with Full Service pumps; how Nick Timiraos killed the market. What happens when rates rise, employment falls, and...

Read More »

Read More »

Kommt die Rezession – oder kommt sie nicht? Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Die “Titanic”-Analogie, die Sie noch nicht gehört haben | Von Charles Hugh Smith

Den vollständigen Tagesdosis-Text (inkl. ggf. Quellenhinweisen und Links) finden Sie hier: https://apolut.net/die-titanic-analogie-die-sie-noch-nicht-gehoert-haben-von-charles-hugh-smith

Ein Kommentar von Charles Hugh Smith.

Passive Akzeptanz des Verleugnens

Ob wir uns dessen bewusst sind oder nicht, wir reagieren mit passiver Akzeptanz des Verleugnens.

Sie haben zweifellos gehört, dass die Neuanordnung der Liegestühle auf der Titanic eine...

Read More »

Read More »

Yesterday’s Dollar Recovery Questioned Today

Overview: The 11 bp jump in the 10-year US yield yesterday after dropping nearly 26 bp in the previous three sessions, helped the greenback recover and took a toll on stocks. Still, the S&P 500 is above the low set on November 30 (~3939) before Fed Chair Powell's talk that day.

Read More »

Read More »

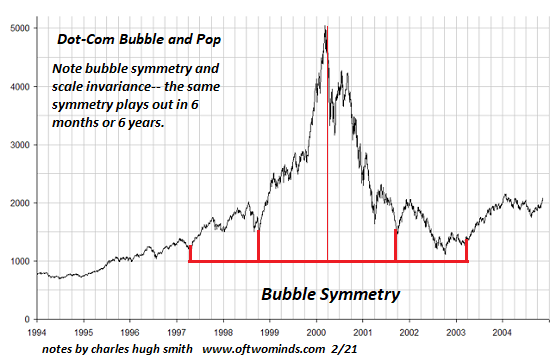

The Bubble Economy’s Credit-Asset Death Spiral

Who believed that central banks' financial perpetual motion machine was anything more than trickery designed to generate phantom wealth? Central banks seem to have perfected the ideal financial perpetual motion machine: as credit expands, money pours into risk assets, which shoot higher under the pressure of expanding demand for assets that yield either hefty returns (junk bonds) or hefty capital gains as the soaring assets suck in more capital...

Read More »

Read More »

Lohn sich GOLD als Investment? #shorts

?philoro 50 CHF Startguthaben fürs Goldabo Gutscheincode: SPARKOJOTE ►► http://sparkojote.ch/philoro

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe ich bei Swissquote und Yuh. Für meine privaten Finanzen nutze ich Zak von der Bank Cler. Meine Säule 3a für die Altersvorsorge betreibe ich bei frankly der Zürcher Kantonalbank. Die Kreditkarte...

Read More »

Read More »

Das Netz fragt – Episode 1: Prof. Dr. Lars Feld und Prof. Dr. Hans-Werner Sinn

«Das Netz fragt» und die beiden Ökonomen Prof. em. Dr. Dr. h.c. mult. Hans-Werner Sinn und Prof. Dr. Dr. h.c. Lars P. Feld antworten. Wir legen den beiden Top-Ökonomen Fragen aus Online-Foren und den Sozialen Medien auf den Tisch: Warum hat der Kapitalismus einen schlechten und der Sozialismus einen guten Ruf? Könnte eine Planwirtschaft auf …

Read More »

Read More »

“Classical Liberalism” Will Never Satisfy the Left

“Today the tenets of this nineteenth-century philosophy of liberalism are almost forgotten. In the United States “liberal” means today a set of ideas and political postulates that in every regard are the opposite of all that liberalism meant to the preceding generations.”

Read More »

Read More »

Reflections upon the Centennial of Mises’s Socialism

Ludwig von Mises published Die Gemeinwirtschaft: Untersuchungen über den Sozialismus in 1922 (translated into English as Socialism: An Economic and Sociological Analysis, 1951). In more than five hundred pages, the most prominent representative of the Austrian school offers a comprehensive and deep analysis of the “socialist phenomenon.”

Read More »

Read More »