Tag Archive: newsletter

Dividenden 2023 auf Rekordkurs! Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

EIL: Die Lockdown Files – Neue Enthüllungen

Quelle: https://www.telegraph.co.uk/news/lockdown-files/

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter:...

Read More »

Read More »

Mit 25 CHF an der Börse Investieren!

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Wie man mit bereits 25 CHF Geld an der Börse investert!?

Erfahre in diesem Video, wie du bereits mit 25 CHF an der Börse investieren und Geld verdienen kannst. Ich zeige dir die besten Strategien und Tools, um erfolgreich zu sein, egal ob du ein Anfänger oder Fortgeschrittener bist. Lass uns loslegen!

#investieren...

Read More »

Read More »

Ist ein Weltkrieg möglich? Atomwaffen? “Selbstverständlich” | Prof. Dr. Max Otte

Ein Jahr nach dem Ukraine-Krieg – Eskalation oder Ende in Sicht? Interview Prof. Dr. Max Otte

Thorsten Wittmann Homepage: https://thorstenwittmann.com/

Prof. Dr. Max Otte Homepage: https://max-otte.de/

Max Otte Multiple Opportunities Fund: https://max-otte-fonds.de/momo/

Können Sie sich eine Eskalation des Kriegs mit Atomwaffen und Weltkrieg vorstellen?

Prof. Dr. Max Otte ist den meisten unter uns wohl geläufig. Er ist einer der...

Read More »

Read More »

So meistern Sie UNVORHERGESEHENES: VORTEILE durch gute ORGANISATION

Auf Unvorhergesehenes bestmöglich vorbereitet sein ist fundamental für einen langfristigen finanziellen Erfolg! Dr. Elsässer gibt in dem Video zahlreiche Tipps und Anregungen, wie man sich am besten organisiert und langfristig seine Daten systematisch zu managen. Die Vorteile sind besseres Risikomanagement und Krisenbewältigung durch Organisation.

_

3.? *https://amzn.to/3V6SbsO - jetzt vorbestellen!

2.? "Dieses Buch ist bares Geld wert"...

Read More »

Read More »

Max Otte: DAS kann niemand stoppen (es passiert jetzt)

?Online Veranstaltung Jetzt Kostenlos Anmelden ➡️https://webinar.investinbest.de/gewinner-im-umbruch

? IIB LIVE EVENT ➡️ https://investinbest.de/produkt-kategorie/iib-live-event/

? Mitgliedschaft (immer noch 390) ➡️ https://investinbest.de/produkt/invest-in-best-mitgliedschaft-jaehrliche-zahlung/

?Mitgliedschaft + Prepare for 2023 (490 einmalig, Verlängerung zu 390) ➡️ https://investinbest.de/produkt/mitgliedschaft-prepare-for-2023/

? Invest in...

Read More »

Read More »

Langsam aber stetig – DAX fängt sich – “DAX Long oder Short?” mit Marcus Klebe – 03.03.23

HIER geht´s direkt Zur Webinar-Serie: Traden mit kleinem Konto

https://register.gotowebinar.com/register/3876278094922468952?source=mk

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international...

Read More »

Read More »

The 2 Habits I Would Encourage Everyone to Do

The 2 habits I would encourage everyone to do. #raydalio #principles #meditation #mindfulness

Read More »

Read More »

Whats The Best Way Forward Charles Hugh Smith

We are currently in the midst of a significant and complicated transition from one era to another. This transition is characterized by confusion and complexity because there are people who are benefiting from the current system and they will resist any change. Meanwhile, there are also forces of adaptation and evolution that are working to determine the best way forward.

Watch more of this short video from Turmoil Ahead As We Enter The New Era...

Read More »

Read More »

Poor People in Developing Countries Find Alternatives to Commercial Banking

People are innovative—if government doesn't get in the way. Entrepreneurs in developing countries find alternatives for people cut off from commercial banking services.

Original Article: "Poor People in Developing Countries Find Alternatives to Commercial Banking"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

The Impossibility of Equality

[Excerpt from chapter 7 of Power and Market in Man, Economy, and State with Power and Market, pp. 1308–12.]

Probably the most common ethical criticism of the market economy is that it fails to achieve the goal of equality. Equality has been championed on various “economic” grounds, such as minimum social sacrifice or the diminishing marginal utility of money (see the chapter on taxation above). But in recent years economists have recognized that...

Read More »

Read More »

ACHTUNG: Habeck plant VERBOT (Öl- und Gasheizungen)

Hast du eine Öl- oder Gasheizung daheim? Dann aufgepasst, Robert Habeck möchte diese schon ab 2024 im Schein des Klimawandels verbieten! Warum das leider kein Witz ist, was genau geplant wird und wie es auch dich betreffen kann, das erfährst du in dieser Folge "Finanzielle Intelligenz".

Mein Blog:

https://www.friedrich-partner.de/blog/neueste-blog-posts

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das...

Read More »

Read More »

Is Now the Right Time to Buy Stocks?

Regardless of whether the stock market was soaring, or whether it was crashing, there's always an opportunity to make money in the stock market.

There are three characteristics of the stock market that make it such a great vehicle to build wealth. Remember the richest man in the world, Warren Buffet, used the stock market to build his wealth.

The three characteristics are:

Liquidity

Agility

Scalability

To learn more about the stock market...

Read More »

Read More »

Max investiert 1’200€/MONAT und will 100k erreichen! | Sparkojote Dividenden Donnerstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDonnerstag Livestream findet jeden Donnerstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDonnerstag #2023 #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★...

Read More »

Read More »

Ich SOLL meine VIDEOS LÖSCHEN!

Schon merkwürdig, dass innerhalb von ganz kurzer Zeit alle Kooperationsverträge gekündigt werden, weil... ja wieso eigentlich? Am Geld kann es jedenfalls nicht liegen.

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

Du willst mehr über...

Read More »

Read More »

Marc Faber US Dollar as Reserve Currency: Time to Say Goodbye

Marc Faber ? US Dollar as Reserve Currency: Time to Say Goodbye

Marc Faber ? US Dollar as Reserve Currency: Time to Say Goodbye

"There are no safe havens in a money printing environment. The Fed is built to print and they will not stop," Marc Faber says

__________________________________________________

#marcfaber #dollar

__________________________________________________

Enjoyed the video? Comment below! ?

? Subscribe to KAIZ ADAM...

Read More »

Read More »

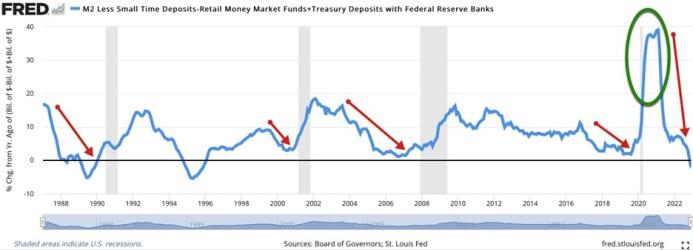

The Coming Recession Will Be a Global One

Over one hundred years ago, Austrian economist Ludwig von Mises discovered what causes the boom-bust business cycle.

As Mises explained, the boom is caused by central and commercial banks creating money out of thin air. This lowers interest rates, which encourages businesses to borrow this newly created money to fund capital-intensive investment projects.

The bust is caused when the money creation process slows. It is then that businesses discover...

Read More »

Read More »

Dr. Gerd Kommer: ETF vs. Immobilien – DIESE Anlageklasse bringt mehr Rendite ein

Während unserer München-Reise haben wir uns mit ETF-Experte und Autor Dr. Gerd Kommer ausgetauscht. Er ist als einer der angesehensten Experten für unabhängige Kapitalanlage-Themen in Deutschland bekannt und hat bereits mehrere erfolgreiche Bücher veröffentlicht. Sein Buch “Souverän investieren mit Indexfonds und ETFs” hat uns maßgeblich dazu veranlasst, ein tieferes Verständnis für Finanz-Themen zu entwickeln.

In dieser gemeinsamen Podcast-Folge...

Read More »

Read More »

KI-Hype! Die neue Dotcom-Blase? #shorts

Wie doll ähnelt der aktuelle KI-Hype der Dotcom-Blase?

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=580&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=580&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️...

Read More »

Read More »