Tag Archive: newsletter

Real Wages Fall for the Twenty-First Month as Rent and Food Prices Keep Rising

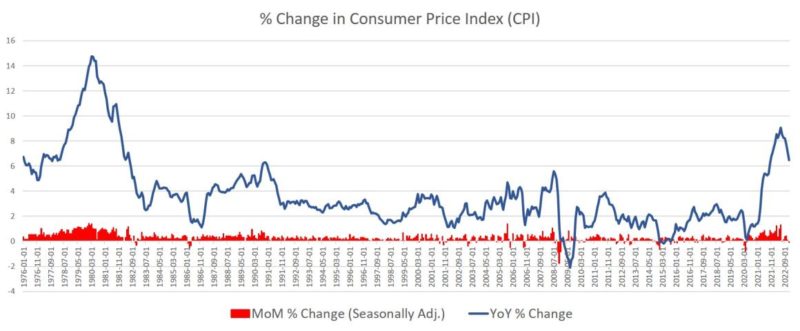

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in fifteen months.

Read More »

Read More »

Is “The Big Reset” Here? Silver & Gold outlook for 2023 – Willem Middelkoop

Hey guys! Let's try and break 2,000 likes on this video!

Don't forget to SUBSCRIBE to the Channel and enjoy the video!

Willem's Patreon: https://tinylink.net/LWTTf

Willem's Twitter: https://tinylink.net/SQDpI

Willem Middelkoop returns to the show, and we dive into the current state of the global economy and how it is undergoing a "BIG RESET." One significant sign of this is China's recent announcement of increased Gold purchases....

Read More »

Read More »

DIE KI CHATGBT…

Gratis Trading-Workshop (Jetzt in 2023 absichern): https://us02web.zoom.us/webinar/register/2216698238673/WN_HGjVPNwDQlCJ34S41vZeyA (jetzt anmelden!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht...

Read More »

Read More »

The Great Reset – gut oder böse? Insider erzählt (Twitterfiles, China, Finanzen)

Klaus Schwab, sein Elitetreffen in Davos, das WEF (World Economic Forum) und sein “Great Reset” sind umstritten wie noch nie. Ist das alles eine Verschwörungstheorie oder ist da was dran? Nachdem Klaus Schwab meine Interviewanfrage abgelehnt hat, konnte ich eine WEF Insiderin gewinnen, um einen Einblick hinter die Kulissen zu gewinnen.

Read More »

Read More »

WAGENKNECHTS PROGNOSE WIRD WAHR!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf!

Read More »

Read More »

The Pension Fund Time Bomb With Keith Weine

Tune in to hear my latest podcast, The Pension Fund Time Bomb With Keith Weiner, and please like, retweet, and comment down below. Don't forget, you can always listen to Lead-Lag Live on Spotify, Apple, YouTube, and all your favorite platforms.

Read More »

Read More »

Ernst Wolff – Dieser SCHOCK trifft auch uns über Nacht wie ein Donnerschlag! 3 Top Fakten!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

Aktie aus NORWEGEN profitiert massiv von RUSSLAND SANKTIONEN!

Seit den Russland Sanktionen, die von der EU und anderen Ländern verhängt wurden, steigt die Nachfrage nach Erdöl und vor allem Erdgas aus anderen Ländern stark an. Ganz stark profitiert das Unternehmen Equinor aus Norwegen. Heute gibt es eine Aktienanalyse dazu

? Kostenlose Anmeldung bei Spatz Portfolio Software ►►► https://gospatz.com/signup

Zum Discord von Spatz ► https://discord.gg/8xjQwCH9Fy

? Meine Depotempfehlung ►...

Read More »

Read More »

Diese Anlageklasse steigt IMMER – Experten-Interview mit Uwe Pettenberg

In diesem Video spreche ich mit dem Experten Uwe Pettenberg darüber, warum Oldtimer eine stabile und sichere Wertanlage sind und wie auch du davon profitieren kannst.

Read More »

Read More »

Max Otte: Darum kollabiert die deutsche Mittelschicht

KLARTEXT! Max Otte: Darum kollabiert die deutsche Mittelschicht

✘ Abonniere hier den Kanal:►► https://bit.ly/3j64j9V ?

Quelle: &t=65s

Max Otte und viele weiter Experten sind der Meinung dass der deutsche Mittelstand gerade stirbt. Die Entscheidung die in der Politik während der Energiekrise getroffen worden sind, machen es dem Mittelstand in Deutschland immer schwieriger zu überleben. Welche Risiken es derzeit für den deutschen Mittelstand...

Read More »

Read More »

“We Won’t Recover From This For Decades” – Marc Faber’s Warning

Marc sees the combination of 'too much debt', asset bubbles, a moribund global economy, and smoldering social unrest resulting from historic levels of wealth inequality serve as a pressure cooker that will break badly somewhere in the system.

Read More »

Read More »

Why Investors and Investment Ideas Fail – Charlie Munger Advises on Investments

In this video, Charlie Munger provides insights and advice on stock market investment. He shares his advice on life and how you can approach life by having common sense.

Read More »

Read More »

Why Millionaires Appear Broke | Tips To Make And Spend Money Smart

Let me guess. You may want to build wealth from scratch or find out how exactly millionaires spend their money. You want to be a millionaire, live, and spend like them. If that’s it, this is just the right video to help you discover their secrets and become a millionaire.

Read More »

Read More »

Andreas Beck vergisst…

? Folge immocation auf Instagram: https://www.instagram.com/immocation/ ?

--------------------------------------------------------------------------------

? UNSER BUCH - BEI AMAZON

--------------------------------------------------------------------------------

Unser Buch: "Die Do-it-yourself-Rente. Passives Einkommen aus Immobilien zur Altersvorsorge."

? In diesem Video erfährst du mehr über das Buch:

▶ Hier kannst du das...

Read More »

Read More »

Trotz hoher Inflation: Diese Produkte werden billiger!

Durch die hohe Inflationsrate des letzten Jahres, sind die meisten Produkte deutlich teurer geworden. Es gibt aber einige wenige Dinge, die dieser Inflation sogar getrotzt haben und günstiger geworden sind. Welche Produkte das genau sind, erfahrt ihr im heutigen Video! Viel Spaß :)!

Read More »

Read More »

Die Inflation ist tot! Kommt jetzt das All-Time High?

Liebe YouTube Freunde,

die Inflation ist tot! Doch auf was müssen wir uns jetzt einstellen? Kommt das All-Time High? Und welche Rolle spielen eigentlich die KI Systeme dabei?

Meine Einschätzung findet Ihr im Video. Wie immer mit Grafiken und Statistiken.

✅ Long&Short Börsenbrief: https://www.homm-longshort.com

✅ Florian Homm Investmentclub: https://florian-homm.com/

✅ Bücherempfehlungen: https://amzn.to/3TFtxhW

✅ Folge mir auf...

Read More »

Read More »

Dr. Markus Krall – Absolut geisteskrank! Diese Entwicklung macht fassungslos! 3 Top Aussagen!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »