Tag Archive: newsletter

Wie Sie dieses JAHR der GEWINNER werden!

In diesem Video gebe ich meine Perspektive zu Ihrer individuellen Situation und zeige Ihnen die Chancen auf, die sich Ihnen in der heutigen Lage bieten. Ich gebe Ihnen Tipps darüber, was jetzt angesagt ist und wie Sie entgegen dem aktuellen Zeitgeist handeln können. Ich stelle auch verschiedene Wege vor, wie Sie Ihre Ziele erreichen können und warum der Fokus auf Qualität so wichtig ist. Schauen Sie sich das Video an, um mehr darüber zu erfahren,...

Read More »

Read More »

Max Otte: Der große Untergang beginnt (unaufhaltsam)

Max Otte YouTube-Kanal➡️https://www.youtube.com/channel/UCnPPHnJUmZvaaHlU0NxWoJA

?Jahresmitgliedschaft➡️ https://investinbest.de/produkt/invest-in-best-mitgliedschaft-jaehrliche-zahlung/

?PREPARE FOR 2023 ➡️https://investinbest.de/produkt/mitgliedschaft-prepare-for-2023/

? Invest in Best ALL IN➡️https://investinbest.de/produkt/invest-in-best-all-in/

? IIB LIVE EVENT ➡️ https://investinbest.de/produkt-kategorie/iib-live-event/

?REICH durch...

Read More »

Read More »

Swiss examine Covid test obligation for travellers from China

While countries around the world impose curbs on travellers from China as Covid-19 cases there surge, the Swiss authorities are still weighing up possible measures.

On Wednesday health experts from the 27 EU member states couldn’t agree on compulsory testing for travellers from China, but they strongly recommended it.The EU health experts also recommended, among other things, that medical or FFP2 masks be worn on aircraft from China.The...

Read More »

Read More »

Rome’s Runaway Inflation: Currency Devaluation in the Fourth and Fifth Centuries

By the beginning of the fourth century, the Roman Empire had become a completely different economic reality from what it had been at the beginning of the first century. The denarius argenteus, the empire’s monetary unit during the first two centuries, had virtually disappeared since the middle of the third century, having been replaced by the argenteus antoninianus and the argenteus aurelianianus, numerals of greater theoretical value, but of less...

Read More »

Read More »

So Investiert der 19 jährige Ben, als Bankkaufmann. | Sparkojote Dividenden Donnerstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDonnerstag Livestream findet jeden Donnerstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDonnerstag #2023 #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★...

Read More »

Read More »

DER SCHRECKEN VON DEEPFAKES

Gratis Trading-Workshop (Jetzt in 2023 absichern): https://us02web.zoom.us/webinar/register/2216698238673/WN_HGjVPNwDQlCJ34S41vZeyA (jetzt anmelden!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht...

Read More »

Read More »

Kollektives Erwachen der Menschheit – Ernst Wolff im Gespräch mit Politik Spezial

In diesem Interview gehen Helmut Reinhardt und der Journalist und Buchautor Ernst Wolff der Frage nach, welche Chancen die derzeitige Krise bietet, um die Menschen nachhaltig vom bisherigen System zu befreien. Weltweit arbeiten die Zentralbanken an der Einführung von digitalem Geld und doch ist dieses Vorhaben bei einem Großversuch in Nigeria krachend gescheitert. Es scheint, als wäre der Zeitpunkt gekommen, an dem sich die Menschen ihrer eigenen...

Read More »

Read More »

2023 wird das Jahr der ganz großen Gewinne – Hans A. Bernecker im Themencheck vom 04.01.2023

Themencheck von Hans A. Bernecker ("Die Actien-Börse") im Rahmen von Bernecker.TV. Hier auf YouTube gibt es die stark verkürzte FreeTV-Variante inkl. (teils nicht direkt zusammenhängenden) Einblicken in die ansonsten längere Sendung vom 04.01.2023. Lust auf die eigentliche Hauptsendung und viele weitere Beiträge der #Bernecker-Redaktion? Informieren Sie sich gerne über #BerneckerTV:

https://bernecker.info/product?id=43

Zu den Themen der...

Read More »

Read More »

Live-Trading mit Rüdiger Born Analyse, Trading-Ideen & Daytrading 10.01.23

Schauen Sie dem Profi-Trader Rüdiger Born jede Woche online und live über die Schulter. Kostenlose Anmeldung: https://de.xtb.com/born-live

? Unsere täglichen Marktanalysen finden Sie hier: https://www.xtb.com/de/Marktanalysen/Taegliche-Marktanalysen

??? Trading Wissen:

https://www.xtb.com/de/Ausbildung

? Unsere BESTE mobile Trading App:

https://www.xtb.com/de/mobile-app

? Aktien ohne Provision: https://www.xtb.com/de/aktien

?...

Read More »

Read More »

Unseriöse Broker vermeiden: Börsenjahr 2023 Tipp 4

Durch das wachsende Angebot an Onlinebrokern in den letzten Jahren fällt es vielen schwer, den richtigen Anbieter für den eigenen Handel zu finden und ich zeige dir, warum ein seriöser Broker extremst wichtig ist. Das Jahr 2023 hat gerade begonnen und wir alle wollen auch in diesem Jahr erfolgreich an der Börse handeln. Aus diesem Grund gebe ich dir diese Woche sieben Tipps, die dir den perfekten Start ins Börsenjahr 2023 sichern.

Sicher dir...

Read More »

Read More »

TWITTER FILES DECKEN AUF: Die Wahrheit über DONALD TRUMP kommt ans Licht!

Twitter sperrte den amtierenden Präsidenten der USA Donald Trump am 08.01.2021 Über die Hintergründe, die zur Sperrung führten erfahren wir nun zum ersten mal Genaueres durch die Twitter Files

bis zu 100 Euro bei Depoteröffnung für ETFs & Sparpläne ► http://link.aktienmitkopf.de/Depot *

90 Tage Audible kostenlos testen https://amzn.to/3CadFNJ *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible...

Read More »

Read More »

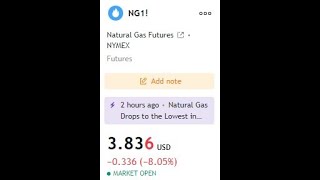

Natural Gas technical analysis: Go Long, go big!

An excelland spot to go Long (at your own discretion) at this amazing technical junction.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 5 janvier 2023, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

The morning Forex technical report for January 5, 2023

A technical look at some of the major currency pairs with the US dollar

Click on the above video to watch the morning Forex technical report for January 5, 2023. IN the reported take a look at the lows and play for some of the major currency pairs versus US dollar including the EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD.

Read More »

Read More »

The 2023 Word of the Year

(1/5/23) The Santa Rally was tardy and tawdry, and markets must make a decision soon whether to move higher or lower; what will the Fed do next? What the MACD is telling us: Take care to be more risk-averse. Is there opportunity for profits in Gold? Market headwinds this year will come from the Fed. The Roberts' Vacation: Being an A-list'er at Red Robin; parsing the latest Fed meeting minutes: How will the Fed lower stock prices without panicking...

Read More »

Read More »

2023: You Wanted Endless Stimulus, You Got Stagflation.

After more than $20 trillion in stimulus plans since 2020, the economy is going into stagnation with elevated inflation. Global governments announced more than $12 trillion in stimulus measures in 2020 alone, and central banks bloated their balance sheet by $8 trillion.

Read More »

Read More »

The Market Appears to Shrug Off the Fed’s Warning

Overview: The US dollar is consolidating in a mixed

fashion today. The FOMC minutes drew much attention but failed, at least

initially, to spur a significant shift in expectations. The pricing in the Fed

funds futures strip is still consistent with a cut later this year, which the

minutes were clear, no officials anticipate. Today's US ADP jobs estimate, and

November trade balance are being overshadowed by tomorrow's nonfarm payroll

figures. The...

Read More »

Read More »

Kann die Fed ein “Soft Landing” schaffen? (Marketing-Anzeige)

Obwohl die US-Inflationsdaten zuletzt hoffen ließen, bleibt trotzdem die große Frage offen: Schafft die Federal Reserve ein "Soft Landing", also die erfolgreiche Bekämpfung der Inflation mit möglichst wenig negativen Auswirkungen für die Konjunktur? Das dürfte auch maßgeblich den Dollar beeinflussen, der zuletzt vergleichsweise eher schwächelte. Die Entwicklung in China bleibt ebenfalls spannend, da sich hier jüngst leichte Entspannungen...

Read More »

Read More »

Your Wealth Will Save Central Banks!

2023-01-06

by Stephen Flood

2023-01-06

Read More »