Tag Archive: newsletter

44 % Übersterblichkeit: Was sind die Ursachen?

► Schütze Dich vor digitaler Überwachung mit NordVPN (Rabattaktion)

http://nordvpn.com/marc

Schockierende Daten: Wir schauen uns heute die aktuellen Zahlen zur Übersterblichkeit in verschiedenen Ländern an und besprechen, was die Ursachen davon sein könnten.

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon:...

Read More »

Read More »

Holt Putin JETZT zum Gegenschlag aus?! DAS Passiert am 24. Februar!!

NEUER GRATIS TRADING WORKSHOP (3. - 5. März 2023):

? https://us02web.zoom.us/webinar/register/9216758012881/WN_XKE_2oV-QjWsy2PgXG8xDQ

Jetzt anmelden!! Plätze begrenzt...

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

00:00 Ukraine Krieg

05:01 Seymour Hersh Nord Stream

09:04 USA

12:14 Wie die USA Ärger machen

18:44 Ukraine Krieg

►Mein...

Read More »

Read More »

A Student Loan Fable

A student goes into a bank. He tells the personal loan banker, “I want to borrow $7,500 per year for the next four or five years.”

“That’s at least $30,000 over time,” the banker says. “Personal loans have a 10 percent interest factor.”

“For my loan,” says the student, “I need an interest rate close to a home mortgage, like 6 percent. Also, I don’t want to be charged interest for the first four or five years of the loan.”

The banker asks, “How long...

Read More »

Read More »

Achtung: Betrüger/KI Chat GPT

Kommentare von „Betrüger-Bots“ lassen sich immer schwerer identifizieren. Worauf du achten musst, um kein Geld durch Betrüger zu verlieren, erkläre ich dir im heutigen Video.

Sicher dir jetzt Tickets für das kommende Mindset- Seminar

https://jensrabe.de/mindset

0:00 Betrüger erkennen

3:09 Fake- Accounts

6:42 Das ist passiert

8:15 KI Entwicklung

10:40 Gründe für den Reinfall

Vereinbare jetzt Dein kostenfreies Beratungsgespräch:...

Read More »

Read More »

Ab wann ist man reich in Deutschland?

Ab wann gehört man zur reicheren Hälfte der Deutschen?

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=576&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=576&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️ Weitere...

Read More »

Read More »

Lipton Matthews: A 5-Way Global Perspective on Innovation and Entrepreneurship in the USA

Entrepreneurship and innovation are the keys to economic growth and higher standards of living. The USA has long enjoyed leadership status on these dimensions — people see the USA as the land of entrepreneurs and the source of new ideas and advances in business. Is the reputation still deserved? Or is it being eclipsed as part of the general decline in standards and capabilities that we observe? Lipton Matthews is a global economic and...

Read More »

Read More »

The USD is mixed in early trading with the EURUSD lower, the GBPUSD higher.

Get the latest update on the forex market as the dollar is higher versus the EUR and JPY but lower versus the GBP. Plus, discover how the dollar is moving up versus the loonie due to lower CPI in Canada. Watch the morning forex technical report for February 21 2023 to get a technical look at these currencies and more.

Read More »

Read More »

Warren Buffet WARNT vor dem Crash #shorts

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist studierter Bankkaufmann und...

Read More »

Read More »

Yes, the US Government Has Defaulted Before

While the 1979 default was relatively small, the 1934 default affected millions of Americans who had bought Liberty Bonds mistakenly thinking the government would make good on its promises.

Original Article: "Yes, the US Government Has Defaulted Before"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Is Sticky Inflation Entrenched in Economy?

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(2/21/23) Is a recession in the works with the Fed still intent on raising rates? Our word of the day is "Recessionista;" what is the Fed going to break? M2 Money Supply as a % of GDP indicates liquidity still flowing through the economy, but declining. The Roberts' Family Saga: Dead Rabbit. No landing scenario, no recession,...

Read More »

Read More »

Was wir Aktionäre aus dem Ukrainekrieg lernen können

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Forget the Liquidity Trap—Loose Monetary Policies Cause Recessions

Advocates of Keynesian economics believe the Federal Reserve should pursue policies that will prevent the possible decline of the economy into a liquidity trap. But what is a liquidity trap?

Economic activity often is presented in terms of a circular flow of money. Spending by one individual becomes part of the earnings of another individual, and spending by another individual becomes part of the first individual’s earnings. Recessions, by this...

Read More »

Read More »

Upside Surprise in UK’s Flash PMI and Better-than-Expected January Public Finances Lift Sterling

Overview: Rising interest rates are weighing on risk

appetites and the dollar is broadly stronger. Sterling is a notable exception

after a stronger than expected flash PMI and better than expected public

finances. The correlation between higher US rates and a weaker yen is

increasing and the greenback looks poised to rechallenge the JPY135 area. A

slightly better than expected preliminary PMI and hawkish minutes from the

recent RBA meeting has done...

Read More »

Read More »

Keith Weiner – Only Gold and Silver Can Stave off the Zombie Apocalypse

Get a two-week free trial of my precious metals newsletter The End Game Investor: https://seekingalpha.com/mp/1347-the-end-game-investor

Join my Patreon for Biblical commentary on economics, monetary policy and government. https://www.patreon.com/endgameinvestor

Get the Monetary-Metals.com Gold Outlook 2023 Report for free https://bit.ly/3StWPAJ

Check out https://monetary-metals.com

Don't follow me on Twitter @RafiFarber

Read More »

Read More »

Klartext zur Politik in Deutschland!

Die ganze Sendung hier:

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

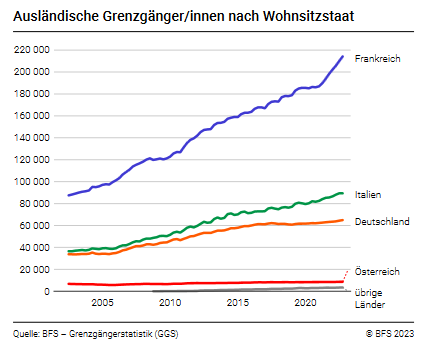

The number of cross-border commuters rose by 6.1% in 4th quarter 2022 over a one-year period

The number of workers holding a cross-border commuter permit (G permit) increased by 6.1% between the 4th quarters of 2021 and 2022 with 380 000 persons. Their share in the employed population was 7.3% (+0.4 percentage points).

Read More »

Read More »

ACHTUNG: KRYPTO PUMP WEGEN CHINA??

Jetzt Pump wegen China? Was genau ist damit gemeint und wie kannst du jetzt handeln, damit du das Beste rausbekommst? Erfahre das jetzt in diesem kurzen Video.

----------

? Möchtest du in Julian‘s Inner Circle? Dann bewirb dich jetzt für unsere exclusive Mastermind: http://i-unlimited.de/joinic

----------

? DR. JULIAN HOSP's Special Insights: https://newsletter.julianhosp.com

? Kostenlose DeFi Academy: https://academy.julianhosp.com/de

?...

Read More »

Read More »

Marc Faber A Lot Of People Will Lose All Their Money’ – Huge Market Losses Lie Ahead

Marc Faber: A Destructive Stock Market Crash Is On The Horizon ? _8n4

Felix Zulauf Warns America: ‘Biggest Stock Market Crash Ever’ Likely By End of June ? -GM70E

Thank you so much for watching!

? Checkout These Similar Videos?

#newsrio

► Subscribe to NewsRio's new channel

✪ Help NewsRio Channel Reach 100 000 Sub!

✉Mail: [email protected]

✪ Thank you for watching my clip. Please click register to support me!...

Read More »

Read More »

Lifting the Debt Ceiling Is Not a Social Policy

Every time the United States reaches its debt limit, we read that it is important to reach an agreement to lift it. The narrative is that the debt ceiling must be raised, or the US economy will suffer a severe contraction. There is even an episode of a TV series, “Designated Survivor”, where the character played by Kiefer Sutherland places lifting the debt ceiling as the priority to get the U.S. economy on track. The debt ceiling is viewed as an...

Read More »

Read More »