Tag Archive: newsletter

Wichtige Morning News mit Oliver Klemm #69

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Schweizer Bitcoin Startup Relai schliesst $4.5M Finanzierungsrunde ab

Relai, die Schweizer Bitcoin-App, gibt eine Investitionsrunde in Höhe von 4,5 Millionen US-Dollar bekannt, die von ego death capital angeführt wird. Weitere Investoren sind Timechain, Cabrit Capital und Lightning Ventures. An der Investitionsrunde beteiligten sich auch der Hauptinvestor von Relai, Redalpine, und der Seed-Stage-Investor Fulgur Ventures, die beide erneut investierten.

In Juni 2021 hatte Relai deren Series A (2.5Mio CHF) abgeschlossen...

Read More »

Read More »

Nasdaq futures technical analysis 7th March, 2023

Yesterday's failed breakout is still lingering as the market waits for more information from Powell later this week. Watch for a possible breakout up, but also be cautious of bears taking control if two consecutive 4-hour candles close below 12233. Learn more about the technical analysis of the NASDAQ and S&P 500 in this video and visit ForexLive.com for additional views and updates.

There may be possible updates on:...

Read More »

Read More »

Schuldenfalle vs. Vermögensboost [Das Geheimnis der Superreichen ??] #shorts

? https://gratis-workshop.com/yts ? Jetzt Gratis Workshop-Platz sichern!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell den...

Read More »

Read More »

Gustave de Molinari, First Anarcho-Capitalist

Of all the leading libertarian French economists of the mid- and late nineteenth centuries, the most unusual was the Belgian-born Gustave de Molinari (1819-1912). Born in Liege, the son of a Belgian physician and a baron who had been an officer in the Napoleonic army, Molinari spent most of his life in France, where he became a prolific and indefatigable author and editor in lifelong support of pure laissez-faire, of international peace, and in...

Read More »

Read More »

Roald Dahl and James Bond Books Are Getting Woke Rewrites. Copyright Law Ensures You Can’t Stop Them.

Thanks to copyright laws, the estate of Roald Dahl can not only rewrite his books, but can also essentially outlaw the old versions. Only books in the public domain are safe from this.

Original Article: "Roald Dahl and James Bond Books Are Getting Woke Rewrites. Copyright Law Ensures You Can't Stop Them."

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Bitcoin: Mein Kurziel 2023!

► Meinen Podcast findest Du hier: https://lars-erichsen.de/podcasts.html

Was könnte man für ein Video aufnehmen, das einem später sehr wahrscheinlich um die Ohren fliegt? Wir machen eine Bitcoin-Prognose für das Jahr 2023. Wo genau, liegt also mein Kursziel? Legen wir direkt los!

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs und erhalte weitere Informationen, zu meinem neuen Projekt - 100% gratis: http://lars-erichsen.de/

► NEU:...

Read More »

Read More »

Slavery in the Americas: Separating Fact from Fiction

The history of transatlantic slavery is riddled with fables and errors. Erroneous claims have been propagated in the media because history is currently perceived as a political project that must justify present sensibilities. History has become so politicized that rigorous research is unable to disabuse activists of inaccuracies. Due to the rampant politicization of academia, noted scholars are usually cajoled into apologizing for defending...

Read More »

Read More »

Bill Gates Zwielichtige Biontech Investition!

Bill Gates hat 2019 in diverse Biotech Unternehmen investiert und eine phänomenale Rendite erzielt, während er gleichzeitig weltweit als eine Art Chief Marketing Office für deren Medikamente auf Tour ging. Anschließend verkaufte er seine Investments und sieht jetzt die hinterfragt nun die Wirkungsweise der Medikamente. Ich sehe hier Probleme!

? Kostenloses Aktiendepot einrichten ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei...

Read More »

Read More »

Unsere Gasversorgung – Asche auf mein Haupt, Warum lag ich falsch?

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Wie ich in einem vorigen Video abgekündigt habe, bin ich bereit jetzt Asche auf mein Haupt zu streuen (symbolisch, in meinem Haus brennt kein Feuer), und zuzugeben, dass ich mit der #Voraussage der #Gasknappheit im März/April 2023 falsch lag.

Bevor sich meine #Kritiker jetzt feiern, lassen Sie uns gemeinsam der Frage nachgehen, warum ich falsch lag. Da wird es nämlich...

Read More »

Read More »

Is Democracy under Attack in Canada? No, but It Should Be

Canadian political, academic, and media elites "worry" that democracy in that country may be under attack. Actually, democracy works all too well there.

Original Article: "Is Democracy under Attack in Canada? No, but It Should Be"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Zinsen bleiben wohl länger höher – DJE- Marktausblick März 2023 mit Markus Koch & Stefan Breintner

Nach einer differenzierten Analyse der Inflation und ihrer Einflussfaktoren rechnen wir mit einer bis auf weiteres anhaltend hohen Kerninflation und Zinsen auf einem Niveau, das über längere Zeit höher bleiben dürfte. Die Sektoren Banken und Versicherungen könnten davon profitieren.

Erfahren Sie mehr zur aktuellen Marktsituation im Video-Interview mit DJE-Researchleiter Stefan Breintner und dem Wallstreet-Experten Markus Koch.

#zinsen #aktien...

Read More »

Read More »

Deutschland geht pleite! (Insolvenzwelle rollt)

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

What will Workforce Benefits of the Future Look Like?

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(3/6/23) The Month of March marks the end of the Quarter, and markets will be affected by a certain amount of quarterly window dressing, this month's FOMC meeting, Friday's employment report, and the latest CPI. It's okay to be bullish with a cautionary caveat. Recession or no recession? A very different economy today, based on services...

Read More »

Read More »

Biden’s Executive Order on Equity: It Will Create Greater Inequality

On February 16, 2023, President Joe Biden issued his second executive order to strengthen equity within federal agencies. Among other things, it ordered them to install equity officers and implement action plans with the superficial aim of making it easier for “underserved communities” to access federal resources.

Although there is plenty of commentary on the specific content of the new order, that is not what this article is about. Rather, the...

Read More »

Read More »

Yields Pull Back to Start the New Week

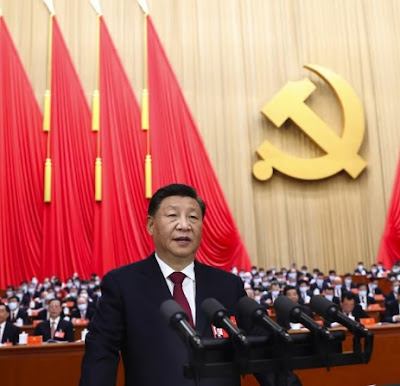

Overview: The modest economic goals announced as

China's National People's Congress starts was seen as a cautionary sign after

growth disappointed last year. It seemed to weigh on Chinese stocks, though

others large bourses in the region advanced, led by Japan's Nikkei and South

Korea with gains of more than 1%. Europe's Stoxx 600 is little changed after

rising for the past two sessions. US index futures are slightly softer. Strong

gains were seen...

Read More »

Read More »

ALLZEITHOCH bei 16.300 in Sicht | Blick auf die Woche | KW 10

Vergangene Woche verdüsterte sich das Gesamtbild des Aktienmarktes noch zunehmend, doch in dieser Woche winken bereits neue Allzeithochs.

Zumindest der DAX steht kurz vor dem Ausbruch auf ein neues Jahreshoch und dann ist auch das Allzeithoch nur noch wenige Prozentpunkte entfernt.

Was das für mich als Trader in dieser Handelswoche bedeutet und ob auch die US-Märkte wieder Möglichkeiten zum traden bieten, dazu mehr im neusten Blick auf die...

Read More »

Read More »

Former top Credit Suisse shareholder Harris Associates sells out of bank

One of Credit Suisse’s longest-standing shareholders has sold its entire stake in the scandal-hit Swiss bank after losing patience with its strategy amid persistent losses and a client exodus.

Read More »

Read More »