Tag Archive: newsletter

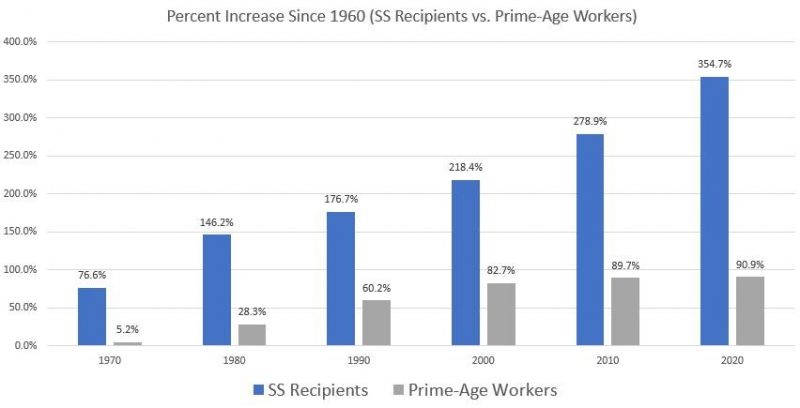

Raise the Social Security Age to (At Least) 75

On January 10, the French government announced plans to raise the retirement age from 62 to 64. The change would mean that after 2027, workers in France would have to work 43 years to qualify for a government pension, instead of 42 years. French workers promptly took to the street in protest decrying even this very small reduction government welfare.

Read More »

Read More »

Investor Andreas Beck: erfolgreich trotz Krise

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: bit.ly/3ijGqRh

#andreasbeck #investieren #aktien #aktienmarkt #privatanleger

Der Fonds-Manager Andreas Beck hat ein neues Buch auf den Markt gebracht. “Erfolgreich wissenschaftlich investieren”. Und hier kommt die gute Nachricht! Das Buch können Sie kostenlos downloaden. Den Link finden Sie hier:

ANDREAS BECKs eBook zum Download -...

Read More »

Read More »

Russia-Ukraine war: 3 killed, 14 injured in Russian strike on residential complex in East Ukraine

Three people have been killed and 14 others have been injured in a Russian strike in Eastern Ukraine city. Kiev said that Moscow targeted residential buildings as garages and civilian cars were damaged earlier in an alleged strike in a Ukrainian hospital.

Read More »

Read More »

Self-Reliance in the 21st Century By Charles Hugh Smith, Chapter by Chapter Preview

Hear it Here - https://adbl.co/3iJOonl

Just as no one was left unaffected by the rise of globalization, no one will be unaffected by its demise. The only response that reduces our vulnerability is self-reliance.

When Ralph Waldo Emerson wrote his famous essay Self-Reliance in 1841, the economy was localized and households supplied many of their own essentials. In our hyper-globalized economy, we’re dependent on distant sources for our...

Read More »

Read More »

Die besten Strategien für das neue Börsenjahr 2023 mit André Stagge

Der Portfoliomanager André Stagge gibt Antworten auf die wichtigsten Fragen für Anleger. Wo entstehen Chancen, welche Risiken gibt es zu beachten?

Read More »

Read More »

Gold Is Money, Everything Else is Credit with Alasdair Macleod

This video is a clip from the WTFinance Podcast Interview with Alasdair Macleod, Head of Research at Goldmoney, Educator for sound money and demystifying finance and economics.

Read More »

Read More »

Pfizer Wissenschaftler rutscht die Wahrheit raus! Brisante Enthüllungen! Ich verkaufe BIONTECH Aktie

Dem Pfizer Wissenschaftler Jordan Walker wurden mit versteckter Kamera von einem Investigativ-Journalisten brisante Enthüllungen entlockt! Mehr dazu erfahrt ihr im aktuellen Video!

Read More »

Read More »

Week Ahead Alchemy: Can Powell Turn a Quarter-Point Move into a Hawkish Hike?

The new year is still

young, but the week ahead may be one of the most important weeks of

the year. The divergence that the market has been anticipating will

materialize. The Federal Reserve will most likely hike by 25 bp on Wednesday,

followed by half-point moves by the European Central Bank and the Bank of

England the following day. On Friday, February 3, the US will report its

January employment situation. It could be the slowest job creation...

Read More »

Read More »

DeFiChain 2022 Review (incl. English subtitles)

#JulianHosp #Bitcoin #Blockchain. Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH #cryptofit zu machen!

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 09.02.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 08.02.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 10.02.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 07.02.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 06.02.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 03.02.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 02.02.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »